Egypt Million Man March Leaves U.S. Stock Market Vulnerable Short-Term

Stock-Markets / Stock Markets 2011 Feb 01, 2011 - 03:54 AM GMTBy: Chris_Ciovacco

Since large institutional investors (hedge funds, pension funds, sovereign wealth funds, etc.) are the primary drivers of asset prices, it pays to keep an eye on them. The market’s ‘big boys’ seem to be focused on this Dow Jones News Service report:

Widespread anti-government protests in Egypt have lifted crude prices sharply higher the last two trading sessions. On Monday, protesters called for a general strike and said they planned a “million man march” Tuesday to mark one week since the start of the upheaval. Though Egypt is not a major oil producer, the continued protests stoked fears that shipping traffic at the Suez Canal, a key energy transit route, could be interrupted or that the unrest could spread to major oil producers elsewhere in the region.

Our guess is a “million man march” has the potential to turn into a violet scene on Tuesday. Large market players seem to agree as they basically have sat on the sidelines as of 2:50 p.m. ET. Trading volume is down approximately 27% vs. the same time on Friday on both the NYSE and NASDAQ.

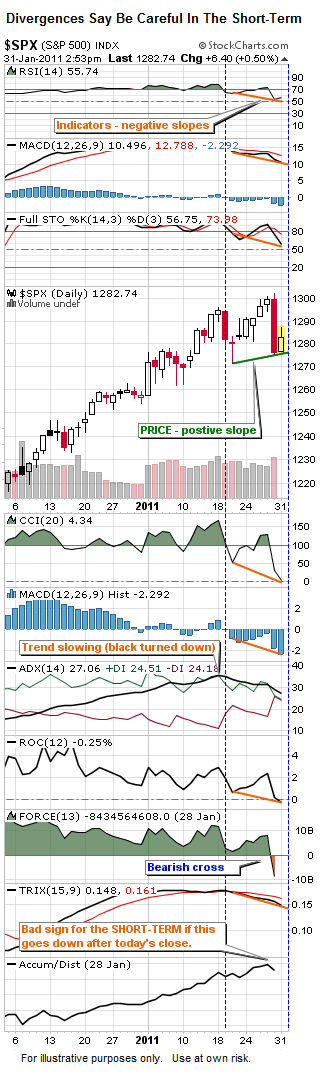

From a technical perspective (another way to track big market players), the S&P 500 is flashing several short-term bearish divergences. Compare the slope of the green line for price to the slopes of the orange lines in the indicators. The orange slopes show a market that is still susceptible to selling in the short-term. These conditions can be easily cleared, but they should not be ignored.

The market may find its footing soon, but we prefer to be patient with any cash. We will also maintain a watchful eye on our holdings until the technical weakness shown above is no longer present.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.