Investing in iPhone Technology: It's Like Buying "B" Shares In Apple Inc

Companies / Tech Stocks Feb 17, 2011 - 06:57 AM GMTBy: Money_Morning

David Zeiler writes:

This technology spent 20 years as a humdrum subset of the industrial microchip business - until its consumer-product potential was realized when Apple Inc. (Nasdaq: AAPL) made it a centerpiece of the must-have iPhone.

David Zeiler writes:

This technology spent 20 years as a humdrum subset of the industrial microchip business - until its consumer-product potential was realized when Apple Inc. (Nasdaq: AAPL) made it a centerpiece of the must-have iPhone.

The sector's overall revenue is already projected to advance by 60% in the next three years.

But you have a chance to do even better.

But you have a chance to do even better.

You see, thanks to visibility it gained from its inclusion in the iPhone and iPad, this microchip technology - known as Micro Electronic Mechanical Systems, or MEMS - represents a ground-floor profit play with a big, and sustained, payoff.

"For the global MEMS market, the iPhone 4 was a breakthrough product," Jérémie Bouchaud, director and principal analyst for MEMS and sensors at market-researcher iSuppli Corp., told Money Morning this week in a telephone interview from Munich.

There's a hefty profit potential from this iPhone technology, especially if you focus on the smaller players whose sales are growing at double- and triple-digit rates.

But one stock in particular packs a promising profit punch. In fact, this company's technology was so crucial to the success of the iPhone and iPad that buying its stock would be like owning "B" shares in Apple.

A Move to the Forefront

What can save your life in an auto accident, make it possible to swing a bat with a Nintendo Co. (PINK ADR: NTDOY) Wii remote and roll the dice on an iPhone when you shake it?

With this bit of high-tech trivia, we're talking, of course, about MEMS.

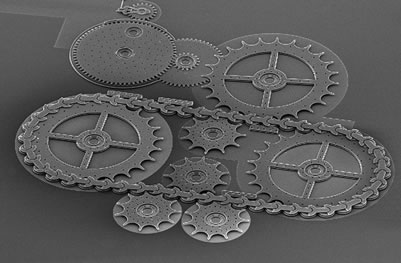

This remarkably powerful microchip technology comes in many different forms. Some look like gears. Some look like springs. Some have mirrors and many have interlocking parts. But they all have some sort of three-dimensional mechanical component.

With MEMS technology, it's even possible to create mechanical membranes smaller than the size of a red blood cell.

The capabilities are limited only by the designer's imagination. Members of the MEMS family can sense motion or changes in pressure, filter noise in microphones, control light in displays, and much more.

Though MEMS technology has been around for more than 20 years - the first large-scale commercial use of MEMS chips was in automobile airbag sensors - engineers have only just begun to exploit the technology's true potential.

Its use as a core iPhone technology proved to be the game-changer. It opened the eyes of product designers, shifting what had been solely a commercial-industrial technology into one with all sorts of consumer potential.

"MEMS is no longer a niche product," Susumu Kaminaga, president of Sumitomo Precision Products Co. Ltd., said at last November's MEMS Executive Congress in Scottsdale, Ariz.

Indeed, the MEMS market happens to be at the start of a surge of growth that should see sales grow from $7 billion annually in 2010 to nearly $11 billion by 2014. That's nearly twice the $5.97 billion recorded in 2009 and well above the 5.1% growth expected for the semiconductor industry as a whole, says iSuppli, which was acquired by IHS Inc. (NYSE: IHS) last year.

MEMS chipmakers posted a year-over-year revenue increase of 18.3% in 2010, and revenue is expected to increase 9.5% in 2011. But that's for the entire industry. And, as we'll see shortly, some companies will enjoy revenue surges in the high double-digits, iSuppli said.

The Consumer Catalyst

One reason the use of MEMS didn't explode sooner is that it took approximately a decade of research to develop increasingly sophisticated variations of the chips - as well as the processes it takes to make them. The second reason for the delay in the blossoming of the MEMS market, quite frankly, is that many people who could have employed the technology simply weren't aware of what it could do.

The wake-up call came from Apple's first iPhone in 2007, which included a MEMS-based accelerometer. That's the iPhone technology that makes the screen orientation change when you turn the device on its side, and that enables the motion-triggered interaction with games that require you to tilt or shake the iPhone. But the iPhone 4 added more MEMs, including two noise-filtering microphones.

That's why the iPhone 4 was a breakthrough product for the MEMS market, says iSuppli's Bouchaud.

"Beyond the large number of MEMS devices in the iPhone 4 itself, the product's design has been highly influential on the rest of the smart phone market, amplifying MEMS sales growth, as other companies move to emulate the product's features," Bouchaud explained.

In recent years, MEMS have started to turn up in many additional consumer devices. Besides smartphones, automobiles and console games, MEMS have brought image stabilization to digital cameras and have made inkjet-printer heads more efficient and capable of producing higher-quality output.

Texas Instruments Inc. (NYSE: TXN) has developed a MEMS chip for its Digital Light Processing (DLP) technology that packs 2 million microscopic mirrors onto a silicon wafer 1 inch by 1 inch. It's used in digital projectors and HDTVs, and it's more recently been employed in so-called "pico-projectors" - handheld projectors that can beam a 20-inch to 40-inch image on a wall or other handy surface. Texas Instruments' DLP revenue grew 26% in 2010, largely because of interest in pico-projectors.

While the use of MEMS technology is expanding in many areas - including medicine, industry, wired communications, military and data processing - it's clearly the consumer segment that's expected to drive the most growth.

According to iSuppli, the consumer-electronics and mobile-handset MEMS market will grow 25% in 2011, accounting for about one-fourth of the total MEMS market. The company says revenue in this sector will more than double - from $1.6 billion in 2010 to $3.7 billion in 2014.

Smartphones and digital "tablets" will supercharge the MEMS market in a big way in 2011, with new models expected to include MEMS gyroscopes, accelerometers, pressure sensors and acoustic filters.

"With their focus on providing compelling user interfaces, tablets are emerging as a major growth area for MEMS," said iSuppli's Bouchaud, who expects tablets to be the second-largest portion of the consumer-technology MEMS market by 2014. "Tablets are like smartphones on steroids. There's more room, so they can use more MEMS."

Many companies design and manufacture MEMS chips, though some are better positioned than others for growth.

Take STMicroelectronics N.V. (NYSE ADR: STM). The Swiss company saw revenue from consumer-electronic-related MEMS components soar 63% last year, to reach $354 million. The Geneva-based firm had success with its gyroscopes, pressure sensors and microphones, which iSuppli believes should carry over into the current year.

For TriQuint Semiconductor Inc. (Nasdaq: TQNT), revenue from consumer products rose from $8.5 million in 2009 to $74.7 million last year - a whopping 778.6% increase.

One reason for TriQuint's success is its bulk-acoustic-wave (BAW) MEMS technology, used in phones to filter radio waves. Within a year TriQuint had seized 26% of the global BAW market from leader Avago Technologies Ltd. (Nasdaq: AVGO). Nevertheless, with $207 million in revenue from consumer devices, Avago maintained its No. 2 industry ranking.

A Look Ahead

The use of MEMS technology is also expanding in other sectors, if not quite as rapidly. Bouchaud identifies three other drivers of growth, consisting of:

•Digital displays, such as Texas Instruments' DSP technology.

•Increasing demand from such emerging economies as Brazil, Russia, China and India (the BRICs).

•And sensors for use in medicine and energy.

Increasing investment in infrastructure in the BRIC nations, particularly China, will help propel MEMS sales for use in fiber-optic networks and smart meters. iSuppli's Bouchaud said rapidly rising automobile sales in China also will spur demand. A typical car uses between 20 and 30 MEMS chips, incorporating them in such systems such as tire-pressure monitors, emission controls and electronic-stability control.

The next few years will also see growing demand for MEMS sensors for use in medicine and energy.

Hewlett Packard Co. (NYSE: HPQ), a leader in MEMS inkjet technology, also has developed an extremely sensitive sensor that will help find new oil reserves, among other applications.

"We've already announced a collaborative agreement with Shell Oil Co. [Royal Dutch Shell PLC (NYSE ADR: RDS.A)] to develop a wireless-sensing system that acquires extremely high-resolution seismic data on land, in areas very difficult for Shell to do while exploring for oil wells," Hewlett-Packard Co. (NYSE: HPQ) strategist RichDuncombe told Electronic Design. "We'll be providing this ‘system' level solution to anyone that needs it, and we see plenty of market opportunities to do this."

MEMS contained in so-called "smart meters" also will help make home heating-and-air conditioning systems safer and more efficient, which should save money while conserving energy.

Healthcare-related MEMS devices, some current and some in development, could have a dramatic impact on people's lives, while also providing yet another avenue for growth.

Portable home healthcare devices that incorporate MEMS can monitor vital signs and can detect patient mobility or a fall.

Implantable devices have an even wider variety of applications. Some can monitor respiration, blood pressure or glucose levels; others can dispense drugs.

"MEMS technology has allowed us to build a novel mini ophthalmic pump that is miniature in size, is biocompatible, can be refilled while it is implanted, and can be programmed for drug delivery," Prof. Mark S. Humayun ofthe Doheny Eye Institute at the University of Southern California told Electronic Design.

Some implantable devices can even transmit a signal that can alert a doctor about a change in a patient's condition. Other devices on the way would monitor or even treat people's vision, hearing, or cardiovascular system. One of the newest devices can treat aneurisms.

"MEMS technology is moving from commercialization to personalization beyond present consumer electronics applications," Benedetto Vegna, vice president and general manager of STMicroelectronics' sensors and high-performance analog vision division told Electronic Design.

Of course, many of the same firms that lead in the consumer market for MEMS are major players in the overall market. Hewlett Packard and Texas Instruments were the market revenue leaders in 2009, according to the latest available data.

Germany's The Bosch Group claimed third, according to iSuppli, followed by Canon Inc. (NYSE ADR: CAJ) and Seiko Epson (PINK ADR: SEKEY). STMicroelectronics was sixth, helped by adding chips for auto airbags to its thriving consumer MEMS business.

Action to take: There are several solid investment candidates in the Micro Electronic Mechanical Systems (MEMS) market.

There's Texas Instruments Inc. (NYSE: TXN), the U.S. semiconductor heavyweight that's doing big things in the MEMS market. There's also TriQuint Semiconductor Inc. (Nasdaq: TQNT), which saw revenue from consumer-related MEMS products zoom from $8.5 million in 2009 to $74.7 million last year - a whopping 778.6% increase.

But if you're looking for a nice balance between size and growth potential, and market muscle and investment upside, look at the Geneva-based STMicroelectronics N.V. (NYSE ADR: STM), which contributed a key iPhone technology to Apple Inc. (Nasdaq: AAPL).

STMicroelectronics has been a market leader as a MEMS supplier, particularly in the fast-growing consumer segment. In fact, company revenue from consumer-electronic-related MEMS components reached $354 million last year, an increase of 63%.

We like that a lot.

STMicroelectronics has reaped the benefits of dominating the "accelerometer" MEMS market by raking in 50% of the revenue for that segment.

But the company isn't resting on its laurels, which we like even more. STMicroelectronics is preparing for any slowing growth in the MEMS consumer segment by investing in the next big growth driver - gyroscopes.

The company has already seen some early returns from that investment: Gyroscopes accounted for 85% of STMicroelectronics' consumer MEMS revenue growth in 2010, according to market-researcher iSuppli Corp. Nor is it stopping there: STMicro is also expanding into microphones and pressure sensors, which should begin to pay off in 2011.

[Editor's Note: Innovations such as the Apple Inc. (Nasdaq: AAPL) iPhone technology detailed in the preceding report create game-changing opportunities for companies - and life-changing for investors like you. It's this kind of innovation that drives monumental leaps in industry, and along the way leads to scorching profits for those that know how and when to dive in.

Understanding those key factors is exactly where our monthly affiliate The Money Map Report excels. To get recommendations like these every month from our team of global financial gurus, click here and take a moment to learn how to subscribe. Next time you'll be the one who's telling others about the great profit opportunities there are out in the marketplace - and smiling over your latest bank statement.]

Source : http://moneymorning.com/2011/02/17/...

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.