How to Tell When Stock Bulls or The Bears Are in Control

Stock-Markets / Stock Markets 2011 Feb 14, 2011 - 07:49 AM GMTBy: Marty_Chenard

There are different ways of measuring what is happening in the markets.

There are different ways of measuring what is happening in the markets.

Indexes measure the market, but some indexes are price weighted, some are market value-weighted or market share-weighted, and some are float weighted. It is sometimes why, a few stocks can have an over exaggerated impact on the movement of an index.

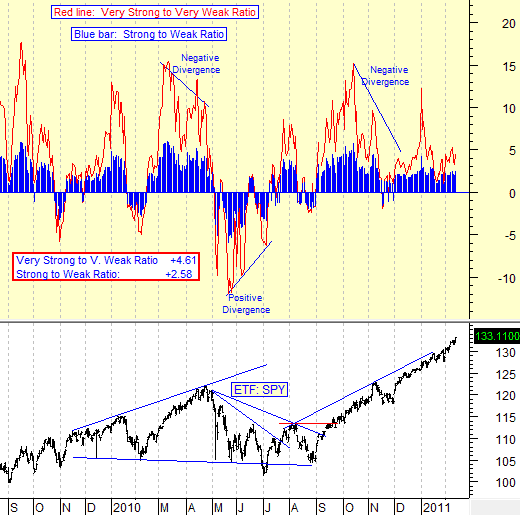

Index values don't answer a very important question, and that is, "What percentage of all the stocks are in an up-trend versus the percentage in a down-trend?" (This is illustrated in the chart below.)

It is an important question, because the answer tell's you who is in the majority ... the Bulls or the Bears.

Finding the answer is not a simple task, because we have to run an analysis of the strength of every stock on every index, every night. We first run a program to count the number of stocks in an up trend, and then we re-run the program to count the number of stocks in a down trend. (We do this for every stock that has a value of over two dollars.)

We don't stop there ... we do two more runs. This time, we measure the number of "Very Strong" and "Very Weak" stocks. With that, we have a good view of what the bulls and bears are doing and if there is a power shift starting to occur. With the four computations, we can create Bull/Bear ratios for the Broad Market stocks and the Leadership stocks in the market.

The answer relative to who is in control (Bulls or Bears) can then be easily determined by dividing the Strong and Weak numbers to produce a Ratio. If the number is positive, then there are more stocks trending up than down. If the number is negative, then there are more stocks trending down and the bears have the advantage.

So, let's look at the Ratio chart and analysis for the past year and a half. There are two Ratios expressed in the top graph of the chart below.

The red line shows you the Ratio of Leadership stocks, and the blue bars show you the Ratio of the Broad Market stocks.

*** There are two things to note in this study. First, when both Ratios are in Positive Territory, the Bulls are in charge and the stock market rallies.

When both Ratios are Negative and the Very Strong Ratio (red line) is lower than the Broad Market ratio (blue bars), then there are more Bears than Bulls and the market pulls back.

**NOTE** It is important to also note that the level and direction of Leadership stocks will "pull the market up or down". The higher the red Leadership line is above the blue Broad market Ratio, the greater the positive pull is on the Broad Market. The opposite is also true.

The past few months ...

For the past few months, the Very Strong (Leadership) Ratio has been positive and higher than the Broad Market ratio. There was one exception on January 18th. where the Leadership Ratio was slightly lower than the Broad Market ratio, but both were still at a strong positive level and that lasted only for that one day.

At the close last Friday, both ratios where positive and the Bulls were in charge.

(Today's chart is shared as a courtesy to our Free members and will not be shown again on this free member site for at least a month in respect for our paid members. This chart is updated every day, and can be found on Section 4, Chart 1 of the Standard subscriber site.)

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.