Silver a Sound and Credible Currency

Commodities / Gold and Silver 2011 Feb 23, 2011 - 03:23 PM GMTBy: Adrian_Ash

As a currency, the Euro doesn't have to do much to equal its peers...

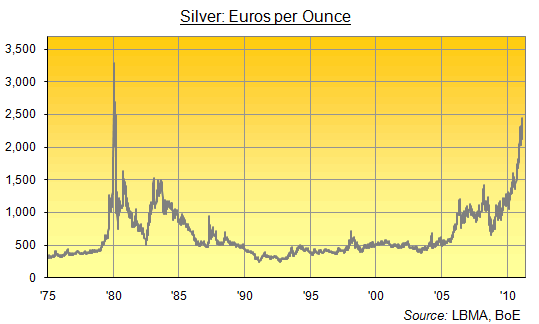

"SILVER HITS new all-time highs in Euro" proclaimed Zero Hedge on Monday.

Regular readers of the blog site won't choke to know it was wrong, this time by only one third. Mistaking (and showing) a chart of month-end prices for a chart of daily silver prices, Zero Hedge's pseudonymous host, Tyler Durden, missed the true Euro-equivalent spike to €32.80 per ounce of 18 January 1980 - hit in what was then the Deutsche Mark the very same day that silver priced in Dollars also hit its all-time high to date...some 44% above this week's top.

Still, the point is near-enough made. Because silver, like gold, isn't just about the Dollar, even though its latest surge coincides with the latest plunge in the US currency. Instead, silver has also caught a strong and growing bid over the last 5 years against the Dollar's upstart challenger too. And since the Euro debt crisis really got started 12 months ago, the silver price has scarcely looked back...rising 108% from the start of 2010.

"The Euro as a currency is not in crisis. The single currency is sound and credible," said European Central Bank president Jean-Claude Trichet in an interview with Paris newspaper L'Espresso earlier this month. Which, a little like Zero Hedge, is both premature and misleading. Because the Euro "as a currency" doesn't have to achieve very much to retain the same credibility as its modern-day competitors.

Against the older monetary measures of gold and silver, on the other hand, the Euro looks just as weak as the other three "big four" reserve currencies - the Dollar, Sterling and Yen.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.