Changing Perception of the U.S. Economy Food for Thought

Economics / Economic Recovery Feb 08, 2011 - 03:06 AM GMTBy: Asha_Bangalore

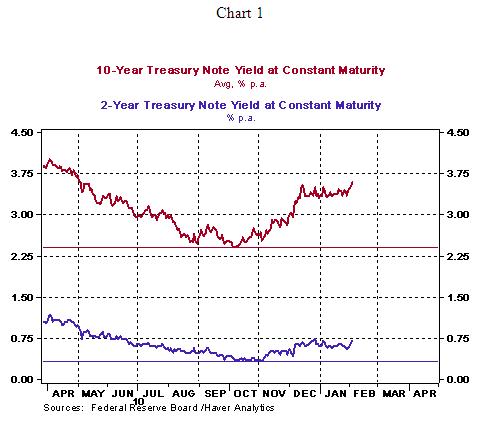

The 2-year Treasury note is trading around 0.78% today, from a low of 0.54% on January 28. The 10-year Treasury note yield has moved up to 3.67% from 3.36% in the same period (see Chart 1). The bond market essentially signals the U.S. economy is turning around and is most likely to establish sustained growth in 2011. A part of the bullish sentiment commenced after Bernanke's speech in the last week of August 2010 when the Fed signaled that a second round of support was on its way.

The 2-year Treasury note is trading around 0.78% today, from a low of 0.54% on January 28. The 10-year Treasury note yield has moved up to 3.67% from 3.36% in the same period (see Chart 1). The bond market essentially signals the U.S. economy is turning around and is most likely to establish sustained growth in 2011. A part of the bullish sentiment commenced after Bernanke's speech in the last week of August 2010 when the Fed signaled that a second round of support was on its way.

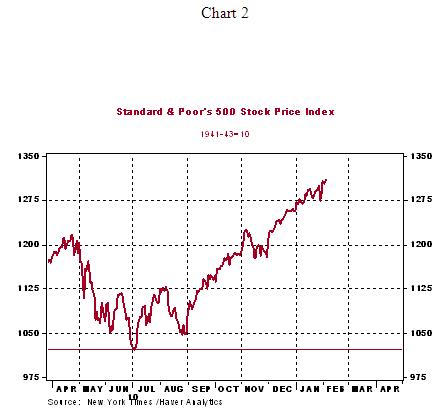

Equity prices have moved in tandem; the S&P500 was quoted at 1321 as of this writing, a solid gain of roughly 26% since a low of 1047.22 on August 26 (see Chart 2), the eve of Bernanke's speech about engaging in the second round of quantitative easing.

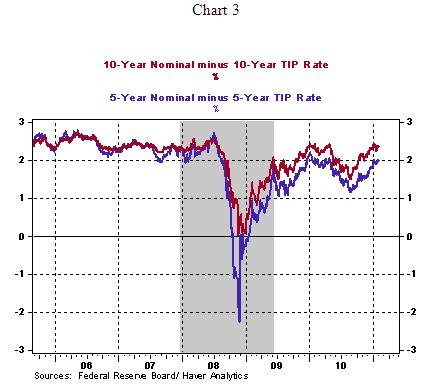

It is noteworthy that inflation expectations have moved up (see Chart 3) from lows in the summer of 2010. But, they are yet to surpass the levels seen prior to the onset of the crisis. Actual inflation measures also do not represent a threat.

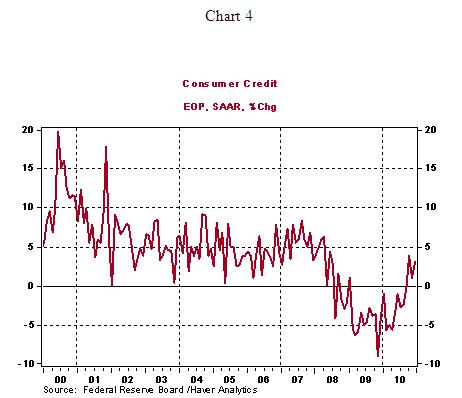

The latest consumer credit data indicate an increase in consumer borrowing for three consecutive months after posting declines in nearly every month since October 2008. This along with other economic reports - auto sales, consumer spending, ISM surveys, employment situation - are each pointing to improving economic conditions and behavior of financial market variables are consistent with these signals.

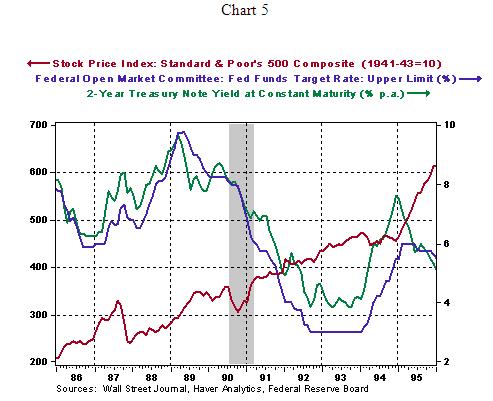

Against this background, the Fed is not expected to hit the monetary policy brake until 2012. What follows when the Fed embarks on a tighter monetary policy? The experience of post-1991 and post-2001 recoveries provides food for thought. The Fed raised the level of the federal funds rate from 3.0% to 6.0% rapidly from February 1994-February 1995 after holding it at 3.0% from September 1992. As shown in Chart 5, equity prices continued to advance but Treasury market rates began to decline by early-1995.

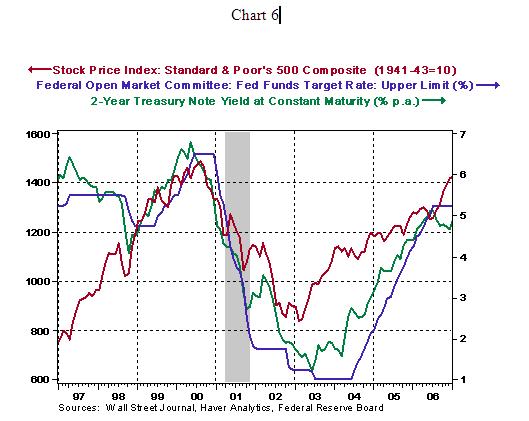

After the 2001 recession, the Fed held the federal funds rate at 1.00% from June 2003 to June 2005. The Fed raised the federal funds rate to 5.25% between June 2004 and June 2006. Once again, equity prices continued to advance but Treasury market yields peaked by July 2006.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.