Top 12 Countries at Extreme Risk of Economic Collapse

Economics / Global Economy Feb 25, 2011 - 10:38 AM GMTBy: Dian_L_Chu

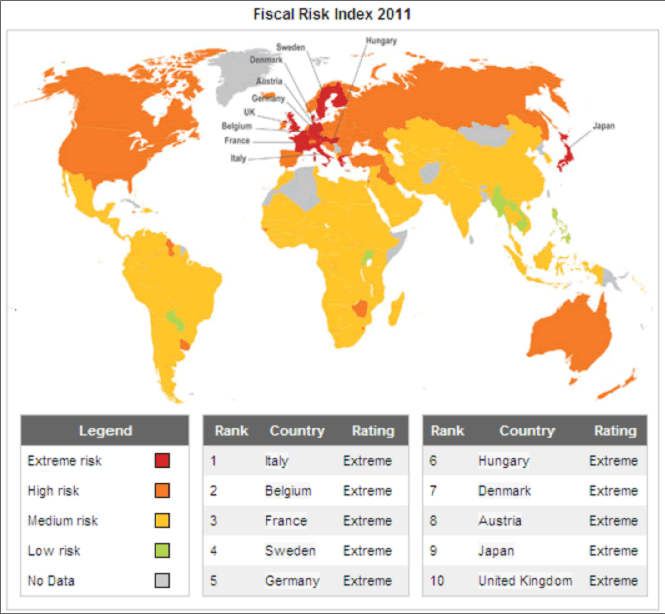

Risk analysis firm Maplecroft just released its new fiscal risk index ranking of 163 countries. Europe trumps all other regions with 11 out of twelve courtiers rated as "extreme risk." However, quite surprisingly, only one PIIGS country--Italy which takes the top spot--is in the top 12.

Risk analysis firm Maplecroft just released its new fiscal risk index ranking of 163 countries. Europe trumps all other regions with 11 out of twelve courtiers rated as "extreme risk." However, quite surprisingly, only one PIIGS country--Italy which takes the top spot--is in the top 12.

The others include many big economies in Europe - Belgium (2), France (3), Sweden (4), Germany (5), Hungary (6), Denmark (7), Austria (8), United Kingdom (10), Finland (11) and Greece (12). Japan at No. 9 is the only other country not in Europe within the highest risk category (See map below).

Aging Demographics

While high national debt and public spending are two common denominators, the study finds it is the aging demographic that puts these countries at extreme fiscal risk. An aging population will place increasing pressure on public expenditure such as pension and health care, while a shrinking working-age population means less productivity and less tax revenues to support public spending and debt payments.

High Dependency Ratio

Aging population also means high dependency ratio, or the number of people 65 and older to every 100 people of traditional working ages. For example, according to Maplecroft, the dependency ratio in France is 1 to 47 (i.e. 47%), Germany at 59%, Italy with 62%, and Japan at the very top with 74%, while the ratio in UK is currently 25%, and is forecast to rise to 38% by 2050.

Source: Maplecroft |

Another problem within Europe is that it has the low labor participation rate in the 65+ age bracket. In fact, the labor market participation of age 65+ amongst the ‘extreme risk’ nations range from 1.4% in France, 7.71% in UK, to 11.7% in Sweden, vs. a 28% average across all countries ranked in the index.

Maplecroft cited pensions and discrimination as two examples that would push people away from the work force.

U.S. – High Fiscal Risk

Although the United States is not ranked among the "extreme fiscal risk," the nation is nevertheless classified as high risk, along with Spain, another PIIGS country, Turkey, Iraq, Australia, Canada and Russia.

Let's take a look at the two metrics mentioned here.

The dependency ratio in the U.S. is 22 in 2010, but is projected to climb rapidly to 35 in 2030, according to the U.S. Census Bureau, mainly due to baby boomers moving up into the 65+ age bracket. The ratio then will rise more slowly to 37 in 2050.

The labor participation for age 65 and over in the U.S. is at 17.5 according to data at Bureau of Labor Statistics (BLS). This is better than most of the European countries, but below the overall average of 28%.

U.S. in Wave 2

Most people typically associate a country’s fiscal risk to its government’s monetary and fiscal policies, and Lehman Brothers has taught us that banking and housing crisis could push the entire world into the Great Recession.

While these are all definite risk factors, a highly productive labor force and relatively young population makeup tend ensure more sustainable prosperity and better odds at digging out of a hole.

The Maplecroft study concludes:

"...in high risk countries, it is increasingly likely that the private sector will be called upon to contribute in the form of pensions and private health care.... Without significant adjustments, such as raising taxes or reducing spending, countries risk going bankrupt."

So, while Europe is being forced to do all that amid sovereign debt crisis in the middle of widespread protests over raised pension age and austerity measures, the U.S. and other "high fiscal risk” countries seem be set up as the wave 2 of this global fiscal chain of events.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.