U.S. Economic Death Spiral Into the Second Great Depression

Economics / Great Depression II Mar 03, 2011 - 03:12 PM GMTBy: D_Sherman_Okst

Bernanke’s Unstoppable, Self Reinforcing, Negative-Feedback-Loop

Bernanke’s Unstoppable, Self Reinforcing, Negative-Feedback-Loop

Wracked up by both parties over many decades our debt has evolved into a yearly deficit that can no longer be serviced with tax revenue and borrowing.

To avoid default Ben Bernanke chose to monetize the un-payable portion of our deficit. Each month about 100 billion dollars are created out of thin air to cover our government’s bills.

This has set forth an unstoppable, self reinforcing, negative-feedback-loop whereby:

- Debt monetization (printing money out of thin air to cover the portion of governments spending not satisfied by tax revenue and borrowing) reduces the value of the dollar.

- The debt monetization triggers dollars to flow out of bonds and into commodities.

- This increases demand, commodity prices rise.

- As commodities make their way into the supply chains businesses and consumers realize higher prices.

- Since globalization has caused wages to stagnate at 1970 levels, and with 23% unemployment, businesses try to eat increases, this in turn reduces hiring, causes layoffs and kills expansion.

- Consumers reduce their purchases, case in point: Wal-Mart is losing market share to the Dollar Store - that right there spells retail health (read: it’s terminal).

- Nations whose citizens spend 32%-52% of their entire budget on food are especially affected.

- In those nations where citizens spend 32%-52% of total their income on food; food riots erupt, social unrest breaks out, governments topple.

- Geographically speaking, many of these nations are in the Middle East where about a third of the world's oil supply comes from - so oil production is adversely affected, the price of oil increases. Drastically increases. The empire must then send in troops and warships to protect oil assets from being wiped off the map.

- Oil is an integral part of everything from farming to manufacturing to transportation, therfore the prices of all goods and services rise.

- This of course creates more stress on our economy, which drives tax revenues down, whic creates a greater deficit, which causes idtiot Ben to lean on the print button and monetize even more debt.

- Like an infinite loop in some errant computer code we go back to #1 above and iterate back through this unstoppable, self reinforcing, negatively-insane-Ben Bernanke-code that we call a negative self reinforcing feedback loop.

Bernanke's Crimes Against Humanity

Exporting Higher Food Prices to Poor Nations:

The price of grain and many other foor comodities are set in US Dollars. Creating more dollars reduces the dollars purchasing power. Creating more dollars makes investors flee securities and rush to hard assets, like grain, corn, soy, oil, cotton, coffee, sugar and so on.

In Tunisia on December 17, 2010 a 26-year-old man who tried to supported his family by selling fruits and vegetables doused himself in paint thinner and set himself on fire in front of a local municipal office.

Police had confiscated his produce cart, the cart he needed to earn a living in order to feed his family. With rising prices he coldn't afford a permit. They also beat him when he objected. Local officials then refused listen to him.

His desperation highlighted the public's frustration over living standards and increasingly higher food prices which accounted for 32.4% of their entire earnings.

A month later the ruler of Tunisia was gone, its government collapsed.

Now it is Libya’s turn.

In Lybia 37.2% of a families budget goes to food.

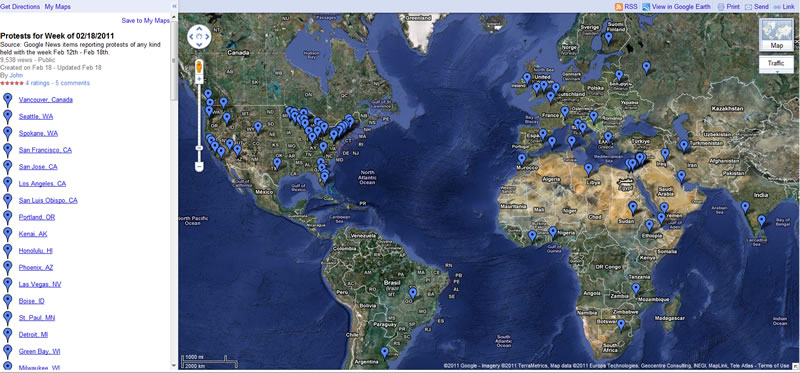

Many other oil producing nations have citizens who face the same income to food budget ratios. Map of many of the countries that are experiencing protests.

Organic bond sales have been anemic. Money is flowing out of securities and into commodities. Bernanke’s plan to have Quantitative Easing reduce interest rates has so far been a failure because of these outflows. That was Bernanke's first mistake.

Rising commodity prices, which for the most part peg global food prices was his second misstake.

Actually, if you count: Bear Stearns, the housing bubble, subprime contageon, unemployment contageon and recesion contageon they are respectively Bernanke's 6th and 7th blunders. Add to that the fact that he is following the steps that Greenspan used to explain how Great Depression One was created and it soon becomes apparant that Ben Bernanke is, without a doubt, the worlds biggest economic imbicile and shouldn't be allowed to balance a checkbook - let alone run the world's (now thanks to him and Greenspan) third largest economy.

Bernanke couldn't find cause and effect in a dictionary. He is an economic moron, and a master of global disaster. The only bigger fools are our leaders who:

- Haven't fired him.

- Still listen to him.

Now we have 2008 redux. Commodity prices and oil prices are headed up. Will they crash or will the dollar crash? If commodity prices and oil prices crash again this time I’ll be surprised if money flows into securities again. The dollar is no longer looked at as secure now that Bernanke is monetizing the debt.

The gig is up, the game is almost over.

When High Frequency Algorithmic Trading (insider trading) became responsible for 70% of stock trades I tossed the term “stock market” out of my vocabulary and replaced it with “rigged casino.”

When Bernanke began monetizing insane amounts of money the term “Bond Vigilantes” got tossed into that same trash heap. “Bond Vigilantes” are like ants with Bernanke counterfeiting over a trillion a year.

There are no more Bond Vigilantes.

Ben Bernanke IS the bond market and so far he hasn't even stepped in enough to keep yields down, but he'll have to.

It is not the smartest or the fittest that survive, it is those who notice change first.

Ben Bernanke cannot stop Quantitative Easing. Stopping the monetization of debt means that the United States of America defaults on its obligations. That’s right, the government stops sending out Social Security payments, government workers stop getting checks, companies who do business with the government stop getting paid, Medicare stops - well, you get the picture.

The other fallacy is that we can make cuts and balance this mess. When 23% of the deficit is debt service and 57% goes to keeping grandma eating. With those two facts in mind, we quickly realize that the deficit can’t be cut. Not without default and total restructuring.

Debt is monetized when the Fed creates money with a computer and credits the Treasury Department for the Bonds it “purchased”. The treasury takes this “money” and pays the government's bills so it can stay open. So those thinking there is no velocity may want to think that through again.

With 23% unemployment and with 43 million Americans on Food Stamps and a 1.5 trillion dollar deficit the Fed can not let interest rates rise. Rising interest rates would create massive deficit pain and inflict more debt servicing nightmares. There will be no Paul Volckler's this time. Bernanke will – en-masse – drive bond prices back up and rates back down by creating massive fake demand for bonds at auction when interest rates get too out of hand.

When he does that the value of our dollar will really tank, investors will step up their continued flight to safety by purchasing commodities and commodity prices will increase even more. Higher oil prices will likely cause investors to flee the stock market, but with thin volume and 70% HFAT who knows what the rigged casino will do. They’ve made a sincere joke of the market, which for people in retirement with funds chained to the rigged house — well this is nothing but a sorrowful situation.

Saudi’s king is buying time on his remaining years – he’s 87 - by handing money out. Like the fine ZeroHedge piece said:

“Unfortunately for Saudi, Bahrain tried this and failed. Also, once you start down this path, there is no turning back, as people demand more and more.”

China is faced with its Jasmine protest.

Bernanke, the other central banks, our leaders and the leaders of the rest of the world still have time to exit this endless loop. Just about every country is broke and needs to re-value their dollar and let the people, the local and state and federal governments get out of debt.

The concern I have is that other countries may exit the loop by announcing a new world reserve currency, which may be composed of one or several [other] currencies - all but ours - or with ours being a fraction of the total reserve.

"If" (please read: When) the United States loses the reserve currency its printing and current debt levels will equate to an ugly and very weak exchange rate. In short, food priced in some other currency will leave us looking like Libya.

You can go back through thousands of years of economic history and realize one fact: No country has ever printed their way to prosperity, all who have tried have wound up in hyperinflation, war or demise. How a guy can teach himself calculis, get into Harvard, become a professor at Princeton and NOT understand that - well it totally defies logic. The idiot was asked about the one time in our history that we had no debt. (Please don't think we balanced the budget during the Clinton years - for you can't debt (apply IOU's in the Social Security Trust Fund) as income.) Andrew Jackson balanced the budget and wiped away our debt by using non debt based money. Bernanke was asked about this during a recent hearing and he scoffed at it - his merit? Because it happened before the Civil War.

By D. Sherman Okst

http://UnveilingTheEconomy.blogspot.com/

Bernardston MA USA

davossherman @ gmail.com

I'm an ex-airline captain with about 15,000 hours and am amazed at all the BS we are taught. Most of my friends still in the business were also taught the wrong aerodynamic principles with respect to what makes planes fly. Aviation or economics, Keynes to Austrian - Bernulli to Newton we've been sold bad goods. It's amazing anything works as backwards as we do things.

© 2011 Copyright D. Sherman Okst - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.