U.S. Taxpayers in Revolt

Politics / Taxes Mar 04, 2011 - 11:32 AM GMTBy: Douglas_French

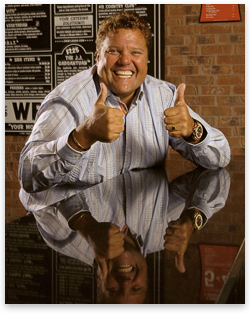

Jimmy John Liautaud, founder of the Jimmy John's sub chain, just applied to move his residence from Illinois to Florida — and his company's headquarters could soon follow. "All they do is stick it to us," he says of the state legislature's move to jack up the personal income tax from 3 percent to 5 percent — and the corporate income tax from 7.3 percent to 9.5 percent.

Jimmy John Liautaud, founder of the Jimmy John's sub chain, just applied to move his residence from Illinois to Florida — and his company's headquarters could soon follow. "All they do is stick it to us," he says of the state legislature's move to jack up the personal income tax from 3 percent to 5 percent — and the corporate income tax from 7.3 percent to 9.5 percent.

"I could absorb this and adapt," Liautaud tells his hometown paper, the Champaign-Urbana News-Gazette, "but it doesn't feel good in my soul to make it happen," he says.

"I could absorb this and adapt," Liautaud tells his hometown paper, the Champaign-Urbana News-Gazette, "but it doesn't feel good in my soul to make it happen," he says.

Where the sub business ultimately moves is up in the air — but Jimmy John's kids have already started school in Florida. "My family and I are out of here."

While Mr. Liautaud seeks friendlier tax climates, talk about municipal and state government defaults are all the rage after Meredith Whitney told 60 Minutes there would be 50–100 municipal-bond defaults this year. Ms. Whitney said it will be as big a meltdown as the real-estate crash.

Its hard to know what kind of financial shape many muni-debt issuers are in, because they are not quick to update their financial statements: doing so would allow bond holders to gauge the value of their investments. Plenty of concerned sons probably forwarded to their muni-bond-holding mothers the Wall Street Journal article that mentioned Helen Kirkpatrick, a retired journalist, who was stunned when a broker mailed her an offer for her Maryland Health and Higher Education bonds at 50 cents on the dollar.

Kirkpatrick constantly sought information about the bonds she bought a decade ago but could find nothing amiss.

These bond issuers don't disclose financial information. DPC DATA Inc., a specialist in municipal disclosure, did an extensive analysis of disclosure and found the problem growing since a 2008 study. Of 17,000 bond issues it studied, more than 56 percent filed no financial statements in any given year between 2005 and 2009. More than one-third of borrowers entirely skipped three or more years, and the number grew to 40 percent in 2009, as credit woes mounted. Another 30 percent filed extraordinarily late in 2009.

"This works out to insufficient ongoing disclosure information for more than $2 trillion of the $3 trillion in outstanding bonds," says Peter Schmitt, chief executive of DPC of Fort Lee, New Jersey.

However, California's state treasurer, Bill Lockyer, says the idea of states going bankrupt is ludicrous.

"It's a cynical proposal, intended to incite a panic in response to a phony crisis," Mr. Lockyer said on a conference call with journalists. "Killer bees, space aliens, and now it's the invasion of the bankrupt states."

I'm a little surprised Lockyer is so cocky. After all, California was forced to issue IOUs in lieu of cash to pay taxpayers, vendors, and local governments back in 2009.

Mr. Lockyer's big plan is for his state to refrain from issuing any general-obligation bonds until the second half of the year, cutting down borrowing costs. That doesn't sound like any great trick, except California hasn't done that since 1988. If that doesn't work, well, "Then, the next option, if you run out of deferrals, is to issue IOUs," Mr. Lockyer said. "It's a possibility. It's not one that anyone wants to do. It's at the bottom of the list of choices. But it is on the list."

Nicole Gelinas of the Manhattan Institute also thinks the idea of states going bankrupt is nonsense. Because states pile up debt indirectly, issuing bonds through tens of thousands of separate legal entities. She writes that New York "state" doesn't owe all of that $78.4 billion in debt; it owes only $3.5 billion in "general-obligation" debt, so relax.

"Who owes the rest?" she writes,

The MTA, the Dormitory Authority, the Triborough Bridge & Tunnel Authority and so on. Legally, each is not a government but a "public-benefit corporation." Each has its own board, its own rules, and its own contractual agreements with creditors, from bondholders to unions. Each of those agreements offers creditors different protections.

So New Yorkers, in this case, are supposed to sleep better at night secure in the knowledge that dozens of government entities owe this debt instead of just one? Meanwhile any one of these public-benefit corporations could default out of the blue, because more than likely nobody will get a heads-up if the Dormitory Authority runs out of dough to pay bond holders.

But the main argument is that these states are sovereign entities that can raise taxes whenever needed and cut spending anytime to make everything all better.

Some governors are trying to balance budgets, which means cutting state worker pay and renegotiating union contracts. There's been a bit of a dust-up in Wisconsin with Governor Scott Walker wanting state workers to contribute some of their own money toward their retirements and untie state workers' collective-bargaining agreements.

Badger State teachers will have none of this. They abandoned their classrooms and descended upon the capital, blocking a door to the Senate chambers. They sat down, body against body, filling a corridor. They chanted "Freedom, democracy, unions!" in the stately gallery as the senators convened.

In Nevada, the University of Nevada at Las Vegas may have to declare financial exigency, the equivalent of bankruptcy.

"Our state is nearing a state of fiscal collapse," university president Neal Smatresk told his faculty.

The president's message moved many of the faculty members to tears.

Education-leadership professor Cecilia Maldonado read a list of grievances at a faculty-senate meeting when the bad budget news was delivered, each beginning with "I'm sick."

"I'm sick we are destroying much of what we've built," Maldonado said.

She said she is sick of politicians describing professors as enjoying "fat salaries and easy living," sick that the public doesn't seem to understand the importance of higher education.

This past week, public employees protested at Ohio's statehouse in Columbus and Nevada's statehouse in Carson City to show solidarity with their union brothers and sisters in Wisconsin.

State legislators will have a hard time cutting budgets. You might say government workers feel entitled.

When it comes to raising taxes, as in the case of Jimmy John Liautaud, when the government pushes you down on the sidewalk — seeking to lighten your wallet and claiming someone else is more worthy of your money than you — you push back.

If you have the resources and options like Jimmy John, maybe you just move. But if you're an average working stiff, underwater on your house, with your job prospects local and family tying you down, when the taxman comes wanting more, a fight breaks out.

So what's the cause of state and local government fiscal woes? Is it the recession? The WSJ's David Wessel points out,

At the worst point, in early 2009, state and local tax revenue combined were down 11 percent from year-earlier levels. Local governments took a hit from the housing bust. State governments got hammered when the income, spending and capital gains they tax declined. Despite an improving U.S. economy, tax receipts at the state level remain 12 percent below pre-recession peaks.

But, almost in Austrian fashion, Wessel recognizes that the problem was the boom:

In the good times, governments enjoyed and spent a tax windfall; state and local tax revenue rose 36 percent in the five years before the bust. In the mid-2000s, overall receipts — taxes and federal grants — rose rapidly. In the ensuing years, spending rose rapidly too. Flush with money, government did more, often encouraged by voters who wanted more spending on education, for instance.

Everyone wants to point the finger at how stupid Wall Street was, or the banks, for loading on real estate during the boom, but what about city hall? They hired plan checkers, inspectors, and city planners and built fancy new digs to house them all, strapping themselves to the same real-estate rocket. And ever-increasing tax levies from real-estate appreciation and fees ladled on new real-estate development would fund everything from education to child care to help for the homeless.

Same way at state houses around the country: who cares what kind of onerous union contracts you sign when the money's flooding in? It's like that old Merle Haggard song: "We'll all be drinking that free Bubble-Up / And eating that rainbow stew."

This all came apart when the financial markets melted down going on three years ago now.

It turns out America has done this before. Three years after the 1929 crash, Herbert Hoover urged Congress to pass the Revenue Act of 1932.

Murray Rothbard wrote that "the range of tax increases was enormous." A number of wartime excise taxes were reinstated, and sales taxes were imposed on a number of everyday goods — necessities and luxuries alike. Income taxes were raised dramatically. Of course, these numbers will seem quaint, but the nominal rate was raised from a range of 1.5–5 percent to 4–8 percent. Personal exemptions were reduced, the earned-income credit eliminated, and surtaxes really jacked up from 25 percent to 63 percent on the highest incomes.

Corporate income taxes were raised. The gift tax was restored.

All these tax increases came on the heels of huge increases in state and local taxes during the 1920s. In 1920, state taxes were .83 percent of national income, David Beito writes in his book Taxpayers in Revolt: Tax Resistance during the Great Depression. And by 1929 state taxes had more than doubled to 1.9 percent of national income.

By the end of the roaring '20s, property taxes accounted for more than 90 percent of taxes levied in cities with a population greater than 30,000.

Real-estate owners were filling state-government coffers all over the country.

"The real estate tax seemed almost designed to incite rebellion," Bieto writes. "Only vaguely did it meet the definition of a tax based on ability to pay."

In the 1920s, as is the case now in the early 21st century, real-estate ownership was a poor barometer to measure the wealth of individuals. Just because Fed policies and cheap money go flooding into house prices and driving up values doesn't mean the owners can afford the tax bill that city hall can't wait to assess them. After all, these aren't rental properties, where the tax burden can be shifted.

Local and state governments love property taxes. The administrative costs are tiny. It's hard to hide a house, so no detective work is required for collections. And what happens if you don't pay your real-estate taxes? Well, you get your name in the local paper. All your friends and neighbors can see you haven't RSVP'd the taxman's invitation to pony up.

So what if you don't pay? The local authorities just slap liens on your property and wait. That property ain't going anywhere. And tax liens are superior to your mortgage loan and anything else.

That's the way private property works in the good old US of A.

Property taxes actually predated the American Revolution, thus, as Bieto explains, "possessing the cardinal administrative virtue: 'The old tax is the good tax.'"

During the 1920s land wasn't the only property taxed; personal property was as well, and the assessment of value and the tax burden were arbitrary and ripe with corruption.

Even with the prosperity of the 1920s, taxpayers buckled under the pressure of increased tax burdens. Detroit's rate of property-tax delinquency increased from 4.5 percent in 1921 to 12 percent in 1929.

And this was a trend that was happening nationwide. According to the report of the President's Conference on Home Building in 1932, "The growth of delinquency is apparently not due to the present business depression but has been going on since 1920 at the latest." The report concluded that people weren't paying their property taxes "apparently due to the increase of the property tax more than any other one cause."

Farmers were hit hard by these taxes. While the price of their goods plummeted, the taxes increased, leading the Department of Agriculture to conclude in 1932 that the "real weight [of the farmer's tax burden] has been doubled by falling prices since 1929," and it "takes more than four times as many units of farm produce to pay the farm tax bill now as it took in 1914."

Farmers didn't take this lying down. In January of 1933, farmers in Doylestown, PA, overran a tax sale, purchased the farm's title for $1.18 and then returned it to the owner. Farmers across the country started employing the "dollar sale" strategy. In some cases farmers just quit paying and the local authorities decided to leave them alone.

Tax protesters in Freeborn County, Minnesota, demanded the abolition of the county agent, county nurse, weed inspector, and home-demonstration agents, along with a 20 percent cut in government employees. In a neighboring county, 2,000 protestors turned out to make similar demands.

"The rural tax protest had a distinctly spontaneous air," Beito writes. "Taxpayers' organizations would appear, disappear, reappear, and then disappear again at dizzying rates." Organizing farmers for the long-term was like herding cats.

But nonetheless these protests were effective. Farmer J.M. Setten issued a warning to Governor Henry Horner: "In some states at tax sales the people bought their property for 50 cents with shot guns. Politicians only understand the language of bombs and bullets."

James Babcock wrote in 1934 that farmers are complaining that "Schools cost too much. Teachers are paid too much money. We are going broke supporting our schools. I say abolish the county agent. He was wished upon us by the state college."

Urban protesters did better at coalescing than their rural brethren in most cases. Individual taxpayer leagues sprung to life on a city or county basis. Edward Barrows, who wrote extensively about these protests, believed there to be "not less than three thousand and probably not more than four thousand [taxpayer organizations] now in action, and that their number is rapidly increasing." Seven hundred were formed just in the spring of 1933 alone, according to the Committee on County government of the National Municipal League.

This was a far cry from 1927, when only 43 such organizations existed.

The Socialist mayor of Milwaukee, Daniel Horn, hated the tax-protesting groups, claiming they were "doing more to undermine faith in government than all the communists in the world," and that they were mere fronts for greedy capitalists and real-estate swindlers.

In Atlanta, a brand new taxpayer league attracted 1,000 members in the first week and quickly rose to 5,000. Despite the protests, Atlanta politicians raised tax rates, and were shocked when counseled that the tax increase would cause a rebellion, finding it difficult to imagine "our staunch leading citizens, taking part in any sort of [tax] strike. Why the thing was simply not done!"

Tax protesters wondered why the cost of government hadn't gone down as the economy had. William Munro, who wrote often about local governments at the time, put it this way: "'I buy less food, less tobacco, less recreation,' says the man who holds his job, 'and I would like to buy less government.'"

But Chicago was the flashpoint for tax protests. Corruption was pervasive in Cook County, with its assessment system an embarrassing mark of local distinction. Tax fixing in the Windy City involved juggling assessments, rewarding those who cooperated with the local political machine, and punishing those who didn't.

There were reform reassessments and a two-year tax holiday from 1928 to 1930 but under the Silas Strawn Plan assessed taxes would jump nearly 24 percent from 1928 to 1930. At the same time, real-estate values plunged between 1927 and 1931 with the value of new construction falling 86 percent and existing real estate dropping 38 percent in value.

On November 29, 1930, 4,000 Chicago taxpayers jammed the Board of Reviews' offices to file protests. When the Board ignored the protests, litigation and nonpayment ensued.

The Association of Real Estate Taxpayers (ARET) formed 161 branch offices in the city by August 1931 where taxpayers could join and sign up for the tax strike.

It was common knowledge that city government was helpless. A municipal-court judge complained that his neighbors and friends made fun of him for paying his property taxes.

City hall tried to shame people into paying their taxes. While the ARET couldn't buy advertising in local papers, these same papers donated full-page "Pay-Your-Taxes" ads. Posters were printed up with "Take Your Trade Where the Taxes Are Paid." Taxpaying property owners were given "This Property Is Now Paying Taxes" posters to display.

Despite being called anarchists and worse, ARET membership reached 30,000 people, and in 1931–32, over 53 percent of Chicago property taxes were delinquent. And it wasn't rich fat cats stiffing the tax man. Beito's research reveals that skilled blue-collar workers made up the single biggest group within ARET, and 26 percent of members were women.

Beito writes that the strike's demise came from division in its ranks. So were the tax strikes successful? Beito says yes, but only with qualifications.

Of course all these protests around the country flew in the face of municipal reformers who had spent a generation professionalizing government in an attempt to improve the image of government employees. It was predicted that if these tax protestors persisted "the reform edifice that they had constructed would be irreparably damaged," writes Beito. Prominent political scientist Charles Merriam "warned that these recurrent criticisms of government employees threatened to poison permanently 'the springs of government interest, enthusiasm and service.'"

Glenn Frank worried that the spreading antigovernment ideology would "divert men of capacity and self-respect from the public service for a generation." I guess it probably has. As H.L. Mencken explained, "the average American legislator is not only an ass but also an oblique, sinister, depraved and knavish fellow."

The last time a US state defaulted on it debt was in 1933, when Arkansas stiffed $146 million worth of bondholders. That time has come again, because taxpayers will either flee — as Jimmy John has — or stay, fight, and strike.

As farmer Setten said, "Politicians only understand the language of bombs and bullets."

Douglas French is president of the Mises Institute and author of Early Speculative Bubbles & Increases in the Money Supply. He received his masters degree in economics from the University of Nevada, Las Vegas, under Murray Rothbard with Professor Hans-Hermann Hoppe serving on his thesis committee. See his tribute to Murray Rothbard. Send him mail. See Doug French's article archives. Comment on the blog.![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.