Mutual Fund Investors Are Piling Into the Stock Market

Stock-Markets / Stock Markets 2011 Feb 19, 2011 - 06:13 AM GMT Gallup Finds U.S. Unemployment Up to 10.0% in Mid-February

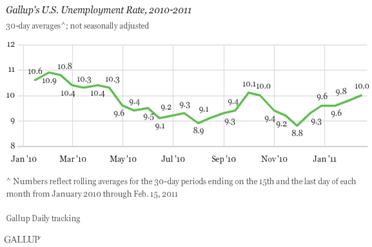

Gallup Finds U.S. Unemployment Up to 10.0% in Mid-February

Underemployment surged to 19.6% in mid-February from 18.9% at the end of January

PRINCETON, NJ -- Unemployment, as measured by Gallup without seasonal adjustment, hit 10.0% in mid-February -- up from 9.8% at the end of January.

PRINCETON, NJ -- Unemployment, as measured by Gallup without seasonal adjustment, hit 10.0% in mid-February -- up from 9.8% at the end of January.

In 2011, Non-farm Payrolls Have To Grow By 121,000 Per Month Just To Keep Up With Population Growth

(ZeroHedge) Until now, in our Non Farm Payroll growth forecasts, Zero Hedge had been using 90,000 as the number of monthly jobs the US should be creating each month just to keep up with population growth. However, per the CBO budget released in January, it may be time to revise this estimate. As the chart below shows, according to the traditionally optimistic Congressional Budget Office, the US has to create 121,000 jobs per month in 2011 just to keep pace with population growth.

Mutual fund investors are piling into the market.

-- The Investment Company Institute has reported $4.921 billion of inflows to domestic equity funds last week. This brings the total inflows of money to domestic stock funds to a record $12.421 billion year-to-date. Retail investors seem to believe never-ending flow of liquidity into the stock market via the Permanent Open Market Operations will keep the wind at their backs.

-- The Investment Company Institute has reported $4.921 billion of inflows to domestic equity funds last week. This brings the total inflows of money to domestic stock funds to a record $12.421 billion year-to-date. Retail investors seem to believe never-ending flow of liquidity into the stock market via the Permanent Open Market Operations will keep the wind at their backs.

ECB May Need to Raise Rates.

--Treasuries fell after a European Central Bank official said it may need to raise interest rates as global inflation pressures mount while the Federal Reserve maintains its target of almost-zero short-term rates. Thirty-year bond yields rose four basis points to 4.7 percent. German bonds slumped, with the two-year German yield, typically most sensitive to rate expectations, climbing as much as nine basis points.

--Treasuries fell after a European Central Bank official said it may need to raise interest rates as global inflation pressures mount while the Federal Reserve maintains its target of almost-zero short-term rates. Thirty-year bond yields rose four basis points to 4.7 percent. German bonds slumped, with the two-year German yield, typically most sensitive to rate expectations, climbing as much as nine basis points.

Gold is wavering at a minor high, Silver at Highest Point in 31 Years.

--Silver futures climbed to their highest level in about 31 years Friday, poised for a weekly gain on bets that industrial and investment demand for the metal will remain strong, as prices for gold climbed as much $7 an ounce on growing tensions in the Middle East. Gold prices rallied toward $1,400, ready to end the week higher as investors sought a safer bet in the wake of intensifying violence among demonstrators and security forces in Bahrain and amid reports that Egypt has agreed to allow the passage of Iranian naval ships through the Suez Canal.

--Silver futures climbed to their highest level in about 31 years Friday, poised for a weekly gain on bets that industrial and investment demand for the metal will remain strong, as prices for gold climbed as much $7 an ounce on growing tensions in the Middle East. Gold prices rallied toward $1,400, ready to end the week higher as investors sought a safer bet in the wake of intensifying violence among demonstrators and security forces in Bahrain and amid reports that Egypt has agreed to allow the passage of Iranian naval ships through the Suez Canal.

Japan Nikkei and Topix may have Outpaced Fundamentals.

--Japan’s Topix index fell for the first time in 10 days on speculation stocks’ gains have outpaced prospects for earnings and concern a rebellion among lawmakers will derail plans to cut corporate tax rates. The Topix index slid 0.1 percent to 973.60 with about eight stocks retreating for every six that gained at the close in Tokyo. The Nikkei 225 Stock Average gained 0.1 percent to 10,842.80 after declining as much as 0.2 percent. For the week, the Nikkei rose 2.2 percent while the Topix climbed 2.9 percent.

--Japan’s Topix index fell for the first time in 10 days on speculation stocks’ gains have outpaced prospects for earnings and concern a rebellion among lawmakers will derail plans to cut corporate tax rates. The Topix index slid 0.1 percent to 973.60 with about eight stocks retreating for every six that gained at the close in Tokyo. The Nikkei 225 Stock Average gained 0.1 percent to 10,842.80 after declining as much as 0.2 percent. For the week, the Nikkei rose 2.2 percent while the Topix climbed 2.9 percent.

China Stocks fall as Banks Increase Reserve Ratios.

-- China stocks fell for the first time in seven days, dragging the benchmark index from a two-month high, on concern monetary tightening will hurt growth after a leading economic index dropped for the first time since 2008. Reserve ratios will increase half a percentage point starting Feb. 24, the People’s Bank of China said on its website today, after the close. The central bank’s order will lock up about 360 billion yuan ($55 billion), Barclays Capital said.

-- China stocks fell for the first time in seven days, dragging the benchmark index from a two-month high, on concern monetary tightening will hurt growth after a leading economic index dropped for the first time since 2008. Reserve ratios will increase half a percentage point starting Feb. 24, the People’s Bank of China said on its website today, after the close. The central bank’s order will lock up about 360 billion yuan ($55 billion), Barclays Capital said.

The Dollar Gives Back Some Gains.

-- The dollar extended losses against major currencies on Friday, most notably versus the Swiss franc, as Iran seemed closer to send warships past Israel’s shores for the first time in more than three decades.

-- The dollar extended losses against major currencies on Friday, most notably versus the Swiss franc, as Iran seemed closer to send warships past Israel’s shores for the first time in more than three decades.

The greenback turned lower against the euro after reports that European Central Bank board member Lorenzo Bini Smaghi warned the bank may have to raise interest rates as global inflation pressures mounted.

Why Home Prices Are Falling Beyond Bubble Capitals

-- There was a time when the housing collapse narrative described a handful of way overinflated markets pulling down all home prices somewhat, but those particular locations felt most of the pain. That's no longer quite right: home prices have declined in cities beyond Florida, California, Nevada, and Arizona. Recently, other locations have begun seeing bigger home value drops than the usual suspects. What's changed?

-- There was a time when the housing collapse narrative described a handful of way overinflated markets pulling down all home prices somewhat, but those particular locations felt most of the pain. That's no longer quite right: home prices have declined in cities beyond Florida, California, Nevada, and Arizona. Recently, other locations have begun seeing bigger home value drops than the usual suspects. What's changed?

Gasoline Prices at a Yearly High.

--The Energy Information Agency weekly report states, “The U.S. average retail price of regular gasoline advanced eight-tenths of a cent versus last week to $3.14 per gallon, $0.53 per gallon higher than last year at this time. Prices on the West Coast gained close to a nickel, the biggest increase of any major region in the country. Prices in the Rocky Mountains and on the Gulf Coast climbed almost three cents over last week. Moving in the other direction, the Midwest gasoline price fell about three and a half cents.”

--The Energy Information Agency weekly report states, “The U.S. average retail price of regular gasoline advanced eight-tenths of a cent versus last week to $3.14 per gallon, $0.53 per gallon higher than last year at this time. Prices on the West Coast gained close to a nickel, the biggest increase of any major region in the country. Prices in the Rocky Mountains and on the Gulf Coast climbed almost three cents over last week. Moving in the other direction, the Midwest gasoline price fell about three and a half cents.”

Natural Gas Demand Fell Precipitously.

-- The U.S. Energy Information Administration reports, “As the extreme cold left much of the lower 48 States this week, natural gas demand for space heating and as a fuel for electric power plants fell precipitously. Compared with the prior report week, U.S. natural gas average daily consumption decreased about 17.1 percent…Prices declined most severely in the Northeast, where reduced consumption allowed pipelines to lift constraints.”

-- The U.S. Energy Information Administration reports, “As the extreme cold left much of the lower 48 States this week, natural gas demand for space heating and as a fuel for electric power plants fell precipitously. Compared with the prior report week, U.S. natural gas average daily consumption decreased about 17.1 percent…Prices declined most severely in the Northeast, where reduced consumption allowed pipelines to lift constraints.”

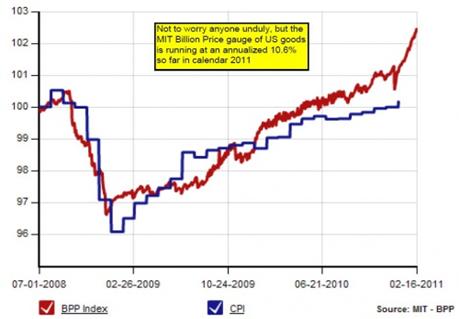

US 2011 Inflation: 10.6%?

(ZeroHedge) We thank Sean Corrigan of Diapason Securities for bringing our attention to the MIT Billion Price real time inflation Index (first reported here) who points out that based on the ongoing surge in prices, which have increased by 1.25% in the last 45 days (December 31, 2010: 101.085, February 14, 2011: 102.353), a simple annualization indicates a 10.6% increase in prices in 2011!

(ZeroHedge) We thank Sean Corrigan of Diapason Securities for bringing our attention to the MIT Billion Price real time inflation Index (first reported here) who points out that based on the ongoing surge in prices, which have increased by 1.25% in the last 45 days (December 31, 2010: 101.085, February 14, 2011: 102.353), a simple annualization indicates a 10.6% increase in prices in 2011!

Big day at the WSJ & Other ‘tin hats’

(ZeroHedge) Mark your calendar. 2/18/2011 might well be a day where history takes a turn. Something that I have been waiting for weeks has finally happened. The Wall Street Journal has written an editorial that is critical of the Fed and its reckless monetary policies.

To be sure this editorial is mild in its language. But when the Journal says things like this it is time to take notice:

Once again the Fed seems to have worried about deflation long after the threat had passed and even as price pressures from its easier policy were preparing to build. Let's hope it turns out better than it did the last time.

Themis Trading On The SEC's Flash Crash (Non) Report

(ZeroHedge) The report is out. Click here to read the 14 page report. The Joint CFTC/SEC committee makes 14 recommendations which they intend to focus on to ensure the integrity of our connected market place. We would like to highlight the 3 recommendations that we think are “news” today, and that we have particularly expressed concern about over recent years: Recommendations 10, 11, and 12, which deal with order cancellation fees, internalization, and trade-at rules.

Missing in the report, however, is any discussion of proprietary exchange data feeds, the proliferation of exchanges, or minimum order life.

One Step Closer To The End: MERS Corporate Secretary Demoted

(ZeroHedge) MERS is finished. A month after CEO and President R.K. Arnold was the first rat to jump the sinking fraudclosure enabling ship, the company's (and we use the term loosely - typically companies actually do stuff instead of just handing out $25 stamps) Corporate Secretary has Bill Hultman was just shown a purple slip, by being demoted to Senior Vice President. Although following earlier news that MERS is basically suspending its operations, we are surprised that anyone pretends there is even a business model behind the fraud. Per Bloomberg: "Merscorp Inc., operator of the electronic mortgage-registration system under criticism by consumer advocates amid a probe into lender foreclosure errors, replaced Bill Hultman as its corporate secretary."

Why Isn't Wall Street in Jail?

(RollingStone) Over drinks at a bar on a dreary, snowy night in Washington this past month, a former Senate investigator laughed as he polished off his beer.

"Everything's fucked up, and nobody goes to jail," he said. "That's your whole story right there. Hell, you don't even have to write the rest of it. Just write that."

I put down my notebook. "Just that?"

"That's right," he said, signaling to the waitress for the check. "Everything's fucked up, and nobody goes to jail. You can end the piece right there."

Nobody goes to jail. This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world's wealth — and nobody went to jail. Nobody, that is, except Bernie Madoff, a flamboyant and pathological celebrity con artist, whose victims happened to be other rich and famous people.

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.