Morningstar's Top Takeover Targets in 2011

Companies / Mergers & Acquisitions Feb 23, 2011 - 05:26 AM GMTBy: Dian_L_Chu

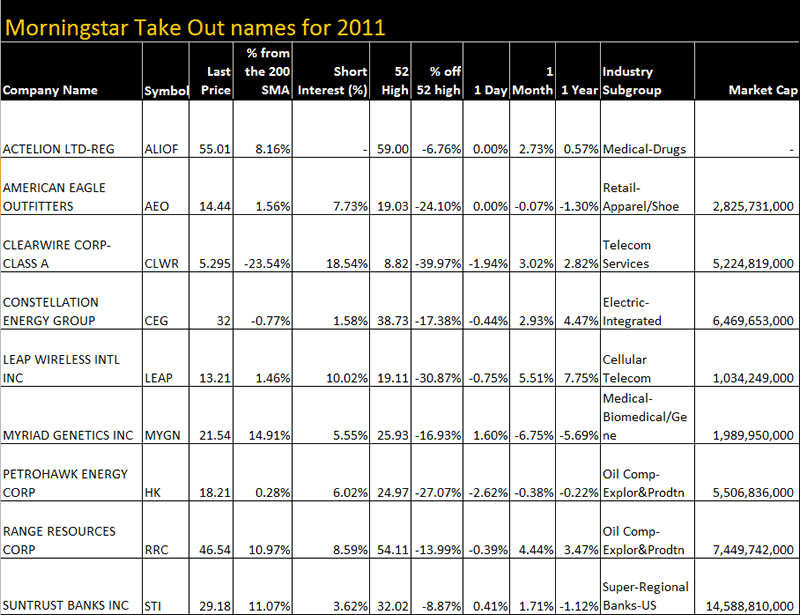

Hedge Fund Live writes: The spreadsheet below gives you the up-to-date internals for the top take out names identified by Morningstar. Before getting to the spreadsheet let me tell you what these companies do and what the rumor mill has been saying over the last few months.

Hedge Fund Live writes: The spreadsheet below gives you the up-to-date internals for the top take out names identified by Morningstar. Before getting to the spreadsheet let me tell you what these companies do and what the rumor mill has been saying over the last few months.

ACTELION (ALIOF.PK): In mid-November, Bloomberg reported that Amgen (AMGN) was preparing an approach that could come within days, while the usual big pharma suspects have all been touted as potentially interested.

American Eagle Outfitters (AEO): The retailer has been subject of take out rumors over the last few months along with competitor Abercrombie & Fitch.

Clearwire Corp (CLWR): BTIG research analyst thinks Sprint, which owns 54% of CLWR, will take them out for $15 a share sometime in the next 6 months.

Constellation Energy Group (CEG): Constellation Energy Group, Inc. (Constellation Energy) is an energy company that conducts its business through various subsidiaries, including a merchant energy business and Baltimore Gas and Electric Company. CEG has been a rumored take out name for years.

LEAP Wireless (LEAP): Leap Wireless International, Inc. (Leap) is a wireless communications carrier that offers digital wireless services in the United States under the Cricket brand. Leap wireless has been a take out name for years with MetroPCS (PCS) being the number one acquirer. Recently, there have been rumors that T-Mobile is very interested in LEAP.

Myriad Genetics (MYGN): Myriad is a molecular diagnostic company focused on developing and marketing novel predictive medicine, personalized medicine and prognostic medicine products. MYGN has been a takeout name for the last year.

Petrohawk Energy (HK): HK is an independent oil and natural gas company engaged in the exploration, development and production of predominately natural gas properties located onshore in the United States. Its business consists of an oil and natural gas segment, and a midstream segment. Its oil and natural gas properties are concentrated in four domestic shale plays.

HK rumors have been abundant last year, with Chesapeake Energy (CHK) being the main mention as acquirer.

Range Resources (RRC): RRC is an independent natural gas company, engaged in the exploration, development and acquisition of primarily natural gas properties, mostly in the Southwestern and Appalachian regions of the United States. RRC was a highly rumored name last year.

Sun trust Banks (STI): STI is a diversified financial services holding company, which provides a range of financial services to consumer and corporate clients. Through its principal subsidiary, SunTrust Bank, the Company provides deposit, credit, and trust and investment services.

Regional Banks have been highly touted takeout names for the last few years and when it comes to naming one, regional Sun Trust tops the majority of lists.

About the Author: Hedge Fund LIVE, founded by Jeremy Frommer, is the world's first interactive network of transparent trading desks.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.