Dow Jones Stock Market Index Reverses at 12,000 Target, Correction Starts

Stock-Markets /

Stock Markets 2011

Jan 31, 2011 - 12:21 AM GMT

By: Nadeem_Walayat

The Dow achieved the long standing limit target of 12,000 early week and afforded traders / investors plenty of opportunity to bank profits on the rally to Dow 12k that began late November that can only be described as market trending higher on autopilot with very little reaction against it.

The Dow achieved the long standing limit target of 12,000 early week and afforded traders / investors plenty of opportunity to bank profits on the rally to Dow 12k that began late November that can only be described as market trending higher on autopilot with very little reaction against it.

The Dow held up at around the 12k level for 4 straight days to break lower on Friday's open that the rear view mirror looking mainstream press blamed on the Egypt situation. There always is a triggering news event in hindsight, anything will do, if it was not Egypt it would have been something else!

My last in depth analysis and concluding forecast for the Dow projected a trend higher into Mid January 2011 to target Dow 12k as illustrated by the below original graph (18 Oct 2010 - Stocks Stealth Bull Market Dow Trend Forecast into Jan 2011).

Last weeks quick interim analysis (24 Jan 2011 - Dow Stock Market Index Interim Trend Analysis and Forecast Update ) concluded in :

The above analysis is concluding towards probability favouring continuation of the trend higher to the Dow 12k target by early Feb, when the market can be expected to consolidate the advance of the past 6 months and enter into a significant correction that at this point suggests a 10% decline, so tighten the stops and take the ongoing rally to bank profits which is the number one AIM of trading / investing!

A painful lesson that analysts need to learn is that too much analysis is just as bad as NO analysis, because the more analysis one does following the now distant original analysis that brought the trader into a position the greater the likelihood exists of doubt and confusion creeping into the traders thought processes, especially if analysis is done virtually every day, a recipe for disaster!

In my opinion and experience, the only way to trade and invest is to arrive at a firm conclusion on a trade / investment scenario, then let money management rules manage the position with limit and stop orders to ensure you stick with the programme and exit either AT target regardless of what the market does AFTER you have exited because that is irrelevant to you, as the only thing that matters is the price you enter and the price you exit, if your scenario starts to go wrong, then the market will throw you out of your position, and THEN you can contemplate new analysis and scenario building AFTER you have EXITED open positions.

In fact as long as a trader does NOT constantly reanalyze the market than the distance in time form the original analysis should act to reinforce the stops and limits and money management as one forgets the intricacies of original analysis over time, which is how it should be so as to ensure that once one has existed one is able to perform analyse for the next trade setup without any bias.

Instead much analysis and commentary out there is written with the benefit of hindsight, with statements such as market moves have been missed or psychological blocks that turn the perception of market trends into the opposite direction such as stating a bull market is a bear market rally which is because the perma-bear analyst is constantly reinforcing WRONG analysis of now approaching 2 years! Which if they actually forgot what they wrote before they may be able to arrive at a more probable conclusion in the present rather than being stuck in a bear market mantra time warp!

The fact is NO broker ! NONE, will every let you trade in HINDSIGHT ! Again what the market does AFTER you EXIT is IRRELEVANT!

More on the Real Secrets of Successful Trading in my forthcoming ebook anticipated completion during late March 2011 (FREE DOWNLOAD).

My next Dow stock index analysis will follow in Mid Feb, following next analysis on UK Interest rates ahead of the next Bank of England MPC Meeting (10th Feb) and quarterly Inflation Propaganda report (16th Feb).

Commodities React to Threat of Freedom in Egypt, Middle East

Freedom is Sweeping the Middle East as western backed dictatorships look set to topple over as their populations awake from over 30 years of totalitarian rule. The spark for the whole trend was the global food crisis as populations on earnings of 1/10th of those in the west are highly sensitive to even small price changes.

Egypt, the middle east's most populous nation looks set to be next after Tunisia, so far the price paid by the population in terms of deaths at under 100 looks relatively low, especially when one compares against that which has occurred in the recent past such as the 50,000+ that died in Algeria. The USA and UK as ever are walking a fine line by sending arms to the dictators to suppress their populations such as news images of columns of U.S. Abraham tanks lined up in central Cairo, to sending public broadcast messages of neutrality and Freedom that do not match what they say behind the scenes as the wikileaks embassy cables reveal.

The quest for freedom in Egypt is only just beginning as there is no sign as of writing of the Dictator Mubarak going easily as did Tunisia's dictator, so the scene is set for things get far bloodier for the Egyptians quest for freedom.

Gold and especially Crude oil leapt higher on Friday because if Egypt goes FREE, ultimately so will the Gangster dictatorships of Arabian Peninsula that account for most of the worlds crude oil exports, though it is going to be tough for those populations to pries the hands of the gangsters from the wealth of those countries.

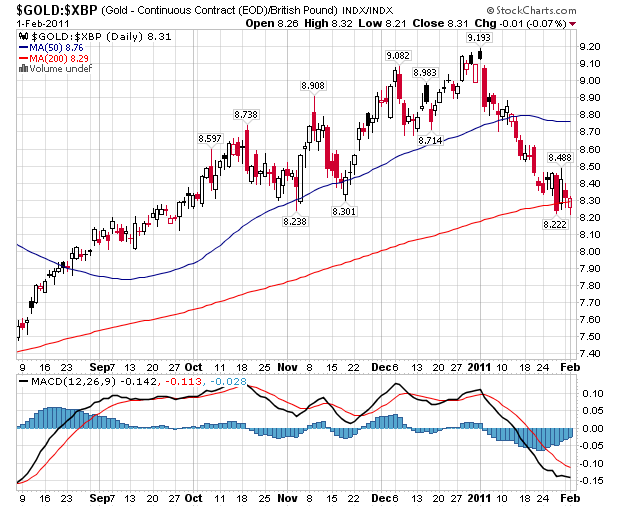

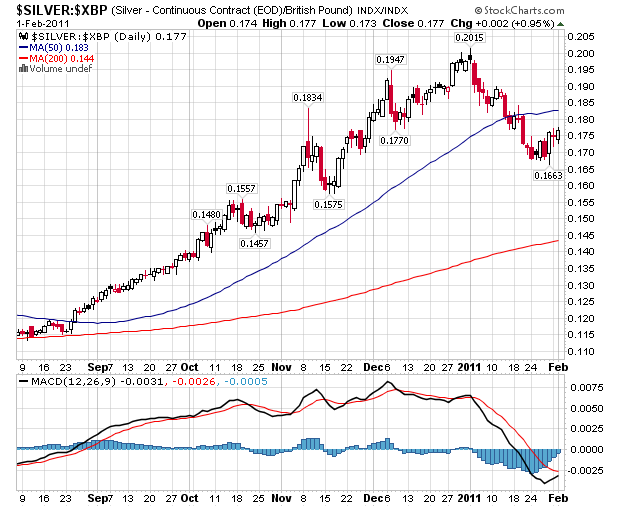

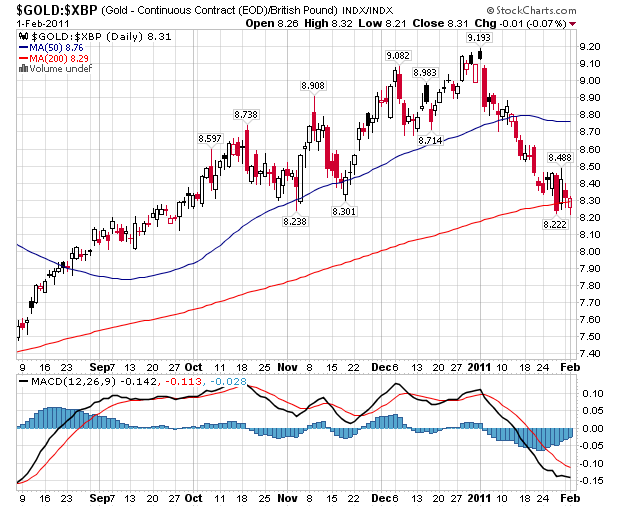

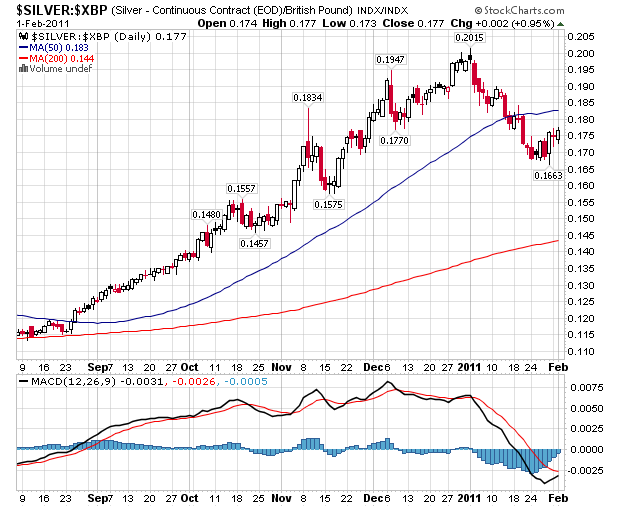

As for the trend, whilst Gold's Friday rally cheered the gold bugs to declare that the correction was over and resumption of the bull market was at hand, my instant take is that the trend is STILL DOWN for Gold, the one day rally failed to reverse the downtrend that suggests probability ultimately favours a continuation of the trend lower to new lows for the move. I have been flat for approaching 2 months now on long standing targets being achieved, Gold $1400 and Silver at $29. I will do an in depth analysis over the coming weeks to attempt to map out a trend scenario for 2011, though probably Crude before Gold as that is an infinitely more important commodity.

Your always leaving his tax return filing to the last minute analyst.

Source and Comments: http://www.marketoracle.co.uk/Article25961.html

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-11 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 24 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 24 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

Diane

31 Jan 11, 10:02

|

DOW Bull to Continue?

Hello Nadeem, I take your point, that the market was not reacting to the Egytian situation, but that pundits linked the market move to the Egyptian situation AFTER the event. As you say: "The Dow held up at around the 12k level for 4 straight days to break lower on Friday's open that the rear view mirror looking mainstream press blamed on the Egypt situation. There always is a triggering news event in hindsight, anything will do, if it was not Egypt it would have been something else!" I had forgotten that when I posted on your last post. I know that you are going to give your in-depth view mid next month. However, I would be most interested to know if your view remains the same in that we remain in a bull market (albeit with the start of a current correction) and that the DOW will continue with upward movement later in the year? Just in general terms? You have been absolutely correct in your forecasts, and have shown up others who have predicted that we are in a bear rally. All best wishes, Diane :)

|

Nadeem_Walayat

01 Feb 11, 04:25

|

stocks correction

My view has remained unchanged since March 2009 that stocks are in a multi-year bull market that is trending towards new all time highs and beyond (subject to quartely in depth analysis). This article is clear that the stock market is CORRECTING, not starting a NEW bear market. Best NW

|

Toby

01 Feb 11, 05:04

|

Gold & Silver

Hi Nadeem, Your forecasting is scarily accurate! The last part of this article worries me though because as a amatuer investor one of the easiest markets to get into is gold and silver so I eagerly await your forecast for gold and silver because as yet I have not taken your advice in making sure to take profits. I remember now that you talked of 1400 gold and 29 silver as the numbers you were targeting alongtime ago I just wish I had remembered myself without been prompted by your latest article.

|

Surinder

01 Feb 11, 06:17

|

Fantastic Call on the DOW

Hi Nadeem, Glad to see you back in top form - your call so far on the DOW has been breathtakingly consisitent inspite of all the bearish commentary out there! It is so wrong that so much of our energies and our extremely precious time is taken away from us by an inefficient and grossly unfair tax system. I recently came across FairTax.org a new growing movement in the USA, Should it's plan ever get implemented there it will cause a tidal shift every where else in the world because of competitive pressures. Good luck to them! Have you any views on FairTax.org? Wishing you every success, Surinder

|

Nadeem_Walayat

01 Feb 11, 08:31

|

Gold & Silver

I don't see any reason to focus on gold and silver right now as I expect the dollar to fall against sterling into Mid 2011, by about another 17%. So even if gold rises by 15% in dollars (not a forecast) its still no profit in sterling. Best NW

|

Chris

01 Feb 11, 09:39

|

Confused

Hi Nadeem, I'm really confused now with the strength of the dow yesterday and today. I took your advice and got out last week at a little over 12K, but are you still expecting the correction? At what point would the DOW have to go up to before you'd consider the correction unlikely to happen? Many thanks, -Chris

|

Shelby Moore

01 Feb 11, 11:20

|

Silver +30% +90%?

Nadeem wrote in the #comment100000 on this site: "So even if gold rises by 15% in dollars (not a forecast) its still no profit in sterling" Silver usually doubles gold's gain at this stage of a global reflation. So you would lose -15% by being in Sterling and not silver. And a +30% rise in silver in dollars is very juicy for American readers. And I expect silver to triple or quadruple gold's gains, as it sometimes does near the end of a parabolic rise in the late stage of a reflation. Then we might be a bigger correction and then QE3, which at Davos they are throwing around a $100 trillion figure for QE3.

|

Cassandra

01 Feb 11, 13:07

|

Sterling

Hi Nadeem, I see you are still saying sterling will rise against the dollar. Are you still expecting the 1.85 to 1.95 range you predicted last year? I wondered if the bad UK GDP figure might have changed your mind a bit? You must believe the "snow" story then? As you say now is not the time to buy gold in sterling if it is going to appreciate 17% against the dollar.

|

Nadeem_Walayat

01 Feb 11, 15:46

|

Sterling Trend

Hi The range was (IS) 1.80 to 1.90, target 1.85. I don't flip flop on news, but instead took the dollar rally as a good opportunity to buy more sterling (on leverage). I did a quick analysis on the GDP, that confirmed my expectations for £/$1.85. Offcourse there is always a risk of being wrong, in which case my stops will be hit (currently £/$1/52). Best NW

|

Nadeem_Walayat

01 Feb 11, 15:48

|

Silver Trading

Hi Shelby Silver is very volatile, for me to open long positions, I would need to do an indepth analysis of Gold and Silver and come to a firm tradeable conclusion. Whilst I would love to do so, I want to determine what interest rates and the UK housing market are going to do during 2011 first. And I don't subscribet to the notion of missed market moves, as everything is always clear in hindesight. For me to trade / invest I need to be certain on the risk vs the reward which takes indepth analysis. Best NW

|

Shelby Moore

01 Feb 11, 20:49

|

Did you gain +233%?

Nadeem did you gain +233% since Nov. 2008, as I have in Silver? You have a choice, buy the fake "Sterling" or the real sterling silver. Because the end game is rapidly approaching and those who keep trading paper, are going to end with its intrinsic value (zero). Sorry to be so blunt, but please be honest. Have you gained more than a buy & hold in silver since Nov. 2009? Okay so you don't want me to pick that range that is favorable to silver. So lets ask a different question. Have you gained +578% (6.8 times gain) since 2003, as Silver has? If you had, you would be a very rich man by now. Face the facts please.

|

Nasir

02 Feb 11, 08:49

|

Dow correction

Hi Nadeem, each time the dow makes an attempt at a meaningful pullback buyers jump back in, i was fortunate enough to buy last year during the 15% correction, but my question really is, is it the institutions that load back up on stocks preventing any meaningful correction, we know that most retail investors have not participated in the rally, so is it the institutions buying up, secondly with so many powerful support levels on the dow, and S&P won't it be difficult for the market to correct more than say 6% or so? kind regards Nasir

|

Wags

02 Feb 11, 12:01

|

Silver Trading

Nadeem has this one Shelby. Your gain of 90% is flawed by assuming ALL silver trades occur in dollars. I can testify to the fact that despite entering silver around US$16 and selling when price was around US$30, in RMB terms it only produced a 25% return. No trade can be seperated from the unit of value it is counted in. Another thing that strikes me is that any unbanked gain is as theoretical as Bernake Bucks, profit only can be considered when it's in the bank baby. Triple or more of golds gain means little if it aint cashed

|

Nadeem_Walayat

02 Feb 11, 12:57

|

Silver Trading Facts

Shelby your appear to be obsessed with gold and silver.

These are the facts for gold and silver in sterling -

GOLD

SILVER

I accumulated silver over several years when it was cheap in sterling, now I have sold the silver near its sterling peak. I am 100% happy with my silver profit which have been one of the best returns for the minimum amount of work! I don't care what silver does not next, if it presents a new opportunity that's good if it does not then that is also fine, for I am not obsessed with silver or gold.

Investment decisions need to be made with the minimum amount of emotional input as possible, else ALL of the gains could be given up!

Best

NW

|

Shelby Moore

02 Feb 11, 16:37

|

silver vs. paper trading

Wags wrote: "Nadeem has this one Shelby. Your gain of 90% is flawed by assuming ALL silver trades occur in dollars. I can testify to the fact that despite entering silver around US$16 and selling when price was around US$30, in RMB terms it only produced a 25% return. No trade can be seperated from the unit of value it is counted in. Another thing that strikes me is that any unbanked gain is as theoretical as Bernake Bucks, profit only can be considered when it's in the bank baby. Triple or more of golds gain means little if it aint cashed" Sorry but I have still got this one correct. 1. Nadeem did not answer the question, did he gain more than "+578% (6.8 times gain) since 2003, as Silver has"? Since he did not address that, I assume he did not beat silver with all his paper trading. 2. Gold & silver are the real money. When you cash into fiat, you have nothing but a promise. That promise is going be broken before 2020 (if not much sooner). And people will be left holding worthless digits (devalued overnight with bank holiday to institute emergency measures). So people are losing both in percentage over time by trading out of silver, and losing everything at the end game by holding a promise instead of real money. Nadeem wrote: "Shelby your appear to be obsessed with gold and silver." Well yes, because I have explained that fiat system can not survive at any real positive interest rate. So the paper units you hold in your brokerage account are going to go poof and disappear one day before 2020. Nadeem wrote: "I accumulated silver over several years when it was cheap in sterling, now I have sold the silver near its sterling peak." You mean paper silver right? So no, you did not accumulate silver. You just were trading paper digits. Nadeem wrote: "I am 100% happy with my silver profit which have been one of the best returns for the minimum amount of work! I don't care what silver does not next" You will care when paper digits go off the board, and silver goes to "no ask" (meaning not available at any price in the old paper digits system).This is not your grandmother's Great Depression, worse, this is a 300 year shift from public to private wave. Did you see that Google Android sales increase 7 fold (600%) in one year, now passing Nokia as #1 market share in the world? ( http://esr.ibiblio.org/?p=2905 ) Wikileaks, Twitter, and cell phones toppling African dictators, and the fiat system is another lie that is going to fall down at an exponential rate. Cheers.

|

Brian Thiesen

02 Feb 11, 23:46

|

Did you gain %700

While you were sitting on silver and gold, were you gaining %300-700 on put options on LEH, BSC, MER CFC etc. 3 times a month? Or instead of a trading screen were you down in your basement making out with your gold bars? Lets call silver %233 puny and is compared to that, so in no way is silver the only game to play. Did you make gains on Rare Earths? Can you go to anywhere besides a bullion dealer to use your "money?" Does the other %99 of the population care? Will you like realtors and homeowners, dotcommers, 80's bond guys and so many before sit on your silver when it hits $9 again? Or let me guess thats impossible... sound like a realtor!!! FINALLY... Have you been pretty much nailing almost every move in the market, unbiased and for free like Nadeem has for a few years? Allowing people to make sound investment decisions, ie profitable ones? Face the facts, instead of your safe of gold. Call Mr. T and Peter Schiff, i'm sure they would be happy to make out with your gold and talk about how they for the past year have forecast tonnes of BS that has never happened. Whens the dollar going to Crash again? tomorrow? Tell us the second you sell your silver... or wait, you never will.

|

Shelby Moore

03 Feb 11, 12:01

|

+578% overall?

Brian Thiesen, Did most people here gain +700% since 2003 as you claim? No! And why? Well because options have unlimited downside risk, meaning they can go BELOW ZERO. Not only can you lose the capital at risk, but you can lose any multiple of that capital. The way people protect themselves is by being diversified and setting stops. Whereas, PHYSICAL silver is real money (unlike paper silver which is just a promise). PHYSICAL silver can never even go to zero. So it is quite reasonable to have 100% of networth in PHYSICAL silver since 2003 and have +578% overall gain in networth. I actually had 100% of my networth in PHYSICAL silver during some periods of time, and more than 60% most of the time. So my outsized triple-digit gain is real for my entire networth. Yours is an imaginary claim that no one can ever achieve for their entire networth. If you gain +700% on 10%, then lose or barely gain on the other 90%, that is not +700%, that is less than 70%. And best of all I will never pay taxes on that gain, because I will never sell silver. And when silver peaks in price, I will lease it and continue to gain ounces, without ever selling it and without ever paying any tax. I don't need to nail any market moves. I just stay in silver and spend my time doing other things which earn me more money. And I outgain all those paper traders. Plus I never pay tax on these gains. Agreed facts are facts. Cheers.

|

Tom

03 Feb 11, 16:46

|

+0% overall

Shelby says: "And best of all I will never pay taxes on that gain, because I will never sell silver" I wonder how many people here then wonder, why bother with your comments when you will be six foot under without having made 0.1% profit on your investment, because a profit is not a profit until you have taken it. Which you have clearly stated you never will. I googled your name Shelby and discovered your blog, interesting reading but you ought to reap the benefits of your hard work at some point.

|

brian Thiesen

03 Feb 11, 16:51

|

Lesse

Actually in options you cannot lose more than you put in so, another misleading, undereducated bit of jibbersih by our boy Shelby! Someone who doesnt even know the difference between and option and futures has no business telling/advising/beeking off about their "non existant gains of %00.0000" You know what I had to do to get my gains on BSC puts? Buy at $200... sell at $1500. THe optimal words here are BUY and SELL. That is called a T R A D E. Some I even bought at $400 and sold at $3800. You know what I was not dumb enough to do? Put my entire net worth into one trade, like you, like any successful trader Knows is SIN # 1 (maybe #2 behind emotional trading) Can anyone "Substantiate" you silver claim? NO they cannot, so why do I have to? or why would I for YOU? Should I fax you my trade log? or put it up for all to see? Who on Earth has ever done that? Come on dude! To all of us the way you talk your entire life is an imaginary claim! How is physical silver real money. Where can you use it as such? Are you on crazy pills! Go to %100 of the stores in any country and try to use your "REAL MONEY" Do you know what promise I get with paper money (like it or not?) Every one will accept it, hence it is money, the most liquid medium of exchange. ACTUAL EXCHANGEABLE AT PLACES BESIDES A BULLION EXCHANGE MONEY. We also thank you for your useless math equations, I did not know that, but thank you, maybe you can come over one day and show me how an option goes below zero, because i'd really love to see it! And again another huge lie, Because you made one trade in 2 years does not mean you in any way have out gained "THE PAPER TRADERS" there are hundreds of thousands of people who have out gained you on your 1 trade. Likely even in 1 trade they did (of course they will all have to come over and show you everything they have done in life otherwise it is just imaginary) and that only means if you bought ALL of your "REAL MONEY THAT YOU CANNOT USE WHICH MAKES IT NOT REAL MONEY UNTIL YOU CASH IT IN HENCE THAT WHICH YOU CASH IT IN FOR IS REAL MONEY, LIKE IT OR NOT FIAT OR NOT" I am excited you own something you will never sell, hence your trade profit is ACTUALLY %00.0000000 gain. So if i buy a call to day and sell it for a %1 gain i will have made more than you. Paper traders trade. Do you know what a gain or a trade is? Do you know you have to sell to actualize profits? Staring at gold and silver can make a man crazy. To the point where they assume they know the slightest about options, think real things are fake and think fantasy gains are actual gains. It can also make them think they will not even have to pay taxes IF they sold to get MONEY to buy things THAT THEY WILL HAVE TO PAY TAXES on like say a house which due to inflation in most places have gone up substantially, even further eroding your %00.00000 gain. Guess what many people can say (like me the imaginary phantom) I bought silver at $7 and sold at $19 50k worth at 7, physical, it was a pain to lug around at that, nice profit for me more than double and almost triple just like you, only I profited, you just talk about the potential to profit Any man with blinders on will always be blinded. Facts are facts, you don't know the facts, and when presented with them call them fiction, when the only fiction is your "gains" and you as a person. To sum it up this man is giving advice when he 1. doesnt know the difference between on option or futures and has no idea how they work. 2.Puts all his eggs in 1 basket. 3. Doesnt know how to profit on a trade or what a trade even is (2 simple steps folks) Yes 2 1, then 2 a man that cant do 2 things wants you to do the same? 4. Doesnt know that what is not a medium of exchange and cannot be used anywhere but a bullion dealer is NOT CASH. 5. Makes fun of people for making gains in the stock market Make your money your way, don't knock everyone who hasnt made it the exact and only way you have, look into your ego and see why you do this, that is if you aren't cheating on your gold bars with a silver one, I hope they don't get jealous? Good luck dude, again show me anyone who has gone below ZERO on an option ever in history, going back to greece.

|

Cal

04 Feb 11, 04:30

|

Correction

Hi Nadeem Great work as usual. I would be very interested to hear your thoughts on this being a 3/5 topping pattern as opposed to a 5/5 EW pattern. The implication being for the depth of correction (that is if we do not continue higher)! Regards Clive

|

Shelby Moore

04 Feb 11, 09:01

|

Silver

Tom, My leasing plan for my silver is so I never need to sell it in order to continue to grow my silver ounces, even when the silver price will be declining, and thus I will indeed capture all my profit Brian Thiesen, Of course you can lose more than you bet, it is called margin trading. And even if you don't trade on margin (as most people do), the point remains that silver has NEVER gone to 0, and options routinely do go to 0. There is infinitely higher risk trading options, even without margin. Why do I say infinite? Because any number divided by 0, is asymptotic. I don't need to sell the silver to get money to buy things, because my networth is much higher than I could ever spend in my lifetime. The purpose of my networth is to help mankind, and by growing my networth and investing it with others by leasing it to them (they can sell it at 0 tax and buy things), instead of watching it shrink due to paying taxes on every trade (as measured in ounces). Cheers.

|

Admin

04 Feb 11, 12:38

|

.

comments closed in this thread.

|

The Dow achieved the long standing limit target of 12,000 early week and afforded traders / investors plenty of opportunity to bank profits on the rally to Dow 12k that began late November that can only be described as market trending higher on autopilot with very little reaction against it.

The Dow achieved the long standing limit target of 12,000 early week and afforded traders / investors plenty of opportunity to bank profits on the rally to Dow 12k that began late November that can only be described as market trending higher on autopilot with very little reaction against it.

Nadeem Walayat has over 24 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 24 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk