China Adviser, Buy Gold Bullion with Nearly $3 Trillion Chinese Reserves

Commodities / Gold and Silver 2011 Mar 09, 2011 - 08:36 AM GMTBy: GoldCore

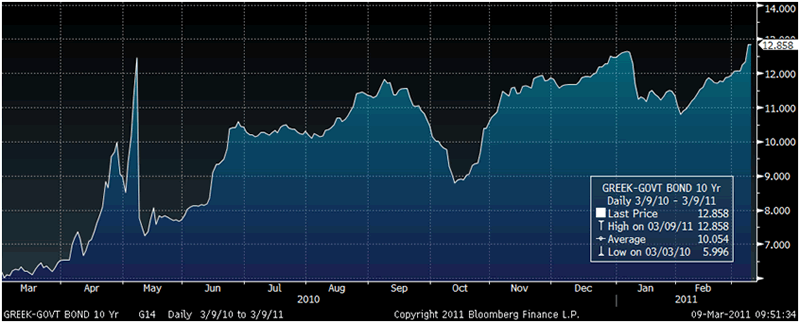

Renewed fears over eurozone debt have seen the euro fall against most currencies and precious metals today. The yield on Greek 10-year bonds is approaching an alarming 13% after jumping to a new record high of 12.89% today (see bond charts below). The Portuguese 10-year rose to a new record high of 7.7% ahead of today’s auction where they borrowed 1 billion euros in order to avoid a “bailout”.

Renewed fears over eurozone debt have seen the euro fall against most currencies and precious metals today. The yield on Greek 10-year bonds is approaching an alarming 13% after jumping to a new record high of 12.89% today (see bond charts below). The Portuguese 10-year rose to a new record high of 7.7% ahead of today’s auction where they borrowed 1 billion euros in order to avoid a “bailout”.

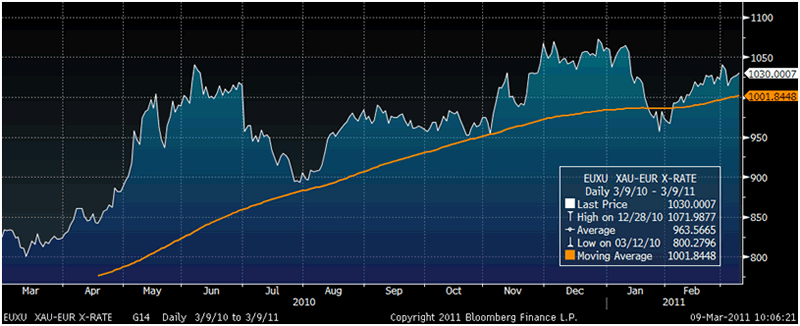

The risk of contagion in the eurozone has clearly not gone away and this is another primary factor supporting gold above the $1,400/oz and the €1,000/oz level. The charts contradict those who simplistically call gold a bubble with gold having seen a period of correction and consolidation since November last year and looking like it is ready to break out and challenge new highs above $1,500/oz and EUR1,100/oz in the coming weeks.

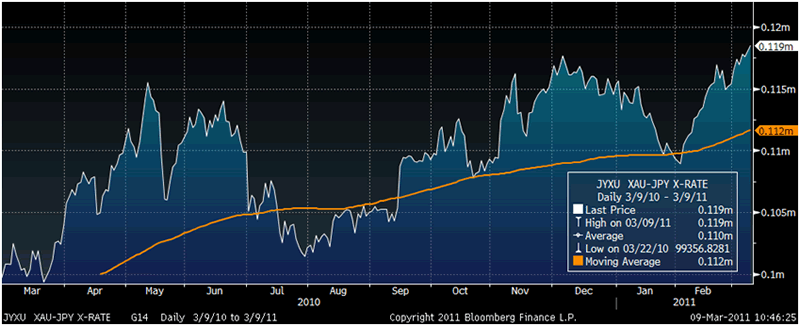

Gold in Japanese yen has continued its gradual rise and has reached multi-year nominal highs at 119,000 yen per ounce. Gold in yen remains a long way from the nominal high of 160,000 yen per ounce seen in February 1980. This is likely a leading indicator that Japan’s deflation may be morphing into stagflation and the yen’s safe haven status is likely to be as questioned as the dollar’s in the months ahead.

While oil prices came off somewhat they remain near recent highs and uncertainty in Libya and in Saudi Arabia (where there are concerns about the coming ‘Day of Rage’ on Friday) will likely see oil remain robust with sell offs being shallow and short.

The likelihood that the People’s Bank of China is increasing and will continue to increase its gold reserves and the percentage of foreign exchange reserves held in gold, was seen in comments by Li Yining, an influential Chinese economic adviser, yesterday.

He said that China should use some of its close to $3 trillion foreign exchange reserves to buy more gold, and should use the precious metal to hedge against risks of foreign currency devaluations. Reuters reported the story this morning (Reuters Africa) and Bloomberg had a very brief news story yesterday.

"China should increase its gold reserves appropriately, and China must take every chance to buy, especially when gold prices fall," Li was quoted by the official Xinhua news agency as saying.

China does not disclose its gold reserves figures (neither on a monthly, quarterly or annual basis) but is likely quietly accumulating and will announce in the coming years that its reserves have risen from 1,054 tonnes, which is very low when compared to the Federal Reserve’s, to over 8,100 tonnes.

Gold’s recent and continuing robustness indicates that the ‘Beijing put’ is supporting the market on all sell offs and will likely continue to do so for the foreseeable future.

The Chinese are too shrewd to ‘telegraph’ their intentions to accumulate much larger gold reserves and will announce the ‘news’ when they are ready.

Gold

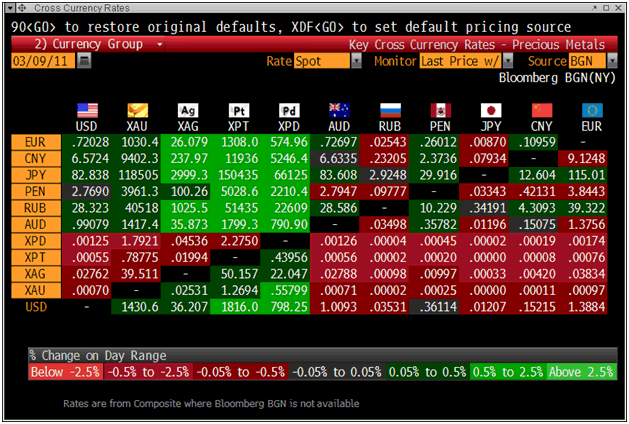

Gold is trading at $1,429.69/oz, €1,027.45/oz and £882.52/oz.

Silver

Silver is trading at $36.14/oz, €25.97/oz and £22.31/oz.

Platinum Group Metals

Platinum is trading at $1,811.00/oz, palladium at $794.00/oz and rhodium at $2,350/oz.

News

(Reuters) -- China adviser says Beijing should buy more gold

China should use some of its $2.85 trillion foreign exchange reserves to buy more gold XAU=, a government adviser was quoted as saying by local media reports on Wednesday.

Li Yining, a senior economist at Peking University and member of the Chinese People's Political Consultative Committee, an advisory body to the national parliament, said that China should use the precious metal to hedge against risks of foreign currency devaluations.

"China should increase its gold reserves appropriately, and China must take every chance to buy, especially when gold prices fall," Li was quoted by the official Xinhua news agency as saying.

His view that Beijing should diversify its foreign exchange reserves, the world's largest, into commodities is nothing new. Many other academics have publicly called on Beijing to do so.

But Li's views may carry more weight than most. Many of his former students are now high-ranking officials, including Chinese Vice Premier Li Keqiang, who is seen as Premier Wen Jiabao's likely successor in 2013.

However, Yi Gang, head of the State Administration of Foreign Exchange, which is responsible for managing most of the country's foreign currency holdings, said recently that it was not possible for China to make big purchases in the spot gold market.

"If China gets into these markets and pushes up prices to extremely high levels, the Chinese people will bear the cost at the end of the day as China is often the key buyer in these markets," Yi said.

He added that Chinese firms and households had purchased more than 300 tonnes of gold last year, and that it would have been hard for the government to buy any more with foreign reserve funds.

"The gold price shot up last year, and surging gold prices have forced Chinese people to pay more as there is strong demand for gold for those getting married and other events," he said. [ID:nTOE71P00H]

According to the central bank, China's state gold reserves have been held at 33.89 million ounces since April 2009.

Gold prices have risen about 10 percent in the last six weeks, as clashes in Libya and turbulence across the Arab world have encouraged investors to seek a safe haven, while oil has gained about 17 percent in the same period, increasing gold's inflation hedge appeal.

(Bloomberg) -- Li Yining Says China Should Raise Gold Reserves, Radio Reports

China should boost gold reserves “appropriately,” to secure the safety of the country’s foreign exchange reserves, Li Yining, an economist, was quoted as saying by China National Radio today.

(Bloomberg) -- Shanghai Gold Exchange to Extend Trading Time for Night Session

The Shanghai Gold Exchange plans to extend trading hours for the night session from late April, the bourse said in a statement posted on its website today.

The closing time for the night session will be 3:30 a.m., the statement said.

(Bloomberg) -- Merrill Lynch Says Brent May Break Through $140 in Three Months

North Sea Brent crude may trade at more than $140 a barrel in the next three months amid rising global demand and halts to production in Libya, Bank of America Merrill Lynch said.

“To reflect a tighter market, we upgrade our average second quarter 2011 Brent crude oil forecast to $122 a barrel from $86 a barrel,” the bank said in a note today. “On average for 2011, we now project Brent crude oil prices at $108 a barrel.” For West Texas Intermediate, the bank forecasts an average of $101 a barrel for this year, up from $87.

(Bloomberg) -- London Accounted for Two-Thirds of Global Gold Trading Last Year

More gold trading takes place in London than any other city, according to the latest commodities report by the financial industry-sponsored TheCityUK.

The U.K. capital captured 67 percent of the record $25.1 trillion in global gold trading last year, compared with 74 percent in 2009, according to TheCityUK. New York had 22 percent of the gold market, up from 16 percent in 2009, followed by Mumbai with 6 percent and Tokyo at 5 percent.

London kept its position as the center of the precious metals market that it established with the daily gold fixing in 1919. HSBC Holdings Plc, based in London, holds the gold on behalf of the SPDR Gold Trust, the biggest exchange-traded fund for the metal.

“London doesn’t have any competition when it comes to over-the-counter trading in gold,” said Marko Maslakovic, senior manager of economic research at TheCityUK in London. “OTC trading has been losing to exchange trading over the past five or six years because we’re getting more and more products traded on exchanges such as ETFs. It’s becoming easier to access the market through exchanges.”

London had 40 percent share of the $3.2 trillion silver market last year, down from 52 percent in 2009, according to the report. New York’s share climbed to 31 percent from 19 percent followed by Mumbai at 27 percent, down from 29 percent in 2009, according to Maslakovic.

The actual gold traded last year in London was 13.8 billion ounces of the global total of 20.48 billion ounces, according to TheCityUK. The silver total in London was 64.6 billion ounces, of a global 157.5 billion ounces, it said.

(Bloomberg) -- Gold Rises to 118,620 Yen an Ounce, Most Since Feb. 15, 1983

Gold for immediate delivery rose 0.4 percent to 118,620 yen an ounce, the highest price since Feb. 15, 1983.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.