Silver Backwardation Continues, Silver Eagle Premiums Rise After US Mint Discontinues Production

Commodities / Gold and Silver 2011 Mar 04, 2011 - 08:09 AM GMTBy: GoldCore

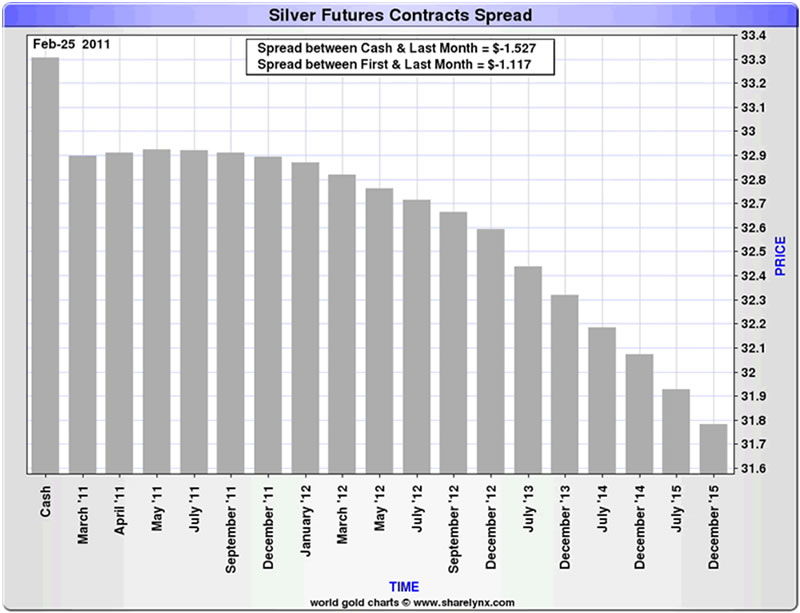

While gold is marginally higher today, silver has risen nearly 1% against the dollar and other currencies. Backwardation continues with spot (for immediate delivery) trading at $34.45/oz while the Dec12 contract trades at $34.22/oz and Dec13 at $33.90/oz. Backwardation has eased since last Friday somewhat (see table below) but continues which suggests continued tightness in the physical silver bullion market.

While gold is marginally higher today, silver has risen nearly 1% against the dollar and other currencies. Backwardation continues with spot (for immediate delivery) trading at $34.45/oz while the Dec12 contract trades at $34.22/oz and Dec13 at $33.90/oz. Backwardation has eased since last Friday somewhat (see table below) but continues which suggests continued tightness in the physical silver bullion market.

Cross Currency Table

Silver’s recent robustness is unusual and sell offs are normally more sharp and normally see follow through. Indeed silver’s sell off yesterday was less than the sell off seen in some government bond markets.

Today could see further profit taking and paper silver selling on the COMEX but there appears to be a change in the dynamic of how silver is trading. Normally a 1.5% sell off in gold would see a deeper 2% or 3% sell off in the smaller silver market but this did not materialize yesterday and silver’s sell off was gradual and shallow.

Silver Spot – 40 Year (Quarterly)

This may be an indication that there are strong hands in the silver pits who are buying all dips and taking on the still very large concentrated short positions of JP Morgan which continue to be investigated by the CFTC (see news below).

Physical demand for silver for both industrial and investment and store of value purposes remains very high and supply anemic at best.

The US Mint has been forced to discontinue the production of U.S. Silver Eagles as they simply cannot keep up with the demand. The US Mint says that production of the silver bullion coins are suspended “temporarily” as they cannot source enough silver bullion blanks to make the very popular coins.

In just the two first months of 2011 alone, 9.633 million Silver Eagles were sold. This corresponds to about 300 tonnes of silver.

According to the U.S. Mint, “The United States Mint will resume production of American Eagle Silver Uncirculated Coins once sufficient inventories of silver bullion blanks can be acquired to meet market demand for all three American Eagle Silver Coin products. “

Since the announcement wholesale premiums have only risen by between 0.3% and 0.5% but this is likely to change in the coming months and premiums are likely to rise sharply again as they did in 2008.

This appears to be more than simply an issue of not being able to source silver blanks to make coins. There appears to real supply issues in the silver market and increasing difficulties to source silver bullion in volume.

Eric Sprott of Sprott Asset Management recently said that his fund was having difficulty sourcing silver bullion bars (1000 oz) in large volumes and there were liquidity issues in the market.

He also warned that the world was running out of silver. "There's $22 billion of silver available in the world, of which the ETFs already own half, and between you guys and us we probably own the other half... Which means there's nothing left."

Record sales in the US Mint have also been seen in the Royal Canadian Mint and the Austrian Mint. The Austrian Mint sold 1.53m ounces of its silver Philharmonic coin in January, more than double the level a year earlier. The Austrian mint would boost production to 2.2m ounces in February and March.

Both the Austrian and Canadian Mints have begun rationing new silver coins to dealers, meantime, after record January sales across the retail industry.

The Royal Canadian Mint, which produces the silver and gold Maple Leaf coins, have spoken about how they are finding it difficult to source silver in volume.

David Madge, head of bullion sales at the Royal Canadian Mint, recently told King World News that “it still remains a big challenge sourcing material. We’re looking at ways of mitigating our risk regarding supply of silver.”

We are anticipating it to become even more difficult to secure supplies in the future. This is based on what we are seeing firsthand and what our suppliers are telling us. We work closely with these banks to secure silver and they tell us there is a lot of competition.”

When asked what this means for the price of silver and how long this condition is expected to persist Madge stated, “I think you are going to see the premiums go up in order to secure silver. At some point some players will be priced out of the market. I don’t think this is a short-term situation, I think there are a lot of issues going forward and this may be the new norm.”

“We have sold everything we can produce in silver and have demand for at least twice that volume,” said Madge.

Silver bullion remains an important diversification and store of value and will help protect, preserve and grow wealth in the coming years.

Should the U.S and global economy continue to recover than silver’s increasing use in a wide variety of industries should prices rise much higher.

In the event of a global recession or Depression, governments will again resort to the printing presses and silver’s finite store of value properties will see increased investment demand which would lead to much higher prices in the very small physical silver bullion market.

Backwardation of Silver (Last Friday - February 25th)

NEWS

(Dow Jones)-- PRECIOUS METALS: Gold Futures Retreat As Unease Wanes

Falling oil prices and anti-inflationary remarks by the head of the European Central Bank prompted investors to cash in on gold's record-high price.

The most actively traded gold contract, for April delivery, fell $21.30, or 1.5%, to settle at $1,416.40 a troy ounce on the Comex division of the New York Mercantile Exchange.

"It's easy to take profits on a day like today," said George Gero, vice president with RBC Capital Markets Global Futures.

Gold had gained 2% from Friday through Wednesday's record settlement of $1,437.70 as tumult in the Middle East and North Africa boosted the metal as a so-called safe-haven investment. A surge in oil prices on the news also helped lift gold as an inflation hedge.

On Thursday, crude oil slipped below $101 a barrel, and equities got a bump after Al Jazeera reported Libyan leader Moammar Gadhafi had accepted a plan proposed by Venezuelan President Hugo Chavez calling for a multinational commission to mediate the conflict with rebel groups.

Equities were also supported and gold pressured following European Central Bank President Jean-Claude Trichet's comment that "strong vigilance" was warranted against rising prices in the 17-nation currency bloc.

"That is certainly a headwind for gold," Gero said.

Gold was also under pressure as a surprise drop in the number of U.S. workers filing new claims for unemployment benefits pointed to continued improvement in the jobs market.

Initial jobless claims fell by 20,000 to 368,000 in the week ended Feb. 26, the Labor Department said Thursday in its weekly report. It was the lowest level since May 2008. Economists had expected claims would rise by 9,000 to 400,000.

Gold's slide may not be sustained, though, as Mideast tensions were still lingering amid news that air strikes had been launched against the Libyan town of Brega.

"With geopolitical instability looking set to escalate...any selloff in the precious metals will likely be tentative," a note from Dublin-based bullion dealer GoldCore said.

The retreat in gold prices may provide opportunities for bargain hunters, said Bob Haberkorn, senior market strategist with Lind-Waldock in Chicago, who expects prices will resume their uptrend.

"There's definitely opportunities for scalpers here," he said.

Other precious metals traded in New York also fell Thursday. Comex May silver lost 1.5%, while Nymex April platinum declined 1.4% and June palladium on the exchange shed 1%.

(Zero Hedge) Utah Pushes To Accept Gold, Silver As Alternative Currency

A month ago we reported that the state of Virginia has established a subcommittee to study alternatives in the case of a terminal "Fed" breakdown, and would propose gold as a sound alternative to the existing fiat currency. Now, the state of Utah has gone a step further and is actually voting, as early as today, on whether to recognize gold and silver coins, issued by the federal government, as legal currency, a move that would send a huge signal to the Marriner Eccles building that Americans have had enough of the Fed's dollar debasement. "The coins would not replace the current paper currency but would be used and accepted voluntarily as an alternative." Reports Foxnews: "The legislation, which has 12 co-sponsors, would let Utahans pay their taxes with gold and also calls for a committee to study alternative currencies for the state. It would also exempt the sale of gold from the state capital gains tax. The bill cleared a state legislative committee on Wednesday, the first of 11 similar bills in statehouses across the country to do so. If the bill clears the House, it would have to pass the Senate before the governor could sign it into law." Paying taxes in gold? Interesting. We certainly hope this was not highlighted due to being the only viable use of funds, as one would question the legitimacy of the entire proposal. Finally: "Attorney and Tea Party activist Larry Hilton, author of the original bill, said he doesn't foresee any roadblocks." We shall see about that, but in the meantime it is worth highlighting that the onslaught against the dollar is coming not only from China which as we reported yesterday is pushing to convert the renminbi to a global reserve currency, but from within, as more and more states realize that the viability of the dollar is now crippled, thanks to the Chairprinter.

From FoxNews:

"There's enough uneasiness going on in the economy to trigger people to feel that, hey, having a little Plan B, kind of a backup system, is not a bad idea," he told FoxNews.com.

The U.S. used some version of the gold standard from 1873 until 1933, when President Franklin D. Roosevelt outlawed the private ownership of gold amid the Great Depression. An international monetary system based on a gold-exchange standard continued until 1971 when President Richard Nixon stopped the U.S. from redeeming dollars for gold altogether.

Critics of the gold standard say it limits countries' control over its monetary policy and leaves them vulnerable to financial shocks, such as the Great Depression. But supporters argue that the current financial system's dependence on the Federal Reserve exposes the value of U.S. money to the threat of inflation.

Not surprisingly, Ron Paul is all over this proposal:

Rep. Ron Paul, a longtime critic of the Federal Reserve who has called on a return to the gold standard, has praised Hilton's efforts.

"Efforts such as yours in states around the country highlight the importance of returning to sound money," Paul wrote in a letter to Hilton. "Even if such efforts fail to achieve legislative success on their first try, their importance lies in bringing to the public's attention the problem of the ever-weakening dollar and the necessity of returning to a sound monetary system."

While the original bill proposed by Hilton also required foreign minted coins to be accepted as legal tender, the revision only limits US produced coins. Even with this setback, Hilton said that he's "willing to take it step-by step."

As we reported yesterday, Bernanke told the Senate yesterday that he does no envision the gold standard as a viable alternative to the disastrous fiat system currently in place, which has resulted in revolutions across the development world. "It did deliver price stability over long periods of time, but over shorter periods of time it caused wide swings in prices related to changes in demand or supply of gold. So I don't think it's a panacea." Supposedly Bernanke has not seen the VIX in 2008.

The bill, once passed will be a critical stepping stone to not only undermining the dollar but to further stablishing gold as a true reserve currency alternative:

Jeff Bell, a policy director for the Washington-based American Principles in Action (APPIA), which helped shape the Utah bill, told FoxNews.com that passage of the bill would send a message to Washington and other states.

"People sense that in the era of quantitative easing and zero interest rates, something has gone haywire with our monetary policy. But people are afraid to say it," said Bell, who was an adviser to Ronald Reagan's 1976 and 1980 presidential campaigns. "If one state recognizes gold as a valid currency, I think it would embolden people not just in other states but in Washington."

Bell credited Tea Party activists for advancing the legislation this far. Rep. Brad Galvez, who introduced the legislation, is a freshman legislator backed by the Tea Party.

"Saying we now recognize gold as money is a big step forward," he said.

And once Utah proves a successful test bed of this near-revolutionary refutation of the Chairman's ideology, everyone else will follow:

Twelve other states have offered similar proposals: Georgia, Montana, Missouri, Colorado, Indiana, Iowa, New Hampshire, South Carolina, Tennessee, Washington, Vermont and Oklahoma.

It goes without saying that we will track these developments closely, and carefully observe who(and why) voices any opposition to comparable proposals elsewhere.

(Bloomberg) -- Dubai Gold ETF Holdings Unchanged at 5,000 Ounces on March 3

Gold holdings in the Dubai Gold exchange-traded fund were unchanged at 5,000 ounces as of March 3, according to figures on the fund’s website.

*T

(New York Times Blog) -- A Conspiracy With a Silver Lining

As Americans know all too well by this point, commodity prices — for corn, wheat, soybeans, crude oil, gold and even farmland — have been going through the roof for what seems like forever. There are many causes, primarily supply and demand pressures driven by fears about the unrest in the Middle East, the rise of consumerism in China and India, and the Fed’s $600 billion campaign to increase the money supply.

Nonetheless, how to explain the price of silver? In the past six months, the value of the precious metal has increased nearly 80 percent, to more than $34 an ounce from around $19 an ounce. In the last month alone, its price has increased nearly 23 percent. This kind of price action in the silver market is reminiscent of the fortune-busting, roller-coaster ride enjoyed by the Hunt Brothers, Nelson Bunker and William Herbert, back in 1970s and early 1980s when they tried unsuccessfully to corner the market. When the Hunts started buying silver in 1973, the price of the metal was $1.95 an ounce. By early 1980, the brothers had driven the price up to $54 an ounce before the Federal Reserve intervened, changed the rules on speculative silver investments and the price plunged. The brothers later declared bankruptcy.

Accusations that JPMorganChase and HSBC allegedly manipulated precious metal markets are worth looking into.

The Hunts may be gone from the market, but there are still plenty of people suspicious about the trading in silver, and now they have the Web to explore and to expand their conspiracy narratives. This time around — according to bloggers and commenters on sites with names like Silverseek, 321Gold and Seeking Alpha — silver shot up in price after a whistleblower exposed an alleged conspiracy to keep the price artificially low despite the inflationary pressure of the Fed’s cheap money policy. (Some even suspect that the Fed itself was behind the effort to keep silver prices low, as a way to keep the dollar’s value artificially high.) Trying to unravel the mysterious rise in silver’s price is a conspiracy theorist’s dream, replete with powerful bankers, informants, suspicious car accidents and a now a squeeze on short sellers. Most intriguingly, however, much of the speculation seems highly plausible.

The gist goes something like this: When JPMorgan Chase bought Bear Stearns in March 2008, it inherited Bear Stearns’ large bet that the price of silver would fall. Over time, it added to that bet, and then the international bank HSBC got into the market heavily on the bear side as well. These actions “artificially depressed the price of silver dramatically downward,” according to a class-action lawsuit initiated by a Florida futures trader and filed against both banks in November in federal court in the Southern District of New York.

“The conspiracy and scheme was enormously successful, netting the defendants substantial illegal profits” in the billions of dollars between June 2008 and March 2010, according to the suit. The suit claims that JPMorgan and HSBC together “controlled over 85 percent the commercial net short positions” in silvers futures contracts at Comex, a Chicago-based exchange on which silver is traded, along with “25 percent of all open interest short positions” and a “a market share in excess of 9o percent of all precious metals derivative contracts, excluding gold.”

In the United States, trading in precious metals and other commodities is regulated and closely monitored by a federal agency, the Commodity Futures Trading Commission. In September 2008, after receiving hundreds of complaints that silver future prices were being manipulated downward by JPMorgan and HSBC, the commission’s enforcement division started an investigation. In November 2009, an informant, described in the law suit only as a former employee of Goldman Sachs and a 40-year industry veteran, approached the commission with tales of how the silver traders at JPMorgan were bragging about all the money they were making “as a result of the manipulation,” which entailed “flooding the market” with “short positions” every time the price of silver started to creep upward. The idea was that by unloading its short positions like a time-released capsule, JPMorgan’s traders were keeping the price of silver artificially low.

Soon enough, the informant was identified as Andrew Maguire, an independent precious metals trader in London. On Jan. 26, 2010, Maguire sent Bart Chilton, a member of the futures trading commission, an e-mail urging him to look into the silver trading that day. “It was a good example of how a single seller, when they hold such a concentrated position in the very small silver market can instigate a sell off at will,” Maguire wrote.

On Feb. 3, 2010, Maguire gave the futures trading commission word about an impending “manipulation event” that he said would occur two days later, when the Labor Department’s non-farm payroll numbers would be released. He then spelled out two trading scenarios about which he had been told. “Both scenarios will spell an attempt by the two main short holders” — JPMorganChase and HSBC — “to illegally drive the market down and reap very large profits,” Maguire wrote in an e-mail to a trading-commission investigator.

On Feb. 5, Maguire took a victory lap, writing in another e-mail to the trading commission that “silver manipulation was a great success and played out EXACTLY to plan as predicted.” He added, “I hope you took note of how and who added the short sales (I certainly have a copy) and I am certain you will find it is the same concentrated shorts who have been in full control since JPM took over the Bear Stearns position … I feel sorry for all those not in this loop. A serious amount of money was made and lost today and in my opinion as a result of the CFTC’s allowing by your own definition an illegal concentrated and manipulative position to continue.”

In March 2010, Maguire released his e-mails publicly, in part because he felt the trading commission’s enforcement arm was not taking swift enough action. He was also unhappy over not being invited to a commission hearing on position limits scheduled for March 25. Then came the cloak and dagger element: the day after the hearing, Maguire was involved in a bizarre car accident in London. As he was at a gas station, a car came out of a side street and barreled into his car and two others; London police, using helicopters and chase cars, eventually nabbed the hit-and-run driver. Reports that the perpetrator was given a slap on the wrist inflamed the online crowds that had become captivated by Maguire’s odd story.

In any case, the class-action lawsuit contends that between March 2010 and November 2010, JPMorgan Chase and HSBC reduced their short positions in the silver market by 30 percent, causing the metal’s price to rise dramatically, but leaving them still with a large short position. Now, with the value of silver rising nearly every day, the two banks are caught in a “massive short squeeze,” according to one market participant, that appears to be costing them the billions they made originally plus billions more. Whether these huge losses will show up on the books of JPMorgan Chase and HSBC remains to be seen. (Parsing through the publicly filed footnotes of derivative trades is no easy task.)

Nonetheless, the conspiracy-minded have claimed that the Fed must have somehow agreed to make JPMorgan and HSBC whole for any losses the banks suffered if and when the price of silver rose above the artificially maintained low levels — as in right now, for instance. (About all this, a JPMorganChase spokesman declined to comment.)

Some two-and-a-half years later, the Commodity Futures Trading Commission’s investigation is still unresolved, and at least one commissioner — Bart Chilton — thinks that after interviewing more than 32 people and reviewing more than 40,000 documents, there has been enough investigating and not enough prosecuting. “More than two years ago, the agency began an investigation into silver markets,” Chilton said at a commission hearing last October. “I have been urging the agency to say something on the matter for months … I believe violations to the Commodity Exchange Act have taken place in silver markets and that any such violation of the law in this regard should be prosecuted.”

What’s more, Chilton said in an interview last week, that “one participant” in the silver market still controlled 35 percent of the silver market as recently as a few months ago, “enough to move prices,” he said, and well above the 10 percent “position limits” the commission has proposed to comply with Dodd-Frank financial reform law. Since that law’s passage last summer, the commodities exchanges have issued waivers permitting the ownership of silver positions above the limits the C.F.T.C. has proposed, and which were supposed to be in place by January of this year. Yet the waivers remain in place, and the big traders have not been penalized, much to Chilton’s frustration And the mystery deepens: last Thursday, the price of silver fell $1.50 per ounce in less than an hour before recovering. “This was robbery at its most obvious and most vindictive,” wrote Richard Guthrie, a London-based trader, in an e-mail to Chilton. “How many investors lost money and positions to the financial benefit of an elite few?”

It’s getting harder and harder to continue to brush off Andrew Maguire’s claims as the rantings of a rogue trader with a nutty online following. The Commodities Futures Trading Commission should immediately release the files from its investigation into the supposed manipulation of the silver market so the public can determine whether JPMorganChase and HSBC did anything illegal, with or without the help of the Fed. In addition, the commission should start enforcing the 10 percent threshold on silver positions it has proposed to comply with Dodd-Frank law. Basically, the other commissioners must join with Bart Chilton to do the job they are required to do: Protecting the sanctity of the markets and preventing the sorts of manipulation we’ve seen all too often.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.