Debt, Inflation and Global Economy Systemic Risks, The ZIRP Trap

Economics / Global Economy Mar 08, 2011 - 05:06 AM GMTBy: John_Mauldin

I get a lot of client letters from various managers and funds, as you might imagine. I read more than I should. But one that shows up every quarter or so makes me stop what I am doing and sit down and read. It is the quarterly letter from Hayman Advisors, based here in Dallas. They are macro guys (which I guess is part of the magnetic attraction for me), and they really put some thought into their craft and have some of the best sources anywhere. So today we take a look at their latest letter, where they cover a wide variety of topics, with cutting-edge analysis and sharp insight. I really like these guys, and suggest you take the time to read the entire letter.#

I get a lot of client letters from various managers and funds, as you might imagine. I read more than I should. But one that shows up every quarter or so makes me stop what I am doing and sit down and read. It is the quarterly letter from Hayman Advisors, based here in Dallas. They are macro guys (which I guess is part of the magnetic attraction for me), and they really put some thought into their craft and have some of the best sources anywhere. So today we take a look at their latest letter, where they cover a wide variety of topics, with cutting-edge analysis and sharp insight. I really like these guys, and suggest you take the time to read the entire letter.#

Today (Tuesday) is the day I want you to start buying Endgame. The early reviews on Amazon are quite gratifying – writing a book is damn hard work, so when people say nice things it just feels good. Have a great week! Now let’s jump into the Hayman client letter.

John Mauldin, Editor

Outside the Box

The Cognitive Dissonance of It All

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one." – Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

Dear Investors:

We continue to be very concerned about systemic risk in the global economy. Thus far, the systemic risk that was prevalent in the global credit markets in 2007 and 2008 has not subsided; rather, it has simply been transferred from the private sector to the public sector. We are currently in the midst of a cyclical upswing driven by the most aggressively procyclical fiscal and monetary policies the world has ever seen. Investors around the world are engaging in an acute and severe cognitive dissonance. They acknowledge that excessive leverage created an asset bubble of generational proportions, but they do everything possible to prevent rational deleveraging. Interestingly, equities continue to march higher in the face of European sovereign spreads remaining near their widest levels since the crisis began. It is eerily similar to July 2007, when equities continued higher as credit markets began to collapse. This letter outlines the major systemic fault lines which we believe all investors should consider. Specifically, we address the following:

• Who Is Mixing the Kool-Aid? (Know Your Central Bankers)

• The Zero-Interest-Rate-Policy Trap

• The Keynesian Endpoint – Where Deficit Spending and Fiscal Stimulus Break Down

• Japan – What Other Macro Players Have Missed and the Coming of “X-Day”

• Will Germany Go All-In, or Is the Price Too High?

• An Update on Iceland and Greece

• Does Debt Matter?

While good investment opportunities still exist, investors need to exercise caution and particular care with respect to investment decisions. We expect that 2011 will be yet another very interesting year.

In 2010, our core portfolio of investments in US mortgages, bank debt, high-yield debt, corporate debt, and equities generated our positive returns while our “tail” positions in Europe contributed nominally in the positive direction and our Japanese investments were nominally negative. We believe this rebound in equities and commodities is mostly a product of “goosing” by the Fed’s printing press and are not enthusiastic about investing too far out on the risk spectrum. We continue to have a portfolio of short duration credit along with moderate equity exposure and large notional tail positions in the event of sovereign defaults.

Who Is Mixing the Kool-Aid?

Unfortunately, “academic” has become a synonym for “central banker.” These days it takes a particular personality type to emerge as the highest financial controller in a modern economy, and too few have real financial market or commercial experience. Roget’s Thesaurus has not yet adopted this use, but the practical reality is sad and true. We have attached a brief personal work history of the US Fed governors to further illustrate this point. So few central bankers around the world have ever run a business – yet so much financial trust is vested with them. In discussing the sovereign debt problems many countries currently face, the academic elite tend to arrive quickly at the proverbial fork in the road (inflation versus default) and choose inflation because they perceive it to be less painful and less noticeable while pushing the harder decision further down the road. Greenspan dropped rates to 1% and traded the dot com bust for the housing boom. He knew that the road over the next 10 years was going to be fraught with so much danger that he handed the reins over to Bernanke and quit. Central bankers tend to believe that inflation and default are mutually exclusive outcomes and that they have been anointed with the power to choose one path that is separate and exclusive of the other. Unfortunately, when countries are as indebted as they are today, these choices become synonymous with one another – one actually causes the other.

ZIRP (Zero Interest Rate Policy) Is a TRAP

As developed Western economies bounce along the zero lower bound (ZLB), few participants realize or acknowledge that ZIRP is an inescapable trap. When a heavily indebted nation pursues the ZLB to avoid painful restructuring within its debt markets (household, corporate, and/or government debt), the ZLB facilitates a pursuit of aggressive Keynesianism that only perpetuates the reliance on ZIRP. The only meaningful reduction of debt throughout this crisis has been the forced deleveraging of the household sector in the US through foreclosure. Total credit market debt has increased throughout the crisis by the transfer of private debt to the public balance sheet while running double-digit fiscal deficits. In fact, this is an explicit part of a central banker’s playbook that presupposes that net credit expansion is a necessary precondition for growth. However, the problem of over indebtedness that is ameliorated by ZIRP is only made worse the longer a sovereign stays at the ZLB – with ever greater consequences when short rates eventually (and inevitably) return to a normalized level.

Consider the United States’ balance sheet. The United States is rapidly approaching the Congressionally mandated debt ceiling, which was most recently raised in February 2010 to $14.2 trillion dollars (including $4.6 trillion held by Social Security and other government trust funds). Every one percentage point move in the weighted-average cost of capital will end up costing $142 billion annually in interest alone. Assuming anything but an inverted curve, a move back to 5% short rates will increase annual US interest expense by almost $700 billion annually against current US government revenues of $2.228 trillion (CBO FY 2011 forecast). Even if US government revenues were to reach their prior peak of $2.568 trillion (FY 2007), the impact of a rise in interest rates is still staggering. It is plain and simple; the US cannot afford to leave the ZLB – certainly not once it accumulates a further $9 trillion in debt over the next 10 years (which will increase the annual interest bill by an additional $90 billion per 1%). If US rates do start moving, it will most likely be for the wrong (and most dire) reasons. Academic “research” on this subject is best defined as alchemy masquerading as hard science. The only historical observation of a debt-driven ZIRP has been Japan, and the true consequences have yet to be felt. Never before have so many developed western economies been in the same ZLB boat at the same time. Bernanke, our current “Wizard of Oz”, offered this little tidbit of conjecture in a piece he co-authored in 2004 which was appropriately titled “Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment”. He clearly did not want to call this paper a “Hypothetical Assessment” (as it really was).

Despite our relatively encouraging findings concerning the potential efficacy of non‐standard policies at the zero bound, caution remains appropriate in making policy prescriptions. Although it appears that nonstandard policy measures may affect asset prices and yields and, consequently, aggregate demand, considerable uncertainty remains about the size and reliability of these effects under the circumstances prevailing near the zero bound. The conservative approach — maintaining a sufficient inflation buffer and applying preemptive easing as necessary to minimize the risk of hitting the zero bound — still seems to us to be sensible. However, such policies cannot ensure that the zero bound will never be met, so that additional refining of our understanding of the potential usefulness of nonstandard policies for escaping the zero bound should remain a high priority for macroeconomists.

–Bernanke, Reinhart, and Sack, 2004. (Emphasis Added) It is telling that he uses the verb “escaping” in that final sentence – instinctively he knows the ZLB is dangerous.

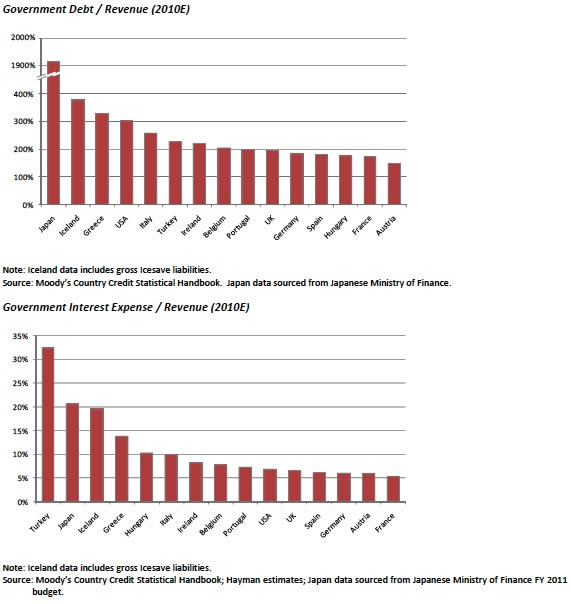

The Keynesian Endpoint – Things Become Nonlinear

As Professor Ken Rogoff (Harvard School of Public Policy Research) describes in his new book, This Time is Different: Eight Centuries of Financial Folly, sovereign defaults tend to follow banking crises by a few short years. His work shows that historically, the average breaking point for countries that finance themselves externally occurs at approximately 4.2x debt/revenue. Of course, this is not a hard and fast rule and each country is different, but it does provide a useful frame of reference. We believe that the two critical ratios for understanding and explaining sovereign situations are: (1) sovereign debt to central government revenue and (2) interest expense as a percentage of central government revenue. We believe that these ratios are better incremental barometers of financial health than the often referenced debt/GDP – GDP calculations can be very misleading. We believe that central government revenue is a more precise measure of a government’s substantive ability to pay creditors. Economists use GDP as a homogenizing denominator to illustrate broad points without particular attention to the idiosyncrasies of each nation. Using our preferred debt yardsticks, we find that when debt grows to such levels that it eclipses revenue multiple times over, (every country is unique and the maximum sustainable level of debt for any given country is governed by a multitude of factors), there is a nonlinear relationship between revenues and expenses in that total expenditures increase faster than revenues due to the rise in interest expense from a higher debt load coupled with a higher weighted-average cost of capital and the natural inflation of discretionary expenditure increases. The means by which sovereigns fall into this inescapable debt trap is the critical point which must be understood. In some cases, on-balance-sheet government debts (excluding pension shortfalls and unfunded holes in social welfare programs) exceed 3x revenue, and current fiscal policies point to a continuing upward trend.

The Bank of International Settlements released a paper in March 2010 that is particularly sobering. The paper, entitled “The Future of Public Debt: Prospects and Implications” (Cecchetti, Mohanty and Zampolli), paints a shocking picture of the trajectory of sovereign indebtedness. While the authors focus on GDP-based ratios as opposed to our preferred metrics, the forecast is nevertheless alarming. The study focuses on twelve major developed economies and finds that “debt/GDP ratios rise rapidly in the next decade, exceeding 300% of GDP in Japan; 200% in the United Kingdom; and 150% in Belgium, France, Ireland, Greece, Italy and the United States”. Additionally, the authors find that government interest expense as a percent of GDP will rise “from around 5% [on average] today to over 10% in all cases, and as high as 27% in the United Kingdom”. The authors point out that “without a clear change in policy, the path is unstable”. (http://www.bis.org/publ/work300.pdf [p. 9])

When central bankers engage in “nonstandard” policies in an attempt to grow revenues, the resulting increase in interest expense may be many multiples of the change in central government revenue. For instance, Japan currently maintains central government debt approaching one quadrillion (one thousand trillion) Yen and central government revenues are roughly ¥48 trillion. Their ratio of central government debt to revenue is a fatal 20x. As we discuss later, Japan sailed through their solvency zone many years ago. Minute increases in the weighted‐average cost of capital for these governments will force them into what we have termed “the Keynesian endpoint” – where debt service alone exceeds revenue.

In Japan, some thoughtful members of the Diet (Japan’s parliament) decided that they must target a more aggressive hard inflation target of 2-3%. For the past 10+ years, the institutional investor base in Japan has agreed to buy 10-year bonds and receive less than 1.5% in nominal yield, as persistent deflation between 1-3% per year provides the buyer with a “real yield” somewhere between 2.5%-4.5% (nominal yield plus deflation). (We believe that Japanese institutional investors may base some of their investment decisions on real yields whereas external JGB investors do not.) If the Bank of Japan (BOJ) were to target inflation of just 1% to 2%, what rate would investors have to charge in order to have a positive real yield? In order to achieve even a 2.5% real yield, the nominal (or stated) yields on the bonds would have to be in excess of 3.5%. Herein lies the real problem. If the BOJ chooses an inflation target, the Japanese central government’s cost of capital will increase by more than 200 basis points (over time) and increase their interest expense by more than ¥20 trillion (every 100 basis point change in the weighted-average cost of capital is roughly equal to 25% of the central government’s tax revenue). For context, if Japan had to borrow at France’s rates (a AAA-rated member of the U.N. Security Council), the interest burden alone would bankrupt the government. Their debt service alone could easily exceed their entire central government revenue – checkmate. The ZIRP trap snaps shut. The bond markets tend to anticipate events long before they happen, and we believe a Japanese bond crisis is lurking right around the corner in the next few years.

Below, pleasBelow, please find a piece of our work detailing some important countries and these key relationships:

What Other Macro Participants Have Missed and the Coming of “X-Day” pan has been a key focus of our firm for the last few years. We could spend another 10 pages doing a deep dive into our entire thesis, but for now we are going to stick with the catalysts for the upcoming Japanese bond crisis.

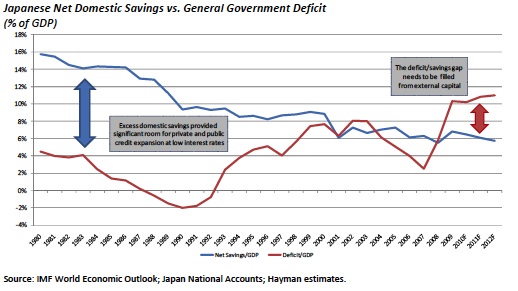

Investing with the expectations of rising rates in Japan has been dubbed “the widow maker” by some of the world’s most talented macro investors over the past 15-20 years. It is our belief that these investors missed a crucial piece to the puzzle that might have saved them untold millions (and maybe billions). They operated under the assumption that Japanese investors would simply grow tired of financing the government – directly or indirectly – with such a low return on capital. However, we believe that the absence of attractive domestic investment alternatives and the preponderance of new domestic savings generated each year enabled the Japanese government to “self-finance” by selling government bonds (JGBs) to its households and corporations. This is done despite their preference for cash and time deposits via financial institutions (such as the Government Pension Investment Fund, other pension funds, life insurance companies, and banks like Japan Post) that have little appetite for more volatile alternatives and little opportunity to invest in new private sector fixed-income assets. Essentially, they take in the savings as deposits and recycle them into government debt. Thus, it is necessary to understand how large the pool of capital for the sale of new government bonds.

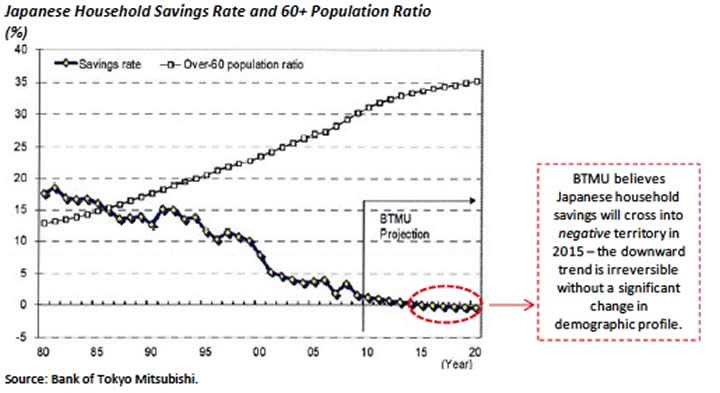

We focus on incremental sales or “flow” versus the “stock” of aggregated debt. To simplify, the available pools of capital are comprised of two accounts – household and corporate sector. The former is the incremental personal savings of the Japanese population, and the latter is the after-tax corporate profits of Japanese corporations. These two pieces of the puzzle are the incremental pools of capital to which the government can sell bonds. As reflected in the chart below, as long as the sum of these two numbers exceeds the running government fiscal deficit, the Japanese government (in theory) has the ability to self-finance or sell additional government bonds into the domestic pool of capital. As long as the blue line stays above the red line, the Japanese government can continue to self-finance. This is the key relationship the macro investors have missed for the last decade – it is not a question of willingness, but one of capacity. As the Japanese government’s structural deficit grows wider (driven by the increasing cost of an ageing population, higher debt service, and secularly declining revenues) the divergence between savings and the deficit will increase. Interestingly enough, Alan Stanford and Bernie Madoff have recently shown us what tends to happen when this self-financing relationship inverts. When the available incremental pool of capital becomes smaller than the incremental financing needs of the government or a Ponzi scheme, the rubber finally meets the road. The severe decline in the population in addition to Japanese resistance to large scale immigration combine to form a volatile catalyst for a toxic bond crisis that could very likely be the largest the world has ever witnessed. Below is chart depicting this relationship:

Personal savings in Japan, while historically higher than almost any other nation, is now approaching zero and will fall below zero in the coming years (as recently pointed out by the Bank of Tokyo Mitsubishi) as more people leave the workforce than enter. For at least the next 20 years, we believe that Japan will have one of the largest natural population declines in a developed country.

One last point about Japan that is more psychological than quantitative: there is an interesting psychological parallel between JGBs and US housing. In the last 20 years, Japanese stocks have dropped 75%, Japanese real estate has declined 70% (with high-end real estate dropping 50% in the last two years), and nominal GDP is exactly where it was 20 years ago. What one asset has never hurt the buyer? What one asset has earned a 20-year procyclical, ‘Pavlovian’ response associated with safety and even more safety? The buyers and owners of JGBs have never lost money in the purchase of these instruments as their interest rates have done nothing but fall for the better part of the last 2 decades. It is fascinating to see an instrument/asset be viewed as one of the safest in the world (10-yr JGB cash rates are currently 1.21%) at a period of time in which the credit fundamentals have never been riskier. Without revealing the Master Fund’s positioning here, we certainly intend to exploit the inefficiencies of option pricing models over the next few years. The primary flaw in pricing the risk of rising JGB yields is the reliance on historical volatility which, to this point in time, has remained very low. We believe that volatility will rise significantly and that current models undervalue the potential magnitude of future moves in JGB yields.

With all of the evidence literally stacking up against Japan, a few members of some of the major political parties are beginning to discuss and plan for the ominously named “X-Day”. According to The Wall Street Journal and BusinessWeek, X-Day is the day the market will no longer willingly purchase JGBs. Planning is in the very early stages, but centers around having a set of serious fiscal changes that could be announced immediately with the intention of giving the Bank of Japan the cover they will need to purchase massive amounts of JGBs with money printed out of thin air. If the BOJ were to engage in this type of behavior, we believe the Yen would plummet against the basket of key world currencies which would in turn drive Japanese interest rates higher and further aggravate their bond crisis. Neither the Fed, the Bank of England nor the European Central Bank have been able to consistently suppress bond yields through purchases with printed money – the bigger the purchase, the greater the risk of a collapse in confidence in the currency and capital flight. No matter how they attempt to quell the crisis, no matter where they turn, they will realize that they are in checkmate.

Will Germany Go “All-In” or Is the Price Too High?

We believe that an appreciation of the extent and limits of German commitment to full fiscal and debt integration with the rest of the Eurozone is crucial to understanding the path forward for European sovereign credit issues.

Despite consistent attempts by the European Commission and other members of the Eurozone bureaucratic vanguard to publicly promote as “done deals” various proposals to extend debt maturities, engage in debt buybacks and dramatically extend both the scope and size of the EFSF – the outcome has remained in doubt. In the end, the national governments of the member states will determine these policies regardless of what unnamed “European officials” leak to the newswires.

We believe that Angela Merkel has heeded the discord in the German domestic political sphere (where consistent polling shows a decline in support for the Euro and an increase in belief that Germany would have been better off not joining) and, as a result, set a series of substantial criteria for any German approval of further reform and extension of the EFSF structure. The areas canvassed – balanced budget amendments, corporate tax rate equalization, elimination of wage indexation and pension age harmonization – read like a wish list for remaking the entire Eurozone into a responsible and conservative fiscal actor in the mold of modern‐day Berlin. However, we believe (absent a dramatic change in the political mood) that several member states will never allow these requests to become binding prerequisites for further fiscal integration – the Irish and Slovaks on tax, the French on pension age, the Belgians and Portuguese on indexation, and almost everybody on the balanced budget amendment.

So the Eurozone seems to be at an impasse – the Germans are reluctant to step further into the quagmire of peripheral sovereign debt without assurances that all nations will be compelled to bring their houses in order, and the rest of the Eurozone rejects the burden of a German fiscal straightjacket. We continue to believe that, in the end, the German people will not go “all-in” to backstop the profligacy and expediency of the rest of the Eurozone without a credible plan to restructure existing debts and ensure that they can never reach such dangerous levels again.

A variety of solutions have been proposed to allow the de facto restructuring of Greek debt without engaging in formal default. The ECB and EC continue to be obsessed with preventing what they have deemed to be “speculators” from benefiting via the triggering of CDS on Greek sovereign debt. Not only is this pointlessly statist in its opposition to market participants, but it is also counterproductive to their other stated aims of maintaining financial stability and bank solvency, as much of the notional CDS outstanding against Greek sovereign debt is held as a bona fide hedge. Data from the Depository Trust and Clearing Corporation (“DTCC”) clearly invalidates the assertion that a rogue army of speculators is instigating a Greek bond crisis for a profit. According to the DTCC, there is only $5.7 billion net notional CDS outstanding on sovereign obligations of the Hellenic Republic, versus approximately $489 billion of total sovereign debt outstanding (as of September 30, 2010). Net CDS on Greek sovereign debt is equal to 1.2% of debt outstanding. (http://www.dtcc.com/products/derivserv/data_table_i.php?tbid=5)

Any revaluation of debt that reduces the real or nominal value of Greece’s debt outstanding – either through maturity extensions or through discounted debt buybacks necessarily creates a loss for existing holders. The European stress tests showed that up to 90% of sovereign debt is held to maturity by institutional players, and thus is still at risk of future write downs. There is no incentive to voluntarily submit to an extension or a buy back that reduces the nominal or real value of these bonds, and coercion will simply force the losses.

In the end the mathematics of the debt situation in Greece are inescapable – there is more than €350bn of Greek sovereign debt and at least €200 billion of it needs to be forgiven to allow the debt to be serviceable given current yields and the growth prospects of the Greek government’s revenues. This loss has to be borne by someone – either bondholders or non-Greek taxpayers. The current policy prescription that has Greece borrowing its way out of debt is pure folly. That is the reality of a solvency crisis as opposed to the liquidity crisis that the Eurozone has assumed to be the problem since late 2008.

Until a workable plan is created that shares the burden of these losses and then formalizes a recapitalization plan, it will continue to fester and spread discord in the rest of the Eurozone. In fact, it is clear from the price and volume action in peripheral bonds that there is an effective institutional buyer strike, and it is only the money printing by the ECB that is keeping these yields from entering stratospheric levels – yet still they grind higher. Some of this move in peripheral European bond yields has been driven by broader moves higher in rates, but putting these spreads aside, it is the absolute yield levels that govern serviceability for these states and both Spain and Portugal are current financing at unsustainably high levels.

Absent a serious restructuring plan, the Eurozone will continue to reel from one mini crisis to the next hoping to put out spot fires until the banking edifice finally comes crashing down under its own weight. In our view, it will severely affect a few states considered to be in the “core” of Europe as well.

Of Iceland and Greece

We recently traveled to Greece and Iceland in order to better understand the situations in each of these financial wastelands. We met with current and former government officials as well as large banks and other systemically important companies and wealthy families. This trip confirmed our quantitative analysis and ultimately was a lesson in psychology. We met many interesting people in both places but virtually all of them lived in some state of denial with regard to each country’s finances. As Mark Twain once said, “Denial ain’t just a river in Egypt.”

In Greece, they currently spend 14% of government revenues on interest alone and are frantically attempting to get to a primary surplus. This is analogous to a heavily indebted company trying to get to positive EBITDA while still being cash flow negative due to interest expense. The Greek government’s revenue is a monstrous 40% of GDP (only 15% in the US) and Greece has raised their VAT tax to 23% from just 17% this past summer. We don’t think they can possibly burden their tax-paying population much more even though the prevalent thought in Greece is that they need to tax the populace more to make up for those who pay no tax. Greece’s key problems today are all of the small and medium enterprise (“SME”) loans that are beginning to default. As the government begins to increase taxes on the Greeks, businesses are moving out of Greece to places like Cyprus, Romania, and Bulgaria (analogous to Californians, Illinoisans, and New Yorkers moving to Texas) where tax rates are much lower. Given the fiscal situation in Greece, a restructuring of their debts (i.e. default) seems the most probable outcome. At nearly 140% sovereign debt to GDP and 3.4x debt to government revenues, Greece put itself into checkmate long ago.

In one of the more comical meetings we have ever attended, one chief economist at one of the largest banks in Greece surmised that if the sovereign could transfer €100 billion of government debt to the personal balance sheets of the population that it would be a potential “magical” fix for the state’s finances (and subsequently pointed out that Greece would not be such an “outlier” as a result). When asked how the Greek state could accomplish such a feat, he said he did not know and that maybe Harry Potter could find a way. It is hard to believe, but he was completely serious. For him, it wasn’t important how or if it could happen – as long as the potential outcome made the situation look better for prospective bond investors. Greek banks have between 3-3.5x their entire equity invested in Greek government bonds. Consider that if these bonds took a 70% haircut (Hayman’s estimate of the necessary write-down), Greek banks would lose more than twice their equity.

Shortly after this meeting, my host informed me of an audit recently done on one of the largest hospitals in Athens. This hospital was hemorrhaging Euros, and the Greek government is required to make up the deficit with capital injections. Officials began an inquiry into these losses and found 45 gardeners on staff at the hospital. The most interesting fact about the hospital was that it did not have a garden. The corruption is endemic in the society, and it is no wonder that Greece has been a serial defaulter throughout history (91 aggregate years in the last 182 – or approximately half the time). It is unfortunate that it is about to happen once again. Although – as we have previously stated, restructuring is actually the gateway to renewed growth and prosperity over time – we have identified at least two assets that we would like to own in Greece in a post-restructuring environment.

Iceland, on the other hand, has a similar balance sheet and different culture. Iceland’s abrupt decline into financial obscurity was the driving force at Hayman that prompted us to look at the world through a different lens. I first encountered Iceland’s history and culture in a book I had read several years ago titled Collapse: How Societies Choose to Fail or Succeed, written by Pulitzer Prize winner Jared Diamond. Diamond is a professor of geography at UCLA and a determined environmentalist. His analysis is based on environmental damage that societies inflict on themselves and that there are other “contributing factors” to a collapse. One comment made early in this book caught my eye many years ago:

Some societies that I shall discuss, such as the Icelanders and the Tikopians, succeeded in solving extremely difficult environmental problems, have thereby been able to persist for a long time, and are still going strong today. –Jared Diamond, Collapse: How Societies Choose to Fail or Succeed

What caught my attention was the fact that Diamond uses Iceland as a country that has been able to “get it right” as a society for a very long time. What brought them to their knees in the last few years was a complete disregard for the risks inherent in allowing their banking system to grow unchecked (due to the overwhelmingly positive contribution to GDP and job growth). In a nation of 318,000 people and approximately $20 billion USD of GDP (2008), Iceland had over $200 billion USD in assets in just three banks. More importantly, Iceland had over 34x its central government revenue in banking assets. To put this into context, a 3% loss ratio in the banking system would completely wipe out the banks and the country’s ability to deal with the problem. Of course, this is precisely what happened and Iceland finds itself today in a state of suspended animation. The government immediately imposed capital controls (money was allowed in, but no money was allowed out) and began a process of determining which debts they could pay and from which multilateral lending institutions they would have to beg. Conventional wisdom suggests that Iceland has turned the corner and dealt with its demons and will emerge stronger and smarter going forward. Unfortunately, we don’t believe that to be the case yet.

Iceland currently spends an estimated 118 billion Icelandic kroner on interest expense (including gross interest on Icesave liabilities) alone against approximately 600 billion kroner of revenues at a weighted-average cost of capital of roughly 4.7% (even with heavily subsidized loans from the IMF and other Nordic countries). With gross debts as a percent of GDP (including Icesave) that exceed Greece (whose 10-yr bonds yield over 11%), we couldn’t find a real public market for Iceland’s debt. Today, their “stated” exchange rate of kroner to the USD hovers around 117 and the “black market” or “offshore” rate for the kroner is 176 (a 33.5% devaluation from the “onshore rate”). Pre-crisis, the official exchange rate was 60 kroner to the dollar – even the onshore official rates have devalued by nearly 50% to today. Government revenue declined in nominal terms throughout the crisis even while the currency depreciated by 50%! Imagine suffering a 50% devaluation in purchasing power and a concomitant increase in export competitiveness, yet the government cannot maintain nominal revenue, which is a key part of the recovery plan to avoid eventual restructuring. While Iceland is hardly an oasis of fiscal reform, we expect over time that it will recognize that restructuring will afford the best opportunity to share financial pain evenly and restart along the path of growth. Like Greece, we have identified attractive assets and investment opportunities in Iceland once the restructuring occurs and capital controls are lifted, allowing the currency to depreciate further towards a real “market” rate.

Iceland is a microcosm of what went wrong with the world, but after the IMF and Nordic loans, attention was diverted away from the problem. Iceland and Ireland share similar roots when it comes to their acute problems. With the development of the European Union and the creation of a European “free-trade zone”, inefficiencies were exploited between countries who had differing tax and deposit structures. Small countries like Ireland and Iceland could actually compete with much larger counterparts by offering slightly higher deposit rates with programs like Icesave accounts. The key problem was that no provincial regulator paid any attention to the size and leverage in each country’s banking systems or even cross border capital flows. In meetings with key politicians, academics, and regulators in early 2009, it became clear that absolutely nobody was paying attention to the gross size of each country’s banking systems or the ability to deal with the problems emanating from the crisis.

Both Iceland and Greece will have to restructure their debts before they are to attract sustained foreign direct investment again. We believe losses on their government and government guaranteed bonds will exceed 50% and new chapters in financial history will be written. Until then, we ask all of our readers to remember a quote from C. Northcote Parkinson: “Delay is the deadliest form of denial”.

Inflation – An Immediate Concern

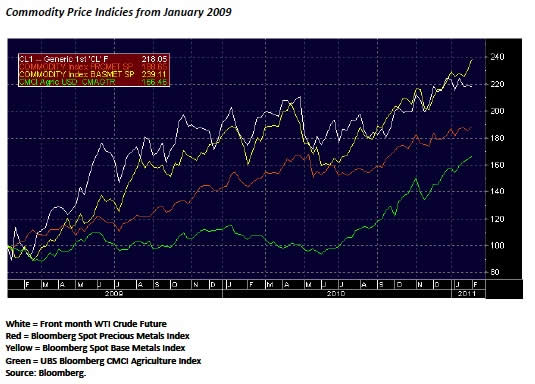

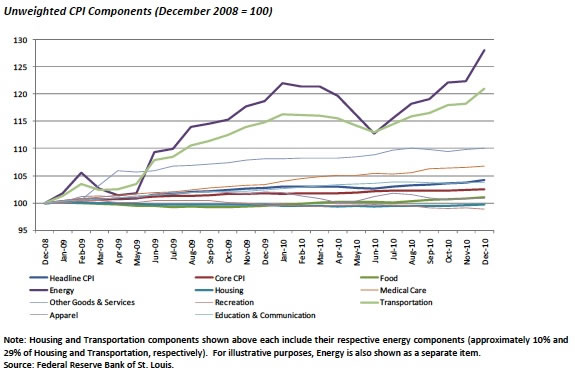

We will keep our thoughts on this subject brief and straightforward. While the inflation/deflation debate is vigorously defended on both sides, and we certainly recognize the ongoing need for deleveraging which should apply deflationary pressures, it is difficult to ignore simple data which points to the contrary. In fact, we find very few assets around the world outside of US housing that are actually deflating in value. Hard and soft commodities across virtually all classifications continue to climb in value (in nominal terms) and many are at or near all-time highs.

A very interesting chart from a recent Goldman Sachs research publication caught our attention. The authors highlighted the severe risks to headline inflation stemming primarily from global food prices. More specifically, they assess the risk to headline inflation on a country-by-country basis in a scenario where local food prices catch up to international food prices in local currency (as was the pattern in the 2007-2008 food inflation spike).

The results are alarming:

We believe that that commodity price inflation has primarily been driven by demand coupled with (in some cases) supply-side shocks in 2010. Interestingly, United States “core” inflation will not move materially until the US housing market turns, which we believe could be up to 3 years away. The reason for this phenomenon is that housing (excluding the energy component) comprises roughly 37% of the headline CPI calculation and 49% of the core CPI calculation. (http://www.bls.gov/cpi/cpiri2010.pdf) The rest is just) The rest is just details, especially when food and energy are removed. Unfortunately, if you eat or drive every day, you are already feeling the impact of inflation.

Just remember: nflations are always caused by public budget deficits which are largely financed by money creation. If inflation accelerates these budget deficits tend to increase (Tanzi’s Law).

–Peter Bernholz, Monetary Regimes and Inflation (Emphasis Added)

With “Helicopter Ben” printing $3.3 billion per day ($2.3 million every minute), the consequences of this financial experiment could be staggering.

Does Debt Matter?

We spend a lot of time thinking about and discussing systemic risk. This is not because we are natural pessimists; rather, we believe that many investors cannot see the forest for the trees as they get caught up in the short-lived euphoria of the markets.

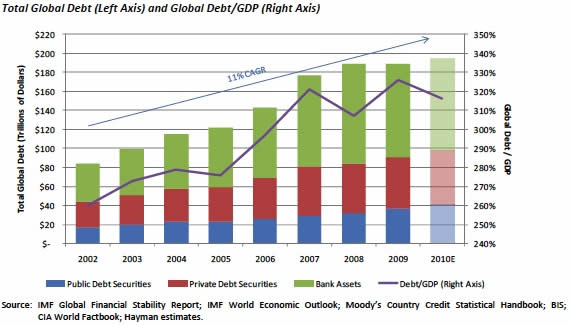

We ask ourselves, and urge you to ask yourself one simple question: Does debt matter? It was excess leverage and credit growth that brought the global economy to its knees. Since 2002, global credit has grown at an annualized rate of approximately 11%, while real GDP has grown approximately 4% over the same timeframe – credit growth has outstripped real GDP growth by an astounding 275%. We believe that debt will matter like it has every time since the dawn of financial history. Without a resolution of this global debt burden, systemic risk will fester and grow.

Best Regards,

J. Kyle Bass, Managing Partner

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.