Chinese Gold Demand 'Enormous' and 'Unbelievable'

Commodities / Gold and Silver 2011 Feb 03, 2011 - 09:10 AM GMTBy: GoldCore

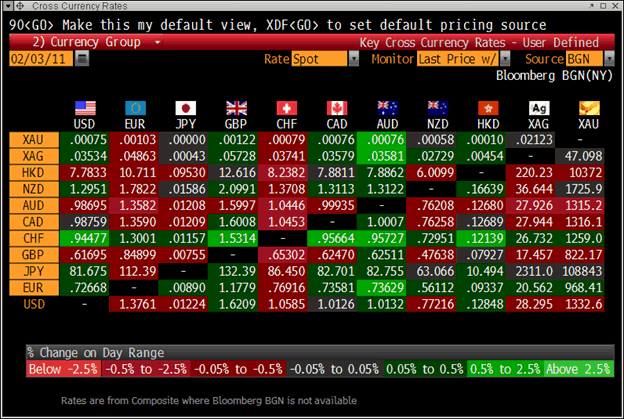

The Swiss franc and the euro are weaker today and marginally lower against gold. Asian equity markets were higher (except for a 0.25% fall in the Nikkei) but European indices are more hesitant this morning. Greek, Italian and Spanish debt markets have seen yields creep slightly higher this morning.

The Swiss franc and the euro are weaker today and marginally lower against gold. Asian equity markets were higher (except for a 0.25% fall in the Nikkei) but European indices are more hesitant this morning. Greek, Italian and Spanish debt markets have seen yields creep slightly higher this morning.

Cross-Currency Markets

Gold and silver have fallen marginally this morning. It is too early to tell whether the paper-driven sell off is over and some western buyers will wait for a higher weekly close. This is not the case in much of Asia where physical demand remains very robust and jewelers and investors are buying the dip. In India, this was seen in the strong Indian ex-duty premiums (AM $.5.36, PM $2.77) for gold yesterday.

The scale of Chinese demand continues to surprise some analysts and dealers. Growing Chinese demand over a period of years and China supplanting India as the largest importer of gold in the world, is what we have said was likely to happen for some time. Data shows China importing 209 tonnes of gold the first 10 months of last year, versus 333 tonnes for India for the whole year.

Many market participants tend to focus on the daily fluctuations and “noise” of the market and not see the ‘big picture’ major change in the fundamental supply and demand situation in the gold and silver markets – particularly due to investment and central bank demand from China and Asia.

The Financial Times reports that precious metals traders in London and Hong Kong were stunned by the strength of Chinese buying in the past month. “The demand is unbelievable. The size of the orders is enormous,” said one senior banker, who estimated that China had imported about 200 tonnes in three months.

The important fact that the Chinese people were banned from owning gold from 1950 to 2003, means that the per capita consumption of over 1.3 billion people is rising from a tiny base, is not realised by most. While the increase in Chinese demand has been very significant, it is likely to continue and the demand is sustainable due to Chairman’s Mao’s half-century gold ownership ban.

Should the Chinese economy crash, as some predict, demand could fall. However, sharp declines in Chinese equity and property markets and problems with the yuan would likely lead to significant safe haven demand.

UBS reports that “many refiners report a backlog of Chinese orders to fill, which suggests that the January buying was not solely for the festive season...the prospect of renewed impressive demand once China returns, should continue to support gold." UBS also reports that while speculative shorts on the COMEX are at a 5 and half year high, there remains "elevated physical demand” and this “usually signals an impending bottom in price."

Also of note is that “gold forward rates have tightened across the curve, with one-year borrowing rates 12bp lower since last Thursday. This is due to a steep increase in physical demand, and to less lending in the market.”

The physical gold bullion market is becoming less liquid, strongly suggesting that we could be close to the bottom in this sell off.

GOLD

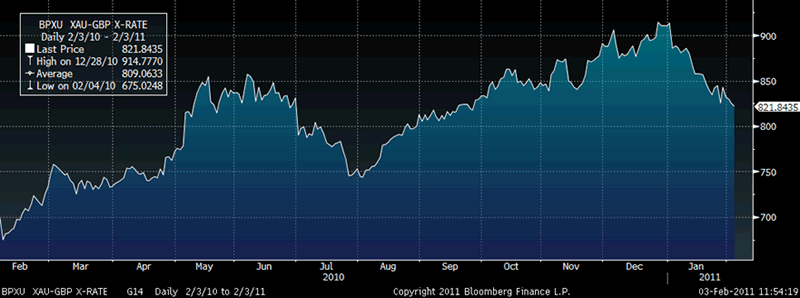

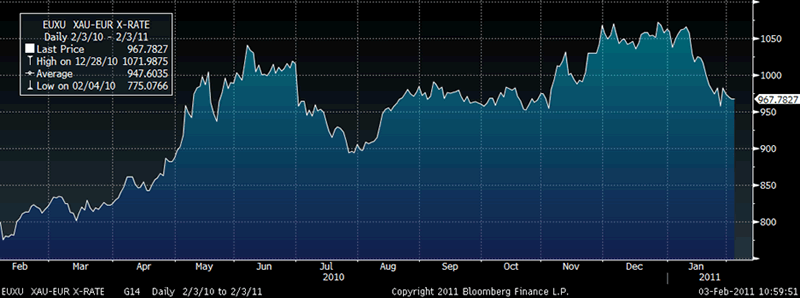

Gold is trading at $1,825.50/oz, €966.50/oz and £820.78/oz.

SILVER

Silver is trading at $28.25/oz, €20.53/oz and £17.43/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,825.50/oz, palladium at $804.50/oz and rhodium at $2,450/oz.

NEWS

(Bloomberg) -- New Year gifts help put China on track to become top gold consumer

China imported about 200 metric tons of gold in three months leading to the Chinese New Year, helped by consumers giving bullion gifts instead of cash for the holiday, the Financial Times reported, citing an unidentified banker.

The premium for physical gold over London prices has dropped to about $4 an ounce today, from as much as $20, the newspaper said.

(Bloomberg) -- Gold Drops for Second Day as Recovery Curbs Investment Demand

Gold declined for a second day on expectation that an economic recovery will erode the allure of the precious metal as an alternative investment amid concerns of rising inflation and escalating protests in Egypt.

Spot gold fell as much as 0.3 percent to $1,331.50 an ounce before trading at $1,332.68 by 3:04 p.m. in Tokyo. Bullion has lost 6.2 percent this year. Holdings in gold-backed exchange- traded products fell to the lowest level since June.

(Bloomberg) Tokyo's gold vending machines vie for attention with drinks and lingerie

Makishi Rokugawa says he's installing the first gold vending machines in central Tokyo so Japanese consumers can invest in "something real".

Space International Ltd, a company started by Rokugawa with funds from selling novelty USB flash drives, is offering gold or silver to the world's biggest vending machine market, where consumers can buy anything from drinks and candy to lingerie and fortune-telling printouts.

In a nation where deflation has cut consumer prices for 21 straight months through November, salaries are the smallest since 1990, bond yields are the world's lowest, and the stock market is 40pc below its December 1989 peak, "ordinary Japanese need a way to invest in something they can touch", Rokugawa (35) said yesterday at a media conference.

"What if you wake up one day and your money is just a piece of paper?" Rokugawa asked reporters at the $410-a-night Imperial Hotel, where he plans to place a second gold vending machine after putting one in his Tokyo office building. Rokugawa plans to take his business "nationwide" next year and is considering entering the Hong Kong market, he said.

The machine offered 1 gram of gold for 6,800 yen ($82.30) yesterday. Gold traded at $1,362.45 per troy ounce at 10:52 a.m in Tokyo, or about $44 a gram.

The vending machine sells the precious metal in the form of coins and ingots, with weights ranging from a gram to a quarter of an ounce.

Japan has a vending machine for every 32 people, according to Bloomberg calculations. The nation posted 5.15 trillion yen in vending machine sales in 2009, about 45pc more than the$42.9bn revenue in the United States, according to the Japan Vending Machine Manufacturers Association.

Germany's Ex Oriente Lux AG, which says it was the first to install a gold-vending machine, operates 11 machines domestically and five abroad, including in Spain and Italy. TG- Gold-Super-Markt installed its first gold bar vending machine at Frankfurt Airport in June 2009, while a similar machine was unveiled at Abu Dhabi's Emirates Palace hotel in May, 2010.

The most expensive item available in Rokugawa's machine yesterday was a quarter-ounce gold coin issued by the Canadian central bank, retailing for about $410. Rokugawa declined to say how much gold would be kept in the machine at any one time.

Prices will be updated once a day and relate to the gold market price, Rokugawa said. Gold for immediate delivery has gained in each of the last 10 years, rising 30pc in 2010.

The metal's biggest one-day jump in the last 12 months was 3.3pc and the biggest decline was 4.1pc.

Silver coins will range from 15.5 grams to 62.2 grams, or 2 troy ounces, in weight, according to the company's catalogue distributed at the opening event.

Precious metal coins from the central banks of China, Australia, and Canada will be on offer, the catalogue showed.

Rokugawa may expand the business to platinum and other precious metals in time, he said.

The entrepreneur said he was encouraged by the gold-vending business in Europe, which has seen client numbers climb since introduction in 2009.

Ex Oriente Lux, which makes bullion vending machines under the "Gold to Go" brand, said in September it planned to more than triple the number of the devices in operation. The company, which is based in Reutlingen in Germany is selling gold bars and coins weighing from 250 grams (8.8 ounces) to as little as 1 gram and updates the price of bullion every 10 minutes. (Bloomberg)

(Reuters) -- Platinum 'resilient' despite gold, oil selloff

NYMEX platinum and palladium futures diverged in Wednesday trading, with palladium slipping more than $9, but platinum inching up despite pressure from price drops in market drivers gold and crude oil. Platinum for April delivery, the active month, settled at $1,828.60/oz, up $4.40 from Tuesday's settlement, and was trading at $1,838/oz at 328 p.m. EST (2028 GMT), after achieving an earlier high at $1,840/oz and coming off a session low at $1,824.90/oz. On the other hand, March palladium settled at $810.55/oz, down $13 from Tuesday's settlement, but it recovered in after-hours trading and was changing hands at $815.90/oz at 328 p.m. EST (1528 GMT). It had earlier reached an intraday high of $828.75/oz. "Platinum was very resilient today," a trader told Platts, in the face of pressure from a technical selloff in gold and crude oil. NYMEX March crude futures pared earlier gains and were 13 cents lower at $90.64/barrel midday Wednesday after the US government reported US crude stocks at the NYMEX delivery point at Cushing, Oklahoma, hit an all-time high.

(Bloomberg) -- Turkey Gold Imports 11.12 Tons in January, Exchange Data Show

Turkey’s gold imports reached 11.12 metric tons in January, the biggest monthly figure since July, the Istanbul Gold Exchange said in a report on its website. The country imported no silver in January, the data show.

(Editors note: Rather than no silver whatsoever being imported it is likely that the data provided to Bloomberg was incorrect).

Happy Chinese New Year in the Year of the Rabbit (Kung Hei Fat Choi)

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.