Trading Advantages of the Elliott Wave Principle

InvestorEducation / Elliott Wave Theory Mar 08, 2011 - 12:32 PM GMTBy: EWI

What advantages does the Wave Principle offer to traders?

What advantages does the Wave Principle offer to traders?

Here's one of the big advantages of using the Wave Principle when trading: you can increase your understanding of how current price action relates to the market's larger trend.

Other tools fall short in this regard. Several trend-following indicators such as oscillators and sentiment measures have their strong points, yet they generally fail to reveal the maturity of a trend. Moreover, these technical approaches to trading are not as useful in establishing price targets as the Wave Principle.

Here's another big advantage of using the Wave Principle in your trading, which comes directly from the free eBook "How the Wave Principle Can Improve Your Trading" -

"Technical studies can pick out many trading opportunities, but the Wave Principle helps traders discern which ones have the highest probability of being successful."

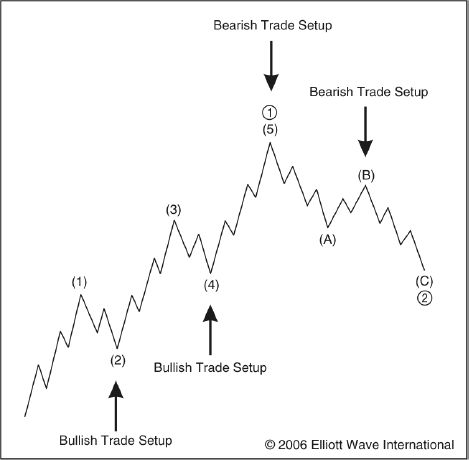

Indeed, this valuable free eBook shows you how to identify and exploit the market's price pattern, as shown in the Elliott wave structure below:

The Wave Principle also helps you to identify price levels where you may want to place protective stops.

"...although the Wave Principle is highly regarded as an analytical tool, many traders abandon it when they trade in real-time -- mainly because they don't think it provides the defined rules and guidelines of a typical trading system.

But not so fast -- although the Wave Principle isn't a trading "system," its built-in rules do show you where to place protective stops in real-time trading." "How the Wave Principle Can Improve Your Trading"

Before you attempt to identify price levels for protective or trailing stops, you should first become familiar with these three rules of the Wave Principle:

- Wave 2 can never retrace more than 100 percent of wave 1

- Wave 4 may never end in the price territory of wave 1

- Wave 3 may never be the shortest impulse wave of waves 1, 3, and 5

The details and specific instructions for placing protective and trailing stops are in the BONUS section of the free eBook, "How the Wave Principle Can Improve Your Trading."

- How the Wave Principle provides you with price targets

- How it gives you specific "points of ruin": At what point does a trade fail?

- What specific trading opportunities the Wave Principle offers you

- How to use the Wave Principle to set protective stops

This article was syndicated by Elliott Wave International and was originally published under the headline Big Advantages of Trading with the Wave Principle. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.