Q.E. Money Printing Negative Feed Back Loop to Hyper-Inflation Oblivion

Interest-Rates / Quantitative Easing Mar 09, 2011 - 09:16 AM GMTBy: Jim_Willie_CB

USFed Chairman Bernanke and the Quantitative Easing programs are caught in a negative feedback loop, the instruments at risk being the USDollar and the USTreasury Bond. The former suffers from lost integrity and direct inflation effect. The latter suffers from direct intervention and market ruin. The next QE round is guaranteed by the failure of the previous program in an endless cycle to be recognized later this year. Leaders are confused why the recovery does not take root. It is because the entire system is insolvent, and the 0% rate assures total capital destruction, not to mention the big US banks are sacred, never to be liquidated, a primary condition for recovery. Liquidation is tantamount to abdication of power of the Purse and control of the Printing Pre$$, never to happen. The greatest hidden damage is psychological, where the USDollar and its erstwhile trusted USTreasury Bond are no longer viewed as the safe haven.

USFed Chairman Bernanke and the Quantitative Easing programs are caught in a negative feedback loop, the instruments at risk being the USDollar and the USTreasury Bond. The former suffers from lost integrity and direct inflation effect. The latter suffers from direct intervention and market ruin. The next QE round is guaranteed by the failure of the previous program in an endless cycle to be recognized later this year. Leaders are confused why the recovery does not take root. It is because the entire system is insolvent, and the 0% rate assures total capital destruction, not to mention the big US banks are sacred, never to be liquidated, a primary condition for recovery. Liquidation is tantamount to abdication of power of the Purse and control of the Printing Pre$$, never to happen. The greatest hidden damage is psychological, where the USDollar and its erstwhile trusted USTreasury Bond are no longer viewed as the safe haven.

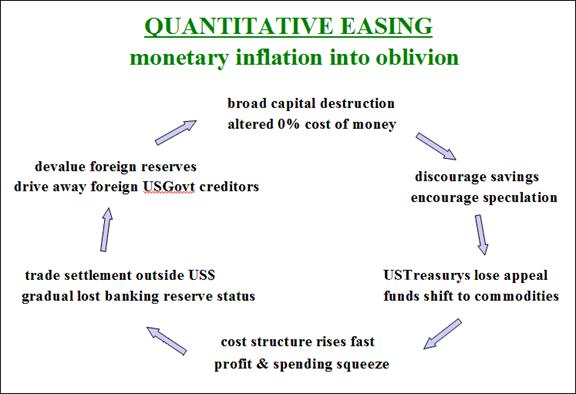

Capital destruction is the main byproduct of monetary inflation, a concept totally foreign to the inflation engineers at the USFed and its satellite central banks. They are agents of magnificent systemic devastation. In the wake of each QE round are discouraged creditors who turn away in disgust. The damage and inflation feeds upon itself in stages of intense wreckage. The motive, need, and desperation for QE3 is being formed here and now, to be announced by late summer probably. Prepare for QE to infinity, endless hyper-inflation, a process that cannot be stopped, as the urgent needs grows. Any attempt to halt the process results in almost immediate total annihilation. So continuation of QE rounds serves to manage the deterioration process and guide the financial structures gradually and orderly into oblivion.

VICIOUS CYCLE FEEDS UPON ITSELF

Simply stated, each QE round guarantees the next round, since damage is done, nothing is remedied, and the funding needs intensify. The list of damage factors is actually growing. The main factor is capital destruction from monetary inflation, as the price of capital is declared zero, and it flees from the USEconomy. Witness the industry long gone, hardly a critical mass remaining to support the system with legitimate income. Government regulation and taxes assure the flight continues in exodus. Almost half of the US Gross Domestic Product is derived from financial paper shuffling, whose negative value has been clearly displayed in the form of mortgage bond wreckage, profound bond fraud, home foreclosure processing, absent home equity withdrawals, bankruptcy processing, and piles of debt that burden households. US economists fail to comprehend the entire concept of capital, this from the supposed leading capitalist nation. The banking and political leaders struggle to produce jobs without a clue of what capital is, instead seeking to put cash in consumer hands. They should pursue business formation, with capital investment, encourage risk taking, provide broad tax incentives, and lead the consumer spending process with job creation and income production. But no. They prefer QE, the accelerator that pushes the nation over the cliff.

The bond market has been disrupted and corrupted, as the debt monetization has driven off foreign creditors, leaving the USFed isolated as buyer. The 0% rate slows the USEconomy tremendously by removing a proper return on honest savings. Return on capital is greatly disrupted all through the USEconomy. The heavily increased monetary supply maintains the emphasis on asset bubbles, as desperation sets in to find the next asset to produce a new bubble. The answer is USTreasury Bonds. A mildly violent reaction has come to the long-term USTBonds, while the short-term USTBills stay near 0% but with the aid of intense leverage power of Interest Rate Swaps. The long end reacts negatively to QE, while the short end is under QE control from the big bulging bid. The entire financial structure is crumbling under the surface. The USEconomy will continue to falter at minus 3% to minus 5% growth in a powerful ongoing recession, covered up by the fraudulent quarter to quarter calculations that permit deep deceptions from adjustments. Businesses cannot justify any expansion, given the household dependence upon home equity has vanished. Businesses have been put on notice, a certain shock, that the national health care plan will place greater burden on the business models. So the USGovt deficits will perpetuate in high volume, making the supply overwhelming in USTreasury securities and making the creditors retreat in a cringe of fear, shock, and disgust. The more the USFed buys its own paper feces with USTBond labels, the more the securities lose their security, the more the foreign creditors refuse to participate in the next auction, the more the integrity of the US$ and USTBond is shredded and lost. The United States has become a Weimar nation with gradual global recognition. Instead of a recovery, it slides into the Third World. Thus the need for the USFed to cover the next USTreasury auction in full, or almost in full. It is deeply committed to monetizing the entire USGovt debt. Call it Weimar, Third World, Banana Republic, whatever!!

An encouragement has come from the QE movement to the entire world to revolt against the USDollar, to seek an alternative, to establish bilateral trade mechanisms, and to bypass the current system that enables privilege, fraud, market meddling, which permits an unwarranted standard of living to the US and its people. The bilateral accords between Russia and China, between China and Brazil, between Germany and Russia, and between India and Iran are all telltale signs of revolt. They wish not to participate in the US$-based system. The consequence is a new trend to diversify out of the USTreasurys with existing reserves, and to avoid accumulation in the future within banking systems for satisfaction of trade settlement in global commerce. The foundation on a global level is crumbling for the USDollar. As the bilateral links build, eventually enough fabric will be woven to support a new global currency, or a new global system. Often mentioned in certain circles is a sophisticated barter system, built upon high level credits in exchange, with a vast trickle down flow of funds, within a balanced system. Nations addicted to deficits will be left out in the cold. The most deficit ridden is the United States, dragged down by endless war costs. Their location has another name, the Third World.

Furthermore, the inflation effect has crossed from the monetary side to the price systems, hitting the entire cost structure in a profound way. The moron bankers strive to cut off the process from handing higher wages to the workers, so that they can afford a higher cost of living. The leaders thus strive to bankrupt the Middle Class, hardly a pursuit in commitment of economic recovery. The cost squeeze is deeply felt by both businesses and households, businesses that cannot hold their workers as profits erode badly, and households that cannot maintain their spending patterns as incomes are devoted increasingly to food, fuel, clothing, insurance, and everything else. Tax revenues from wages and corporate profits and capital gains are descending into the gutter, not available to cover the USGovt deficits. Witness the death of the USEconomy in hyper-drive, pushed by the USFed Quantitative Easing. The impact on the worsening recession at the macro level, and the shrinking of both businesses and households, translates to larger deficits. Notice that in early 2009 when QE1 was first announced, and later when QE-Lite was announced, the USGovt minions forecasted reduced budget deficits for 2010 and 2011. The USGovt posted its largest monthly deficit in history in February, a $223 billion shortfall. Most decisions center on budget cuts, for education, welfare, projects, and more, while war spending is largely intact, priorities revealed. They have no clue how to build tax revenues. The Jackass forecast was for greater deficits due to the ravages of capital destruction and cost inflation, which both arrived with billboard attachments. The dependence therefore upon the USFed for its Printing Pre$$ buyer of USTreasury Bonds will increase with each QE round, assuring the next round.

The harsh savage negative reaction to QE2 kicked into high gear the movement of funds out of the USTreasury complex and into commodities generally. The shift to financial commodities in Gold & Silver has been even greater than for crude oil, the traditional hedge. Despite not being the leading non-financial commodity in price increase, the crude oil impact is enormous, in food production, in transportation costs, and especially in industrial feedstock costs. The result is an energy tax, compounded by a systemic cost that acts like a gigantic tax. The USFed QE program thus imposed a significant tax increase on the entire USEconomy. The entire population is aware, except for the USFed, the Wall Street master, and banking elite. Actually, they are aware, but they cannot speak about the scourge they unleashed since they would invite criticism and turn the blame onto themselves for destroying the United States financially, economically, and systemically. The moral fiber is long gone among leaders, as the US nation is being recognized as a fraud king playpen. The end result is that in the cycle, movement from USTreasurys to the USEconomy is not happening during this death spiral, as it normally does. Instead, the next bubble is in the entire commodity arena. Beware that such a trend is highly destructive, since it erodes the profit margins and disposable income, thus causing deep recession if not systemic collapse. The energy and material tax renders huge harm, pushing the system into a deeper recession. It never ended.

Money is fleeing bonded paper, as all bond markets are in a severe situation. Even the stock market is supported heavily by the Working Group for Financial Markets and Flash Trading, a form of self-dealing, whereby both prop up stock share prices. Hence, the USFed is left more isolated to purchase its own inbred cousin toxic paper securities. The USFed must continue with QE3, the only remaining details are the securities that join the USTreasurys. My bet is state and municipal bonds, along with a bigger swath of mortgage bonds that would otherwise be put back to the Big US Banks, the dead pillars taking up space casting long shadows. Numerous are the bond candidates for official rescue, since all of them are in deep trouble. Buyers are simply vanishing. The bond markets is in ruins, propped by QE.

LAST ASSET BUBBLE

The tragedy is that the USTreasury Bond is the location of the biggest and most important asset bubble in the last 100 years. It is propped by the QE debt purchase, enforced by the USFed, made urgently necessary by the USGovt deficits, and blessed by the USDept Treasury. The USTBond bubble is the last bubble with any semblance of positive benefit. The next bubble in commodities will be negative, harsh, and highly destruction, as they will lift costs without a corresponding rise in wages. That event has already been triggered. The key characteristic of asset bubbles is that in the late stages, they require an accelerated source of funds just to maintain their inflated condition. The QE programs will be endless because the USTBond bubble demands it, even infinite funds. Thus the mantra in criticism of QE TO INFINITY. With the heightened source and blossoming channels to fund it, the integrity of the USTreasury Bond complex will be ruined even as the reputation and prestige of the USDollar will be shattered. This is an end chapter, marked by central bank frachise model failure.

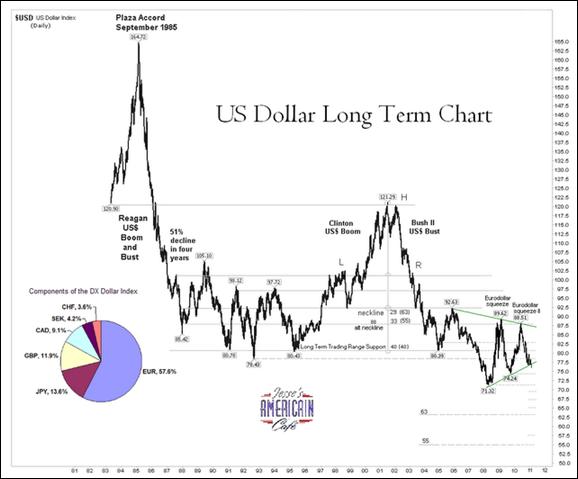

USDOLLAR FACES THE ABYSS

The US$ DX index is a bad joke, but its performance is highly revealing. As preface, the DX major component is the Euro, even though the biggest trade partner of the United States is Canada, with Mexico and China close behind. The argument is old and tired. Rare is the 30-year chart offered by the Jackass, since its reliance as a tool is often evidence of shallow analysis and little insight to offer for the current year and its main events. But the historical USDollar chart shows the great danger, since the world banking system rests on its unit of exchange. The DX index lows from 1991, 1992, 1995, and 2005 have all been breached, a major warning signal. Jesse at Cafe Americain points out the pennant flag pattern formed in the last three years. It must resolve up or down. My contention is that the pennant has already been broken on the lower barrier, a bear signal. The next QE3 announcement should send the DX index heading fast toward the 2008 critical low with a 71-72 handle. It is written; it will be done.

Many technical analysts are pre-occupied with monitoring the critical support levels. Those levels are 72, 75, and 76.5, seen in the weekly chart. Instead, focus on the lower barrier of the crucial pennant. The pennant trendline has been broken on the downside, an important development. Traders in the currencies, a multi-$trillion market, will take the minor technical breakdown and push the already weak USDollar lower. Many argue the Euro is in deep trouble, with a union in the midst of dismantlement. That might be true, but in the Reverse Beauty Pageant, the USDollar is by far the ugliest of the coined damsels. Its deficits are on par with the PIGS of Southern Europe in percentage terms. Besides, the US is the site of QE, the greatest monetary inflation scourge in modern history. Notice that the bounce in recovery off the October and November low of 76.5 could not manage a rise about the 20-week or the 50-week moving average. Those MA series serve as current overhead resistance. The DX chart is caught in powerful downward momentum. My forecast is for a breach of 76 in the next few weeks, and a battle of paramount importance at 74, the next critical support.

The intraday US$ DX chart shows more trouble in the very short term. The recovery off the 76 floor could not be maintained. In fact, the sudden swoon displayed its weakness if not artificial props. Be sure that the USDept Treasury with its fascist business model trusty tagteam of JPMorgan and Goldman Sachs are trying to do the herculean feat of preventing the USDollar from a powerful decline. The ugly truth is that JPM & GS are probably trying to manage the decline in the USDollar down to the 50-60 range in the US$ DX index, all as part of the USGovt agenda. The plan is to weaken the USDollar sufficiently enough to make the USEconomy competitive again with respect to export trade. The backfire in their faces is the price inflation curse and anathema. The price structures will rise first from the QE exercise in Weimar desperation, and will rise second from the US$ decline most assuredly worse than its major currency competitors. The report card will be seen in a much worse recession in the USEconomy, grander USGovt fiscal deficits, even larger USTBond issuance, and more grotesque QE debt monetization more characterisitic of a Third World Banana Republic.

SWIRL DOWN TOILET IN DETERIORATION

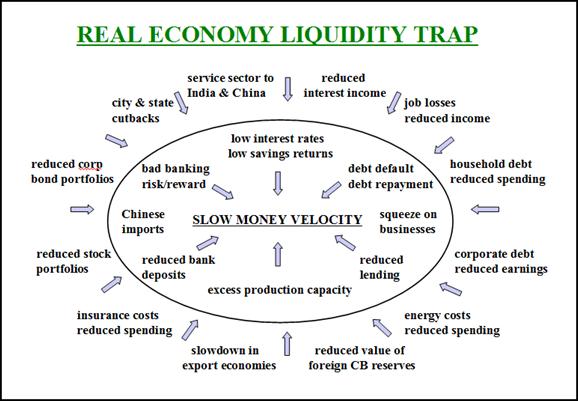

Within the Jackass archives, an item was found from work done in 2005. What began as a graphic display of the grand liquidity trap emanating from the failed housing & mortgage bubble has turned out to be highly relevant in the aggressive metastasizing process from monetary inflation cancer combined with basic economic deterioration from capital destruction. Many are the ills of the USEconomy and its fractured financial foundation. Take the time to note all the different powerful factors at work that slow the entire system down. Forces are shown from external shocks and internal shocks. The money supply velocity is falling, ordered slower by the short-term interest rate stuck at 0%, the Zero Interest Rate Policy described as an important chamber label of failure. Recall the empty calls for an Exit Strategy throughout 2009 and into early 2010, as vacant as the Green Shoots and Jobless Recovery basis of propaganda that unmasks the fraudulent bank leadership. The Fed Funds Rate stuck at 0% cannot rise by USFed dictate, because the housing market would implode more quickly, because the USEconomy would sink more quickly, because the US stock market would dive like a dead mallard, because the USGovt borrowing costs would bring more deficit from debt service than other major items. The USFed has been backed in a corner for two years, no longer relying upon a temporary 0% rate to stimulate. It is stuck with 0% as a badge of dishonor, as a two ton cement block around its neck, as a Weimar membership card. The complex chart should remind the reader of a toilet, sewer drain, or even a rectum.

Some advice. As the movement swirls, as the next QE program details are revealed, as the central bank model is shattered in discredit, as the global monetary system crumbles before your eyes, as sovereign debt worldwide loses its exalted safe haven security, as your personal budget finances erode beyond your worst nightmare, invest what is left of your life savings in Gold and especially Silver. In time, they will be the primary portions of your portfolio with surviving value. Each will rise, but Silver will do a moon shot!!

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"Your analysis is absolutely superior to anything available out there. Like no other publication, yours places a premium on telling the truth and provides a true macro perspective with forecasts that are uncannily accurate. I eagerly await each month's issues and spend hours reading and studying them. Many times I go back and re-read the most current issue just make sure I did not miss anything the first time!"

(DevM from Virginia)

"Days like these, I congratulate myself I had the good sense to follow your advice. I am much indebted to you!! For the last three years of my Hat Trick Letter membership, I have been able quickly to separate the grain from the chaff and save my assets from doom, having made sound investments in precious metals. Your thorough knowledge of macro-economics and financial cogwheels paired with your courageous visionary writing have been a much needed eye opening university."

(PatrickB from France)

"I think that your newsletter is brilliant. It will also be an excellent chronicle of these times for future researchers."

(PeterC in England)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.