Global Systemic Crisis, World Geopolitical Breakup By End of 2011

Economics / Global Economy Feb 17, 2011 - 11:36 AM GMTBy: LEAP

With this issue our team is celebrating two important anniversaries in anticipation terms. Exactly five years ago, in February 2006, the GEAB N°2 suddenly encountered worldwide success by announcing the next "Triggering of a major global crisis" characterized especially by "The end of the West as we have known it since 1945”.

With this issue our team is celebrating two important anniversaries in anticipation terms. Exactly five years ago, in February 2006, the GEAB N°2 suddenly encountered worldwide success by announcing the next "Triggering of a major global crisis" characterized especially by "The end of the West as we have known it since 1945”.

And exactly two years ago, in February 2009, in the GEAB N°32, LEAP/E2020 anticipated the start of global geopolitical dislocation phase by the end of that same year. In both cases, it is important to note that the undeniable interest aroused by these anticipations at international level, measurable particularly by millions of people reading the related public announcements, has been matched only by mainstream media silence over these same analyses and the fierce opposition (on the internet) of the vast majority of economic, financial or geopolitical experts and specialists.

However, whilst the signals become real warning sirens, our elite seem to have decided to do anything and everything to ignore them. Take a very recent example: the comparison of events affecting the Arab world with the fall of the Berlin Wall. Our team has been very interested to note that this image which we have used since 2006 to help understand the ongoing process of the disintegration of US power, has now blithely been taken up by the political leaders (led by Angela Merkel (6)) and experts of all kinds. Yet today, even those who make this comparison abstain from continuing their intellectual journey to the end, until it leads to an understanding of the dynamics of events. They settle for describing, without analyzing.

Yet this "wall" which is collapsing has been built by someone, or something, and for a specific purpose. The "Berlin Wall" was built by the East German government in the broader context of the "Iron Curtain", which the USSR wanted in order to separate the Communist bloc from the West as tightly as possible. And it was mainly to avoid any questioning of the power held by the single party in each communist country to perpetuate Moscow’s control of the East European countries; in return, Moscow guaranteed full support and stipends of all kinds to the leaders of Eastern European countries. The fall of the "Berlin Wall", challenging these monopolies of power and therefore the purposes that they served, thus caused, in a few short months, the successive fall of all the Eastern European communist regimes, ending two years later with the dissolution of the USSR and the end of seventy years absolute power of the Russian Communist Party.

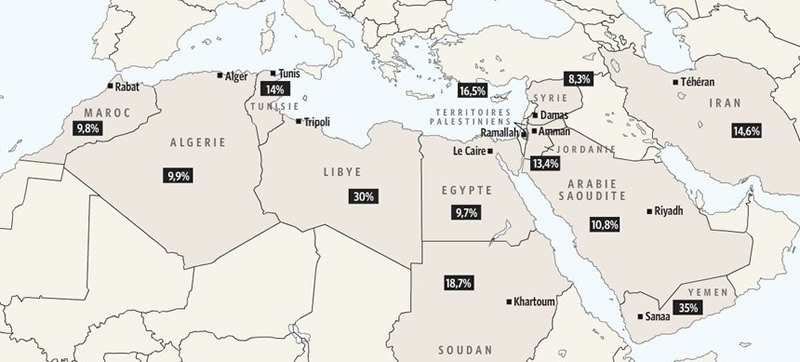

Unemployment rate in the Arab world and Iran - Source: Le Temps, 02/11/2011

So if it's also a "wall" that’s falling before our eyes in the Arab world, in order to hope to anticipate the subsequent events it is essential to be able to answer these questions: who built it? for what purpose? And the answers are not that difficult to find for those who don’t watch the news with ideological blinkers:

. this "wall" was built by each Arab dictator (or regime) of the region to ensure their continued monopoly on the power and wealth of the country, avoiding any calling into question of their single party or dynastic legitimacy (for the kingdoms). In this sense, there is very little difference between the cliques in power in the Arab countries and those which led the communist countries.

. this "wall" was part of the broader system set up by Washington to preserve their preferential access (in US Dollars) to the region's oil resources and protect Israel’s interests. The forced integration of the military and security apparatus of these countries (except Syria and Libya) with the US defence system ensures (ensured) unwavering US support and allows (allowed) the Arab leaders involved to receive all kinds of stipends without being called into question by internal or external forces.

So, in thinking a little more about her comparison with the fall of the Berlin Wall during the Munich Security Conference, the German Chancellor could have turned to her neighbour in the discussion, the US Secretary of State Hillary Clinton, and asked her: "Don’t you think that current events in Tunisia and Egypt are the early signs of the fall of all the regimes that depend on Washington for their survival? And that, in particular, they can lead to a rapid collapse of the system supplying oil to the United States set up decades ago? And thus the global system for oil billing and the central role of the Dollar here (7) ? Whilst the Munich Security Conference audience would have suddenly realized that they were finally discussing something serious (8), Angela Merkel could have added: "What about Israel? Don’t you think that this fall of the "wall" will involve the need to reconsider the entire US-Israeli policy in the region very quickly (9) ? And then miraculously, the Munich Security Conference would have regained a foothold in the XXIst century and the Euro-American debate could recharge its batteries in the real world instead of rambling in the transatlantic virtual world and the fight against terrorism.

Sadly, as we all know, this exchange didn’t take place. And the ramblings of our leaders are, therefore, likely to continue with the effect of accentuating the shocks of 2011 and its ruthlessness as GEAB No. 51 anticipated.

(1) Even the IMF, with the little imagination it possesses is now evoking the specter of civil wars throughout the world as the Telegraph reported on 02/01/2011, whilst The Onion of 01/24/2011 successfully uses black humour in a surprising article, yet indicative of the current atmosphere, that calls the designation by the World Heritage Foundation, sponsored by Goldman Sachs, of the "Gap between the world’s rich and poor" as the 8th Wonder of the World because of its now unparalleled size.

(2) In quotes because we believe a decision maker who does nothing and an expert who knows nothing are, in fact, impostors.

(3) The CIA and the French government provide two outstanding examples of this trend: they didn’t see it coming in Tunisia and Egypt, even though one spends tens of billions of dollars a year spying on the Arab world and the other walked (the Prime Minister and Minister of Foreign Affairs) in the highest corridors of power of the countries concerned. The simple reading of our expectations for 2008 (GEAB N°26 on the subject would, however, have put them on the track since it is exactly the trends then described that have led to the events in Tunisia and Egypt of these last few weeks. Summarized sharply in the Spiegel of 03/02/2011, "Revolution isn’t good for business" ... especially when one didn’t see anything coming, one could add.

(4) Here, investors and market players who were satisfied with these analyses now find themselves in serious difficulties since the "El Dorados" smoothly promoted by news reports and "well-informed" glossy articles have been suddenly turned into capital traps in volatile areas whose future cannot be forecast with any certainty. The "tremendous competitive advantages" have for them, almost overnight, become "countries with unmanageable risk". Outsourcing, sub-contracting, tourism, infrastructure construction, ... for all these activities, the whole social, legal, economic, monetary and financial context of the countries involved is pitched into the unknown.

(5) A brief philosophical and methodological comment: without premeditation, our team once again subscribes to a particularly Franco-German approach as our anticipation work not only draws on the concept of "listening" and the unveiling of reality so dear to Heidegger, but also the approach advocated by Descartes, namely the definition of a rational method. Here, moreover, is a synthesis that should inspire those who are currently working to define the future characteristics of Euroland governance. To learn more about this issue of Heidegger and Descartes’ "way", it is worthwhile reading this page on the Digressions website. And to better understand the method used by LEAP/E2020 and to try to apply oneself at first hand, we recommend the Handbook of Political Anticipation published by Anticipolis.

(6) Source: Bundeskanzlerin, 10/02/2011

(7) We have already witnessed some sizeable changes over oil since the US is about to abandon its own WTI oil index to go by the European Brent index to which Saudi Arabia already converted in 2009 in abandoning the WTI. The price divergence between the two indices culminated with the Egyptian crisis. We will return to the oil issue in another chapter of this issue. Source: Bloomberg, 02/10/2011

(8) This conference, like the Davos Forum, has a delightfully retro air about it. Organizers and participants do not seem to have realized that the world to which they belong has disappeared, that their discussions don’t actually interest anyone in the "real" world and that the many hours of programming devoted to them by international television are the inverse measure of the very small number of spectators who watch them. With more than 1,500 US and UK participants versus 58 Latin American and less than 500 Asian ones, Davos undeniably embodies the typical forum of the "world before the crisis”, confirmed by its linguistic signature, just English (even on its website). Indeed, monolingualism or multilingualism is, according to LEAP/E2020, a first sign, very simple to assess, of whether a project or an organization with international ambitions belongs rather to the world before the crisis or, on the contrary, is already partially adapted to the world after.

(9) On this subject, one should read Larry Derfner’s outstanding editorial in the Jerusalem Post of 02/09/2011.

(10) Washington has thus demonstrated a complete lack of preparation, then obvious indecision, confirming not only the end of all US leadership internationally, but the acceleration of a process of paralysis at the heart of US government. To understand the importance of the event, remember that Egypt is one of the countries in the world that has been the most directly funded and supervised by the United States since the late 1970s. Moreover, the New York Times of 02/12/2011 summarizes the situation very well, whilst trying to present it as a strategy whereas it’s only a lack of strategy, describing the management of the crisis by Barack Obama as the "straddle;, a market technique of trying to cover both sides when one feels that something important will happen but with no idea of what direction it will take. Incidentally, the article illustrates the divide between "ancient" and "modern" that this crisis has brought to the surface at the heart of US power. But we return in more detail to all these aspects and their consequences in another part of this issue.

(11) Which is a strategically essential block of the « Dollar Wall », like the « Berlin Wall » was for the whole of the “Iron Curtain”

By Leap

GEAB is an affordable and regular decision and analysis support instrument intended for all those whose work involves some understanding of ongoing and future global trends seen from a European point of view: advisors, consultants, researchers, experts, heads of public institutions, research centres, international companies, financial institutions and major NGOs.

Available in: Français, English, Deutsch, Español

Frequency: Monthly - 10 issues a year published on the 16th of each month (interruption in July/August)

Contributors: Every issue is coordinated by Franck Biancheri and mobilises the totality of our research teams

© 2011 Copyright LEAP - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.