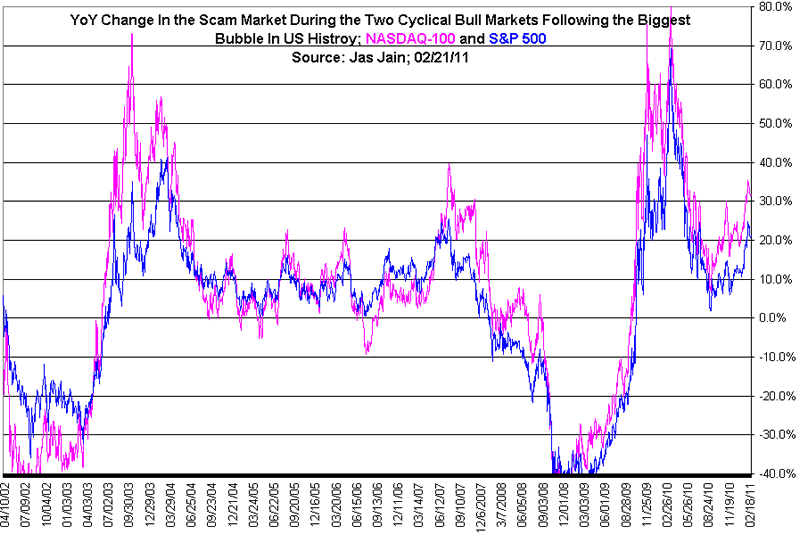

Picture of the Two Latest Cyclical Stocks Bull Markets and Where the Current One is Headed

Stock-Markets / Stock Markets 2011 Feb 22, 2011 - 02:27 AM GMTBy: Jas_Jain

The US "stock market" is but a reflection of the US econo-political system firmly in control of the corporate crooks that put the top powers (Presidency and the Chairmanship of the Federal Reserve) in hands of those who would not shy from policies that result in evil economic and financial deeds. No other nation is the cause of America's economic problems. They are all homemade. The reason Americans are angry and anxious about the future is that evildoers, driven by desperation, have led the US economy and there is no change in sight. Obama was lying when he promised change.

The US "stock market" is but a reflection of the US econo-political system firmly in control of the corporate crooks that put the top powers (Presidency and the Chairmanship of the Federal Reserve) in hands of those who would not shy from policies that result in evil economic and financial deeds. No other nation is the cause of America's economic problems. They are all homemade. The reason Americans are angry and anxious about the future is that evildoers, driven by desperation, have led the US economy and there is no change in sight. Obama was lying when he promised change.

One cannot forecast the future of the US economy and, hence the "stock market," without references to the evildoers in-charge! An evildoer is what an evildoer does. The deal Obama made, with equally unprincipled Republicans, in December of 2010 was an evil deed. I had identified Greenspan, GW Bush and Bernanke evildoers before the crisis of 2007-08! A large dose of brainwashing of the population is necessary to tolerate and support, via voting, the evildoers. Such, regrettably, is the state of affairs, as it has existed in The United States of America in recent years. We must come to terms with the reality as it exists and not as one would wish, or as per the theory.

Above is a graph of the current cyclical bull market and the one during 2003-07 that followed the bursting of the biggest bubble. The only drivers of these two bull markets are irresponsible monetary and fiscal polices compounded by horrendous enforcement and oversight. The underlying motivation for the irresponsible polices lay in the quest for holding on to the power, at a huge cost in the future, first by evildoers Greenspan and GW Bush and now by evildoers Bernanke and Obama. What makes these four men evildoers is that they would do anything to keep the power at the detriment of the nation and the vast majority of the population, in the future, of course. When that future arrives these evildoers plan to blame someone else, or claim that no one could have known the outcome. Also, rewarding irresponsible bankers and financiers, if not outright crooks, under any pretext is evil. Hack, Greenspan and Bernanke were their biggest enablers. That alone secures them the label of evildoers. Bernanke, in particular, is a case of a born-and-bred evildoer because he was schooled in the art of evil schemes of financial manipulation primarily for the benefits of the banking and finance crooks and at the expense of the working class, as the outcomes of his policies would prove in the coming years.

Now that we have outlined the underlying dynamics of the econo-political system that has been driving the Scam Market (a turn from the stock market to the Scam Market in 1995), what does the experience of the last 12 years instruct us in terms of the longevity of the current cyclical bull market? Faster they rise shorter they last and harder they fall. One can easily see from the attached graph that the current market has risen faster despite a relatively weak economy and employment, supported wholly by desire to get the economy ready for the 2012 selection (not an election, because the Presidential candidates must be first selected by the economic elite, mostly crooks). If evildoer Obama loses so would evildoer Bernanke because a new President is highly unlikely to reappoint Bernanke. In their desperation (yes, evildoers are unusually desperate men) evildoers Bernanke and Obama have been running the loosest monetary and fiscal policies in history. It is highly unlikely that they can continue it in 2012 because that could cast doubts on the recovery and a sharp reaction in the markets.

The Scam Market would start pricing in the end of the loose policies, the fuel that has fired it, especially, over the past six months. The current cyclical bull market would not last for three years and we shall soon find out if it would last for two full years (the last one lasted for approximately 4.5 years). Some time during 2012-13 we should witness a decline of more than 40%, including a probable new low, once the current market has topped. This would once again confirm my thesis that the economy has been, and continues to be, manipulated by evildoers with political power and is in a secular decline that needs bigger and bigger artificial boost via borrow-and-spend.

The cyclical bear market that began in 2000 has a long ways to go and we would only know after fact as to how many cyclical bull markets it would contain.

By Jas Jain , Ph.D.

the Prophet of Doom and Gloom

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.