Gold and Silver Prices Strengthen as the US Dollar Weakens

Commodities / Gold and Silver 2011 Feb 21, 2011 - 03:09 AM GMTBy: Bob_Kirtley

We kick off with a quick look at the chart for gold and as we can see both the 50dma and the 200dma are moving up nicely in support of gold prices. The recent correction could have taken gold to have tea with the 200dma, however, strong buying came in and pushed the price through resistance in preparation for the next leg up. The technical indicators, the RSI and the STO, are on the high side suggesting that a breather could be on the cards, but don't count on it, indicators can remain distant from the ‘norm’ for extended periods of time.

We kick off with a quick look at the chart for gold and as we can see both the 50dma and the 200dma are moving up nicely in support of gold prices. The recent correction could have taken gold to have tea with the 200dma, however, strong buying came in and pushed the price through resistance in preparation for the next leg up. The technical indicators, the RSI and the STO, are on the high side suggesting that a breather could be on the cards, but don't count on it, indicators can remain distant from the ‘norm’ for extended periods of time.

By comparison the US Dollar is struggling to gain any sort of traction as two attempts by the USD to get above the 200dma since December have failed, along with the recent attempt to break out above the 50dma just recently. The RSI, MACD and the STO have struggled to rally and are now heading south which does not bode well for the USD in the short term. Maybe it will make a stronger stand at much levels say around the ‘72′ level as there does not appear to be much in the way of support at the moment.

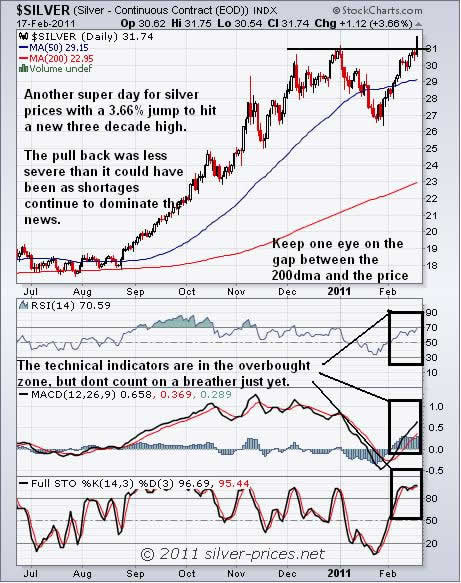

Friday was another super day for silver prices with a 3.66% jump to hit a new three decade high. The pull back was less severe than it could have been as shortages continue to dominate the news. The technical indicators are in the overbought zone with the RSI just above the ‘70′ level sitting at 70.59, however it can stay there when its in the mood. On the negative side watch the yawning gap that is developing between the 200dma and silver prices. The chart suggests that we could now be in for a breather but don’t count on a breather just yet as the physical market is struggling to meet demand.

In a piece found on Jesse’s Cafe American relating to an original article carried by the Financial Times we have the following snippet regarding silver prices:

The short squeeze in silver is fairly remarkable and obvious to all but the most pig-headed or willfully misdirecting. Looking at the Comex warehouse, SUPPLY is consistently and smoothly decreasing even while PRICES are increasing sharply.

Silver does appear to have hit a bit of a ‘high note’ here perhaps, and has once again come far and fast. A consolidation or a pullback might not be unexpected, depending on what US equities might do. For now many things are riding on the dollar liquidity bubble, including those who are merely fleeing it and seeking safer stores of wealth, particularly in Asia. Silver is outperforming gold as demonstrated by the decreasing gold to silver price ratio, no doubt influenced by the fact that the central bankers have access to gold in their national treasuries, but few have any silver. Silver is in a short squeeze, and so volatility and upside surprises are to be expected.

All it needs now is for you to ensure that you are positioned in this market via a holding of the physical metal, the gold and silver producers or a few long dated call options.

Have a sparkling week and thank you for your attention.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.