U.S. Consumer Spending Disappoints, But Partly Weather-Related

Economics / US Economy Mar 01, 2011 - 05:48 AM GMTBy: Asha_Bangalore

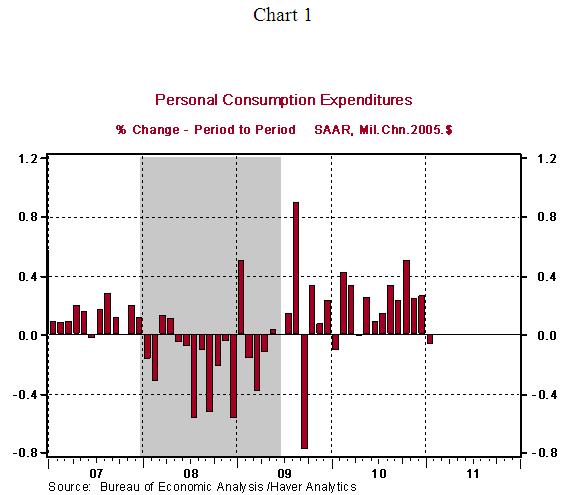

Real consumer spending fell 0.1% in January after a 0.3% increase in the prior month. Purchases of durable goods increased 0.3% but this strength was offset by declines in purchases of non-durables (-0.2% vs. +0.1% in December) and services (-0.1% vs. +0.2% in December).

Real consumer spending fell 0.1% in January after a 0.3% increase in the prior month. Purchases of durable goods increased 0.3% but this strength was offset by declines in purchases of non-durables (-0.2% vs. +0.1% in December) and services (-0.1% vs. +0.2% in December).

Details of consumer spending indicate that bad weather led to a 0.4% drop in the transportations services and 0.6% drop in food services and accommodations. The services component is projected to reverse these declines in February. The January reading of consumer purchases sets back consumer spending for the entire quarter, assuming there will be no extraordinarily strong gains during February and March.

The 1.0% jump in personal income reflects the reduced employee contributions for social security authorized under the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010. Disposable personal income moved 0.7% in January after a 0.4% gain in the prior month. The expiration of the Making Work Pay provisions of the American Recovery and Reinvestment Act of 2009 raised taxes and reduced disposable personal income. The net impact of these two factors resulted in a boost to disposable personal income which would have posted only a 0.1% increase in the absence of these special factors.

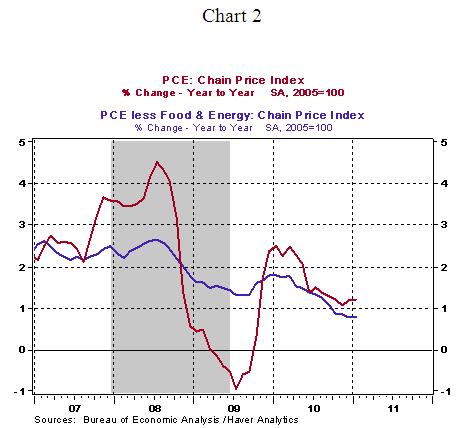

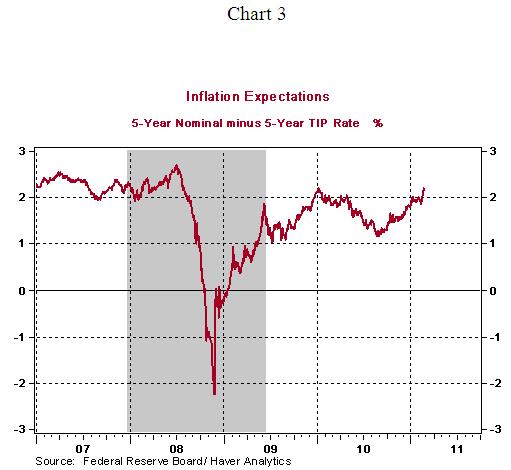

The personal consumption expenditure price index rose 0.3% in January, matching the increase posted in December. The core personal consumption expenditure price index, which excludes food and energy, advanced 0.1%, putting the year-to-year gain at 0.81% in January vs. a record low of 0.77% in December 2010. These readings are not inflationary and allow the Fed to maintain the current monetary policy stance. Janet Yellen's response in the Q&A session following the speech on February 25 indicated that movements of core inflation and inflationary expectations would be the triggers for a change in monetary policy. Chart 2 indicates that core inflation is contained and Chart 3 suggests that inflationary expectations also do not present a threat, as yet. The most recent gain in inflation expectations is related to the turmoil in North Africa and it is most likely a temporary event.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.