Gold Rises on Deepening European Sovereign Debt Crisis, Risk of Contagion and Bond Market Crash

Commodities / Gold and Silver 2011 Feb 16, 2011 - 07:17 AM GMTBy: GoldCore

There is a real sense of the “calm before the storm” in markets globally. Complacency reigns, despite signs that the sovereign debt crisis in Europe is deepening and that Japanese and US bond markets also look very vulnerable due to rising inflation, very large deficits and massive public debt.

There is a real sense of the “calm before the storm” in markets globally. Complacency reigns, despite signs that the sovereign debt crisis in Europe is deepening and that Japanese and US bond markets also look very vulnerable due to rising inflation, very large deficits and massive public debt.

Gold in Japanese Yen – 6 Months (Daily)

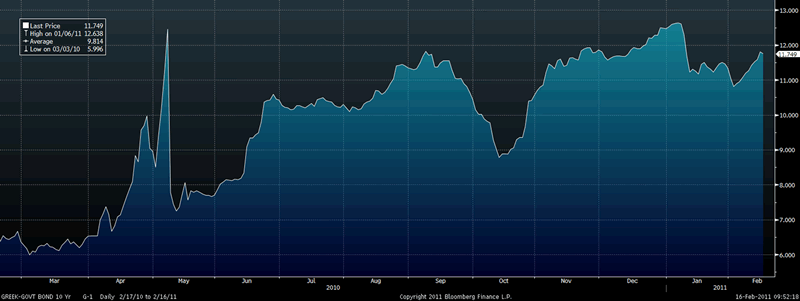

The unfortunately named PIIGS have seen their bond yields rise sharply again in recent days. Greek, Irish and Portuguese bonds in particular have come under pressure on concerns of deepening economic contractions and possible defaults.

Greek bonds fell for a ninth day after a report showed the nation’s economy shrank for a 10th consecutive quarter. In less than 2 weeks, the yield on the Greek 10-year has risen sharply from 10.804% to 11.750%.

Greek 10 Year Bond Yield – 1 Year (Daily)

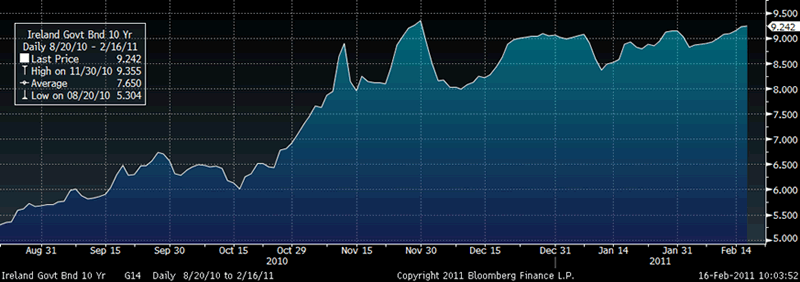

Irish two-year notes fell sharply this morning, pushing the yield to the highest since the introduction of the euro in 1999. The yield increased 10 basis points to 7.26 percent in London after jumping as high as 7.56 percent. The Irish 10-year yield rose three basis points to 9.26 percent.

Peripheral sovereign bonds remain under pressure despite considerable support and outright purchases by the ECB.

Ireland Government Bond 10 Year – 1 Year (Daily)

Sovereign debt issues are not confined to the eurozone and there is a real risk of the contagion spreading to other large debtor nations, including Japan and the US.

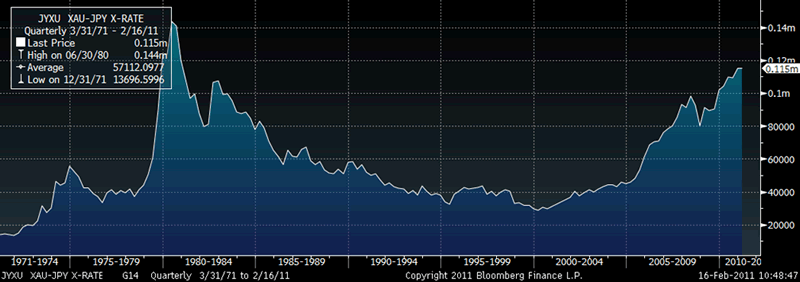

A Japanese minister denied overnight that there was any chance of a Japanese default on their massive government debt (see News). Japanese bond prices came under selling pressure with the yield on the 10 year rising to 1.36% and gold prices in Japanese yen rising to JPY 115,000 near the recent nominal record of JPY 118,000 seen in December (see charts above and below).

Gold in yen terms is still more than 25% below the nominal high of 30 years ago which should give those calling gold a bubble pause for thought.

Gold in Japanese Yen – 40 Year (Quarterly)

US Treasuries have been sold by some of the largest investors (both private and sovereign) in the world recently (see news). These include large creditor nations Russia and China but also PIMCO, the largest bond fund in the world.

The estimated cost to service the US National Debt of $14.09 trillion is $240 billion for fiscal year 2011 alone. The US national debt now equals the value of the entire US economy in GDP terms.

This is making investors nervous and they are rightly demanding and will continue to demand higher interest rates for the increased risk of financing the US’ unsustainable fiscal and monetary policies.

The Obama administration’s budget is seen by many as being optimistic in the extreme based as it is on the hope of rapid economic growth after two years of sluggish growth. The unpartisan Congressional Budget Office however does not share that optimism and thinks that the economy will continue to struggle.

A global sovereign debt crisis is now quite possible. At the very least, we are likely to have a long period of rising interest rates which will depress economic growth.

Contrary to some misguided commentary, rising interest rates will benefit gold as was seen when interest rates rose sharply in the 1970s. It was only towards the end of the interest rate tightening cycle in 1980, when interest rates were higher than inflation, that gold prices began to fall.

Gold’s importance as financial insurance and the fact that it cannot go bankrupt or default will also be increasingly important in the years ahead.

As ever, it is best to be optimistic but realistic and to hope for the best but be prepared for less benign scenarios by diversifying accordingly.

Gold

Gold is trading at $1,372.00/oz, €1,015.62/oz and £854.62/oz.

Silver

Silver is trading at $30.72/oz, €22.74/oz and £19.14/oz.

Platinum Group Metals

Platinum is trading at $1,372.00/oz, palladium at $835.00/oz and rhodium at $2,400/oz.

News

(Bloomberg) -- Yosano Says Japan Debt Appeal Points to Zero Default

Japan’s bond market will find support from domestic investors even as government debt swells because they lack better alternatives, Economic and Fiscal Policy Minister Kaoru Yosano said.

“I see zero chance of Japanese government bonds nosediving at the moment,” Yosano, 72, said in an interview in Tokyo today, responding to calls from opposition lawmakers to prepare for a collapse in government finances. “Investor still believe that the government, to a certain extent, is pursuing fiscal discipline.”

Members of the Liberal Democratic Party met today to discuss emergency measures the government needs to take should the nation’s bond market collapse, underscoring growing concern about public finances since Standard & Poor’s downgraded Japan’s credit rating for the first time in nine years. A former finance minister, Yosano has advocated raising taxes to pare debt and increase the sustainability of government finances.

“Long-term bond yields have been contained at incredibly low levels due to a lack of promising domestic investment opportunities,” Yosano said. Investors within the country also are able to absorb government debt, he said.

More than 90 percent of the nation’s government debt is held domestically. Japan accumulated a 17.1 trillion yen ($203 billion) current-account surplus in 2010 and is also the world’s second-largest holder of foreign reserves.

10-Month High

Benchmark government bond yields climbed to a 10-month high last week on expectations the economy is recovering after contracting in the fourth quarter. Borrowing costs driven by growth would differentiate Japan’s situation from that of Europe, where yields are rising over concern about the region’s fiscal woes, Yosano said.

Japanese government bonds have returned 9.8 percent in the past five years, according to indexes compiled by Bank of America Merrill Lynch. The Nikkei 225 Stock Average has declined more than 30 percent in the same period.

Japan’s public debt will probably increase 5.8 percent to 997.7 trillion yen in the year starting April 1, from a projected 943.1 trillion yen this year, the Finance Ministry forecasts. The nation’s debt load is forecast to reach 204 percent of gross domestic product this year, compared with 99 percent in the U.S., according to the Organization for Economic Cooperation and Development.

Reputation Maintained

Yosano said the nation’s sovereign reputation has been maintained because investors see room for the government to raise its 5 percent sales tax to bolster revenue.

“If the government fails to undertake comprehensive tax and social welfare reforms, that would hurt Japan’s credibility,” he said.

Prime Minister Naoto Kan appointed Yosano last month to help lead discussions on whether to raise Japan’s sales tax. Yosano quit on Jan. 13 as a member of the opposition Sunrise Party, a group he formed in April after leaving the Liberal Democratic Party, which ruled Japan for five decades until the Democratic Party of Japan came to office in September 2009. Yosano served as LDP Finance Minister in 2009.

Yosano also said the Bank of Japan has made “extraordinary efforts” to bolster the economy by pursuing unconventional measures in the past years, an indication there isn’t much more it can do.

“Japan’s problem isn’t monetary policy -- it’s that the country has fewer investment opportunities that can offer a high expected rate of return,” compared with the past, Yosano said.

The central bank lowered its benchmark interest rate to near zero percent and pledged to purchase financial assets including corporate bonds and exchange-traded funds in October.

Yosano reiterated the government’s support for the U.S. dollar as the world’s key reserve currency. Officials of Group of 20 economies have said they will discuss the global currency system when they gather this week in Paris.

“It’s very important that the value of the dollar is maintained” because Japan has many dollar-denominated assets and is a major exporter, he said. “The U.S. hasn’t given up on its fundamental view” that a strong dollar is in their national interest, he said.

(Bloomberg) -- Gold Rises to Highest in Almost Four Weeks on Inflation Concern

Gold futures climbed to the highest in almost four weeks as rising consumer prices boosted demand for the precious metal as a hedge against inflation.

In January, China’s inflation accelerated as costs excluding food rose the most in at least six years, and U.K. consumer prices rose the most in more than two years. Billionaire investor George Soros increased his SPDR Gold Trust holdings by 0.5 percent in the fourth quarter, and John Paulson kept his investment unchanged.

“With inflation concerns heating up and the metals underpinned by a mix of physical and investment demand, it looks as if further gains are in the pipeline,” James Moore, an analyst at TheBullionDesk.com in London, said in a report.

Gold futures for April delivery rose $9, or 0.7 percent, to $1,374.10 an ounce at 1:42 p.m. on the Comex in New York. Earlier, the price reached $1,377.50, the highest since Jan. 19. The metal has climbed 26 percent in the past 12 months.

Surging food prices have spurred protests in North Africa and the Middle East, while Brent crude oil, a global benchmark, closed yesterday at the highest since September 2008.

“Currency debasement and higher food and energy prices are leading to an inflation surge in both developed and emerging markets,” Goldcore Ltd. in Dublin said in a report.

Silver futures for March delivery climbed 16.2 cents, or 0.5 percent, to $30.696 an ounce.

Palladium futures for March delivery rose $7.10, or 0.9 percent, to $839.90 an ounce on the New York Mercantile Exchange.

Silver and platinum have doubled in the past year.

Platinum futures for April delivery gained $4, or 0.2 percent, to $1,831.60 an ounce on the Nymex. The metal is up 21 percent in the past 12 months.

(Financial Times) -- China and Russia sell US Treasuries

China has sold billions of dollars in US Treasury bills for the second month in a row, even as strong buying from other foreign investors countered Beijing’s move to reduce its holdings.

A Treasury report on Tuesday showed net foreign demand for long-term US securities, including bonds and equities, was $41.8bn in December, versus $64.5bn in November. Monthly net Treasury International Capital flows rose to $48.2bn in December, up from $35.6bn in November and $17.2bn in October. The rise was driven by private investors, while official accounts, or foreign central banks, sold US assets for the second successive month.

Foreign private investor demand for US long-dated government debt remained solid in December and US Treasuries with maturities of more than a year recorded inflows of $55bn. But, short-term bills suffered a $37bn fall, after November’s $32bn drop.

Alan Ruskin, strategist at Deutsche Bank, said the mixed flows reflected foreign interest in longer-term Treasuries as yields rose. China, for example, bought $5bn of bonds and notes in December, but sold $9bn of Treasury bills. “The negative take for the bond market is that China reduced its overall Treasury holdings, but they have increased their exposure to US interest rates by buying longer-term Treasuries,” said David Ader, strategist at CRT Capital. “It is an important distinction.”

Russia also pared its Treasury holdings for the second month, down to $106bn from $122bn.

But the UK continued to drive demand for Treasuries with a rise to $541bn, up from $512bn in November and $208bn in January last year. That increase, according to analysts, reflected the UK’s status as a financial centre where Treasuries are bought by investors who are not domiciled in the country.

“Some of China’s Treasury purchases may also be showing up in UK-sourced data that has been consistently strong, but nonetheless, it looks like China was more actively trying to dodge the Treasury sell-off than most,” said Mr Ruskin.

Indeed, when the Treasury revises its data later this year the share of UK Treasury holdings is expected to drop sharply.

China remained the largest foreign holder of Treasuries at $892bn in December, down from $896bn the prior month. “According to these, admittedly backward-looking data, there is little immediate cause for concern that non-US investors are losing their appetite for US securities,” said Jeffrey Young, strategist at Barclays Capital. He estimated that the December inflow represented an annualised rate of about $575bn, enough to cover the US current account deficit.

Caribbean Banking Centres, a proxy for hedge funds, increased their holdings of Treasuries to $156bn in December, up from $139bn in October. Singapore and oil exporting countries also increased their Treasury holdings.

“This report points to continued strong demand for US securities among foreign investors and officials, underscoring the ease at which the Treasury is able to fund its borrowing needs in the open market,” said Millan Mulraine at TD Securities. Prices of US Treasuries rose slightly on Tuesday as the Federal Reserve bought almost $6.7bn of intermediate-dated debt. The yield on the 10-year note was 3.6 per cent.

(Financial Times) -- China pull-back paints unsettling rate picture

It is no secret that China’s appetite for Treasuries has been waning. Official figures now bear out Beijing’s stated desire to diversify away from US government debt.

The market impact is likely to be muted for now, given the Federal Reserve’s bond-buying under its “quantitative easing” programme. But what happens when QE2 ends in June? Beijing’s pull-back may then become noticeable.

The US Treasury market occupies the centre of the global financial system. It is the deepest and most liquid bond market in the world, and demand from central banks and institutional investors, including private sector banks and hedge funds, has allowed the American government to finance its multibillion-dollar budget deficits.

Indeed, the US is more dependent than other countries on foreign investors buying its debt. The UK, Italy and Japan are largely funded by domestic investors. So far, robust demand for Treasuries from the UK and, to a lesser extent, Japan and US domestic investors has helped offset China’s waning appetite over the past year. The Fed effect has been supportive, too. The US central bank has become the largest single holder of Treasuries, with $1,160bn, as it continues buying securities.

But as Barack Obama, US president, attempts to tackle the country’s burgeoning deficit with austere budget proposals, there are growing worries that the cost of servicing the national debt could grow. At some stage, US interest rates may jump sharply to keep attracting buyers of Treasury debt.

“The low level of yields currently may not be attractive and in the future the Treasury may need a higher real rate to attract capital,” says Gerald Lucas, senior investment adviser at Deutsche Bank. Treasury yields, which move inversely to bond prices, are already rising. Ten-year yields rose to 3.77 per cent last week, their highest since April, extending a three-month bear run from about 2.5 per cent.

Among the major foreign holders of Treasury debt, China has long been the largest and is seen as a bellwether of foreign investor participation. China ended 2010 with $891bn in Treasuries, extending its drop from a record high of $940bn in July 2009.

“The upward march in Chinese reserves has been accompanied by reduced participation in the Treasury market over the past year,” say analysts at TD Securities. “The implications for the US are not particularly daunting yet, but are nevertheless a bit troubling.”

US households, hedge funds, banks and private pension funds have increased their Treasury holdings in the past two years. But, as the economy recovers and inflation picks up, there is a risk these investors will seek better returns from other assets, equities for example, and not government debt.

The significance has not escaped policymakers and key players in the bond market: US debt servicing costs will amount to $240bn for the 2011 fiscal year, equivalent to the entire budget deficit in 2006, according to RBS estimates.

This month a group of bond market experts, representing some of the biggest banks and hedge funds investing in Treasuries, voiced its concern about the reliance on foreign buyers for purchasing a large slice of the country’s $9,000bn in outstanding government securities.

“Foreign ownership of Treasury debt was significant, with ownership concentrated among a few key foreign investors,” said the minutes from a meeting of the Treasury borrowing advisory committee. “A more diversified debt holder base would prepare the Treasury for a potential decline in foreign participation.”

One proposal advocated at the meeting for diversifying the base of investors would entail the Treasury issuing new securities, including “callable” debt, ultra-long bonds with maturities of up to 100 years and floating rate debt, on which payments to investors would rise and fall with inflation.

These securities could appeal to domestic investors, particularly prospective retirees. They could also enjoy increased demand from banks and pension funds as a result of new international banking rules and proposed reforms to pensions accounting. The advisory committee estimates demand for long-term US bonds could reach $2,400bn in the next five years as these new rules take effect. The alternative, should yields rise sharply, could be discomforting for taxpayers.

(Financial Times) -- Bank lays ground for interest rate rises

The Bank of England said monetary policy would need to be tightened to bring medium-term inflation back on track, confirming market expectations that interest rates would start rising in May.

In a letter to the chancellor George Osborne that was triggered by a 4 per cent increase in consumer prices last month on the back of surging food and petrol costs, Mervyn King said inflation was “likely” to return to the Bank’s official 2 per cent target on “the assumption that [the] Bank rate increases in line with market expectations”.

Mr King’s comments confirmed investor expectations of a series of quarter-point hikes in interest rates, beginning in May. Mortgage lenders have already withdrawn or repriced fixed rate deals in the expectation of higher interest rates.

Economists rushed to predict the Bank would raise rates earlier than before and were “astonished” at how direct the governor was in his letter. “I can’t ever remember anything laid out quite this explicitly before,” said Peter Westaway, chief European economist at Nomura and a former senior Bank official, adding that the letter was a green light to a May rate rise.

Michael Saunders of Citigroup described the governor’s letter as a “softening up exercise”, adding “that after today or tomorrow nobody could be surprised by a rate hike”. He thought Mr King’s heart might not be in such a move, but “the governor is not quite the centre of gravity of the MPC”.

Richard Barwell of RBS, a former Bank economist, said the inflation forecasts were now a signalling device to “pave the way for a hike in May and not really a genuine forecast of inflation”.

The prospect of higher interest rates sent sterling up 0.9 per cent against the currencies of Britain’s main trading partners, reaching a level not seen for more than five months.

Inflationary pressures in Britain, where prices are rising almost twice as fast as in the eurozone, stem partly from the pound’s 25 per cent depreciation since late 2007, which has pushed up import prices.

The Bank expects higher inflation even with the recovery held back by the weakest household income growth since the 1920s.

Mr Osborne sought to use the deteriorating inflation outlook to criticise Ed Balls, shadow chancellor, and those who want to slow the pace of public spending cuts. He said any delay in deficit reduction would “risk prompting an offsetting monetary tightening such that overall there would be little if any net impact on demand”.

Danny Alexander, chief secretary to the Treasury, told the cabinet on Tuesday that the year ahead would be difficult. Treasury officials fear that although the recovery remains fragile, faster growth would exacerbate inflation even further.

In response, Mr Balls said the government’s value added tax increase had made it harder for the Bank to set interest rates. “The problem is that if you’ve got too fast spending cuts and a VAT rise but inflation is going up too, it really is putting the Bank in a very difficult position,” he said.

(Bloomberg) -- Greek, Irish Banks Force ECB to Print More Money: Euro Credit

The European Central Bank is being forced to print money to bolster banks in bailed-out Greece and Ireland, leaving the region’s taxpayers on the hook as the final guarantors of those nations’ debts.

Greek and Irish banks have issued at least 70 billion euros ($95 billion) of bonds to create the collateral required to get cash from the ECB, according to the International Monetary Fund and regulatory filings, a figure that may rise to 100 billion euros after Greece said Feb. 11 it may extend another 30 billion euros of guarantees to its banks.

“What you have here is micro-quantitative easing, or money printing,” said Cathal O’Leary, head of fixed-income sales at NCB Stockbrokers in Dublin. “The banks are issuing unsecured loans to themselves.”

The ECB has vowed to eschew the type of monetary policy implemented by the Federal Reserve, whose bond-buying to boost growth has left it owning more Treasuries than are held by China, the biggest foreign buyer of U.S. debt. By granting loans against bank debt, the ECB is adding to the monetary base and would be out of pocket were the guarantors to renege.

The yield premium investors demand to hold Irish 10-year bonds rather than German securities is 593 basis points, up from 153 basis points a year ago. The spread between Greek and German 10-year bonds is 852 basis points, up from 305 basis points a year ago.

‘Stressed Market Conditions’

Ireland’s banks have issued at least 17.4 billion euros of notes backed by government guarantees, with 9.2 billion euros going to Bank of Ireland alone. The program amounts to 11 percent of Ireland’s 2009 gross domestic product.

“Access to ECB operations allows the banks in question to obtain funding that is not currently available in the continued stressed market conditions,” the Irish central bank said in an e-mailed response to questions.

Greece’s current state-guaranteed liquidity program is 55 billion euros, according to the IMF country report, equivalent to more than 20 percent of the nation’s $330 billion output in 2009. That’s on top of the 8 billion euros of zero-coupon bonds Greece has lent to the banks and 15 billion euros of direct capital injections, according to John Raymond, an analyst at CreditSights Inc. in London.

‘Huge Credit Exposures’

“To a very significant extent, the ECB is taking the place of capital markets,” said Alan Dukes, the former Irish finance minister who is now chairman of Anglo Irish Bank Corp., which posted Ireland’s biggest-ever loss in 2010. “The ECB is no longer in a position to pursue a clear monetary policy because it is running huge credit exposures,” he said in a speech last week.

Ireland has put 46.3 billion euros into its debt-laden banks in the past two years as property prices collapsed and loan losses soared. Irish-based lenders, including foreign-owned banks, received 126 billion euros of ECB funding at the end of January and as much as an additional 51.1 billion euros of “exceptional liquidity” from the Irish central bank, figures published on Feb. 11 show.

“The own-bond issuances are a pragmatic response in exceptional circumstances,” said Donal O’Mahony, global strategist at Davy Capital Markets in Dublin. “While the notes are not backed by the banks’ own assets, they are backed by the government guarantee, which is an important point. State- guaranteed notes are ECB-eligible collateral.”

‘Expensive Emergency Liquidity’

Greek banks, with 1.5 percent of European banking assets, and the Irish, with 5.5 percent, account for 17 percent and 24 percent of ECB borrowing, according to a Feb. 7 report by Laurent Fransolet and Giuseppe Maraffino at Barclays Capital in London.

“The ECB accepts government-guaranteed bonds as collateral,” said Maraffino. “The Irish banks are replacing expensive emergency liquidity with cheaper ECB funding. It’s just the way it works.”

As the lender of last resort, the job of the ECB is to ensure the European banking system has the liquidity it needs to function. While the nascent European Financial Stability Facility probably will have the task of ensuring solvency, for the moment the ECB has that role, too.

“This is a great example of bank risk moving to national government risk, and now to ECB risk,” said Jean Dermine, professor of banking and finance at INSEAD business school in Fontainebleau, France. “The ECB is increasing the money supply and that is raising inflationary pressure. There is also credit risk, the fact that default would lead to a loss for European taxpayers.”

‘Difficult to Distinguish’

Monetary growth in the euro area, as measured by M3 money supply which the ECB uses as a gauge for future inflation, turned positive in June and reached a 15-month high of 2.1 percent in November.

The ECB is calling on governments to step up efforts to restore confidence, to allow sovereigns and their banks to regain access to the capital markets.

“It’s difficult to distinguish banking and sovereign risk,” said Nicolas Veron, senior fellow at Bruegel, the Brussels-based economics research group. “What happens if there’s a default? Everyone would like to avoid testing that out in real life. Governments are really scared of the consequences of an actual restructuring.”

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.