U.S. Durable Goods and Housing Home Sales Data

Economics / US Economy Jan 28, 2011 - 03:26 AM GMTBy: Asha_Bangalore

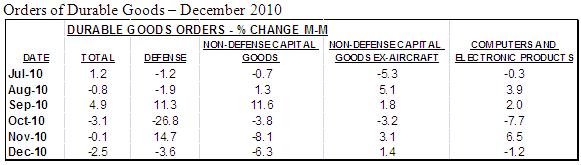

Durable goods orders fell 2.5% in December, reflecting largely the impact of a significant drop in orders of civilian aircraft ($24 million vs. $5.019 billion in November). Excluding transportation, orders of durable goods moved up 0.5% in December vs. 4.5% gain in the prior month. Also orders of non-defense capital goods excluding aircraft rose 1.4% in December.

Durable goods orders fell 2.5% in December, reflecting largely the impact of a significant drop in orders of civilian aircraft ($24 million vs. $5.019 billion in November). Excluding transportation, orders of durable goods moved up 0.5% in December vs. 4.5% gain in the prior month. Also orders of non-defense capital goods excluding aircraft rose 1.4% in December.

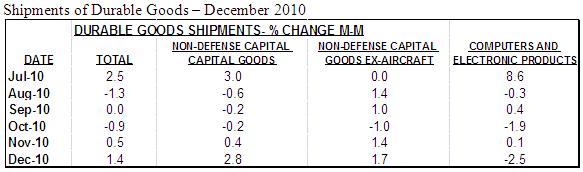

Shipments of durable goods increase 1.4% in December following a 0.5% increase in November. Shipment of non-defense capital goods advanced 1.7% in December following a 1.4% increase in November.

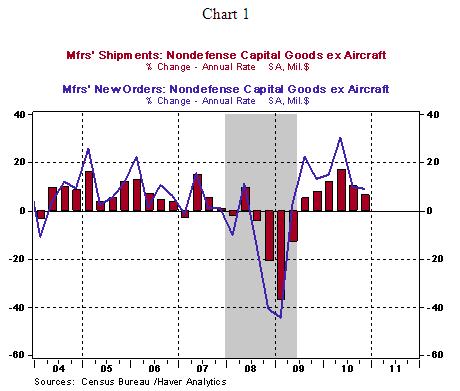

The bottom line is that orders and shipments of durable goods grew in the fourth quarter but at a decelerating pace compared with the gains in the first three quarters of the year (see Chart 1). This decelerating trend raises questions about the status of the factory sector.

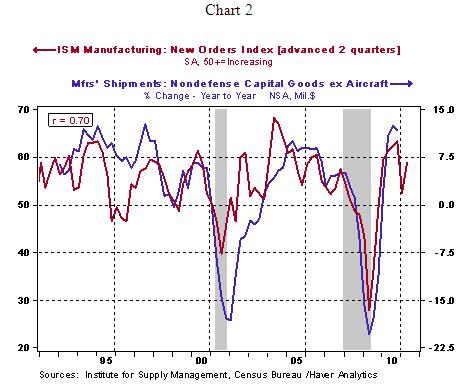

The new orders index of the ISM manufacturing survey advanced two quarters has a strong positive correlation with shipments of non-defense capital goods excluding aircraft (see Chart 2). The new orders index increased in the fourth quarter after declining in the third quarter. The turnaround points to a pickup of shipments of durable goods in the quarters ahead.

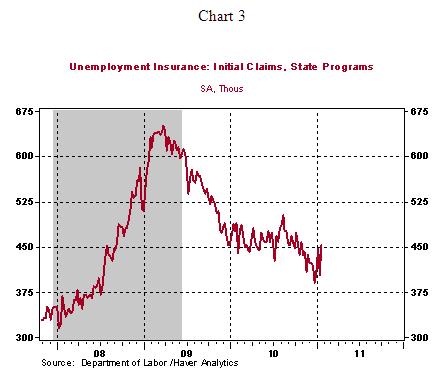

Weather and Seasonal Factors Raise Initial Jobless Claims

Initial jobless claims rose 51,000 to 454,000 during the week ended January 22. The latest reading is the highest since October 2010, which begs questions about the reason for the unexpected jump. The Labor Department indicated that bad weather, which prevented filing of jobless claims, and seasonal factors played a role in raising the latest weekly reading of jobless claims. Clean numbers of the following weeks will be necessary to assess whether labor market conditions are deteriorating or improving. Continuing claims, which lag initial claims by one week, rose 94,000 to 3.99 million.

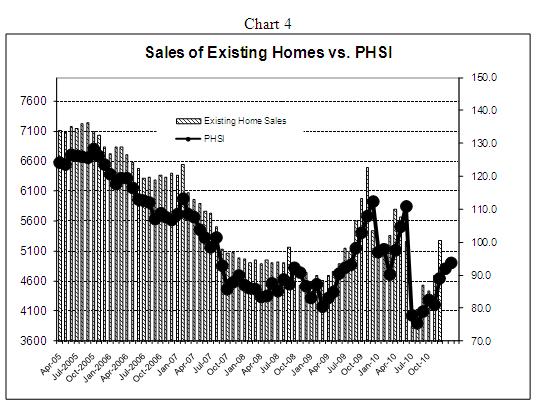

Housing Market Update: Pending Home Sales Index Posts Third Monthly Gain

The Pending Home Sales Index (PHSI) of the National Association of Realtors increased to 93.7 in December from readings of 89.1 and 91.9 in October and November, respectively. The PHSI leads actual sales of existing homes by one or two months and is a reliable leading indicator of future home sales of existing homes. Sales of existing homes rose 12.3% in December. The latest reading of the PHSI augurs positively for sales of existing homes in January.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.