Gold and Silver Sell Targets

Commodities /

Gold and Silver 2011

Feb 19, 2011 - 05:33 AM GMT

By: Ned_W_Schmidt

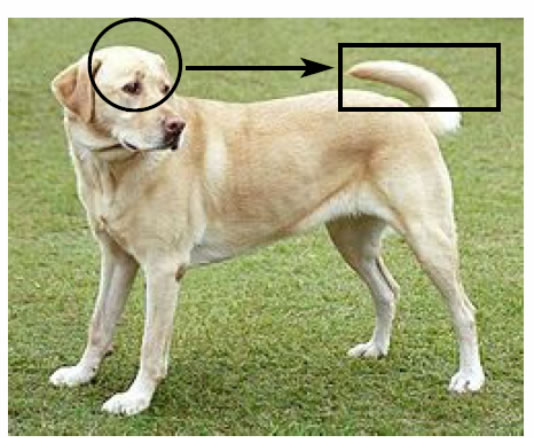

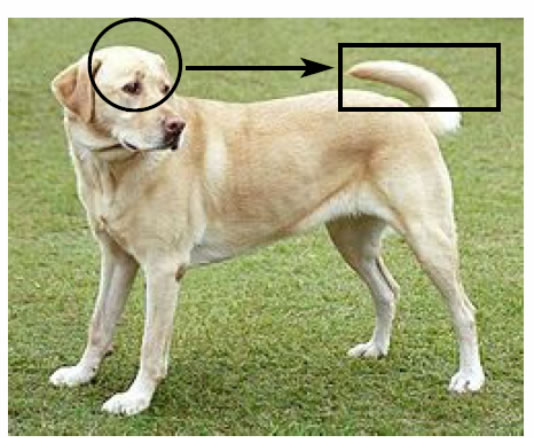

Below is a picture of a dog. In order to simplify this discussion in such a way those even Silver momentum traders might understand it, we have placed a circle around the approximate location of the dog's brain and a rectangle around the tail. At this point, we should all be together.

Below is a picture of a dog. In order to simplify this discussion in such a way those even Silver momentum traders might understand it, we have placed a circle around the approximate location of the dog's brain and a rectangle around the tail. At this point, we should all be together.

Control center for dog is the brain, see circle. An appendage named tail, see rectangle, is controlled by the dog's brain, see circle. Control mechanism runs, see arrow, in one direction, from circle to rectangle. It does not run other way. The tail does not wag the dog. Even though these times are widely claimed to be different, a bright man once reminded us that God, your choice, does not allow randomness to operate brain-tail function of a dog.

Silver coins were created to fill a void left by Gold coins. Imagine a world with only one issue of currency, a $1,390 bill. How well might that work at the local food store? What if one only needed a carton of milk? One would have to buy $1,390 worth of milk or pay $1,390 for one container of milk. Such a situation illustrates the utility of a Silver coin worth much less. It is the Gold coin, however, that gave the Silver coin both utility and value. Silver coins were the "poor man's coins". Gold in this case, the provider of utility and value, is the dog. Silver is the tail.

Spurred on by spurious stories of Silver shortages by Silver conspiracists, Silver moved above the most recent highs. While not yet sure if this is a breakout or a triple top, the Silver market, the tail, moved higher. After Silver added an irrational 3% in one day, Gold, the dog, followed the tail higher.

Above chart is of the approximate market prices for Silver futures(17 Feb) going from spot out to December of next year. As is fairly evident in that chart, the price pattern has a negative slope. Silver for delivery tomorrow is cheaper than Silver for delivery today. This set of price relationships is referred to as backwardation. It represents normal market conditions.

No shortage of supply is necessarily indicated by this price pattern. That today's price is higher than tomorrow's price might mean that demand is especially strong today or that supplies tomorrow will be more than adequate. It does not necessarily mean that shortage exists. Markets relationships show no indication of shortage tomorrow for Silver.

More important perhaps than this particular set of Silver pricing relationships might be how it got this shape. The Financial Times has been reporting( 9 February & 15 February) on the massive sales of Silver into forward markets by non primary Silver producers. Their estimate is that roughly 100mm ounces have been sold forward. Relative to estimates of the historical size of the Silver hedge book this would make today's forward sales at or near a record.

Given the wisdom of selling Silver production forward at current prices, we should reasonably expect that non primary Silver producers will continue forward sales. The Silver market seems willing to digest such sales today largely due to the mania level of speculative activity. How those holders of contracts for future delivery react in the coming year as that Silver is delivered is likely to be interesting. Are they ready for the trucks to back up and start unloading?

Our current summary of Gold and Silver valuation is provided in the above table. While valuations are indeed somewhat more alchemy than science, they do force a discipline onto the investment process lacking in many approaches. Further, over or under valuation does not say a market will rise or fall. However, over valuation has been regularly shown to be a precursor of market adjustments to prices when price is too far out of proper relation to fundamentals.

As is readily evident in that table, Silver is over valued and approaching price levels where a reduction in exposure might be warranted. In particular, given the relative valuations, a swap of Silver into either Gold, or possibly Rhodium, is probably appropriate. Naturally such a move should be in part dependent on the size of Silver holdings relative to an investor's total portfolio. Those over weighted in Silver are most at risk, and should begin shifting their portfolio.

In short, one question arises. Are you going to manage your precious metals, or is the dog's tail?

By Ned W Schmidt CFA, CEBS

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS as part of a joyous mission to save investors from the financial abyss of paper assets. He is publisher of The Value View Gold Report, monthly, and Trading Thoughts, about weekly. To receive these reports, go to www.valueviewgoldreport.com

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

ross

27 Feb 11, 02:56

|

comment

How can fair value be calculated using USD as a base? What is "fair value" of 1 USD

|

AdamSmith37

27 Feb 11, 16:26

|

The Decoupling of Silver and Gold Values

This article makes assumptions of historical relationships that largely no longer exist. Reversing the situation may shed light on what is actually happening. Placing silver into the dog's brain and gold into the tail would better reflect actual current events. The dog is somewhat confused since he is not used to having his tail in his head and vice versa. Silver consumption continues to increase thus reducing or even eliminating real supply. Gold consumption is virtually non-existent thus increasing real supply. To confound the analysis even further, one needs to realize the separation between "paper silver" and "real silver". As time goes forward, we may experience "real" shortages while "paper" supply appears adequate. The COMEX which allows one to purchase as much as one desires, but only allows one to take possession of however much they will allow you, underscores this relationship. Also, the ETF's which supposedly own large amounts but will not allow share owners to surrender their shares for actual "real silver" will have effectively quarantined "real silver" to the extent they actually have in storage, unless they too have acquired "paper silver" to any extent. With paper currency markets in the present state of flux, those who own "real silver" today are apparently not willing to sell at today's prices, thus the near term "real silver" shortage. As to the future, those who consume probably already have either locked up adequate supply or feel they will be able to acquire such later for equal or less cost, or are simply not in a position to do so at present. Backwardation is largely a reflection of "paper silver" which sooner or later may see the "chickens come home to roost" as more and more those with physical possession become reluctant to sell at real or perceived manipulated "paper" prices. Even though large deposits of silver ore remain to be mined, the cost to extract and run multi-year planning of such, needs to be accentuated by consistently average to above average sales of product that exceed anticipated ever increasing costs. For instance if you have an ore body that contains an estimated 30 billion ounces of silver, but it takes 200 years or more to mine such, then it will have negligible effect on today's price. In addition, geologically speaking, the bulk of silver is considered to have been contained within the earth's upper crust. Beyond that, only small amounts are extracted as by-products of other types of mining operations. Economically speaking, the cost of silver has little to do with end product usage per item. The elasticity of silver shows that each particular item or product or application that requires it, requires a very minuscule amount so that the end product pricing changes very little even if silver goes up astronomically in price. Except in the aggregate, the cost is easily passed on to end users and consumers on a per item basis. Gold on the other hand which is largely not consumed or used up, continues to accumulate in storage vaults or jewelry, but very little is actually removed from supply. While we may see intermittent ups and downs in the silver market due to the foregoing, ultimately it may again reach it's historical value of one ounce for an average day's wage. As inflation takes hold that could easily increase to several hundred dollars per ounce. What the overall markets are telling us is that we are witnessing a separation and/or reversal of the historical relationship between the value of silver and gold. Other base metals such as copper, zinc, lead, steel, etc., may replace silver's historical value with regards to currency value, while silver may take its own decoupled place of premium value according to actual supply and demand, perhaps eventually even exceeding or equaling that of gold, platinum, palladium, rhodium, etc.

|

Onc' Scrooge

28 Feb 11, 13:57

|

1 Silver Oz wage ?

Hi Ned, who has told you that a day's wage in history was about 1 ounce of silver ? This amount is only reached after 1900 in Europe when silver wasn't any more a money metal but a fiat money metal at a value of around 1:50 to gold coins. In the US 1 ounce silver wage / day was reached first in most regions in the civil war (but this were inflationary war wages) and after 1870 silver money was more or less fiat against gold with a silver - gold ratio from 1:30 to 1:60. So you have to go back before the demonitization of silver to times when silver had been real money - means before 1860. Some examples: - ancient Greece Drachme BC = 1 day wage = aprox. 4.5 gr fine silver (0.14 oz) - Augustanian roman Denar around 0 AC = 1 day wage = aprox. 4 gr fine silver = (0.13 oz) - Constantinean Argenteus aprox. 294 AC = 1 day wage = aprox. 3.4 gr fine silver (0.11 oz) - Carolingean Denar 800 AC = 1 day wage = aprox. 1.3 gr fine silver = (0.04 oz) - Middle Ages Gros/Groat = 1 day wage = aprox. 4 gr fine silver (0.13 oz) - 16th century Spanish real 3.4 gr = (0.11 oz) - 18th century French Livre = 4.5 gr fine silver (0.145 oz) - 19th century French Franc same as Livre before - 18th-19th century British Shilling around 5-6 gr (0.16 to 0.2 oz) - German day wages 1600 to 1850 3 to 6 gr fine silver (0.1 - 0.2 oz) - In America the wages are a little bit higher (more silver - less people) 178x = 10-12 gr fine silver (0.3-0.4 oz) 184x = around 1/2$/day but also kwown 1/4$/day with board So we have in normal times in average countries something in between 3 to 5 gr fine silver for a day's wage (.1 to 0.16 oz) - in critical times (war, desease, starvation ...) much less. So far to historical wages but I think if we try to find out how much silver or gold is in coming crisis a day's wage we have to declare: IT WILL BE OFFER AND DEMAND AGAIN !!! In the US 1876 it had been 14.60$ per capita in circulation in 1886 only 6.67$. In 169x France there has been 4.5 gr Gold and 85 gr silver per capita in circulation. How much will it be today ? I think not as much because there are not many people who hold PM's and they will not have great interest to give it in circulation all together in a given moment but slowly as they need it year after year. I think silver wages would start at around 1 gr a day or even less (0.01 oz / day ?). Cheers Onc' Scrooge

|

Below is a picture of a dog. In order to simplify this discussion in such a way those even Silver momentum traders might understand it, we have placed a circle around the approximate location of the dog's brain and a rectangle around the tail. At this point, we should all be together.

Below is a picture of a dog. In order to simplify this discussion in such a way those even Silver momentum traders might understand it, we have placed a circle around the approximate location of the dog's brain and a rectangle around the tail. At this point, we should all be together.