How Undervalued Are Austrailian Gold Miners?

Commodities / Gold & Silver Stocks Oct 29, 2007 - 09:04 AM GMTBy: Neil_Charnock

Don't think for a minute that the world has not become a “one market place” game or you will miss out. Investment strategy must follow the money or money flows to stay with trends and the earlier you catch one the more you make if you can hang in there – simple isn't it. I have an early trend for you to consider and it is misunderstood by most – with low sovereign risk.

Don't think for a minute that the world has not become a “one market place” game or you will miss out. Investment strategy must follow the money or money flows to stay with trends and the earlier you catch one the more you make if you can hang in there – simple isn't it. I have an early trend for you to consider and it is misunderstood by most – with low sovereign risk.

For some time GoldOz has been writing about and discussing gold & silver but also the undervalued status of Australian gold miners and in general the whole ASX resource sector. This is our niche – not all to ourselves we have some fine company but this is what we specialize in. We have been arguing our pro-resource / gold (and silver) stance for over 12 months on a very public basis and our views have not changed. I have outlined my arguments on a web site that receives around 3 million hits a day and also on 30 other important web sites.

What is our record like? We called the August breakout of gold from $US673 just before it did and were amongst the first in the industry to do so. Colin Emery has been predicting only shallow dips in gold over the past few weeks in our Newsletter when some of us, including me, have been expecting a larger correction. It hasn't happened yet in gold but some of the junior and mid tier emerging stocks pulled back so I was half right. I digress - this essay is about undervalued assets of which – the identification of – is the very essence of investing.

We don't over sensationalize although I am lucky enough to be teamed up with a guy that has traded up at the elite international levels for over 20 years – directing trading in senior positions in Treasury Departments for some of the world's biggest banks. And now he works for himself in addition to his GoldOz activities – his insights into metals, forex and the markets are something to behold. We specialize in the Australian resource sector and all investors should pay some attention – at least to read what we have had to say – why?

Well for one reason - because we have been right so far – and the $AUD has also gained appreciably greatly enhancing or protecting the investments made here from offshore depending on where you live. Inflow into our resource sector has been massive this year and has had a great effect so far yet we argue the best is still in front of investors. Let's get down to the crux of my logic and analysis, I “set the stage” above in the hope you may pay attention…

Some plain logic – look the rules have changed – or haven't you noticed?

If you had not noticed don't feel bad – neither have well over half of the mainstream (does not include most of the gold camp) economic profession and they have “training” to understand these things. But they keep referring to Economics 101 and getting it wrong about the USA , the commodities cycle and metals prices and Asian growth etc. If left to their own devices and if they forgot the old theory I am sure they would do better to a man and woman in their predictive abilities. Consider the following in fresh light and forget the text books for a minute.

Compared to our North American counterparts, on an “ounce for ounce” resource basis the ASX gold stocks are greatly undervalued. The sovereign risk (country risk), depth, grades, cost and metallurgical recovery issues compare so these factors do not explain the undervaluation. Same goes for our base metals miners and diversified miners. You may look on and yawn and say this has also been so however consider this for the sake of your own asset; appreciation, diversification and protection. The “goal posts” will be moved on this issue too – mark my words the supply of gold will enforce this into reality because there is just not enough to go around.

We have argued the resource sector is undervalued here in Australia and that nickel has more to run, with zinc, copper, gold and of course silver. As an example our larger nickel and resource stocks have gained in price considerably from a very low base and looked to be high on the charts. Yet we still argued there is a huge upside to resource and gold investing here – a bit of a lonely pastime when it was considered that nickel was or is? …dead (same with copper nearly a year ago).

But now our thanks go out to Xstrata for offering an apparently high 35% premium of $23 per share for Jubilee Mines NL – thanks for confirming our argument and joining the ranks of large institutional offshore investors and or companies that have helped bid our heavy weight miners to record highs. Note I have said “apparently high 35% premium” and $3.1B is no chump change it is a substantial statement. I make no statement here on risk, value or any other matter related to the offer.

Let me be clear - I say the following in the context of the statements below;

- The global resource demand is just that – global – Asia , Russia and South America too.

- The global commodity demand cycle is still going strong and inflation has to be factored into the current prices for “historic price” comparison purposes. On this basis there is considerable price upside over time however this is not likely to be a straight line as we have seen in nickel and gold so far.

- The global currency (debt based) debasement is just that – “debasement” and “global” – it is an international problem that few understand like we do. This point ties in with the inflation factor mentioned above. The three points made here fit into a powerful triangular force that has changed the investment landscape and this offers opportunity.

This paragraph should be framed for your reference.

The obvious conclusions one can make from the above is that there is no sound reason for Australian resource stocks to remain undervalued in a global demand environment . This may have been so in the past however the unprecedented resource demand is coming from our neighborhood this time, yes from Asia . Sorry I don't mean to seem rude and be shouting all over the page about this but only the early smart money has caught on so far and I see potential for so many investors to protect and grown their hard earned capital.

Our currency is likely to appreciate but so is theirs ( Asia ), especially as they let go of USD pegging (buying US Treasuries and printing their currencies excessively to do so) which only creates inflation in their growing economies. They have enough challenges without adding unnecessary risk via the purchase of depreciating assets. My side point here is that a strong AUD will not hurt our commodity exports when Asian currencies appreciate and they will be able to afford more of our “rocks” so stay tuned.

They (Asian Nations) have ample foreign reserves, growing internal demand and manufacturing clout too so it would seem this game can and will continue – it should all have ended already according to “accepted economic theory” however the actual economic “goal posts” keep moving which confuses some commentators and economists. The Asian growth is coming off a low base too which I seldom see factored into mainstream analysis – their potential to create additional demand to soak up all planned additional production is still high.

In years gone past the recent US “situation” would have caused an immediate crash in global markets and yet strangely those who panicked and expected this to happen have been surprised and caught underweight in resource stocks since the August crash. Funds are now buying back in, yes risk assessment is now factored into credit markets and things have changed in some other aspects too but this needs careful assessment to arrive at investment decisions - by individuals and the mining industry. Risk in credit markets and as an assessment tool with added weight in investment portfolios are crucial to this new changed climate and look at gold confirm this.

The same “demand - inflation – global” story goes for gold and the size of the supply end of the equation is very small when compared to potential demand. Total market capitalization of the gold sector world wide is small compared to just one of the giant global corporations and yet gold has played a vital role in mans monetary history for thousands of years. The imbalance in the price of gold is significant when we take this into account with the inflation factor.

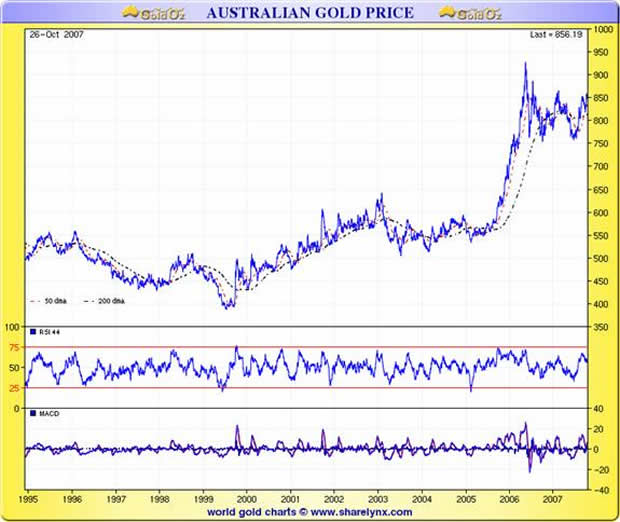

Now consider this last gem of a fact – the AUD price break in gold has had only one leg to date as the following shows very clearly…

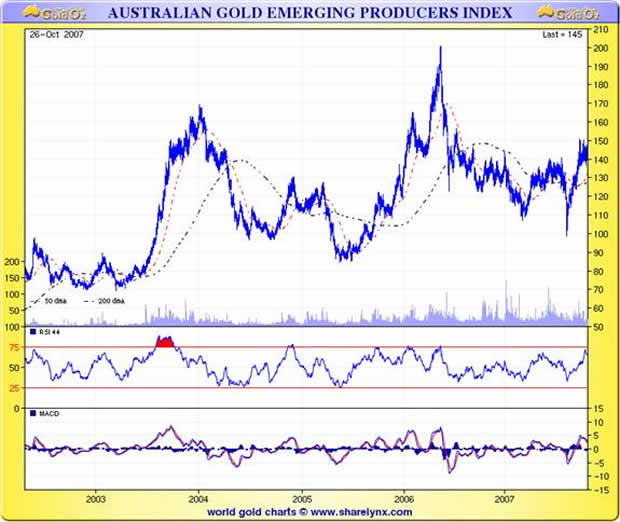

And some gold stocks – despite major advances in their activities / prospects – have hardly moved as yet. Oh yes the juniors have rocketed from low bases but I see very near term opportunity in many sub-sectors of our mining industry including emerging producers as the chart shows below. Take out the statistical anomaly of the August over reaction and you get an early trend with maximum leverage to the upside – fantastic!

Of course some expertise is required to assess the individual stocks and this is where services like GoldOz and our colleagues come into play.

One must always plan for a rainy day and the storm clouds are certainly here – we have volatility and this is only to be exploited by the experienced and well informed. This can be you too but caution not to get greedy - and to play this boom with care and retain profits – be sensible about it. We believe some professional assistance is also wise and we keep a close eye on all these issues in the Weekly GoldOz Newsletter (we are running a special on annual subscription at present), written by Colin Emery the GoldOz elite level global trader for over 20 years and subscription details are available at our site for anyone with an interest in these matters – ASX companies too, contact us for global exposure.

Good trading / investing.

Regards,

By Neil Charnock

www.goldoz.com.au

Copyright 2007 Neil Charnock. All Rights Reserved.

REGISTERED ADVISOR – WHO THE ADVICE COMES FROM IN THE GOLDOZ NEWSLETTER: Colin Emery is currently a Branch Manger and Senior Client Adviser of a Stock Broking Company in Queensland Australia. Prior to his work in Share broking he spent nearly 20 years in Senior Management and Trading positions in Treasuries for major International Banks such as Bank Of America, Banque Indosuez, Barclays Bank, Bank Of Tokyo and Deutsche Bank AG. He spent a number of years as a Senior trader in New York , London , Singapore , Tokyo and Hong Kong with these institutions. He also was Global Head of emerging energy, emission and commodity products for the leading Energy and Commodities brokerage firm of Prebon Yamane Ltd – Prebon Energy for four years before moving to Cairns in 2003 to focus on the Stock market and Private consulting work. The private consulting and advisory work currently undertaken is with companies involved in Resources, Energy and Renewable Energy and Forestry.

Neil Charnock is not a registered investment advisor. He is a private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are my current opinion only, further more conditions may cause my opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.