Federal Stimulus Should Keep Stock Market Bulls Happy

Stock-Markets / Stock Markets 2011 Feb 22, 2011 - 05:48 AM GMTBy: Money_Morning

Jon D. Markman writes:

Stocks rose fitfully last week in a typically strange, exciting, exasperating options-expiration week. The Dow Jones Industrial Average, Standard & Poor's 500 Index and the Nasdaq Composite Index all ended roughly 1% higher, while the Russell 2000 small-caps rose 1.5%

Jon D. Markman writes:

Stocks rose fitfully last week in a typically strange, exciting, exasperating options-expiration week. The Dow Jones Industrial Average, Standard & Poor's 500 Index and the Nasdaq Composite Index all ended roughly 1% higher, while the Russell 2000 small-caps rose 1.5%

Treasurys enjoyed their firmest session of the past month in part due to an unexpected rise in unemployment claims. Bonds love misery because it suggests that inflation -- their arch enemy -- will remain under control. Inflation will be a problem as long as home prices retreat, jobs are scarce and wage hikes are a far-off dream.

But most importantly: U.S. President Barack Obama's new fiscal 2012 budget was sent to Congress.

Here's my quick take: Expect more deficits, and false promises to erase them.

The government is betting on rising economic growth to produce the taxes necessary to pay for this stimulus plus interest payments, and so far they are right. Tax receipts are rising despite the extension of the Bush-era cuts and the new depreciation allowance. So is employment. I would not be shocked to see February employment log a 200,000 job gain when reported March 4, and one hedge fund research director who I respect told me privately that we could see a 500,000-job surge, in part due to the way adjustments are being made to the counting method.

More jobs equal more tax revenue, which means the deficit shrinks. It's simple math. So I would caution you not to become overly pessimistic about the deficits. If you look back over the course of U.S. history, every generation since the War of Independence has felt as if the government was overspending and disaster loomed.

So far we have managed to muddle through. Capitalism is funny that way; it contains both the seeds of its own destruction (2007-2008) and rebirth (2010-present).

Bottom line: More fiscal stimulus is on the way, which will combine with the U.S. Federal Reserve's monetary stimulus to keep a fire simmering under this two-year bull cycle. Say what you want as a citizen, but that's good news for investors.

Big Caps Coming Back

Some new merger deals in the satellite and energy industries on Monday ignited much of the past week's positive vibes, and one of the strongest advances among large companies was ExxonMobil Corporation(NYSE: XOM), up 15% this month.

Now I know I have said this before, but I cannot emphasize it enough: The rally in ExxonMobil is very important. It has not received much attention from financial television news anchors because it cannot compete with Egypt and rising food prices. But it is significant that the largest company in the market-weighted S&P 500 Index has been rising by increments of 2% a day and is now within a hair's breadth of its all-time closing high.

With one more $2.50 advance, XOM will exceed its prior monthly closing high, which occurred in December 2007; with a move $5 higher it will reach its all-time intra-month high set in May 2008. If XOM can exceed these levels and move to all-time high territory, you will be surprised at how explosively it could move higher.

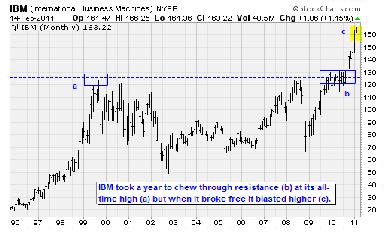

New highs are incredibly powerful when it comes to lightening the gravity field around a stock. With no natural sellers around, it has an opportunity to levitate briskly, like a helium-filled balloon. For recent examples, I showed youUnited TechnologiesCorporation (NYSE: UTX) recently. Two other examples are the third-largest company in the S&P 500,International Business Machines Corp. (NYSE: IBM), and the second largest, Apple Inc.(Nadaq: AAPL).

I'm not trying to be overly optimistic here. I'm just letting you know that the calm and unimpeded advance of leaders like ExxonMobil, IBM, Apple, United Technologies and now General Electric Company (NYSE: GE) is probably laying the groundwork for a return of the entire big-cap index to its prior high sooner than most expect. Be prepared.

Reaching New Heights

It was nice to have a wide spectrum of our recommended positions show up on the new highs list, this week, including subsea drilling engineerOceaneeringInternational (NYSE: OII), +3%; chip makerCavium NetworksInc. (Nasdaq: CAVM), +2.7%; oil reservoir specialistCore Laboratories N.V.(NYSE: CLB), (see chart); and aerospace parts makerTransdigmGroup Incorporated (NYSE: TDG).

We've been talking about the value of the new high list for some time, as this is where gravity is the thinnest. With no overhang of sellers, stocks in motion have a tendency to just keep going as new investors arrive to get in on the action.

Does a new high worry you? It shouldn't.

New highs often are a sign of bubble behavior when the economics of the companies involved becomes disengaged from their value, but that is not the case now. Most tech and energy companies on my recommend lists are either cheap or on the low side of fairly valued, and should continue to see their P/E multiples expand along with their fundamental growth.

Core Labs, one of our StrataGem positions this month, is a good example. It is a $4.5 billion mid-cap growing at around 21% a year and sports a fantastic return on equity of 51%. It has surprised with upside in each of the past five quarters. And yet its forward price/earnings multiple is only 22. That's not dirt cheap, but by no means is it expensive. Just to be glib for a moment, it's like an $11 hamburger at a fine restaurant: more spendy than a Big Mac, sure, but it's made with prime meat and served on a brioche bun with homemade ketchup. It's a reasonable price.

In for a Dollar

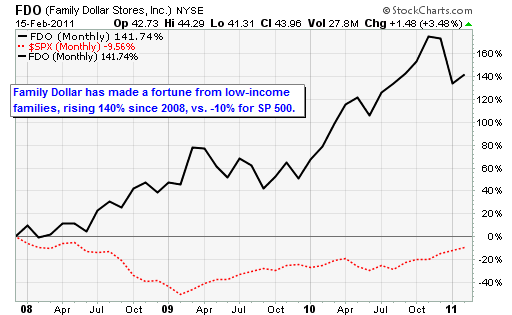

Trian, the investment group headed by Nelson Peltz, made an offer to buy discount store chain Family Dollar Stores Inc. (NYSE: FDO) for $55 to $60 per share, or around $7 billion. That pushed the value of our shares up 26% in after-hours trading. Gotta love it.

Peltz, who has made a career of similar raids on consumer companies, dialed the chairman of FDO, Howard Levine, and told him that he owned 8% of the shares and was gunning for the rest. The financier offered Levine, who is son of the chain's founder, a chance to participate in the buyout.

This was a nice surprise. FDO entered our portfolio in April last year. I put it on the buy list in part because it's just one of those quirky little companies you can't help but admire. FDO was one of the few stocks to rise in 2008 when everything else collapsed. It flat-lined in 2009 when everything else exploded higher, then resumed its advance with a 60% gain in 2010. Family Dollar specializes in super-low prices in 6,800 convenient, small strip-mall locations, catering to customers with annual incomes of less than $40,000; a quarter make less than $20,000.

Shares peaked over $50 this year, then slipped after one weak report. And the fact that Peltz swooped in at this point should make bears pause about shorting a decent company whose shares are a little down.

So what's the message of this move? This kind of raid by Peltz is the reason the market has been so buoyant. It has been a poisonous environment for bears. You do not want to be short in technically weak stocks like FDO when buyout money is easy to borrow because on any given day your carefully thought-out idea could blow up to the tune of 25% in ten seconds. It's too painful to contemplate. So a sharp advance like this from nowhere is part of an electric fence emerging around the market's weaker stocks warning bears to stay away.

In a Better Mood

It was great to meet many readers at the Money Show in Orlando last week and have a chance to discuss my fund and stock recommendations with you. The show attracted about 50% more visitors this year than last, and I witnessed a little more optimism than I have seen in a few years.

Still, I would not characterize the mood as overly bullish -- not the in slightest. I have been speaking at these shows for more than a decade, so I know what a frothy, hyped-up, super-bullish crowd looks and sounds like. And this was not it. People were hopeful, but still worried. I heard a lot of questions about when the next correction was coming.

I also heard a lot of concern about politics, monetary policy, the impact of QE2, and high unemployment. And people wanted to know why wasn't I more worried about China, inflation, deflation, Europe, deficits, Obama or the new Congress.

When the mood is super-crazy positive, no one sees these negatives. They all just disappear, and everyone becomes an expert in fiber optics, or oilfield services, or teen retailers, or whatever the flavor of the month is. Extreme optimism vacuums up all worries and deposits them in a little dust bag in the corner. So this was not a show that suggested to me that greed is running wild.

And yet we do have to wonder what happened to the correction that every sensible investor has had a right to expect this quarter. Or at least a pause long enough to allow us to put more money to work.

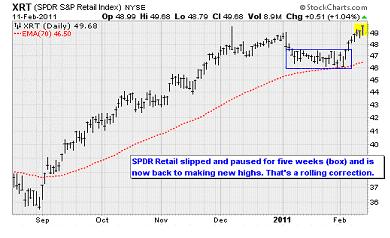

My suspicion is that instead of a single, broad, lengthy correction, the market gods have determined the way to really get people off balance would be miniature rolling corrections of individual sectors. One at a time, so you barely notice.

In short, the corrections are occurring but they have been hidden by strength in other areas. For example, look atSPDR S&P Retail(NYSE: XRT), above. It slipped at the start of the year and then paused for five weeks. I recommended buying XRT in mid-January, near the end of the correction, then suggested that subscribers add again in early February.

Now the transportation stocks -- airlines, railroads, truckers, shipping services and freight forwarders -- are just about to complete the same arc. They slipped into a correction in mid-January, just long enough for the Dow Theory people to say they were not conforming to the advance of the industrials. Then bang, they have advanced strongly the past three days and are all set to make new highs. The truckers have been particularly beaten down in recent months and look poised to rebound.

In summary, these mini-corrections are relieving the overbought quality of the broad uptrend. So long as this pattern of behavior continues, and the S&P 500 remains above 1,300, the bears will continue to be frustrated.

Hungry for Freedom, or Just Hungry?

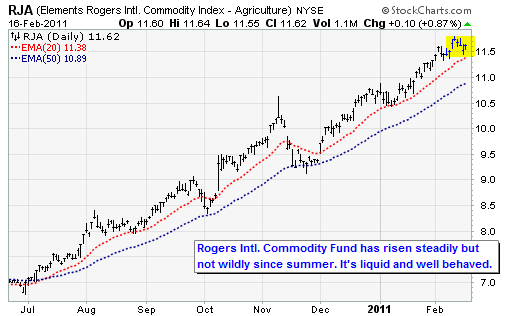

We have not talked much about the advance in agricultural products lately because, well, I don't think it's wise to try to be an expert in everything. But now the rise in the prices of wheat and corn, not to mention cotton, soybeans and coffee, is becoming impossible to ignore. It's more than a crops story. It's a political and economics story.

Evidence is growing that lack of food, as well as the high prices of staples, has been a primary driver of the street revolutions in North Africa and the Gulf. Something like 40% of Egyptians survive on less than $2 per day, according to reports. Analysts observe that the price of unsubsidized bread rose by a factor of 10 in 2008, and the cost of rice doubled in a single week earlier this year. Meanwhile the national minimum wage has remained virtually unchanged since 1984, at 115 Egyptian pounds per month. The per-capital income in Egypt is the equivalent of $1,800, which doesn't buy much when prices are rising.

Most Egyptians are receiving food assistance from the government, yet people are starving. Elsewhere in the region, many of Egypt's neighbors are classified as "heavily indebted poor countries," or HIPC, by the International Monetary Fund. This is not a religious issue; it is partially the fault of kleptocratic ruling families and centrally planned economies that do not provide for their people.

I would expect a lot of leaders in the region to take the hint and start buying wheat and corn on the open market. Better to feed the people than to see them revolt. And yet the wacky weather worldwide this year -- in Russia, Australia, Brazil, Argentina, the United States and China -- has tightened grain supplies.

When you add this incremental demand on top of the supply/demand imbalance, you can see a perfect storm brewing. The world is just one hot summer away from a terrible harvest and a bushel of trouble. This is why the farm futures and stocks are outperforming over the past six months, and quite possibly the rest of the year.

The Week Ahead

Monday, Feb. 21: National and market holiday. No economics or earnings releases.

Tuesday, Feb. 22: Case Shiller Home Price Index; consumer confidence. Earnings: Ameren Corporation (NYSE:AEE), A.H. Belo Corporation (NYSE: AHC) Atlas Pipeline Partners L.P. (NYSE: APL), Expeditors International of Washington (Nasdaq: EXPD), Forest Oil Corporation (NYSE: FST), Genuine Parts Company (NYSE: GPC), The Home Depot Inc. (NYSE: HD), Hormel Foods Corporation (NYSE: HRL), Macy's Inc. (NYSE: M) Medtronic Inc. (NYSE: MDT), Medco Health Solutions Inc. (NYSE: MHS), NRG Energy Inc. (NYSE: NRG), Cabot Oil & Gas Corporation (NYSE: COG); Chesapeake Energy Corporation (NYSE: CHK), Hewlett Packard Company (NYSE: HPQ), ITC Holdings Corp. (NYSE: ITC); RadioShack Corporation (NYSE:RSH)

Wednesday, Feb. 23: MBA Mortgage Purchase Applications; ICSC Goldman Chain Store; Redbook Chain Sales; Existing Home Sales; API Crude Inventories. Earnings: American Tower Corporation (NYSE: AMT), Denbury Resources Inc. (NYSE: DNR), Frontier Communications Corp. (NYSE: FTR), Federal-Mogul Corporation (Nasdaq: FDML), Garmin Ltd. (Nasdaq: GRMN), Toll Brothers Inc. (NYSE: TOL), The TJX Companies Inc. (NYSE: TJX), Yamana Gold Inc. (USA) (NYSE: AUY), DryShips Inc. (Nasdaq: DRYS), Flowserve Corporation (NYSE: FLS), Continental Resources, Inc. (NYSE: CLR), Jack in the Box Inc. (Nasdaq: JACK), Limited Brands, Inc. (NYSE: LTD), priceline.com Incorporated (Nasdaq: PCLN), Whiting Petroleum Corporation (NYSE: WLL).

Thursday, Feb. 24: Initial jobless claims; durable orders; Bloomberg Consumer Comfort; New Home Sales; FHFA Home Price Index; EIA Natural Gas Inventories; DOE Crude Inventories. Earnings: CMS Energy Corporation (NYSE: CMS), DISH Network Corp. (Nasdaq: DISH), El Paso Corporation (NYSE: EP), Foster Wheeler AG (Nasdaq: FWLT), KBR Inc. (NYSE: KBR), Kohl's Corporation (NYSE: KSS), Newmont Mining Corporation (NYSE: NEM), Mylan Inc. (Nasdaq: MYL), Patterson Companies, Inc. (Nasdaq: PDCO), Sears Holdings Corporation (Nasdaq: SHLD); Safeway Inc. (NYSE: SWY), Target Corporation (NYSE: TGT), Autodesk, Inc. (Nasdaq: ADSK), American International Group, Inc. (NYSE: AIG), Applied Materials, Inc. (Nasdaq: AMAT), salesforce.com, inc. (NYSE: CRM), First Solar, Inc. (Nasdaq: FSLR), The Gap, Inc. (NYSE: GPS), Alleghany Corporation (NYSE: Y).

Friday, Feb. 26: Q4 GDP (first revision); Michigan Consumer Sentiment. Earnings: Interpublic Group of Companies, Inc. (NYSE: IPG), Pepco Holdings, Inc. (NYSE: POM), Rowan Companies, Inc. (NYSE: RDC), Berkshire Hathaway Inc. (NYSE: BRK.A), Leucadia National Corp. (NYSE: LUK) Public Storage (NYSE: PSA).

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2011/02/21/federal-stimulus-should-keep-stock-market-bulls-happy/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.