Stock Market Bias Remains Bullish, But Resistance Ahead

Stock-Markets / Stock Markets 2011 Feb 07, 2011 - 09:05 AM GMTBy: Chris_Ciovacco

We head into the new week with some good news from the Middle East, Europe, and the United States. The bias on the Street remains positive, but from a strategy perspective we have potential resistance to contend with near 1,315 and 1,326 on the S&P 500. Below, we outline a possible approach for the week from a portfolio management perspective. Quick reads from this morning’s news capture the early tone for Monday:

We head into the new week with some good news from the Middle East, Europe, and the United States. The bias on the Street remains positive, but from a strategy perspective we have potential resistance to contend with near 1,315 and 1,326 on the S&P 500. Below, we outline a possible approach for the week from a portfolio management perspective. Quick reads from this morning’s news capture the early tone for Monday:

According to data compiled by Bloomberg, 72 percent of Standard & Poor’s 500 Index companies reported more revenue last quarter than analysts estimated, the largest proportion since at least 2006. Sales beat projections by an average 2.3 percent, the most in two years.

Talks between Egypt’s government and opposition parties eased pressure for the immediate departure of President Hosni Mubarak, helping the country’s financial system to return toward normality (Bloomberg story).

The highest yields on German short- term bonds in two years relative to Treasuries are boosting the euro, easing pressure on Chancellor Angela Merkel as Europe’s leaders consider expanding a rescue program to end the region’s debt crisis (Bloomberg Story).

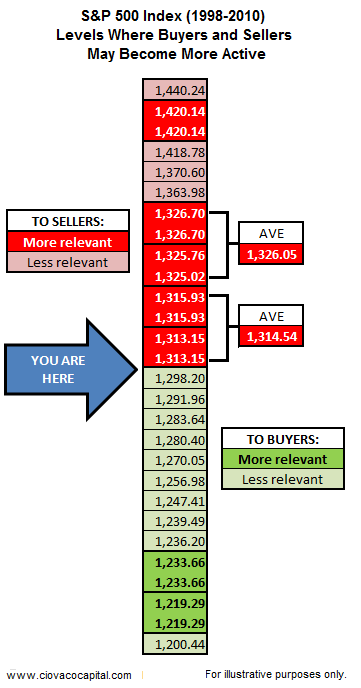

Below, we have provided an updated version of our S&P 500 support and resistance table, which was originally presented on January 6, 2011. Possible support and resistance levels mean little until we see how market participants behave once key levels are reached. Therefore, the levels outlined here represent a map in terms of where to pay attention. A high volume reversal near one of these levels would make us more apt to sit on cash and review areas to protect profits should the situation deteriorate further in the coming sessions.

A close above 1,326, especially on impressive volume and healthy breadth, would make us more likely to deploy some additional cash into the markets. We would review energy, including IEZ and XLE, agriculture, including DBA and RJA, semiconductors (SMH), and broad market, U.S.-focused ETFs (SCHB) as possible buy candidates this week.

Our comments from Friday (summarized below) still apply to our approach for cash and long positions:

In terms of strategy, the markets remain in a good position to hold longs that we added to or established roughly two months ago, including XLE, XLB, XLI, XLY, and IYW (see 12/05/10 ETF post). In the short-term, it is difficult to justify adding to long positions with potential S&P 500 resistance coming in near 1,313 and 1,326. Best case scenario for new cash would be to buy on an orderly pullback. If our technical models become overextended as outlined in yesterday’s post (see below), we would be more inclined to look to reduce risk from weaker positions, such as EEM. From where we sit, more information is needed prior to making any moves with our longs or cash. A pop in the U.S. dollar (see below) would also add to our short-term hesitation to deploy new cash. The S&P 500 and market breadth can help us manage all our positions, including those mentioned in this paragraph.

Table below updated as of Friday’s close:

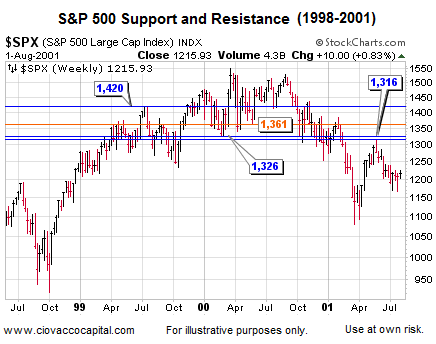

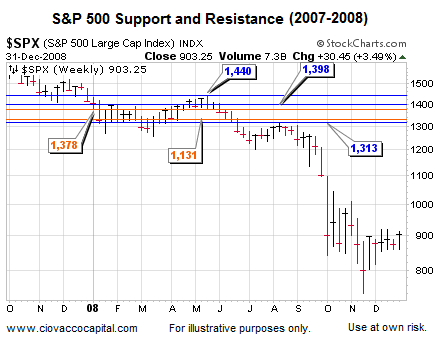

The charts below allow you to see the relative importance, in the minds of market participants, of the key areas to watch. The more prices congregate or cluster around a given area the more relevant it is to today’s market.

Another thing to look for is areas where sharp reversals took place in the past. Reversal resistance, where the intermediate-term trend changed in the past (for a few weeks), is much more important than ‘pause resistance’, where the prevailing trend was simply slowed, but remained intact. On the right side of the chart above, notice how the market advanced for five weeks, but was turned back at 1,313; that is an example of ‘reversal resistance’. The sharper and longer the reversal, the more we should pay attention to the level where the reversal took place.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.