Gold and Silver Gain on Catastrophic” Implications for U.S. Economy if $14.3 Trillion Debt Ceiling Not Raised

Commodities / Gold and Silver 2011 Feb 04, 2011 - 06:57 AM GMTBy: GoldCore

Gold and silver have given up a small bit of yesterday’s strong gains in all currencies (especially the euro – see chart below) but are up more than 1% and 3% respectively on the week. Asian equity indices were higher overnight and are higher for the week, except for India where there are growing concerns about surging inflation and interest rates. European indices are higher today and most are up by some 1.5% to 2% on the week – as are US indices.

Gold and silver have given up a small bit of yesterday’s strong gains in all currencies (especially the euro – see chart below) but are up more than 1% and 3% respectively on the week. Asian equity indices were higher overnight and are higher for the week, except for India where there are growing concerns about surging inflation and interest rates. European indices are higher today and most are up by some 1.5% to 2% on the week – as are US indices.

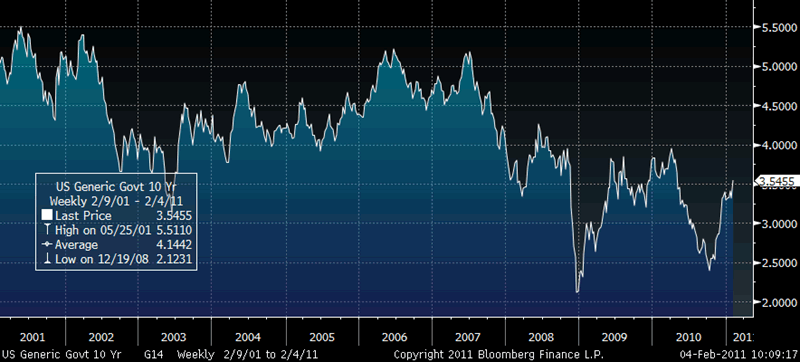

US Government 10 Year Bond – 10 Year (Weekly)

Government bond markets continue to creep higher with the benchmark 10 year yields in the UK, Germany and US rising 3.53%, 2.6% and a substantial 6.8% respectively just this week. The rise in the US 10 year is one of the biggest market movements this week and bears watching as it appears to be breaking out above resistance at 3.5% (see chart above). So too does the US 30 Year treasury which has risen to 4.66%, meaning the 30 year yield is 2.76% higher just this week.

Ben Bernanke warned yesterday that not hiking the debt ceiling could put the US “into a position of defaulting on its debt and the implications of that, for our financial system, for our fiscal policy, for our economy, would be catastrophic.” This would obviously have a negative impact on paper assets denominated in dollars and other fiat currencies.

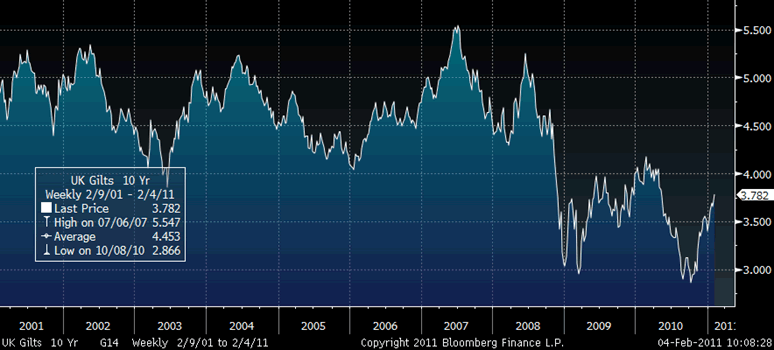

While US bonds are weaker this week, German and UK bonds have fallen more sharply so far in 2011 with yields rising 9.3% and 11.5% respectively.

UK Government 10 Year Bond – 10 year (Weekly)

The scale of commodity price increases and growing inflation internationally will likely see US government bonds continue to come under pressure and the US may take further steps to monetise their massive liabilities, thereby further debasing the US dollar. Other developed nations face similar fiscal and monetary challenges, and their bond markets and currencies similar risks.

Copper, wheat and rice are up 3.9%, 4.4% and 8% respectively this week alone and so far in 2011, they are up 2.3%, 8% and 13.3%.

Markets will watch Egypt today and the instability in Egypt and the Middle East is contributing to higher oil prices with NYMEX crude up 1.8% and Brent crude up 2.54% this week.

The National Inflation Association reported overnight that wheat prices are up 100% since June and warned that food and energy price inflation could lead to food riots spreading from Egypt across the world and even to the US by 2015. They believe that this is a further sign that massive inflation and potentially hyperinflation is coming in the coming months and years.

All eyes will be on the US Non Farm payrolls number today and whether the tentative economic recovery continues to be jobless. Given the scale of hedonic adjustments and manipulation of the methodologies of calculating the unemployment figures, the numbers are somewhat dubious and not wholly reliable.

Baltic Dry Index – 5 Year (Daily)

A far more important measure of the health of the global economy is the Baltic Dry Index which measures international dry-bulk commodity-shipping costs and is seen as an excellent proxy for global trade and thus the health of the global economy (see chart above). After a massive collapse, from nearly 12,000 to 666 in December 2008, it subsequently recovered somewhat in 2009. It then gradually fell in 2010 and it is down 8% this week alone and 41% so far this year.

The continuing fall in the Baltic Dry Index strongly suggests that the global economic recovery is not as robust as claimed and that we may be on the verge of a double-dip recession and a bout of stagflation – possibly a severe one.

Gold’s price surge yesterday was likely a combination of short covering, the very bullish demand figures out of China, accommodative monetary policy sounds from Trichet and Bernanke. The geopolitical situation in Egypt and the Middle East likely also led to buying.

Gold was particularly strong in euros and surged from EUR 962 to over EUR 994 in minutes. The ECB’s ultra-accommodative monetary policy continues and the EBC is losing credibility regarding inflation. Also, the very survival of the euro, as we know it today, in the coming years continues to be in doubt.

Gold in Euros – 10 Day (Tick)

Former United States ambassador to the United Nations, John Bolton's comments that Israel should bomb Iran if Mubarak falls has not got much attention. While Bolton’s neo-conservative politics are out of favour in the current White House, his hawkish views would be shared by some in the Pentagon and intelligence agencies.

GOLD

Gold is trading at $1,349.65/oz, €990.50/oz and £837.62/oz.

SILVER

Silver is trading at $28.90/oz, €21.21/oz and £17.94/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,836.35/oz, palladium at $813/oz and rhodium at $2,450/oz.

NEWS

(Dow Jones)-- PRECIOUS METALS: Gold Eases In Asia; Egypt Situation In Focus

Gold fell a little while trading in a narrow range in Asia Friday, in a regional market thinned by Lunar New Year public holidays in many countries, but holding most of the gains put on overnight after U.S. Federal Reserve Chairman Ben Bernanke effectively underscored a continued easy money policy.

At 0520 GMT, spot gold was bid $1,351.40 a troy ounce, down $4.20 from Thursday's New York close, towards the lower end of the day's trading range thus far of $1,350.30 to $1,355.55. Tocom December gold rose Y51 to Y3,560 a gram.

Technically, gold has bounced off a key target area around $1,320, said Jonathan Barratt, Managing Director of Sydney-based Commodity Broking Services; for the past two days the firm has been urging clients to take long positions.

But other issues are also supporting gold, he said, adding that the crisis in Egypt could be worsening, and is now a flight-to-quality story for gold.

(Bloomberg) -- Gold May Gain on Physical Buying, Political Unrest, Survey Shows

Gold may advance as this year’s drop boosts physical purchases and political tensions in the Middle East spur demand, a survey found.

Thirteen of 24 traders, investors and analysts surveyed by Bloomberg, or 54 percent, said the metal will rise next week. Eight predicted lower prices and three were neutral. Gold for April delivery was down 0.6 percent for this week at $1,334 an ounce at 11:15 a.m. yesterday on the Comex in New York.

Gold declined in January for the first month since July, and has dropped 6.9 percent since setting a record $1,432.50 in December. Protesters have clashed with supporters of Egyptian President Hosni Mubarak this week as the political turmoil that has engulfed the Middle East the past month spread to Yemen.

(Bloomberg) -- CME Raises Margins for Silver, Copper, Platinum After Today

CME Group Inc. raised margins for silver, copper and platinum, effective after the close of business today, the exchange said in a statement on its website.

(Bloomberg) -- Investors Treat London Luxury Homes Like Gold: Chart of the Day

London luxury homes act more as a haven for wealth than other types of real estate and have more in common with gold, according to Savills Plc.

The CHART OF THE DAY shows how the number of sales of central London homes costing more than 5 million pounds ($8 million) follows a similar pattern as the three-month percentage change in gold prices.

“It’s as much about storing wealth as it is about real- estate investment -- the way that gold behaves,” said Yolande Barnes, head of residential research at the London-based property broker.

Overseas investors currently account for 60 percent of buyers of high-end homes in central London compared with about 40 percent in 2009, Savills estimates. Russians are the biggest group, with 20 percent of all purchases.

Prime residential properties in the city appreciated by about almost 5 percent last year, Savills estimates. Average values for homes across the U.K. dropped 3.4 percent, according to an index released on Jan. 10 by Halifax, the mortgage-lending arm of Lloyds Banking Group Plc.

(Bloomberg) -- Gold Futures Rise as Much as 1.8% on Signs of Mideast Tensions

Gold rose as much as 1.8 percent on signs of escalating tensions in the Middle East.

The Muslim Brotherhood movement denied calling to revoke Egypt’s peace treaty with Israel and said the country’s parliament has the right to review the pact if the people want. Mohamed Saad El-Katatni, a member of Muslim Brotherhood’s top executive body, spoke in a phone interview today.

Gold futures for March delivery reached $1,355.80 an ounce on the Comex in New York, the highest in two weeks.

(Wall Street Journal) -- Old Yeller! Gold Jumps on Egypt, Big Ben

Gold seems to have snapped out of its funk today.

On the Comex, gold rose for the second time in three days, adding a solid $20.80, or 1.6%, to $1352.30. Cousin Silver also added 1.5% to $28.7330, its fourth increase in five sessions.

The events in Egypt are certainly helping the dark-hearted goldbugs gather more adherents. Chaos is, umm, golden to them. But perhaps more important than the violence in Egypt, the big central bankers unexpectedly released a dole of doves today despite more signs of the recovery improving.

Jean-Claude Trichet, head of the European Central Bank, has recently associated himself with concerns about incipient inflation. Earlier today, however, after the ECB policy meeting he stressed that the ECB isn’t about to raise short-term rates anytime soon.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

reverted to trend

07 Feb 11, 06:13 |

baltic dry

reverted back to trend 2006? So your comparison is invalid..search the chart on google finance? 10yr etc. |