Are US Interest Rates Going to Fall on Wednesday? The Markets Certainly Thinks So

Interest-Rates / US Interest Rates Oct 30, 2007 - 08:01 AM GMTBy: Donald_W_Dony

When the last Fed rate cut occurred, it set off a rapid chain reaction in all of the four markets; currencies, commodities, bonds and stocks. For example, the Canadian dollar jumped to par with the U.S. greenback, gold broke out of its 12-month consolidation, U.S. bonds reversed their three year slide and utilities started to climb again. Will the Fed cut the rates again at the next meeting on Wednesday? The markets are certainly suggesting that.

When the last Fed rate cut occurred, it set off a rapid chain reaction in all of the four markets; currencies, commodities, bonds and stocks. For example, the Canadian dollar jumped to par with the U.S. greenback, gold broke out of its 12-month consolidation, U.S. bonds reversed their three year slide and utilities started to climb again. Will the Fed cut the rates again at the next meeting on Wednesday? The markets are certainly suggesting that.

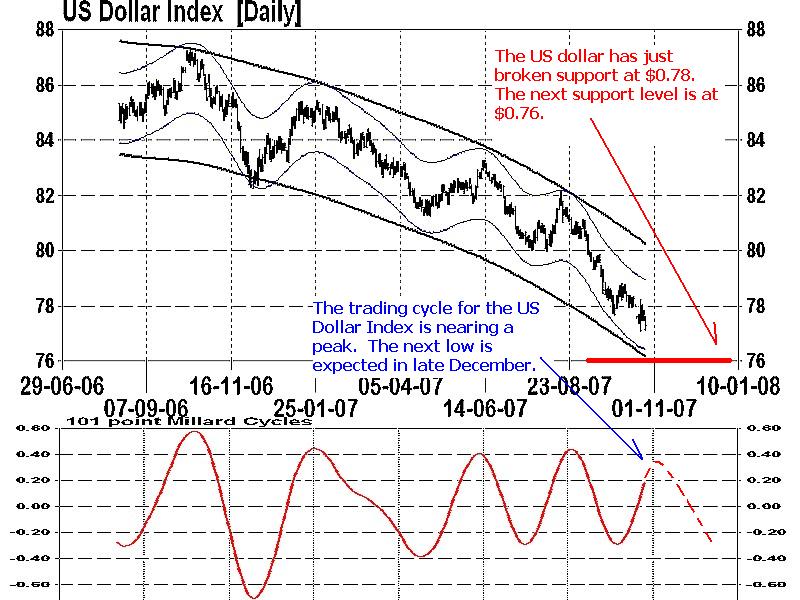

After the last Fed rate cut in September, the U.S. dollar (chart 1) plunged below $0.80 for the first time in over 30 years. In October, the currency has found brief support at about $0.78. However, in recent weeks, the U.S. greenback has been displaying increasing weakness. Technical models suggest additional downward pressure can be anticipated by year-end and a new low is expected in late December with $0.76 as the target.

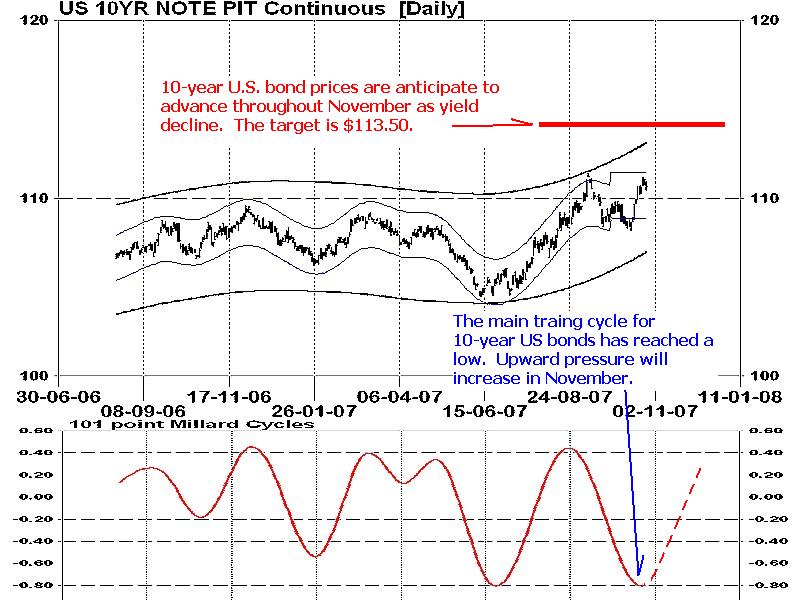

The movement in bonds is often a forecast of the direction of the Fed. A hawkish approach by the FOMC often sees bond prices retreat just before important meetings. Conversely, the expectations of lower rates will bond prices firm. In chart 2 of the 10-year U.S. Treasury bonds, technical evidence indicates growing strength throughout September and October as bond prices stabilize above $108.50. In the lower portion of the chart, the 8-week trading cycle has reached a low in late October. Increasing upward pressure can be anticipated in November.

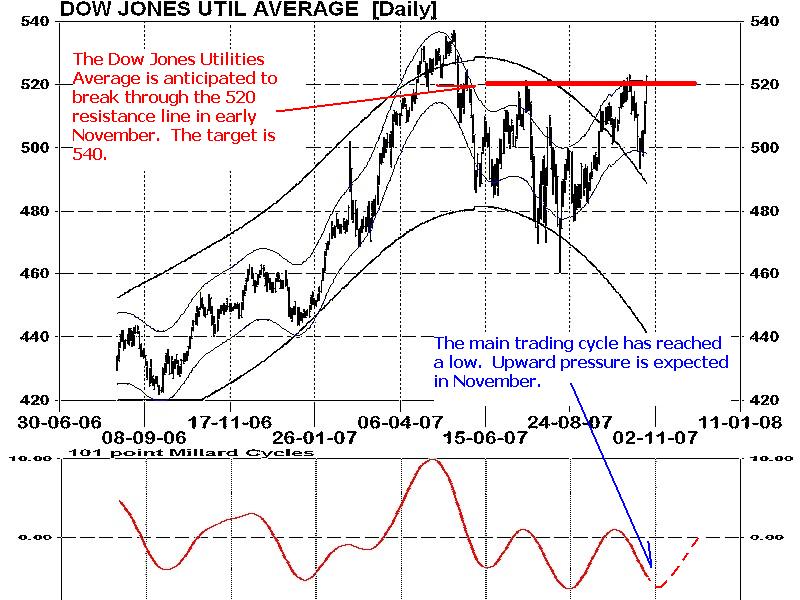

Utilities are the most interest rate sensitive equity sector. Due to their fixed income leverage, this group of stocks often moves with anticipation of rate adjustments. In chart 3 of the Dow Jones Utilities Average, recent market action has pushed this sector back up toward the resistance level of 520 again. New buying pressure and technical evidence in late October supports expectations of additional advancement. Projections place the first target at 540.

Bottom line: The continuing downward slippage of the U.S. dollar, through on going fundamental weakness and interest rate reductions, will effect many elements in the four markets. The first response of a lower USD will equal higher numbers for many global currencies. With the USD at $0.76, the CDN dollar should be at $1.05, the AUS dollar at $0.95 and the Euro at $146.50.

Lower values for the U.S. currency also points to higher gold prices. As increasing downward pressure is expect for the dollar over the next 6-8 weeks, gold has an upper target of $800-$820 by year-end.

More information on intermarket analysis is available on www.technicalspeculator.com and in the monthly subscription-based research reports.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.