Gold, Central Banking, Fecks, Lies and Video Tape

Commodities / Gold and Silver 2011 Feb 22, 2011 - 10:38 AM GMTBy: Rob_Kirby

The purpose of this article – it’s an attempt to bring some transparency to what’s really happening in the precious metals complex by underscoring the words and actions of players in the Central Banking community. Attention is drawn to the fact that these elitists lie as a matter of policy but are prone to making simple mistakes like all humans do. Specifically, light is shone on the degree to which these same elitists will go to keep their surreptitious market activities ‘secret’ and their irredeemable fiat currencies viable.

The purpose of this article – it’s an attempt to bring some transparency to what’s really happening in the precious metals complex by underscoring the words and actions of players in the Central Banking community. Attention is drawn to the fact that these elitists lie as a matter of policy but are prone to making simple mistakes like all humans do. Specifically, light is shone on the degree to which these same elitists will go to keep their surreptitious market activities ‘secret’ and their irredeemable fiat currencies viable.

In December, 2010 – I wrote a paper titled, Something’s Wrong in the Silver Pit, and It’s Much Bigger than J.P. Morgan. This paper highlighted how the Federal Reserve had stonewalled the Gold Anti Trust Action Committee’s [GATA’s] FOIA requests for information on Fed activity in the gold bullion markets – citing, as an excuse, its ‘privileged status’ and reluctance to divulge ‘trade secrets’

The paper made comparisons between bullion data published by the U.S. Office of the Comptroller of the Currency [OCC] and bullion data published by the Bank For International Settlements [BIS], based in Basel, Switzerland.

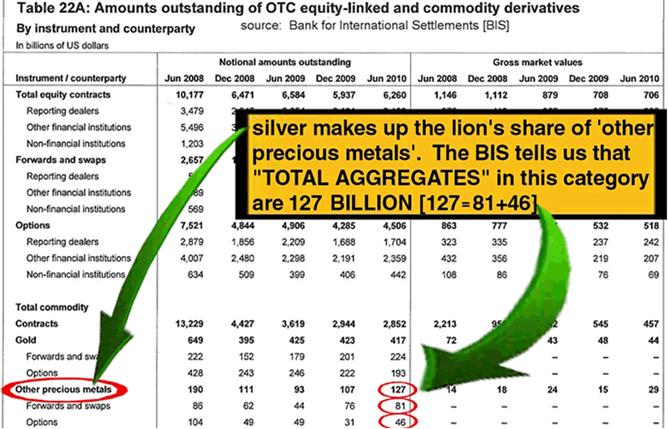

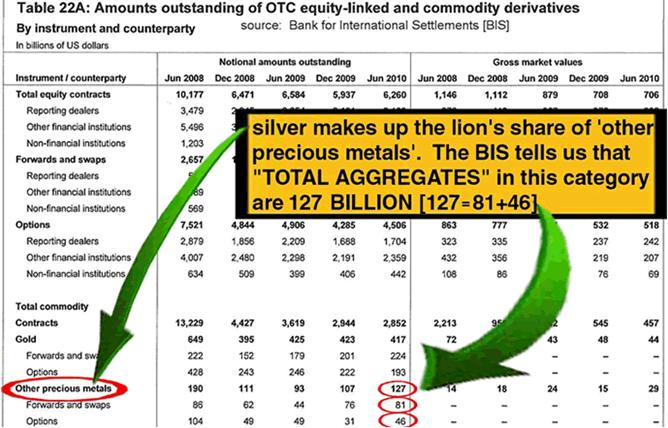

Whether looking at the OCC data or that published by the BIS – the overwhelming conclusion was that the “then prevailing” gold / silver ratio [at 49: 1] was a contrivance. This math indicates that a disproportionate quantity of silver relative to gold derivatives existed – indicative of major silver market manipulation. Here’s the BIS data used:

source: http://www.bis.org/statistics/otcder/dt21c22a.pdf

This was illustrated by posing the question: If there is a total of 417 Billion notional in Gold derivatives outstanding – AND THE GOLD / SILVER Price RATIO is 49:1 – then WHY are outstanding notional silver derivatives 127 Billion???? These BIS numbers suggest that the proper gold / silver ratio should be roughly 3.3:1 or silver priced TODAY at 1,400 / 3.3 = 424.00 per ounce.

Because the BIS data appeared to be so COMPLETELY at odds with the [then] 49: 1 prevailing gold / silver ratio – I wrote to the BIS’s “PRESS SERVICE” with the following query:

From: Rob Kirby [mailto:rkirby@kirbyanalytics.com]

Sent: 23 December 2010 17:48

To: Press, Service

Subject: question

Dear Sir or Madame;

I was wondering if you could help explain something I am having a great deal of difficulty understanding – in the absence of Fraud – that you reported in one of your latest Derivatives reports:

source: http://www.bis.org/statistics/otcder/dt21c22a.pdf

Question: There are a total of 417 Billion notional in Gold derivatives outstanding – AND THE GOLD / SILVER Price RATIO is 49:1 – then WHY are outstanding notional silver derivatives 127 Billion???? These BIS numbers suggest that the proper gold / silver ratio should be roughly 3.3:1 or silver priced TODAY at 1,400 / 3.3 = 424.00 per ounce.

So, does the BIS have any comment on the proposition that metals markets are rigged? If not, how does the BIS explain the discrepancy in their own figures cited above?

Thanks in advance for your time and consideration,

Sincerely,

Rob Kirby

Proprietor, Kirbyanalytics.com

Toronto, Ontario

Canada

Phone: xxx xxx xxxx

The BIS acknowleged receipt of my query, on Dec. 27, 2010, as expressed here:

Dear Mr Kirby

Thank you for your enquiry which we have passed your enquiry along to our Statistics department. Unfortunately the expert who would be able to respond to your questions is currently not in the office, but you may expect a response when he returns returns in early January.

With best regards

Marisa Bourtin

Press

Communications

Bank for International Settlements

Centralbahnplatz 2

4002 Basel, Switzerland

I received this “official reply” to my PRESS INQUIREY on Jan. 5, 2011 from an individual who I’ll simply refer to as Mallo [ccing the BIS Press Service, and another individual]:

Dear Mr Kirby,

Many thanks for your email showing interest in our statistics and apologies for our late reply.

Concerning your query, please be informed that the market risk category "other precious metals" covers not only silver but also other precious metals like the platinum. Please also note that we receive these data from the reporting central banks already aggregated according to the same broad categories listed in the tables published in our website, therefore I am afraid that we cannot estimate the contribution of the silver contracts, or any other specific contracts, to the aggregates reported as "other precious metals". [in red, RK emphasis]

Please note that this information is being provided for your own guidance and it is not for quoting or for attribution.

We hope this helps.

Best regards

Mallo

BIS-IBFS

If you have followed along with me so far, note how the BIS replies to PRESS INQUIRIES with “sweet nothings” - which subsequently, there-after are shown to be BLATANT LIES - which they then lay claim are not for quoting or attribution????? Also, make specific note of the claim, “Please also note that we receive these data from the reporting central banks already aggregated according to the same broad categories.”

When Sweet Nothings Become Blatant Lies

That’s the way things stood – no quotation or attribution until a key revelation surfaced Friday, Feb. 18, 2011. After a lengthy dose of “legal footsy” with GATA – the Federal Reserve was finally compelled to release a document detailing the minutes of G-10 Gold and Foreign Exchange Committee Meeting from 1997 – linked here.

Moving on to the minutes of the G-10 Gold Meeting, we can clearly see that the BIS itself is involved in gold LEASING:

Gill (Bank for International Settlements), said that the BIS had not sold any gold in many years. The BIS did some leasing, but kept its participation moderate because it did not want to become "too big" in [sic] that business and be seen as the liquidity provider of last resort. He agreed with Smeeton that the market was worried about central bank selling. He noted that central banks own 30 percent of the gold ever mined, and that 25 percent of their reserves were in gold. He posed several questions that now perplexed the market: What was the posture of central banks toward gold? Would they continue selling it [sic] will"? Was it possible for central banks to coordinate their sales programs? Perhaps a pooling of sales? Given the difficulty of finding buyers in this market, would other central banks be willing to step in and absorb any oncoming supply?

The United Kingdom’s Plenderleith also speaks of the BIS assembling a paper with more detailed aspects of the Central Bank gold leasing market to serve as “Background Material”:

Plenderleith suggested the BIS assemble a paper on the more factual aspects of this market, not ignoring the leasing market, and for this paper to serve as background for the Governors discussion in July.

So, now it’s finally confirmed that INDEED – the BIS does possess precious metals data which IT DOES NOT PUBLISH, and in fact, they HIDE it from public scrutiny. In their posted data – there IS NOT and there has NEVER BEEN an “aggregation category” titled, GOLD LEASING.

Now folks, this is where respect for this “Mallo” character and the BIS goes “RIGHT OUT THE WINDOW” with their off-the-record-lies and prompted this unpleasant reply from yours truly. and just for fun, I cc’d a bunch of my friends. One of them was so intrigued, he wrote an article in his own mother tongue, German, published here. Needless to say, they all know exactly who Mallo really is – just so there’s a good record of this correspondence and that it really happened.

Mallo;

http://www.gata.org/files/FedMemoG-10Gold&FXCommittee-4-29-1997.pdf

Do you have any idea how information at the above link makes what you told me look like a BLATANT LIE??

You made claim that the BIS only receives information aggregated in the way the table displays. Yet, in this disclosure cited above – we can CLEARLY SEE that the BIS possesses much more detailed breakout on precious metals data that it HIDES – PARTICULARLY as it relates to gold and leasing. Are we to now believe that you ONLY MISDIRECT and LIE to the PUBLIC about Gold but tell the truth about silver and platinum group metals?

Mallo, do you and the BIS have that much contempt for EVERYONE?

Mallo – instead of LYING TO ME – you should simply have not responded. You have erred.

When I feel that an institution like the BIS is intentionally LYING and DECEIVING – I’m sorry, I have no choice but to report on this.

Screw you, the BIS and your collective hubris!

Best regards,

Rob Kirby

Conclusions:

Precious metals prices have been suppressed – as a matter of a closely coordinated Central Bernaking “edict” by a group of lying, ruthless elites who fancy themselves as “better and more important than all of us”. These elites have captured and control governments. At times, they ‘slip up’ and make mistakes – due to their arrogance and hubris – and they forget or pay little attention to details like the gold / silver price ratio at 49: 1 when the amount of derivatives outstanding for the same are more reflective of 8: 1 – exposing the fact that silver is likely the most mis-priced asset on the planet. When this is pointed out, the establishment stonewalls if they can, lies if they must or ignores such critique altogether.

The gold / silver ratio [at the time of writing has narrowed to 42:1] IS GOING BACK TO WHERE IT BELONGS – somewhere around [give or take] 10: 1. When this happens it will mark nothing more than a reversion to an historic mean. Note how there is no assignment of nominal price – expressed in dollars – to silver. Over the course of human history, fiat currencies have come and gone BUT for the biggest chunk of human history – true wealth has been measured in ounces of gold and silver. Historical axioms dictate that this is likely to repeat.

The ONLY reason why gold leasing data was hidden by the Central Bernanking Complex in the first place - is for the reason that LEASED GOLD is “by definition” SOLD into the bullion market to suppress its price.

This is why the Central Bernanking Complex – in light of their unlimited power to print failing fiat currencies – LIES about and conceals data regarding how much of the “go to” precious metals alternatives are being DUMPED into the market via the leasing mechanism - to suppress its price.

Additional contents of the “just released” formerly secret minutes of the 1997 G-10 meeting – particularly those of the United Kingdom’s Smeeton, as they relate to Maastricht Treaty Guidelines / Euro qualification – go a long way to affirming much of the material presented in another recent paper [subscriber only] titled, Fine Italian Dining, posted at kirbyanalytics.com.

Like it or not, we are ALL engaged in what outspoken commentator Alex Jones refers to so often as an “Info War”. Lies and deception on the part of officialdom - concerning what money is - run deep. It is these lies and deceptions on the part of the Global Banking System – which holds NO ALLEGIANCE to ANY NATION - that are the root cause of most of the world’s most pressing issues. Humanity needs to “come to grips” with this and get the information out.

None of this should come as a surprise to any of us. Remember folks, it was none other than former Federal Reserve Vice Chairman Alan Blinder – while appearing on the Nightly Business Report back in 1994 – issued these prescient words,

“the last duty of a central banker is to tell the public the truth”

Knowledge is power.

Physical precious metals are real money.

How aware are you and how many ounces do you possess?

Amen.

Subscribe here.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.