Gold and Silver Through the MacroScope

Commodities / Gold and Silver 2011 Feb 09, 2011 - 10:02 AM GMTBy: John_Hampson

Gold and Silver Through the Macroscope

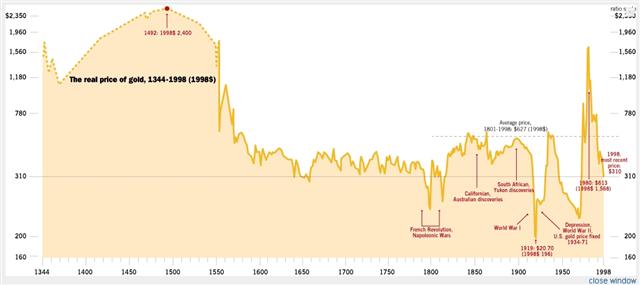

Let's start with a 600 year perspective on gold prices (gold-lined chart) and silver prices (blue-lined chart):

Let's start with a 600 year perspective on gold prices (gold-lined chart) and silver prices (blue-lined chart):

Source: Silverstockreport.com

Both charts show prices in constant 1998 dollars, removing currency dilution from the picture. The message? Neither gold nor silver have been a good long term investment. Why would this be?

Firstly, precious metals as real money - let's rewind to how modern money got started: goldsmiths. Goldsmiths sprung up in response to gold owners who wished to keep their precious metal somewhere safe. The owners were given a redemption note, effectively a promise to pay out the gold when they wanted it. However, the owners then started to use these notes occasionally to pay for goods or services, meaning the redeeming owner changed and the gold stayed put. Gradually, the redemption notes acted as currency and there was little gold redemption. In response to this, the goldsmiths took a gamble and issued more notes than they had gold, charging interest on these notes. So began the banking practice of creating money out of thin air as debt, with only partial asset backing. Fast forward to today and fractional reserve banking is alive and well, but currency is no longer convertible to gold, and fiat currency is therefore a game of confidence. But the key point is, on the demand side people wanted notes, not gold, due to its flexibility, portability, and practicality, and on the supply side, banks and governments also preferred notes as they were able to easily expand supply and make a profit on this.

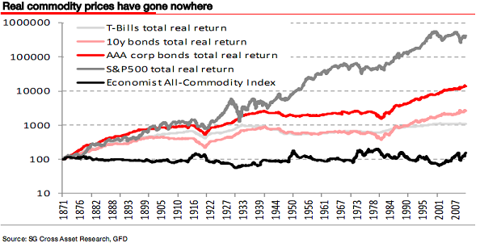

Secondly, precious metals as commodities. Here is a 100 year chart comparing returns between asset classes:

Source: Societe General

Stocks have truly wiped the floor with commodities over the long term, and the difference between the two is human value-add. We take commodities out of the ground and combine them into computers, airplanes, cameras and satellites. The whole is significantly greater than the sum of the parts. Humans are the sole agents of technological evolution, and the pace of technological evolution is exponential. This gap should therefore continue to widen, although we face peak resource constraints ahead. However, technological evolution may provide solutions on this front also, through nanotechnology and renewable energy.

In short, precious metals, despite their precious qualities, are not historically that desirable per se, but let's dive in a bit further.

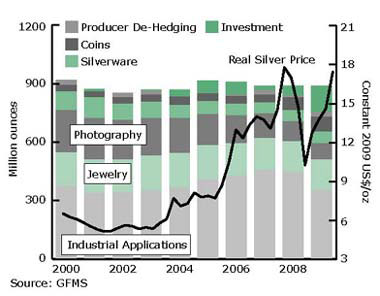

There are three key components to gold and silver demand: jewelry, investment and industrial uses. In the last 10 years, worldwide investment in gold has tripled, and now makes for almost 40% of gold demand. Central banks have become net buyers rather than net sellers of gold and exchange traded funds have emerged enabling investors to more easily participate. Silver investment demand has grown from negligible to around 20% in that same time. Combined industrial and jewelry demand has remained fairly constant for both metals. It is investment demand that been the fuel behind price increases in precious metals.

Source: GFMS

Mined supplies have been recently growing by around 3-4% a year, with more mined supply due to come on stream in the next couple of years. There is a time lag in supply in response to higher prices, due to a lack of investment in the 1980s and 1990s.

So if we pinpoint increased investment demand and inelastic supply as the principal driver taking gold from $250 and silver from $5 in 2000 to today's respective prices of over $1350 and $30, then why exactly has investment demand boomed in that time? There are three main reasons: 1. a flight to safety, 2. a store of value in the face of currency dilution and inflation, and 3. a relatively attractive asset compared to yielding assets when real interest rates are negative.

1. Flight to safety: precious metals are perceived as a safe haven against economic crises (2000-3 and 2007-9), debt and currency crises (2007-9), conflict and unrest (there are ongoing military conflicts and political uprisings around the world, but statistics reveal an overall decline in war and conflict in the last two decades so this can be excluded).

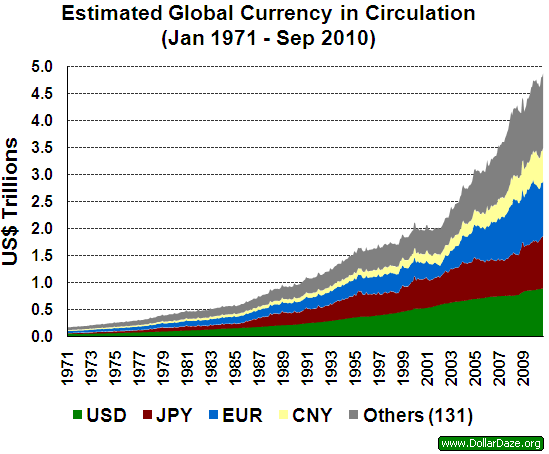

2. Store of value: real inflation (grey in the chart below) has been fairly rampant over the last decade and there has been widespread currency dilution:

Source: Dshort.com

Source: Dollardaze.org

3. A relatively attractive asset compared to yielding assets when real interest rates are negative. The chart below shows that we have been in and out of that scenario in the last decade:

Source: Black Swan Insights

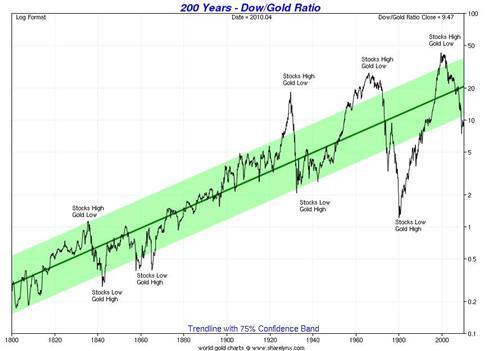

So we can summarise that persistent real inflation, currency dilution, intermittent negative real interest rates and financial and economic crises have together accounted for increased precious metal demand and price rises in the last decade. But there is one other key factor: secular cycles in assets and relative cheapness. By 2000 stocks had hit an extreme of relative expensiveness to gold and commodities, and in line with history money cycled into the cheaper asset class, building into a process of momentum out of stocks and into commodities:

Source: Sharelynx.com

Fast forward to today and we are approaching levels where stocks are looking good value in relation to gold and commodities, and real estate is also approaching historic cheapness in relation to precious metals. This sets us up for a secular inversion in the next several years. But if this is to happen, then we first need to punch at least some holes in the 'story' for precious metals outlined above - inflation, currency dilution, intermittent negative real interest rates and financial and economic crises. Supply is not the real issue for precious metals - it is the trend in investment demand and whether this reverses.

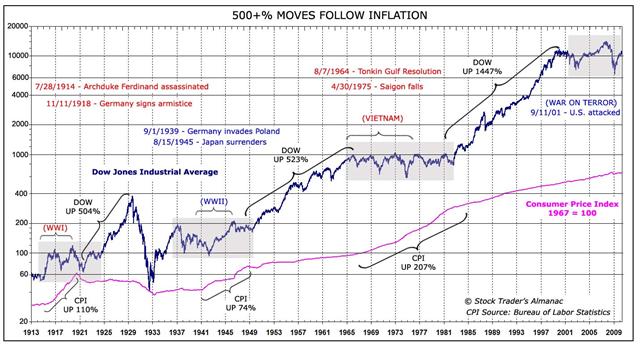

Well, inflation looks here to stay as it is permanent government policy and we will likely adjust to permanently ratched higher inflation rates. We will see interest rate tightening cycles in the West but it remains to be seen as to whether interest rates will lag inflation and remain negative. Currency dilution will also continue as debt levels are chased ever higher. HOWEVER, it is in the area of financial, economic and conflict crises that we can expect sustained improvement, as we enter a period of sustained growth based on expanded liquidity and new technology (AI, biotech, nanotech, renewable energy, space expoloration) and peace:

Source: Stock Traders Almanac

Recall that people, banks and governments do not want precious metals as real money, and central banks, corporations and individuals do not want to invest long term in gold and silver. The exit will therefore be crowded once we reach a combination of extreme relative cheapness for stocks and real estate compared to precious metals together with sufficient financial stability and economic growth, enabled by ongoing exponential technological evolution.

I make a case for why precious metals should make a parabolic final move in 2011-2012 in my article here:

http://amalgamator.co.uk/2011February1st.aspx

This would take us to that relative value extreme. Prices should then remain elevated for 2-3 years whilst a gradual secular inversion is made in which stocks take over in a new secular bull, and precious metals begin a new secular bear.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation / Site launch 1st Feb 2011

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.