Huffington Post Alone Won’t Rescue AOL, A Case Study into Failure

Companies / Mainstream Media Feb 14, 2011 - 04:23 AM GMTBy: Mike_Stathis

Recently, I reminded readers of a very lucrative (and what I felt was a very obvious) long-short equity strategy I discussed that would have yielded huge returns to those who opted to take on this risky maneuver.

Recently, I reminded readers of a very lucrative (and what I felt was a very obvious) long-short equity strategy I discussed that would have yielded huge returns to those who opted to take on this risky maneuver.

I normally don’t recommend that everyday investors take short positions because it’s extremely risk for many reasons. Most non-professional investors fail to recognize the risks involved with shorting securities because taking a short position is just a mouse click away if you have an online brokerage account. That in itself is an entirely different issue that needs to be addressed by the SEC.

Unless you have a good deal of relevant investment experience, you’re not likely to full appreciate the risks involved with shorting. Some unwary investors have learned the hard way after taking a short position, only to watch helplessly as the stock is halted during the trading session prior to the release of a major announcement. While such events can swing either way, more often than not, such an announcement is likely to go against you if you’re short.

There are times when I feel very confident about a company’s bleak future. In the past, I have made the bold move to publish a short recommendation in a book. As discussed recently, I made this call when presenting my analysis of Blockbuster in the Wall Street investment Bible. I added that a nice example of an effective long-short strategy would be to take a long position in Netflix and a short position in Blockbuster.

As many of you recall, I also made this call for Fannie, Freddie, the banks and homebuilders in Cashing in on the Real Estate Bubble, released in early 2007.

In this book my main strategy for making money from the real estate bubble was to short real estate-related securities. I made specific mention of those securities I felt most likely to collapse and provided guidance as to the timing. I even included a brief tutorial for those who were not experienced shorting stocks.

First on this list were Fannie, Freddie, Accredited Lender, Novastar, and Fremont General. Next were the banks and homebuilders. I also discussed that General Electric and General Motors were likely to get hit really bad.

The downside associated with putting these calls into a book is that I had no way to change my mind if I turned out to be wrong. So if things didn’t turn out as I anticipated, I might have looked silly. But that wouldn’t have been the first time a person made a poor investment call in a book. In fact, I challenge you to see if you can find a book that has ever specifically instructed readers to short a stock. You are unlikely to find a single case because shorting is a short-term strategy that often reverses.

The point I want to make is that all investment strategies must always be managed. Even if someone has overwhelming evidence to indicate a company is destined for demise, the fact is that no one has a crystal ball. Things can and often do change over time. Thus, if you ever plan to take a short position you must hedge your position. And you must manage the position throughout its duration.

One way to hedge a short position is to purchase call contracts. But you cannot expect to receive a full hedge against the position unless you select in-the-money calls (whereby the strike price is below the price of the underlying stock at the time you short it) to account for slippage, frictional costs, exit premiums and other less obvious costs. Many investors don’t like to pay the added costs involved with hedging, but I can assure you it is well worth the price.

Here I want to show you another example of a more recent long-short position. Note that I am not recommending investors take this long-short at this point. There are man better opportunities out there. I merely wanted to point it out to show the irony.

As many are aware, a few days ago AOL announced its purchase of Huffington Post for around $315 million. Immediately after the announcement the Internet was buzzing with the news. First , let’s take a brief look at Huffington Post.

Huffington Post. Trash or Treasure?

I won’t get into the details of my analysis, but many of you probably already know what I think of the Huffington Post. In short, I feel it is complete trash that disguises itself as an ally and advocate for Main Street when the fact is that it’s really no different than other media publications that only serve the interests of their corporate sponsors. Similar to many other publications, HP has successfully fooled millions who go to the site thinking they are receiving unbiased, accurate insight and valuable opinion.

In reality, HP is no different than the rest of the media except it contains even more trash. The only real news the site gets comes from other sources. In fact, HP is really a social blogging site whose bloggers have been selected based on their adherence to Arianna’s own views.

As you might imagine, HP has also banned me. In fact, those at HP who monitor emails have never even responded to my inquiries to submit articles on healthcare and the economy, despite the fact that HP publishes opinion pieces from more than 15,000 blogs. Similar to all other corporate media firms, HP does not want the truth to be exposed about these critical topics because they represent corporate and political agendas.

In addition to its own publications largely from inexperienced reporters, Huffington Post features opinion pieces and interviews from the same names with the same lines you see on TV and other print media. You’ll see the same marketers who have been positioned as experts by the media. I recently provided clear evidence of the incompetent nature of Huffington Post’s business reporter.

“By now it should be clear to even the most naïve individuals that the banking cartel caused this global collapse. Meanwhile, its partner in crime, the corporate media kept consumers in the dark, while covering up the criminal activities of Wall Street. Yet some journalists still remain clueless. For instance, in a recent conversation I had with Shahien Nasiripour, the business reporter for the Huffington Post, he stated that he was not aware that Wall Street banks committed securities fraud. This was a few weeks after I sent him chapter 10 of America’s Financial Apocalypse and chapter 12 of Cashing in on the Real Estate Bubble. Brief excerpts from these chapters can be found here.

Even Greenspan recently admitted the financial collapse was due to Wall Street fraud. If Greenspan is willing to admit fraud caused the collapse, it implies that virtually everyone with a pulse is aware of it. If only he could take responsibility for his own actions which facilitated the fraud.

Meanwhile, like all other media, Huffington Post continues to feature articles and blogs from Washington and Wall Street hacks, as well as extremists who claim to be chief economists, but are merely marketers. For the record, the Huffington Post has also banned me.

Regardless who you turn to in the Huffington Post, New York Times, or any of the other members of America’s propaganda machine, you will find one of two things. Their so-called “experts” either have no idea what they are talking about, or they are lying in order to line their own pockets. Have you ever wondered why you see the same bozos throughout the media? It’s called the flooding approach. People will believe anything if it is repeated over and over.”

Reference: America's Second Great Depression: 2010 Year-end Update (Part 1)

But remember, the media’s mission is NOT to deliver unbiased insights from real experts with solid track records. The real mission is to brainwash its audience to accept the positions most beneficial to corporate America because they are the ones buying the ads. You get the same censored, biased, agenda-filled content, plastered with ads from corporate America.

In the end, rather than something different, HP provides the same trash. In fact, HP is more like the TMZ of news, economics, healthcare and other topics that most Americans fail to truly understand because they look to the corporate media monopoly as their primary source of information.

Furthermore, HP has been accused of stealing content from other sites, as well as other questionable behaviors. It should be clear to any intelligent individual who has spent time on HP that this media site contains very little if any original valuable content. It appears that most of the efforts at HP are spent on SEO (search engine optimization) activities rather than on delivering quality content.

As the head of a corporate media firm, you can imagine the low opinion I have of Arianna Huffington. She’s obviously a complete whore for corporate America. Despite her surname (which she chose to keep after her divorce from former Congressman Michael Huffington) Arianna is Greek. As a Greek-American myself, I’m disgusted by her behavior.

Arianna has a long history of cozy relationships with the right group of people that one would need to form a “successful” media company. The same can be said about Wall Street, Washington, academia and virtually everything else. I have documented this on numerous occasions. Perhaps Arianna has become a victim of the company she keeps.

Arianna offers no expertise other than spin facts, censoring, and brown-nosing. Yet she is invited to speak at events offering her opinion on critical issues such as healthcare, the economy, trade and politics much in the same way as Sarah Palin has. This is disconcerting.

Under her direction, HP staff carries out the fine art of selective censorship mastered by America’s media monopoly by publishing content and permitting only those who share in her deluded views, all without offering balance. This is problematic.

Arianna has also used HP as a platform to feed her ego by posting her “All Things Arianna” section on the site. It’s unfortunate that Steve Case no longer heads AOL, because Arianna’s ego would have provided a nice fit.

I think it is important to ask the following question. Other than her physical appearance, is Arianna really much different than Sarah Palin?

A Case Study in Failure

Some of you might also know what I think of AOL. The AOL-Time Warner merger embodied everything that went wrong with the dotcom era, marking the end of a longer era of irrational exuberance that led to the great bull market. Ridiculous valuations and delusions of greatness preached by incompetent CEOs with large egos characterized this period. Towards the end of the dotcom bubble, AOL had emerged to a prominent position. In its final act prior to its demise, AOL led the worst merger in U.S. history; the merger between AOL and Time Warner.

For those who don’t remember, or for others who were too young to care, in 2000 under the “leadership” of Steve Case AOL purchased Time Warner for $165 billion making it one of the largest mergers ever. The business strategy was simple. Combine the world’s largest Internet access firm with the world’s largest media firm.

The problems with this merger were several-fold. First, AOL was severely overvalued due to the dotcom bubble. But it was also severely overvalued due to accounting tactics that had not yet surfaced. Even worse, AOL had no real broadband strategy to speak of. Thus, going forward the company stood to lose significant market share. The stress would mount as the dotcom bubble corrected and accounting problems were revealed.

Yet, all of the “geniuses” praised the merger. If the deal was truly as great as Ted Turner claimed (“better than sex”) I certainly don’t envy his sex life. I never bought AOL either before or after the merger because I didn’t fall for the hype.

When a company spends hundreds of millions of dollars sending out trial CDs month after month, that should tell you that its services really aren’t that good. This marketing strategy allowed AOL to seize a first-mover advantage. But it also pissed a lot of people off because they became tired of receiving CDs from AOL every month.

"If there's one thing more certain in life than a Man United fan living in Portsmouth, it's that every person in the UK will, at some point, receive an AOL sign-up CD.”

Anyone who knows the first thing about business will tell you that a first-mover strategy is not considered a competitive advantage. It merely offers a temporary advantage. And if this early lead is not used to establish a competitive advantage, all bets are off. This was specifically why Case wanted Time Warner. It had exactly what AOL needed; a huge and diverse collection of valuable (from a monetary sense) content. The only problem is that Case completely blew the distribution side of the equation.

Analysts assumed Case would make up lost ground by rolling out a reliable broadband strategy, but this never happened. By the time AOL realized that broadband would represent the new market for Internet access it was too late. Millions of AOL customers had already departed to cable and telecom providers offering faster Internet connections.

This failure by Case soon took its toll on the newly merged entity. By 2002 AOL Time Warner recorded the largest loss ever (at the time) at nearly $100 billion. As a result, the company wrote off most of the value of the merger. This amounted to an immediate vaporization of $100 billion of shareholder equity.

The merger of AOL and Time Warner serves a perfect example of the need to scrutinize the goodwill entry on the balance sheet. Goodwill is something I discuss in the Wall Street Investment Bible. Although it is often considered to represent the value of intangible assets, what it really amounts to is a black box because the value of these assets is very difficult to determine.

After many years of pain and suffering, Time Warner finally ditched the virtually useless AOL in 2009. It’s been a long and rough struggle for Time Warner ever since destroying billions of dollars of shareholder value.

Although management has done a somewhat admirable job since this disaster, after more than a decade the market cap of Time Warner stands at just $40 billion. With a market cap as high as $230 billion at the peak of the dotcom bubble, it is unlikely that shareholders who bought shares of Time Warner anytime during 1998-2000 will live to see the day when they break even on their investment.

Some Things Never Change

Despite execution of the most irresponsible and disastrous merger in U.S. history, no heads rolled from either AOL or Time Warner. This outcome is much like the case seen today after Wall Street reaped huge payouts while committing securities fraud. Some things never change.

In fact, Case and several former AOL employees remain very wealthy today. At one point, Case had 10 personal assistants. Having spoken to several of these individuals by phone while I was on Wall Street, it was clear to me that they were not particularly well educated or intelligent. They were essentially gophers or glorified secretaries. Yet, each of them became very wealthy from stock options.

Other AOL employees (many in their mid- to late-20s) were being paid $200,000 and more back then for basically entry-level IT jobs. It’s no wonder why so many have flocked to ITT, Devry and other less-credible colleges for 2-year degrees in IT.

This ridiculous compensation continued even after the merger. I know this because I did a lot of research and spoke to numerous individuals back then. These ridiculously high salaries represent an irresponsible use of shareholder equity and therefore could be argued to constitute shareholder fraud.

Furthermore, the employee stock options system that is widespread throughout corporate America constitutes insider trading (especially for executives). But it is permitted by the SEC. I discussed this 5 years ago in America’s Financial Apocalypse.

Case got away with massive accounting fraud much in the same manner that he and Time Warner executives got away with destroying shareholder value, so of course these other issues would never be addressed by the SEC.

Ultimately, shareholders are responsible for these acts of fraud and irresponsibility because they continue to sit back and let it happen over and over again. Thus, I really don’t have any sympathy remaining for those who lost it all. Keep sitting back, doing nothing and the same results will repeat indefinitely.

The Future of AOL and Time Warner

As far as content is concerned, Huffington Post compliments the cheese and trash content offered to AOL’s dial-up users. However, AOL would need a revolutionary strategy in order to have long-term success. The main engine of AOL’s business model continues to come from its dial-up Internet service which comes at a price tag of up to $25.90 per month. However, the majority of its revenues come from advertisements.

I can’t imagine how anyone these days is able to surf the web too well with such slow access, especially when new web-based programming continues to require more bandwidth. Remember, we are now living in a period whereby wireless smart phones have 4G Internet access.

While AOL doesn’t stand much of a chance of long-term survival, the company is by no means distressed. While it has a nice cash position even after overpaying for Huffington Post, in the worst case scenario it will still be around for a few more years. However, AOL remains stuck in a vortex of shrinking growth due to strategic confusion.

AOL has established a consistent pattern possible only under the leadership of incompetent management. AOL’s overpaid and clueless management team continues to search blindly for a way out of the corner, after losing a huge amount of money on Bebo and several other assets, many having been sold at a loss with others on the way.

Without a significant restructuring of its business model and strategy, AOL’s purchase of Huffington Post will most likely represent one more page in the story of a once large company that has faded into the dusk due to a chronic period of poor execution, terrible strategy and incompetence, all while very few take notice.

I do believe I understand what AOL needs to do to mount a permanent turn around. But I’m not about to share this for free for the benefit of AOL’s management. Most likely, management wouldn’t listen to me even if I sent in a written analysis and strategic blueprint, similar to the one I sent Blockbuster management some 6 years ago.

Unlike the situation seen in Japan, Canada and most other advanced nations, in the U.S., executive management of publicly traded corporations are not held accountable for their actions. They pull in huge salaries and bonuses regardless how low the stock price sinks. This is specifically management does things their own way, which often positions their own incentives above those of shareholders. They don’t listen to those who might be better able to build shareholder value because they don’t have to. In fact, Washington operates in the same manner.

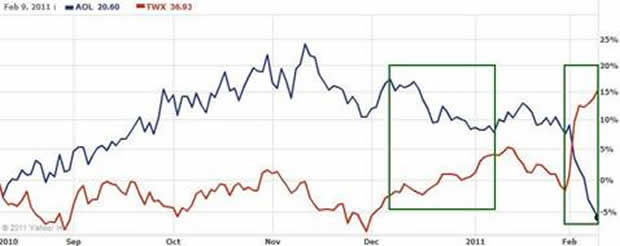

While I certainly wouldn’t be a buyer of Time Warner much in the same as I wouldn’t short AOL at this point, I think it’s ironic to note the long-short strategy that would have performed nicely over the past few months. The following chart is likely to represent the long-term fate of each company.

Down the road the best investment in AOL just might end turn out to be collecting old trial CDs. Maybe not, but it appears that some have already started.

http://www.lydiasaoldisks.com/

http://www.angelfire.com/my/aolcollection/

Remember, if you plan to short AOL or any other security, you had better hedge your position.

I invite you to join other subscribers who wish to become great investors, as they learn how to navigate the financial landmines that promise to be commonplace for years to come. The best way to achieve this difficult task is to subscribe to one of our investment newsletters.

At AVA Investment Analytics, we publish 3 investment newsletters and provide customized research to financial institutions, financial advisers and serious retail investors.

- The Intelligent Investor is our flagship publication. It is the most comprehensive investment newsletter we know of in the world. See here for more details.

- The Market Forecaster provides forecasts for the U.S. and emerging markets (excluding Russia). See here for more details.

- The Dividend Gems provides my most highly recommended dividend securities with active management strategies, as well as discussions of other dividend securities. See here for more details.

By Mike Stathis

www.avaresearch.com

Copyright © 2010. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

READ THIS LEGAL NOTIFICATION IF YOU INTEND TO REPUBLISH ANY PORTION OF THIS MATERIAL

Market Oracle has received permission rights to publish this article. Any republications of this article or any others by AVA Investment Analytics must be approved by authorized staff at AVA Investment Analytics. Failure to do so could result in legal actions due to copyright infringement.

Our attorneys have determined that the so-called “Fair Use” exemption as it applies to the Digital Millennium Copyright Act does not permit use by websites that have ads or any other commercial application.

In addition, fair use does not imply articles can be republished or reproduced. The distinction between fair use and infringement may be unclear and not easily defined. There is no specific number of words, lines, or notes that may safely be taken without permission. Acknowledging the source of the copyrighted material does not substitute for obtaining permission. Please see this statement from the U.S. Copyright office for more information. http://www.copyright.gov/fls/fl102.html

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.