Gold $2,300, Silver $150 and Looming Stock Market Crash

Commodities / Gold and Silver 2011 Feb 23, 2011 - 12:17 PM GMTBy: Jason_Hamlin

Notes from the Cambridge House Silver Summit - Cambridge House puts on some of the best commodity-focused investment conferences in the industry and this year was no different. The February show in Phoenix, Arizona included presentations from industry heavyweights such as Ted Butler, Bill Murphy, Jay Taylor, Mickey Fulp, John Kaiser and others. Over 40 booths were filled with up-and-coming junior resource miners, including one of my favorite silver plays, Aurcana Corporation (CVE: AUN or AUNFF). Aurcana stock advanced as much as 19% today, the first trading session following the conference. Aurcana just began construction on their Shafter mine in Texas, which is estimated to be one of the top ten largest silver mines in the world. In addition the company is already producing one million ounces from its La Negra mine in Mexico and is projecting a jump to 5 million ounces per year once Shafter comes online.

Notes from the Cambridge House Silver Summit - Cambridge House puts on some of the best commodity-focused investment conferences in the industry and this year was no different. The February show in Phoenix, Arizona included presentations from industry heavyweights such as Ted Butler, Bill Murphy, Jay Taylor, Mickey Fulp, John Kaiser and others. Over 40 booths were filled with up-and-coming junior resource miners, including one of my favorite silver plays, Aurcana Corporation (CVE: AUN or AUNFF). Aurcana stock advanced as much as 19% today, the first trading session following the conference. Aurcana just began construction on their Shafter mine in Texas, which is estimated to be one of the top ten largest silver mines in the world. In addition the company is already producing one million ounces from its La Negra mine in Mexico and is projecting a jump to 5 million ounces per year once Shafter comes online.

I gave a 30-minute presentation to a packed room of investors and also sat on a panel with some of the world’s foremost experts on precious metals investing. My presentation focused on why precious metals were nowhere near a top and offered arguments for much higher prices in both gold and silver.

As a subscriber to this site, you are probably already aware of these key underlying factors that will continue to drive the prices of gold, silver and most commodities much higher. They include the record $1.65 Trillion deficit this year, unsustainable debt levels, central banks becoming net buyers of gold for the first time in over 20 years, Chinese consumer demand, a shift from paper to physical ownership, supply shortages and growing calls around the world for an end to the dollar as world reserve currency.

I will be speaking again at the Vancouver conference in June, which is much larger than the Phoenix version. In the meantime, here were some of the key takeaways and top stock picks that I gleaned from the conference.

Gold and Silver Nowhere Near a Top

Most speakers agreed on a price target around $1,800 gold and $50 silver by the end of 2011. Furthermore, analysts and newsletter writers were forecasting that gold would eventually reach $3,000 at a minimum, with many discussing the fundamental reasons that gold will reach the $6,000 level. Similarly, experts were predicting silver would easily climb to $150 and could hit as high as $1,000 per ounce before the current bull market is over. Those are lofty numbers, but give you some perspective of just how early in this bull market we might be. The inflation-adjusted highs range dependent on which statistic is used – the official government statistic or the more realistic estimation made by John Williams at Shadow Stats. Here are the inflation adjusted highs:

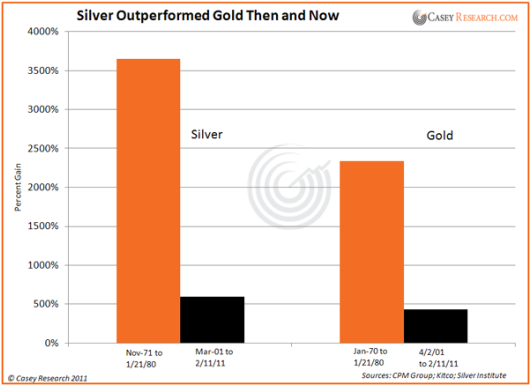

If the inflation-adjusted highs don’t drive home the point enough, here is a chart from Casey Research showing the percentage gains in gold and silver now versus the gains during the last bull market. From 1971 to 1980, silver climbed 3,646% versus only 596% during the current bull market. Silver would need to hit $160 in order to have a similar gain to that of the last bull market. Gold climbed 2,333% during the past bull market versus just 430% during the current bull market. Gold would need to reach at least $6,227 to register a similar gain to that of the last bull market.

The key takeaway from this data should be obvious… gold and silver are nowhere near a top in this current bull market. Furthermore, the fundamental conditions that drove the past bull market in precious metals are even more severe today. Gold and silver should not only match the advances of the last bull market, but should surpass them handily.

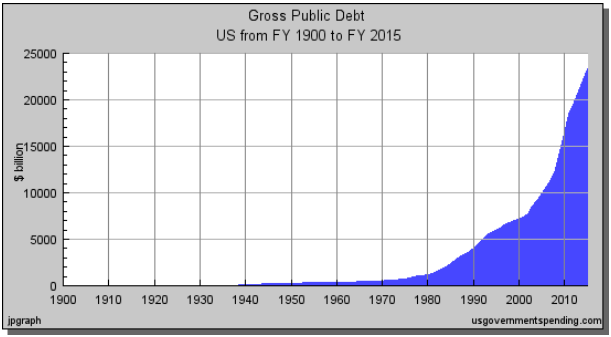

For example, let’s take a look at the debt situation now versus the 1970s/80s. Gross debt has gone parabolic since 1980 and we have added more debt in the past few years than in the previous 100 years combined!

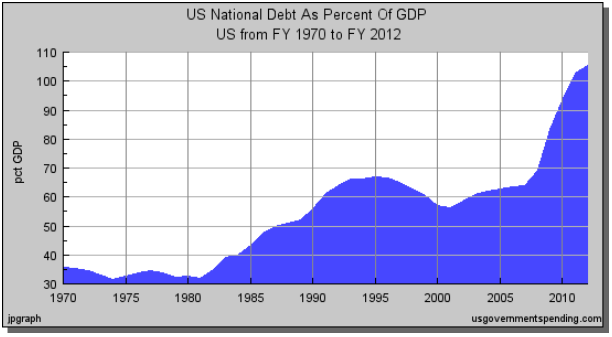

Similarly, the debt-to-GDP ratio in the 1970s was around 35 and is now approaching 100. With the record $1.65 Trillion debt projected this year and weak GDP growth, the U.S. debt is projected to reach 100% of GDP in the next few months, a level not seen since World War II.

But another consideration when trying to determine how high gold and silver might go is your measuring tool. It is less important to understand how high prices go in dollar terms than to understand the value of gold in terms of the things you need in life… energy, food, shelter, etc. So, while precious metals might go up hundreds or thousands of percentage points against fiat dollars, the true value comes in knowing that you will be able to maintain or even increase your purchasing power of key items over the years.

Double-Dip Stock Market Crash Looms

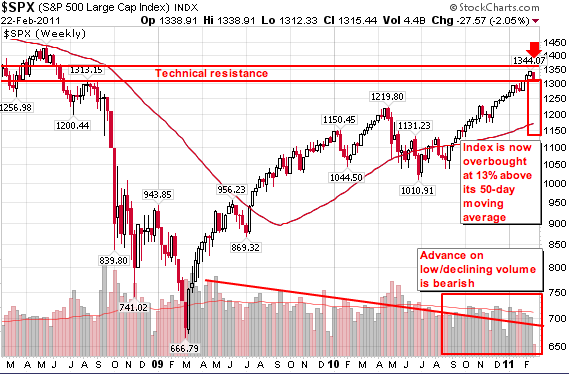

The S&P 500 has doubled from its bottom to return to pre-crash levels. There have only been a few times in history when the stock market has doubled in just two years and they came off severely oversold conditions. Most technical analysts are pointing to overbought conditions. So, the astute investor has to consider whether 2009 prices were really severely oversold and whether the underlying fundamentals of the economy justify the doubling we have witnessed in the past two years.

While it is true that we’ve had unprecedented levels of quantitative easing and stimulus programs, most of that money went to the banks and is either parked in excess reserves collecting interest from the FED or has been paid out in record levels of bonuses. Only a small percentage went into circulation and into the hands of those that would actually need to spend it. An even smaller percentage went into the hands of those that create real jobs in manufacturing, energy and elsewhere. Our nation’s wealth, both financial and intellectual, has been handed over to a bunch of exploitative assholes that create nothing of true value to society. Oh yes, I am talking to you Mr. Bankster. You know where you should be sitting.

While the country’s debt and deficits are exploding off the charts, unemployment remains high, food stamp participation is at record levels, foreclosures persist and industrial output is sluggish. There is a huge and glaring disconnect between the gains on Wall Street and the desperation on Main St. There is no organic or sustainable growth, only QE and manipulation. It is working in the short term, but as soon as investors panic and confidence sinks, stocks are going to crash even more severely than in 2008.

Cautious optimism seemed to be the underlying theme connecting the different presentations at the Cambridge House investment conference this past weekend. There is an uneasiness about how far and how high the stock market has charged in the past year. One broker told me that he thought cash was the best place to be at the current moment, even while acknowledging the 5-10% loss that would be taken annually via inflation.

My takeaway is that we should not get too complacent with the incredible gains experienced recently. The extreme bullishness and investor complacency should be viewed as a contrarian indicator and caution is advised. This does not mean to short the market, as the manipulation could keep stocks grinding higher for a while longer. But it does mean to watch your positions closely or tighten your stops so as to avoid huge capital losses should another major sell off occur.

Downside protection can be found in the form of various inverse ETFs that go up when the market goes down. A few of my favorite ways to hedge my portfolio and profit during down dips include EDZ and FAZ. If I am holding for a time horizon longer than a few months, I look to short EDC or FAS, as the ultrashort funds suffer from long-term decay. Either way, it is important to have a strategy that will protect your portfolio and even provide you with profits to offset the declines you might face in core positions during the upcoming double dip, should it occur.

Have an End Game in Mind

One interesting recommendation that is far too often overlooked is to know your end game. Owning precious metals as a way to hedge against inflation, protect your assets and even increase your wealth and purchasing power is a solid strategy. However, most gold bugs have yet to consider their end game. When gold and silver go parabolic and mainstream investors create a blow-off top, what are you going to do with your metals?

As hard as it might be to imagine today, there will come a top in precious metals and time when other assets will become more attractive. How will you know when to sell and what will you be willing to sell for? Where do you move your wealth after you have sold your precious metals? We might be a few years away from having to deal with this question, but it is a critical one nonetheless and deserves your attention.

As a cycles investor, I will be looking for the beginning of the next bull market cycle in another sector. My choice will likely be real estate, although it is hard to foresee what opportunities might develop between now and then. Regardless, I believe that real estate is nowhere near a bottom yet and will be likely to bottom around the same time that precious metals hit a top. If this thesis is true, investing in gold and silver now and transferring those assets into real estate when the cycles cross will yield many times more real estate for your money. As real estate prices continue lower and precious metals prices continue higher, we are likely to get to the point once again where a single-family median home can be purchase for less than 1,000 ounces of silver. Do you have your 1,000 ounces yet?

If we are lucky enough to catch the start of the next bull market in real estate, our wealth will continue to grow until it is time to sell real estate and move wealth into the next bull cycle in another asset class. Or perhaps you want to invest in education, start your own business or blow your newly-acquired wealth on travel or partying. Maybe you believe precious metals will never hit a top and will continue increasing in value indefinitely, in which case you will hold most or all of your metals. But the point is to know your end game and have a plan for exactly what you will do when prices spike to obscene levels and finally peak.

The Yukon and Prospect-Generators Heat Up

This year’s conference had plenty of talk about the Yukon. Those of you tracking junior gold miners have probably heard stories about the notable discoveries in the Yukon and the story of Shawn Ryan, who has been systematically staking claims in the search for the “source rock” for all that gold that was panned from the Yukon’s rivers in the first gold rush. Although significant amounts of placer gold was found in the nearby creeks and streams, they apparently never found the huge underground deposits that birthed all of those nuggets. Shawn Ryan lived in a tin shack for years before uncovering the so-called White Gold district and many believe he has now found the source of all the placer gold.

Miners have been working with Shawn Ryan and others to find some very promising deposits in the area. A few of the Yukon miners mentioned at the conference by newsletter writers and others analysts include:

Northern Tiger Resources (CVE: NTR)

Tarsis Resources (CVE: TCC)

Kaminak Gold Corporation (CVE: KAM)

Silver Quest Resources (CVE: SQI)

Out of respect to paying subscribers, I have left out my favorite junior Yukon stock, a Columbian miner that just hit high grades and an extermely undervalued Nevada junior that is going into production this year.

If you would like to find out which junior stocks I think have the most upside potential, consider subscribing to the Gold Stock Bull contrarian newsletter and joining the premium membership. You will be able to view my portfolio in real time and you will receive specific email alerts every time that I am buying or selling. Get started now for just $35!

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2011 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.