How to Buy a Vacation Home with Silver

Commodities / Gold and Silver 2011 Feb 04, 2011 - 02:53 PM GMTBy: Jeff_Clark

For most people, there are some surefire luxuries that signify wealth, a few pearls of conspicuous consumption that say you've made it. For me, it's always been a second home. My grandparents owned a vacation home in Arizona and then Florida when I was a kid, and it was an annual highlight to travel there every year.

For most people, there are some surefire luxuries that signify wealth, a few pearls of conspicuous consumption that say you've made it. For me, it's always been a second home. My grandparents owned a vacation home in Arizona and then Florida when I was a kid, and it was an annual highlight to travel there every year.

But something happened on the way to my generation's version of the American dream. Of all the people I knew that had second homes, only one acquired it through their own hard work and success. The rest inherited them.

With high unemployment, shaky business conditions, desperate governments, weak real estate demand, and a suspect stock market, owning a vacation home is not even on the radar these days for most Americans. Paying their existing mortgage is the primary concern, something millions of homeowners still aren't able to do. So, how is it that I can suggest a way to buy a vacation home in these conditions?

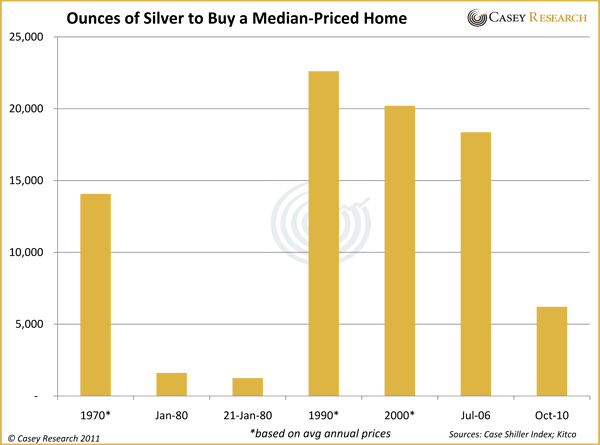

Because there are two trends in motion that I believe will continue working in our favor. And it likely won't take long for them to reach a culmination point, allowing those of us with such a goal to see it realized. The chart below will give you an eye-opening visual of my claim.

First, real estate. For those of you who have a glass-half-full prognosis for the near future of real estate, I'd like to challenge an assumption you may be making; namely, that real estate prices rise in an inflationary environment. While the massive amount of quantitative easing and buying of mortgage-backed securities will likely put a floor under prices, it's the black swan of rising interest rates that could derail any significant recovery.

Once rates start climbing, home-buying will become more unaffordable, keeping demand low, especially when the starting point is a million-plus hangover of vacant houses. And if mortgage rates return to the 12-14% levels we saw in the last big inflationary period of the early '80s (they peaked at 18% in 1982), real estate prices aren't going anywhere but down in real terms. They may rise in nominal dollars, but after accounting for inflation, they'll still lose ground. Your half-full glass might not get filled for a long time.

Second, hard assets. The amount of money being created from nothing and thrown at our problems right now is unprecedented in history, so inflation is a when question, not an if one. This process can and will result in a devalued currency unit, and a direct beneficiary of that is rising precious metal prices.

In real terms, real estate will go down, precious metals will go up.

It's interesting to look at this trend with gold, but it's absolutely fascinating when you plug in the numbers for silver. Not only may silver outperform gold before this is all over, but silver is more "affordable" to the masses.

Take a look at how many ounces of silver have been needed to buy a median-priced home in the U.S.

In 1970, it took 14,067 ounces of silver to buy a median-priced U.S. home ($23,000). By January 1980, it had dropped all the way to 1,603 ounces, based on silver's average price that month of $38.80. The ratio bottomed at 1,258 at silver's record high of $49.45 (London PM Fix) on January 21. (We can argue later how much of that spike was due to the Hunt Brothers hoarding of the metal, but I will point out that gold and silver peaked on the very same day, implying the same forces were influencing both).

The ratio peaked in 1990 at 22,616 due to silver's average price that year of only $4.06, and was still at 18,365 in July 2006, the pinnacle of the real estate boom. However, look what happened to the ratio in the four years and three months since: it's dropped 66.1%, to 6,213.

You may think the ratio won't fall further since it's already declined 69.2% in the last ten years. But I would point out that it collapsed 88.6% during the 1970s - and that was amid a 170% rise in home values! Only economists on government-laced Kool-Aid could fathom home prices rising that much over the next decade.

All this adds up to one thing: the number of ounces of silver to buy a median-priced home at some point in the near future will likely fall below 2,000. And given the unrelenting abuse to fiat currencies, it's very possible it could hit a measly 1,000 ounces. Now that's affordable.

The fine print, of course, is that you actually sell when the silver price is high, and that you pay the tax on the gain from another source. But I would argue that even a modest budget could come up with a few extra ounces to offset the tax bill.

Think silver is too volatile to use as a savings vehicle? The price fluctuates, no doubt, but ask yourself this: if you were to put ten grand into a savings account and another ten into silver, which asset will have more purchasing power five years from now? Even with the savings account earning interest, you'd be able to purchase much more with the stash of silver when you go to spend the proceeds.

Doug Casey is insistent real estate hasn't bottomed because we're on the cusp of a depression. I'm convinced the silver price won't be stopping when it hits $50. If we're right about these trends, that million-dollar vacation home you spotted on Nag's Head five years ago could be had for less than 2,000 ounces of silver.

Vacation home, here I come.

Are you convinced your portfolio is properly positioned to benefit from the rise in precious metals? Now that China, Russia and other countries are getting ready to dump the dollar, gold and silver prices are poised to go to the moon. To learn how you can profit, click here.

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.