Bernanke Says Two Speed Economic Recovery Requires Different Policies

Economics / Economic Recovery Feb 19, 2011 - 05:43 AM GMTBy: Asha_Bangalore

Chairman Bernanke's speech was drawn from his paper examining the nature of international capital flows prior to the global financial meltdown. The analysis is long on detail and useful for policymakers and research. More importantly, Bernanke indicated that the two speed global economy calls for different policies.

Chairman Bernanke's speech was drawn from his paper examining the nature of international capital flows prior to the global financial meltdown. The analysis is long on detail and useful for policymakers and research. More importantly, Bernanke indicated that the two speed global economy calls for different policies.

"To achieve a more balanced international system over time, countries with excessive and unsustainable trade surpluses will need to allow their exchange rates to better reflect market fundamentals and increase their efforts to substitute domestic demand for exports. At the same time, countries with large, persistent trade deficits must find ways to increase national saving, including putting fiscal policies on a more sustainable trajectory. In addition, to bolster our individual and collective ability to manage and productively invest capital inflows, we must continue to increase the efficiency, transparency, and resiliency of our national financial systems and to strengthen financial regulation and oversight."

China and USA are the primary targets in this policy prescription, followed by regulators. The Chairman confined his remarks to the subject of global imbalances and did not offer insights about the near term course of monetary policy.

Additional Thoughts on the January 2011 Consumer Price Index

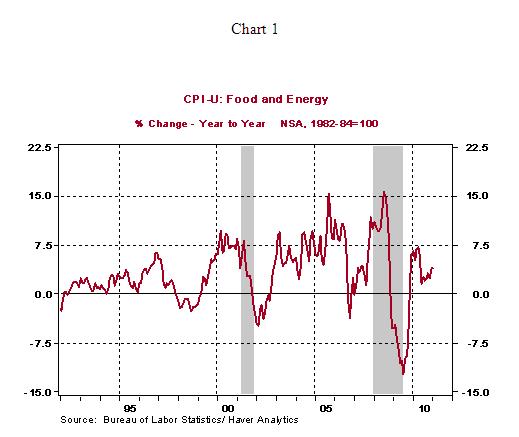

The Wall Street Journal article Split Economy Keeps Lid on Prices in today's paper comments on prices of goods and services and presents a case, as the title suggests, that benign gains of prices of services are the reason the overall Consumer Price Index (CPI) shows a rising but contained trend. We have no arguments about this analysis but would like to take it a step further and indicate that food and energy prices are the major culprits and not prices of all commodities. The price index of food and energy rose 4.02% from a year ago. Additional gains of these prices are possible and should not be surprising. Food and energy makes up roughly 23% of the CPI.

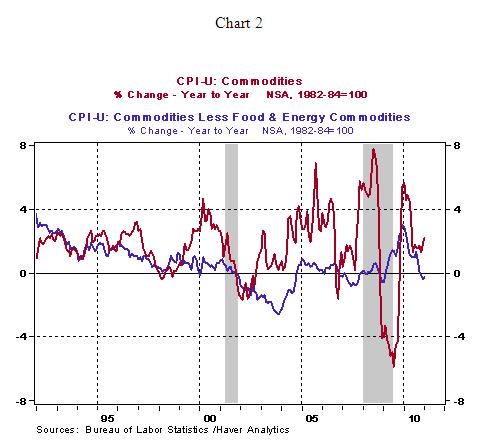

It should be noted that prices of all commodities are not moving up. Excluding food and energy commodities, the commodities price index fell 0.2% from a year ago (see Chart 2).

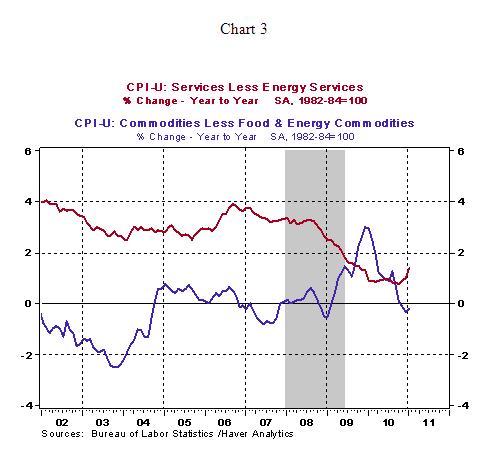

By contrast, cost of services excluding energy services (natural gas and electricity) increased 1.4% from a year ago (see Chart 3). This index has risen about 60 basis points from October but the commodities price index excluding food and energy has declined (see Chart 3). In sum, details of the CPI have more nuances to track than traditional categories.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.