Bullish Small Business Optimism Index and Opposing Views from the Fed

Economics / US Economy Feb 09, 2011 - 05:33 AM GMTBy: Asha_Bangalore

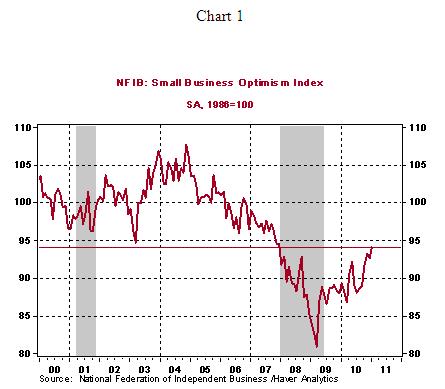

The NFIB survey results of small businesses for January 2011 point to an improved outlook. The composite index moved up to 94.1 in January from 92.6 in the prior month. The level of the composite index is close to the pre-recession reading of 94.4 in November 2007 (see Chart 1).

The NFIB survey results of small businesses for January 2011 point to an improved outlook. The composite index moved up to 94.1 in January from 92.6 in the prior month. The level of the composite index is close to the pre-recession reading of 94.4 in November 2007 (see Chart 1).

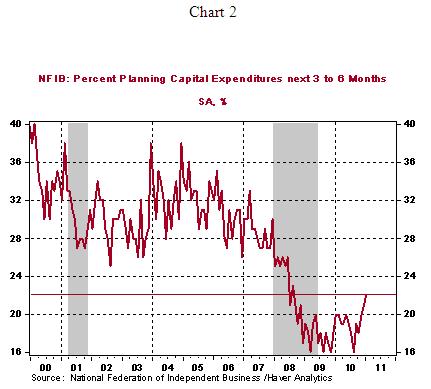

The percentage of respondents who noted that they are planning on capital expenditures rose to 22%, the highest since August 2008 (see Chart 2).

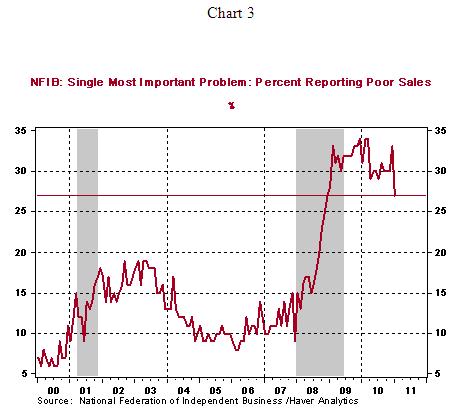

Fewer respondents indicated that poor sales were the single most important problem in January compared with February. 27% of the respondents noted that poor sales were their biggest concern, which is sharp drop from 33% in December. As shown in Chart 3, this is noticeable improvement in the outlook of small businesses. The improved optimism of small businesses, conveyed in this report, is consistent with other bullish reports of the past week.

Opposing Views from the Fed

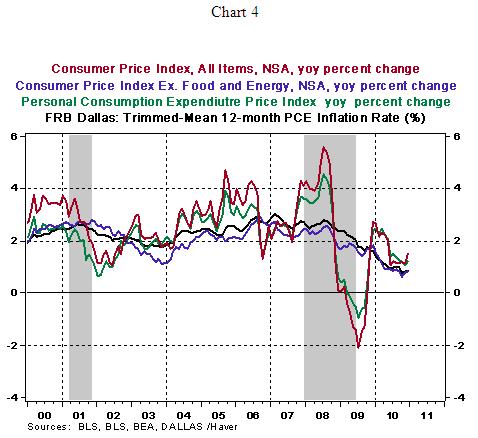

Prior to Chairman Bernanke's testimony tomorrow, Richmond Fed President Lacker and Atlanta Fed President Lockhart, both non-voting members of the 2011 FOMC, presented opposing views. President Lacker believes that inflation has probably bottomed out and noted that he sees a "significant risk" that higher energy and commodity prices will translate into higher overall inflation even though core prices remain contained. He also suggests a "revaluation" of the Fed's $600 billion program of purchasing Treasury securities as economic reports show notable improvements in the economy. At the same time, President Lockhart of Atlanta indicated that inflation is below the desired level of price stability. He stressed the difference between inflation and increases in the price level driven by individual items in price indexes such as food and energy. Inflation measures of the U.S. economy remain contained, for now (see Chart 4). President Fisher, a voting member, of the Dallas Fed presented an extremely concerned stance about the size of the Fed's balance sheet and emphasized that in the current economic environment, with reports indicating improving conditions, he would not support additional monetary accommodation of the Fed. In January 2011, he voted with the majority to maintain the current stance of monetary policy. In light of these opposing views, Chairman Bernanke's testimony on February 9 is eagerly awaited.

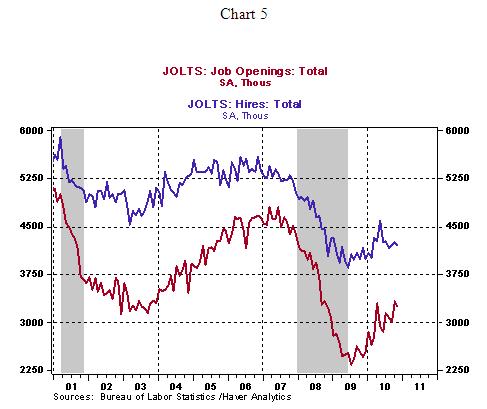

Job Openings and Hiring Remain at Troubling Levels

The number of job openings in November 2010 fell to 3.248 million from 3.328 million in the prior month. It is noteworthy that in December 2007, the number of job openings stood at 4.378 million. At the same time, the pace of hiring is also lower than on the eve of the recession (see Chart 5). These numbers beg questions about claims that structural unemployment is developing in the US economy.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.