Is the Stock Market Making a Major Top?

Stock-Markets / Stock Markets 2011 Feb 03, 2011 - 12:22 PM GMTBy: Chris_Ciovacco

With the often misused term “overbought” being thrown around regularly on Wall Street these days, it is a good time to take a step back and assess the odds of a new bear market rearing its ugly head from current conditions.

Some on Wall Street make decisions based on economic fundamentals; some use technicals, and others use both. In terms of helping discern between favorable market conditions and unfavorable market conditions, fundamentals and technicals are both important. Bull markets tend to have favorable fundamentals and technicals backing them. Bear markets almost always are associated with weak or negative economic growth and corresponding weakness in the technical state of the markets.

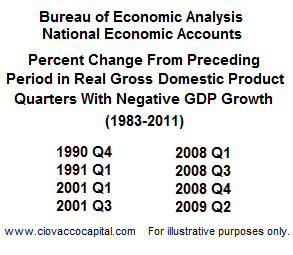

From a fundamental perspective, experienced investors know the periods shown below were less than friendly in terms of returns. Stocks tumbled in July of 1990. Bear markets were wrapped around economic weakness in 2001, 2008, and 2009.

Do we have fundamental conditions in place to suggest a major stock market top is around the corner? Said another way, is there a realistic chance of negative GDP growth occurring in the next several quarters? The Wall Street Journal’s annual survey of the best economic forecasters produced favorable responses on the economy’s prospects in 2011. Similar upbeat results are contained in the latest Blue Chip Economic Indicators survey. The consensus in both surveys is that the economy will grow by at least 3% this year; hardly what we would expect to usher in a new bear market. We do respect (a) forecasting is difficult, and (b) things can change over the next few months, but for now the fundamental outlook remains bullish.

With the Obama Administration looking to increase exports, the recent acceleration in manufacturing activity was encouraging. In the latest ISM survey, the PMI composite index rose 2.3 points to 60.8, the highest level since May 2008. Economists expected a slight decline to 58.0. A 5.8-point jump in new orders to 67.8 represents the best level in seven years. Employment increased 2.8 points to 61.7, the highest reading since the spring of 1973.

Recent data also points to more responsible lending practices in the housing market. According to Freddie Mac, cash-in deals rose 11 points to 46% of all refinancings in Q4, the highest share since data began in 1985. Cash-out deals fell to a record low 16% of refinancings.

Some hints of an improving labor market have surfaced in 2011 as well. Online help-wanted postings jumped a record 11.4% in January 2011, representing the best level since the summer of 2007. New help-wanted postings jumped 16.1% (best since July 2008). Historically, these figures align well with employment gains in the coming months.

If the fundamentals do not align with the onset of a new bear market, what about the technicals? We cover that side of the ledger in Is The Stock Market Extremely Overbought?

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.