U.S. Treasury Bonds, Yen, Euro and Dollar Chart Analysis

Stock-Markets / Financial Markets 2011 Feb 26, 2011 - 06:17 AM GMTBy: Justin_John

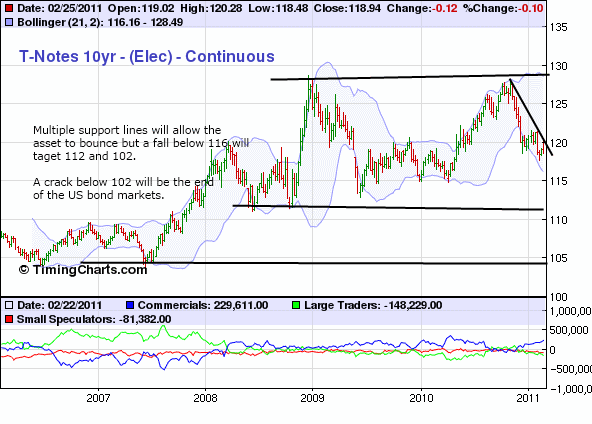

Treasury: Close to entering a long term bear market on US treasury on 10 year duration. We believe the COT captures the true picture of the developing situation in the US as FED moves in with QE3 which will be close to $400-500 billion of asset purchase. COT for week ended Feb 26 indicates that shorts have increased their position with nearly 148k contracts shorted, an increase of 32k new shorts for the week.

Treasury: Close to entering a long term bear market on US treasury on 10 year duration. We believe the COT captures the true picture of the developing situation in the US as FED moves in with QE3 which will be close to $400-500 billion of asset purchase. COT for week ended Feb 26 indicates that shorts have increased their position with nearly 148k contracts shorted, an increase of 32k new shorts for the week.

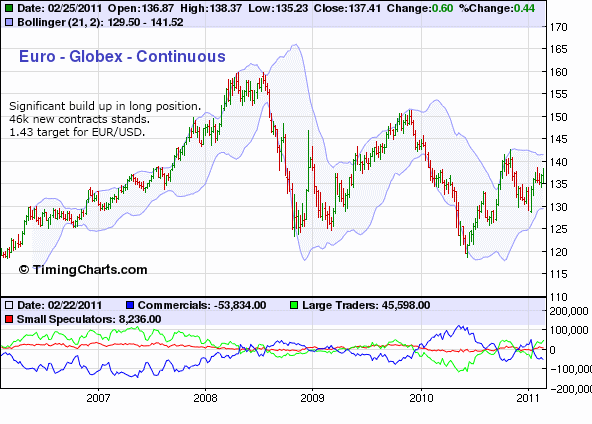

EURO crosses:

Euro crosses have shown an alarming ability to withstand events in the middle east. COT indicates that longs have increased the position to 46k contracts from 35k last week. EURO yields have risen 1.55% from 1.4% last week on the 2 year bunds. Yields continue to show divergence from the euro position as eur/usd should be closer to 1.5 levels on yield adjusted basis. EUR/YEN should be 135 on a yield adjusted basis. We believe the divergence will vanish soon once the sovereign believe that EU debt crisis is nearing an end.

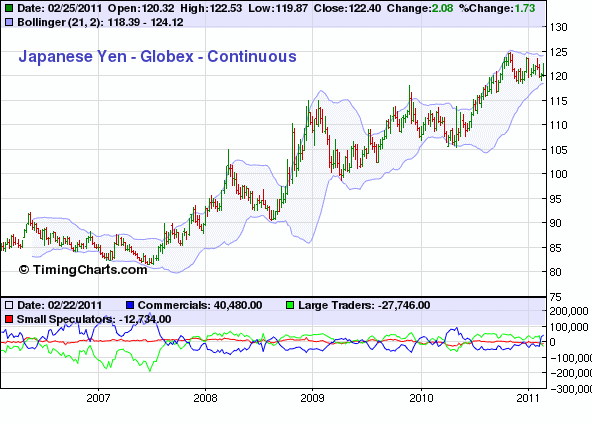

YEN

Yen COT position indicate an increasing speculator build up on the short side with short rising to -27k after last week massive unwinding of longs from 55k to -16 k which was the largest unwind for over 6 months. YEN has been hit both technically and fundamentally with downgrades and fall in yields on its 2 year bonds.

YEN has hit a multi decade top at 120 and breaking out from here looks near impossible and hence the risk to the trade is very low. EUR/YEN is the pair which should be the best trade available to short YEN given the largest yield differentials.

Dollar Index

The most surprising part of 2011 has been the dollar index which has refused to rally even with all the events of risk aversion around. Even Portugal yields crossing some key levels could not spark any rally in the dollar which brings us to the question whether the dollar has finally lost its safe haven status to Swiss and YEN.

We do believe US dollar is in a zone where it is clearly looking down against high yield currencies like the EURO. While the EURO has its own problems, it is just too powerful and well backed to fall apart as some claimed in 2010. China has constantly been buying into EURO and diversifying out of the US Dollar and that alone is enough to drive the trade for next few months if not years. EUR/USD has broken key levels at 1.375 and we believe the next stop is 1.43 for the queen of all pairs.

Source: http://dawnwires.com/investment-news/...

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2011 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.