Silver May Rise to $40/oz in March on Tight Supply

Commodities / Gold and Silver 2011 Mar 10, 2011 - 11:53 AM GMTBy: GoldCore

Risk aversion has returned with equity markets internationally under pressure after the Spanish downgrade and continuing geopolitical tension. Gold and silver have taken a breather and are lower in all currencies today. A correction is well overdue but the technicals and fundamentals would suggest that any sell off may again be short and shallow.

Risk aversion has returned with equity markets internationally under pressure after the Spanish downgrade and continuing geopolitical tension. Gold and silver have taken a breather and are lower in all currencies today. A correction is well overdue but the technicals and fundamentals would suggest that any sell off may again be short and shallow.

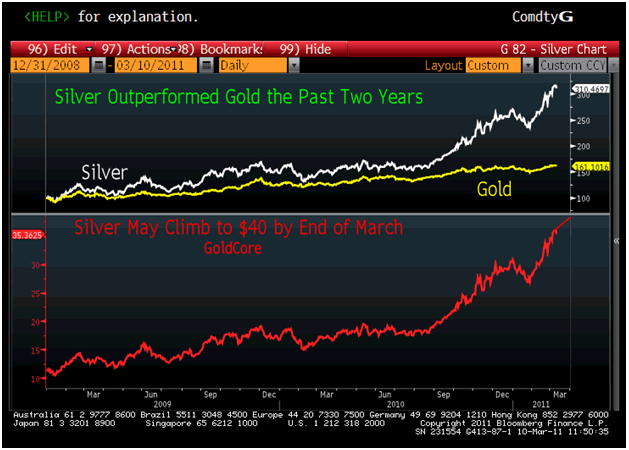

Bloomberg Chart of the Day

All dips in gold and silver are being bought by value buyers. Silver could correct to previous resistance at $30/oz but physical demand, backwardation and a short squeeze suggest that $40/oz is possible before the end of the month.

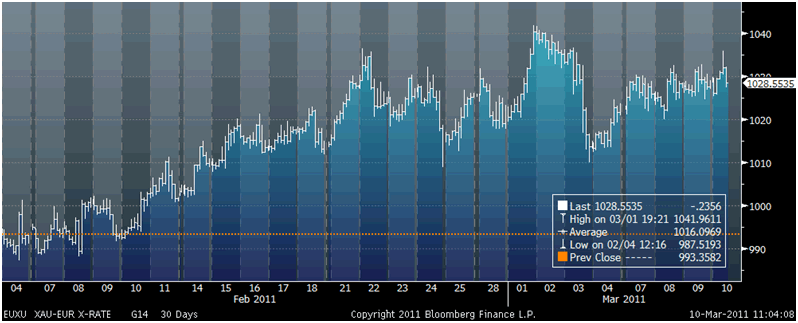

The downgrade of Spain and worries about other periphery eurozone states is leading to euro weakness and euro gold consolidating above EUR 1,000 per ounce.

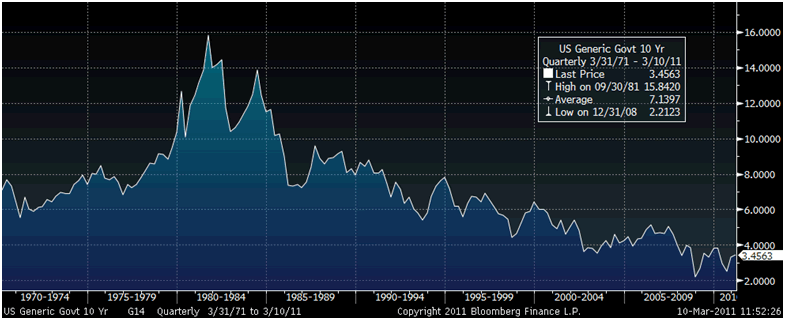

PIMCO’s decision to cut its US debt holdings to zero (as first reported by Zero Hedge – see news) does not bode well for US government bonds and government bonds internationally. Stagflation and currency debasement are likely to lead to interest rates rising, possibly sharply. The last time interest rates rose sharply for a period of years was in the oil crises and stagflation of the 1970s.

Gold is correlated with rising interest rates as was graphically seen from 1971 to 1980. Gold will only become vulnerable towards the end of the interest rate tightening cycle when savers (deposits) and investors (bonds) are rewarded with positive real interest rates above the real rate of inflation (as opposed to hedonically adjusted and manipulated inflation figures).

The fact that the US has to electronically create money in order to buy their own long term government debt creates the real risk that stagflation could degenerate into a more serious monetary event such as a currency crisis. The worst case scenario of a Weimar Germany style hyperinflation is increasingly a possibility. The US and the world needs to return to some form of monetary discipline and adopt a rational and prudent Volcker-style monetary policy which guards against inflation and currency debasement.

Gold

Gold is trading at $1,418.19/oz, €1,026.04/oz and £878.79/oz.

Silver

Silver is trading at $35.28/oz, €25.52/oz and £21.86/oz.

Platinum Group Metals

Platinum is trading at $1,775.00/oz, palladium at $766.00/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Silver May Rise to $40 in March on Tight Supply: Chart of Day

Silver may extend its gains to a 31-year high this year and be at $40 an ounce by the end of the month as supplies tighten and demand for the metal used more in industry than gold increases, said brokerage GoldCore Ltd.

The CHART OF THE DAY shows silver rallied more than fourfold since 2008 as gold more than doubled. Silver last month moved into backwardation on the Comex in New York, where nearer- dated contracts trade at a premium to those for later delivery, a sign of tighter supply now, GoldCore said.

“There’s a lot of demand coming from Asia and China particularly” for industrial usage and as an inflation hedge, said Mark O’Byrne, executive director of GoldCore in Dublin. “There’s tightness in the marketplace.”

Silver and gold have advanced as concern inflation will accelerate and unrest in North Africa and the Middle East boosted demand for alternative assets to stocks and bonds. One- ounce silver coin sales from the U.S. Mint jumped to a record in January, and an ounce of gold bought as little as 39.3 ounces of silver on March 7, the least since February 1998. While gold climbed to a record this month, silver is below the $50.35 all- time high reached in New York in 1980.

Silver held in exchange-traded products backed by the metal gained 3.7 percent in the past month, data compiled by Bloomberg from four providers show. The metal, used in industrial applications such as solar panels and plasma screens, traded at $35.8675 an ounce at 5:15 p.m. in London yesterday.

“If the economy recovers, that’s very good for silver because there will be huge industrial demand,” O’Byrne said. “If the economy is doing badly then people will buy silver as a store of value.”

(Bloomberg) -- Vietnam’s Banks to Report Gold Deposits, Lending By March 16

Vietnam’s central bank asked banks to report on gold deposits and lending before March 16, according to a statement today on its website.

(Bloomberg) -- Europe Commodity Day Ahead: China Corn Demand Set to Climb

The following are the top stories on metals, agriculture and shipping.

ForecastPriorTime (NY)

Initial Jobless ClaimsMAR 5376K368K8:30

Continuing ClaimsFEB 263750K3774K8:30

Trade BalanceJAN-$41.5B-$40.6B8:30

Bloomberg Consumer ComfortMAR 6-39.39:45

U.S. Corn End StocksMAR675M8:30

U.S. Soybean End StocksMAR140M8:30

U.S. Cotton End StocksMAR1.90M8:30

World Wheat End StocksMAR818M8:30

WASDE Supply & DemandMAR8:30

Net Exports Cotton - TotalMAR 3403.38:30

Net Exports Corn - TotalMAR 31202.38:30

Net Exports Soybeans - TotalMAR 3645.38:30

Net Exports Wheat - TotalMAR 3650.98:30

COMMODITY EXCLUSIVES:

- China’s Corn Demand Climbs on Meat Consumption, New Hope Says

New Hope Group Co., China’s biggest maker of livestock feed, said rising output of meat, dairy and eggs will boost demand for corn this year, draining stockpiles.

- Philippine Rice Imports May Beat Target on Rising Food Costs (1)

The Philippines may import more rice than planned as it seeks to secure supplies amid record global costs, according to the nation’s grain-buying agency.

- Wheat Production in Western Australia May Grow 29%, Premier Says

Wheat output in Western Australia, the nation’s biggest exporting state for the grain, may increase 29 percent by 2016 as producers respond to expanding global demand, Premier Colin Barnett said.

- Toho Zinc Shuts Down Lead Smelter for 20-Day Maintenance

Toho Zinc Co., Japan’s biggest producer of refined lead, shut down its Chigirishima smelter for 20 days for regular maintenance, a company executive said.

- Silver May Rise to $40 in March on Tight Supply: Chart of Day

Silver may extend its gains to a 31-year high this year and be at $40 an ounce by the end of the month as supplies tighten and demand for the metal used more in industry than gold increases, said brokerage GoldCore Ltd.

INDUSTRIAL METALS:

- Copper Declines to Near Two-Month Low as China’s Imports Tumble

Copper declined to near a two-month low as imports by China, the world’s biggest user, tumbled in February and higher oil prices spurred concern that the global economy may slow down, reducing demand for metals.

- China Copper Imports Slump to Two-Year Low on Ample Supplies (1)

Copper imports by China, the largest consumer, tumbled 35 percent in February to the lowest in more than two years as ample domestic supplies weighed down prices, making shipments unprofitable.

- Aluminum Stockpiles in Japan Decline for Second Month (1)

Aluminum stockpiles in Japan dropped 5.7 percent to 208,100 metric tons at the end of February, marking the second straight monthly decline, trading company Marubeni Corp. said.

MINING:

- Rio Tinto Raises Takeover Offer for Riversdale to A$16.50/Share

Rio Tinto will increase its offer price for Riversdale Mining Ltd. to A$16.50 a share if it obtains an interest in more than 50 percent of Riversdale shares by March 23. The company reported the information in a regulatory filing.

- Equinox to Hold Shareholder Meeting on Lundin Deal in April (1)

Equinox Minerals Ltd., seeking to buy Lundin Mining Corp. for C$4.8 billion ($5.0 billion), plans to hold a shareholder meeting in April to approve issuing new shares as part of the takeover.

- Molycorp Says China May Be Net Importer of Rare Earths by 2015

Molycorp Inc., owner of the largest rare-earth deposit outside China, said Chinese leaders have said the country may become a net importer of rare-earth minerals by 2015 as China seeks to consolidate its rare-earth mining companies.

- China Guangdong Nuclear Unlikely to Bid for Extract, CLSA Says

China Guangdong Nuclear Power Group Co., seeking to buy Kalahari Minerals Plc for 756 million pounds ($1.2 billion), is unlikely to also bid for affiliated uranium explorer Extract Resources Ltd., CLSA Asia-Pacific Markets said.

- Kalahari Minerals Held Talks With Others Before Chinese Bid (3)

Kalahari Minerals Plc, subject of a 756 million-pound ($1.2 billion) offer from China Guangdong Nuclear Power Group Co., said it held talks with other groups prior to the state-owned company’s bid this week.

PRECIOUS METALS:

- Gold Drops After Rally to Record This Week Spurs Investor Sales

Gold declined as the metal’s rally to a record this week, bolstered by the prospect of rising inflation and unrest in the Middle East, prompted some investors to sell holdings.

AGRICULTURE:

- Palm Oil Drops on Forecasts for Higher Production, Lower Prices

Palm oil dropped amid forecasts for higher production this year and on speculation that an improving supply of vegetable oils could ease prices.

- Wheat Advances as 8.8% Tumble in Three Days Attracts Investors

Wheat futures climbed after a decline of 8.8 percent in three days lured importers and investors before a U.S. government report that may cut estimates of global grain supplies. Soybeans increased.

- China to Limit Corn Processing, Ensure Food Use, Minister Says

China, the second-biggest corn consumer, will curb the amount used in producing industrial chemicals to ease the growing pressure on grain supply, the Minister of Agriculture said.

- China Harvested More Rapeseed Than Estimated, Center Says

China’s rapeseed production probably reached 13.15 million metric tons last year, the China National Grain & Oils Information Center said, raising its estimate from 12.6 million tons in December.

- Rubber Gains for First Day in Seven as Low Prices Lure Buyers

Rubber gained for the first time in seven sessions as investors bought the commodity after the price tumbled to a two- month low amid concern that car-sales growth is slowing in China, the largest consumer.

SHIPPING:

- Port Hedland February Iron Ore Exports Were 12.85 Million Tons

Iron ore shipments from Australia’s Port Hedland, the world’s largest bulk export terminal, were 12.85 million metric tons in February, the Port Hedland Port Authority said on its website today.

- Maersk Megaship Order Hits Capacity Sweet Spot: Freight Markets

Maersk Line, the world’s largest container shipper, may extend its market share and lift earnings by taking delivery of the 10 biggest cargo vessels ever built just as a global shortfall in capacity increases carriage rates.

ECONOMIES:

- Yuan Forwards Weaken After China Reports Surprise Trade Deficit

Yuan forwards weakened for a fourth day after China reported a surprise trade deficit for February, easing pressure on the currency to appreciate.

- China Home Prices to Fall This Year, Central Bank Adviser Says

China’s home prices will decline later this year, with sales volume already falling following purchase restrictions by local governments, said Li Daokui, an adviser to the People’s Bank of China.

- China Raises Yield in Three-Month Bill Sale; Swap Rates Climb

The People’s Bank of China raised the yield on three-month bills for the second consecutive week, increasing speculation that policy makers will increase benchmark interest rates to cool inflation.

- China Reports Unexpected Trade Deficit as Export Growth Cools

China reported an unexpected $7.3 billion trade deficit in February after a Lunar New Year holiday disrupted exports, the customs bureau said.

- Japan’s Economy Contracts More Than Initial Estimate (2)

Japan’s economy contracted more than the government initially estimated in the fourth quarter because of a downward revision to capital investment and consumer spending.

- Australian Employers Unexpectedly Cut Workers in February (3)

Australian employers unexpectedly cut workers in February for the first time in 18 months as floods and a cyclone disrupted hiring in the nation’s northeast.

OTHER MARKETS:

- Asian Stocks Drop as Rising Rates, Oil Offset Merger Optimism

Asian stocks fell the most in more than two weeks as violence in Libya drove up oil prices and central banks from South Korea to Thailand raised interest rates.

- Dollar Rises Before U.S. Jobs Data; Euro Falls on Debt Concerns

The dollar rose against all its major counterparts on prospects jobs data will signal a continued recovery in the world’s largest economy amid signs growth in Asia is slowing.

- Tokyo Exchange Plans to Merge With Osaka Amid Global Takeovers

Tokyo Stock Exchange Group Inc., which runs the world’s second-largest equity market, plans to hold merger discussions with Osaka Securities Exchange Co. as takeovers sweep exchanges around the world.

- Crude Oil Climbs as Libyan Violence Intensifies, Refinery Bombed

Oil climbed for the first time in three days in New York as escalating violence in Libya, Africa’s third-largest producer, renewed concern that supply disruptions may spread to the Middle East.

- Qaddafi Forces Hammer Rebels as Nations Weigh No-Fly Zone

Rebel fighters in Libya came under fire from rocket barrages and air strikes as they battled Muammar Qaddafi’s forces east of the oil town of Bin Jawad.

- China Will Never Adopt a Multiparty Political System, Wu Says

China’s Communist Party will never share rule in a multiparty system or create a government where power is divided between the executive, legislature and judiciary, National People’s Congress head Wu Bangguo said.

- Mubadala Says Holding Talks With Dubai Aluminium on Expansion

Mubadala Development Co., an Abu Dhabi government-owned investor, said it is holding talks with state-owned Dubai Aluminium Co. to explore opportunities to expand their partnership.

INDIA DAYBOOK:

- Food Inflation, Terror Alert, Asset Sales, Gamesa

Finance Minister Pranab Mukherjee’s plan to raise 400 billion rupees ($9 billion) from asset sales to narrow the budget deficit spurred almost $1 billion in capital inflows into India in a week, the most in two months.

(FT) -- Pimco cuts US Treasuries holdings to zero

The world’s biggest bond fund has cut its holdings of US government-related debt to zero for the first time since early 2008 in the latest sign of increasing investor expectations of rising interest rates.

The move by the $237bn PimcoTotal Return fund follows warnings by its fund manager Bill Gross of rising bond yields as the US Federal Reserve nears the end of its massive bond buying programme, known as quantitative easing, or QE2.

Such rises would hit the value of holdings of bonds as their price move inversely to their yields.

Mr Gross, one of the most influential figures in bond markets, said in his March investment outlook that Pimco estimated the Fed has been buying 70 per cent of annualised issuance of Treasuries since QE2 began – a programme he last year likened to a Ponzi scheme.

Meanwhile, foreign investors have been buying the remaining 30 per cent. Mr Gross said as a result there was a risk of a temporary void in demand once QE2 is scheduled to end in June.

“Yields may have to go higher, maybe even much higher to attract buying interest,” he said.

The Federal Reserve is buying some $100bn of Treasuries each month and since November has purchased $412bn of government debt under QE2. By the end of June, the Fed is expected to have purchased around $800bn of Treasuries, pushing its total holdings to $1,600bn

After slashing its government- related holdings to zero, Pimco Total Return’s assets are primarily in US mortgages, corporate bonds, high yield and emerging market debt.

The fund holds 23 per cent of its assets in net cash equivalents, defined as any instrument that has a low sensitivity to movements in interest rates. The move was first reported by the Zero Hedge website.

The fund is the best performer in its category over the past 15 years, according to Morningstar. Mr Gross also has track record of making high-profile calls on markets. In 2007, when bond yields were rising, Mr Gross forecast housing would lead the economy into recession and send bond yields into reverse.

Last year, he controversially described the UK gilt market as “resting on a bed of nitroglycerine” due to the scale of the nation’s debts.

He later told the Financial Times his assertion was always meant to be directed at the pound, not gilts, and that he mellowed his views after the government’s austerity programme to cut spending.

“I would change it from nitroglycerine to dynamite,” he said.

The positioning by Pimco’s best-known fund follows a drop to 12 per cent of assets held in government-related debt in January, from as much as 63 per cent in late 2009.

The fund has returned 7.23 per cent in the past year, beating 85 per cent of its peers, according to data compiled by Bloomberg. It gained 1.39 per cent over the past month.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.