Fed's Wealth Effect Money Creation Machine Driving Stocks Bull Market, Keep Bears at Bay

Stock-Markets / Stock Markets 2011 Mar 07, 2011 - 08:30 AM GMTBy: Money_Morning

Jon D. Markman writes:

Stocks ripped higher at the start of the past week, then collapsed, revived and collapsed again.

Jon D. Markman writes:

Stocks ripped higher at the start of the past week, then collapsed, revived and collapsed again.

Yeah, it was an exciting few days. By the time it was all over bull and bears discovered they had fought to a tie that just barely favored buyers as the Dow Jones Industrial Average closed up .3% for the week, while the Standard & Poor's 500 Index was +0.1%, the Nasdaq Composite was +0.13% and the Russell 2000 small-caps were +0.3%.

Concerns that insurrection would flow across North Africa to the oil-rich sultanates of the Middle East was the key concern, lifting crude oil by $4 and keeping prices in check. But straining to make a positive impact were upside surprises in U.S. and global manufacturing and services data, plus auto sales, same-store sales, initial unemployment claims and private payrolls data. A recovery is well under way, if only it could get out from under the geopolitical cloud.

The market's whipsaw action of the past few days must be confusing to people who do not understand the underlying narrative of the market in this cycle. It must look like traders can't make up their minds about what big companies are worth.

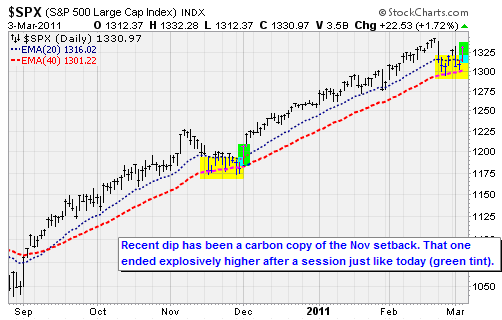

The reality as you know is that the major forces in this market have embarked on a deliberate campaign to inflate assets of all stripes and create a sustainable economic recovery through radical monetarism. Occasionally bearish sentiment is allowed to creep through, like a mildly corrosive acid, to create some texture to the uptrend. But there has been little chance for any material erosion to take place before bulls reassert their authority.

Biggest gainers for the week among sectors were health care, +2.4%, utilities, +0.6%, energy, +0.4% and staples, +0.2%. Losers were financials and telecom.

The latest economic data offered support to the Friday payrolls report that companies have almost certainly started hiring vigorously again. On Wednesday we saw a better-than-expected 217,000 increase in February's Automatic Data Processing (Nasdaq: ADP) private payrolls. And Thursday we see that initial claims fell 20,000 to 368,000 last week, compared with an expected uptick to 395,000.

Separately, the Monster Employment Index rose 5.7% in February, its first increase in five months, to 129, suggesting strengthening online job demand. The year-over-year change in the index has eased to 4.0%, partly due to the steep decline in public sector activity, according to Ned Davis, but has remained positive for over a year.

In more minor economic data news, the ISM non-manufacturing composite index rose 0.3 points to 59.7 in February, its highest level since August 2005, indicating faster growth in the service sector. Economists expected a slight decline of 0.4 points to 59.0. This is how you get companies like Comedy Central producer Viacom Inc. (NYSE: VIA), one of our StrataGem XR positions, achieving new heights both in its fundamentals and price appreciation.

Car sales are a huge part of overall retailing, and they are rolling higher again according to data provided by Ned Davis Research (NDR). Boosted by incentives, vehicle sales rose 6.4% to a 13.4 million unit annual rate in February, the most since the cash-for-clunkers program in August 2009.

Domestic autos led the way with a sales gain of 15.3%. Sales of light trucks rose to its best level since August 2008. Sales of heavy trucks also did well with an 8.2% advance to a 277,000 unit annual rate, the most since September 2008, an indication of increased capital spending.On a year-over-year basis, total sales have risen 27.6%, the most in 23 years.

NDR concludes that light vehicle sales would top 13.4 million units this year, which would have seemed like an outrageous idea nine months ago. The fundamental driving forces that NDR identified, such as improving credit availability, remain in effect. In fact, leases made up a quarter of all new vehicle sales in February, the most since November 2005, according to auto info source Edmunds.

All in all, a strong week of data - cloaked by the mess in North Africa. My expectation is that the geopolitical tumult will subside more quickly than most expect, and allow the underlying strength of the recovery to dominate again.

Many observers expressed surprise that buyers were not a stronger force on Wednesday, given the prior session's sharp downdraft. They fretted over the lack of ardent dip-buying.

But I don't think that's the right way to view the action. Bulls don't need to prove anything. They are in charge. It's bears that need to prove they can take the bull market down. And they have failed.

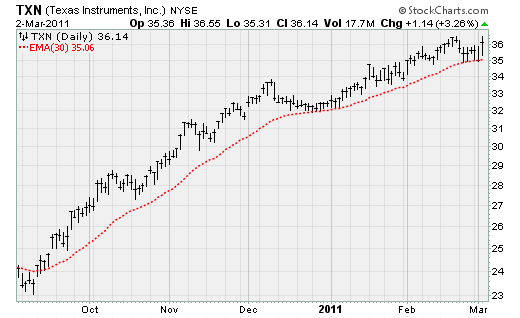

Here's what I mean. Bulls have bought and paid for this uptrend. They own it, they have maintained it -- it's a shining, beautiful hot-rod in their driveway that they are proud to show off. Look at this chart of Texas Instruments Inc. (NYSE: TXN), as one shimmering example. It's ready to explode higher again after a touch of its 30-day exponential moving average. It's textbook.

Bears are the outsiders. They are looking at the bulls' ownership of this breathtaking beauty of an uptrend -- +100% in two years! -- and they want nothing more than to smash it and lay it low. They aren't bad people. They just see the world differently than the bulls. If you chatted over a glass of Lagavulin, they would intelligently lay out a hundred perfectly sensible fiscal, monetary and fundamental reasons that stocks should be valued 20% lower than where they are today.

But bears' problem is that they are trying to fight the most prodigious positive force in the history of investment liquidity, and that is a U.S. Federal Reserve hellbent on creating a sustainable global economic recovery through the transmission mechanism of a "wealth effect."

The Fed wants to push the market up to make Americans feel richer on paper so that they buy more stuff. They want that buying to encourage businesses to obtain more equipment and hire more workers. They want this to be self-sustaining, and they have absolutely no qualms about the means they use -- ranging from buying Treasurys to sparking the equity futures -- to get to their end.

They don't see this as cynical. Fed chief Ben Bernanke, a former Princeton University econ prof, is just trying out a theory he devised a decade ago for just this scenario. Hopefully it works. No one can say with any certainty that it will or won't, though admirers and detractors each think they have facts and history on their side.

Bears keep warning that bulls will get their comeuppance when the Fed ends this second round of quantitative easing as scheduled in mid-summer. But I think they underestimate the Bernank's persistence. If he has not achieved its goal of a glidepath to sub-8% unemployment and stable inflation, we can expect a third and fourth round of easing.Whatever it takes.

The commodity markets and Organization of the Petroleum Exporting Countries (OPEC) seem to understand this more than the equity bears. They realize that all this easing is cheapening the dollar. So they are pushing up the value of tangible goods to compensate. A supply shortfall is helping, but there's more at play here.Commodities, especially oil and grains, are the new global currency. They are universally fungible and useful.

You may recall my target for gold was $1600 in the first half of 2011, and we appear to be on that path, as you can see in the chart above. If you think of crude oil as a currency instead of just a fuel, you can see it has potential to $130-$160.

So it's not a surprise to see corn, cotton, crude and gold at or near record highs. And the broad stock market? Well, it's made up of a lot of individual companies but taken as a whole shares are considered just another inflation hedge. So there's no reason it can't go to a new high too -- as, of course, the mid-cap indexes already have.

Chips on the Dip

While the overall market move this week was rather soft there were some powerful advances in the most deeply cyclical industries that fell sharply the day before.

In demand were semiconductor makers, like my model's favoritesTexas Instruments,Altera Corp. (Nasdaq: ALTR)and Analog Devices Inc. (NYSE: ADI), semiconductor equipment makers, like our Applied Materials Inc. (Nasdaq: AMAT), as well as industrial manufacturers, likeRoper Industries Inc. (NYSE: ROP) and Gardner Denver Inc. (NYSE: GDI).

These cyclicals have been the drivers of the broad up-move since March 2009, as discussed on Tuesday. Expect them to continue to lead at least over the next couple of months.

The upside in chips and chip equipment makers was driven largely by an upgrade from JPMorgan Chase & Co. (NYSE: JPM)analysts to "constructive" from "cautious." Constructive is a weasely word, but it means they are positive. And an industry association reported that spending on chip-making projects could grow by 22% globally this year, while spending on chip equipment production will grow by 28%.

George Diseldorff, analyst at Semiconductor Equipment and Materials International, said that 2011 spending will finally exceed the peak year of 2007 of $46.4 billion.

The organization expects spending on chips and chip-gear projects to approach $47.2 billion in 2011, almost $9 billion more than last year, as companies look to upgrade existing facilities to avoid overcapacity and oversupply. Reuters reported that industry giant Intel Corp. (Nasdaq: INTC)has increased capital expenditure plans to $9 billion in 2011 from $5.2 billion in 2010.

That's a huge, huge change in forecast -- not to be underestimated.

So why was the rest of the market unengaged? It's those pesky financials. Life insurers cracked, as MetLife Inc. (NYSE: MET) announced a share sale that took its stock down 5%, and also cratered rivals Prudential Financial Inc. (NYSE: PRU) and Lincoln National Corp. (NYSE: LNC). Regulatory concerns continue to swamp the banks as well, as investors mope over coming mortgage and credit card rules.

These companies are still paying for past sins, and may have to do so for the rest of the cycle, much like techs underperformed not just during their crash of 2000-2002 but in the 2003-2007 upswing that followed.

Bottom line for the week: The Libyan crisis will stumble toward a resolution fairly soon. Don't be too surprised if Col. Moammar Gadhafi manages to retain power. He's brutal, canny and a survivor. The Americans have weighed in against him, but he still has the support of the Russians and Chinese and, nervously, the Europeans. Expect the flow of oil to be restored if a third party, such as the Turks or Venezuelans, can broker a truce between the rebels and government. It will take a while for evacuated foreign drilling services workers to return, but oil prices will simmer down.

Even if Libya chills out, though, oil prices will not go back to where they were because they are actually elevated due to the fear that Saudi Arabia will be in play next.

The Week Ahead

Monday, March 7: Consumer credit. Earnings: Ciena Corp. (Nasdaq: CIEN), Sasol Limited (NYSE ADR: SSL), TransMontaigne Partners L.P. (NYSE: TLP), Willbros Group Inc. (NYSE: WG) ABM Industries Inc. (NYSE: ABM), Seaboard Corp. (AMEX: SEB), Urban Outfitters Inc. (Nasdaq: URBN)

Tuesday, March 8: NFIB Small Business Index; ICSC-Goldman Chain Store; Redbook Chain Store; API Crude Inventories. Earnings: Brown-Forman Corp. (NYSE: BF.A, BF.B), US Ecology Inc. (Nasdaq: ECOL), Stage Stores Inc. (NYSE: SSI), Diamond Foods Inc. (Nasdaq: DMND), Focus Media Holding Ltd. (Nasdaq ADR: FMCN), Finisar Corp. (Nasdaq: FNSR), Pengrowth Energy (NYSE: PGH), Walter Investment Management Corp. (AMEX: WAC).

Wednesday, March 9: MBA Mortgage Purchase Applications; Wholesale Inventories; DOE Crude Inventories. Earnings: American Eagle Outfitters (NYSE: AEO), The Bon-Ton Stores Inc. (Nasdaq: BONT), Zalicus Inc. (Nasdaq: ZLCS), Coldwater Creek Inc. (Nasdaq: CWTR), Express Inc. (NYSE: EXPR), The Men's Wearhouse Inc. (NYSE: MW), Semtech Corp. (Nasdaq: SMTC), Valhi Inc. (NYSE: VHI).

Thursday, March 10: Initial Jobless Claims; Continuing Claims; USDA Crop Report; Trade Balance; Bloomberg Consumer Confort; EIA Natural Gas Inventories; Treasury Budget. Earnings: Atlas Energy Inc. (Nasdaq: ATLS), Aircastle Limited (NYSE: AYR), Baytex Energy Corp. (NYSE: BTE), The Buckle Inc. (NYSE: BKE), Cytori Therapeutics Inc. (Nasdaq: CYTX), GeoResources Inc. (Nasdaq: GEOI), Kirkland's Inc. (Nasdaq: KIRK), Air Methods Corp. (Nasdaq: AIRM), Alon USA Energy Inc. (NYSE: ALJ), Aeropostale Inc. (NYSE: ARO), Clean Energy Fuels Corp. (Nasdaq: CLNE), National Semiconductor Corp. (NYSE: NSM), Quiksilver Inc. (NYSE: ZQK), Zumiez Inc. (Nasdaq: ZUMZ).

Friday, March 11: Retail Sales; Michigan Consumer Sentiment; Business Inventories. Earnings: AnnTaylor Stores Corp. (NYSE: ANN), LMI Aerospace Inc. (Nasdaq: LMIA).

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2011/03/07/...

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.