Credit Crunch Causes Credit Card Chaos

Personal_Finance / Credit Cards & Scoring Nov 06, 2007 - 12:05 AM GMTBy: MoneyFacts

A survey carried out by Moneyfacts.co.uk reveals in the last two months credit cards have been hit hard by rising charges, in particular cash withdrawal fees and rates,

A survey carried out by Moneyfacts.co.uk reveals in the last two months credit cards have been hit hard by rising charges, in particular cash withdrawal fees and rates,

- 69 cards have seen increased cash withdrawal fees

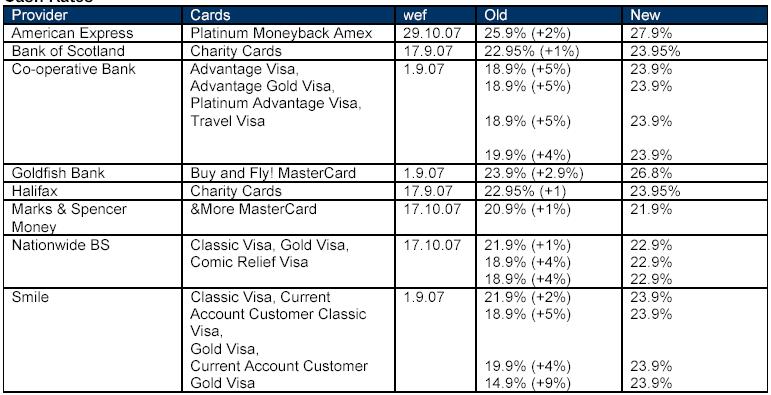

- 25 cards now face higher cash withdrawal rates

- 18 cards have been hit by higher foreign usage charges

- 10 cards have higher balance transfer fees

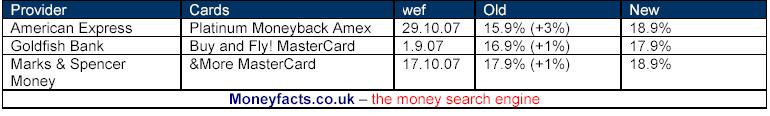

- 3 cards have increased purchase rates

and many cards would have suffered a combination of these

Esther James, credit card analyst at Moneyfacts.co.uk – the leading independent financial comparison site, comments: “Its seems as if the credit crunch is beginning to cause credit card chaos. 125 fee and rate increases inside two months is quite staggering. With the majority of increases staying away from the headline purchase rates, these fee and rate increases are less in the public view, and often tucked away in lengthy terms and conditions. However they can still make a substantial increase to the cost of using your card.

“With Christmas coming up, incomes will be stretched to the max with more people perhaps turning to their plastic for access to additional cash, only to get stung by still higher rates and fees.

“Choosing the wrong card can be a costly mistake. With almost 300 credit cards to choose from, there is plenty of choice.

“Avoid taking cash from your credit card unless you absolutely have no choice. Interest rates average 23%, and are charged from the date of withdrawal. Also expect to pay a fee of up to 3%. Would you still withdraw £500 if you knew that by making only the minimum repayments (2.5%, min £5) you would repay a total of £1382.70. That’s £882.70 extra in interest over a term of 20 years and 4 months?

“Don’t just keep to the minimum repayments, take control of your debt and repay as much as you can afford each month. Doing so will knock years off your debt and save you a fortune in interest.

“Following a year of rising rates and fees, its time to take a look at your card. Check the interest rate you are paying, as there are still some great 0% deals on purchases and balance transfers to be found. So don’t pay interest unnecessarily. Make sure you look after your own pocket instead of fuelling the profits of the card providers.”

Full details of the recent changes can be found below:

Cash Fees

Foreign Charges

Cash Rates

Balance Transfer

Purchase Rates

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.