Dallas Fed President Fisher Could Dissent if Crude Oil Prices Maintain Upward Trend

Interest-Rates / US Interest Rates Mar 09, 2011 - 04:12 AM GMTBy: Asha_Bangalore

Dallas Fed President Fisher indicated yesterday that he would vote to scale back or discontinue the Fed's Treasury securities buying program of $600 billion at the March 15 FOMC meeting. Last week, Chairman Bernanke has indicated that only under conditions of strong sustained growth, expanding payrolls, and inflation readings that are consistent with price stability would the Fed consider terminating the program. Current economic data indicate that the Fed is not even close to meeting these targets.

Dallas Fed President Fisher indicated yesterday that he would vote to scale back or discontinue the Fed's Treasury securities buying program of $600 billion at the March 15 FOMC meeting. Last week, Chairman Bernanke has indicated that only under conditions of strong sustained growth, expanding payrolls, and inflation readings that are consistent with price stability would the Fed consider terminating the program. Current economic data indicate that the Fed is not even close to meeting these targets.

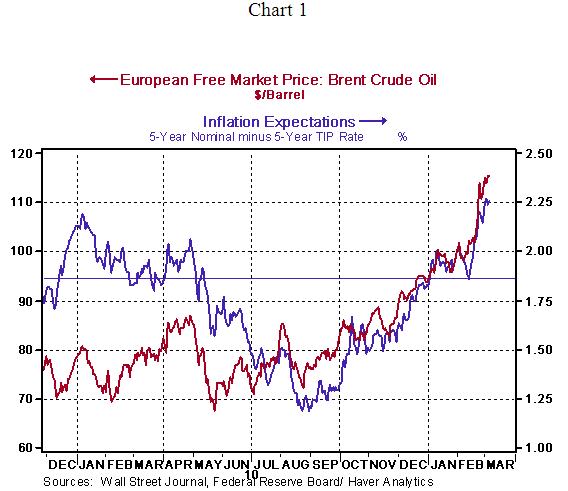

The Fed has completed roughly 67% of the purchase plan announced in November 2010. In January 2011, President Fisher voted with the majority to continue expanding its holdings of Treasury securities. In his opinion, the Fed's job "is done" and continued purchases of Treasuries may result in raising inflation expectations. As shown in Chart 1, inflation expectations have moved up as the crisis in North Africa has intensified and lifted oil prices in recent weeks.

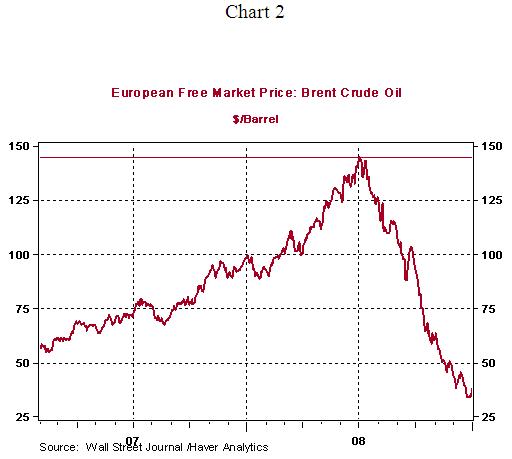

Stepping back in time, there was a sharp increase in oil prices in a very short time span in the first-half of 2008 (see Chart 2). We are all aware of the major economic events of 2008 and a reminder is unnecessary. President Fisher dissented at each meeting during January 30, 2008 - August 2008 to either take no action or adopt less aggressive easing of the federal funds rate between January 2008 and April 2008. The Fed went on to lower the federal funds rate 150 basis points between January 30, 2008 and April 2008 to 2.00%. At the June and August 2008 meetings, President Fisher would have preferred to raise the federal funds rate when the Fed held the funds rate unchanged. He voted with the majority at the September 2008 meeting to leave the federal funds rate steady at 2.00% by which time oil prices had reversed trend (see Chart 2) compared with the earlier part of the year.

Returning back to the present and comparing notes, the voting preferences of President Fisher appear to be closely tied with the trend of oil prices. The U.S. economy has recorded six quarters of economic growth but is yet to post meaningful gains in payroll employment. The level of payroll employment in February 2011 (130.515 million) is a tad above the level recorded in June 2009 (130.493 million) when the economic recovery commenced and real GDP is about 5.0% below potential GDP. The slack in the economy, at the present time, is significant to justify maintaining the current stance of monetary policy.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.