The Three Risk Factors Every Stock Market Investor Should Know

Stock-Markets / Stock Markets 2011 Jan 24, 2011 - 06:37 AM GMTBy: Money_Morning

Jon D. Markman writes:

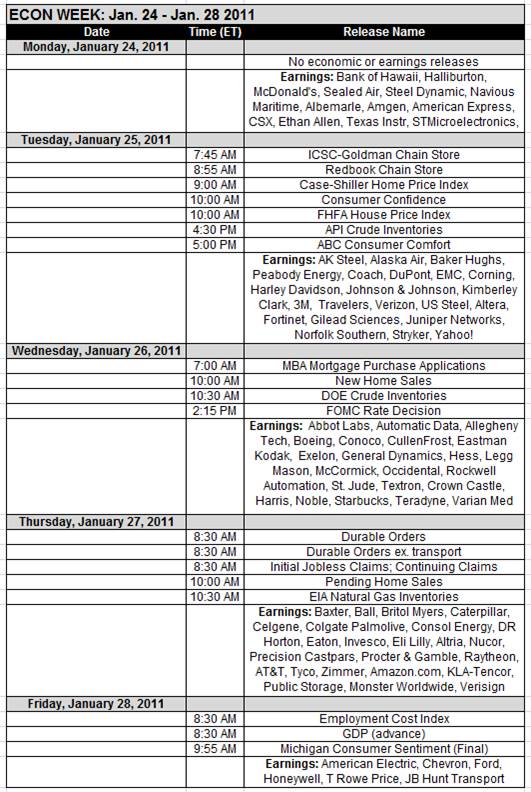

Last week had its ups and downs, but some winners emerged. Consumer staples and technology companies had strong showings. But in determining which companies will continue to succeed going forward, there are three important risk factors to consider.

Jon D. Markman writes:

Last week had its ups and downs, but some winners emerged. Consumer staples and technology companies had strong showings. But in determining which companies will continue to succeed going forward, there are three important risk factors to consider.

Stocks reacted to the first big week of earnings with a surprisingly mixed-up performance, as large-cap value stocks rose 0.7% while mid-caps fell 0.7% and small-caps fell 2.4%.

The Standard & Poor's 500 Index snapped a seven-week winning streak and the Dow Jones Industrial Average was the only index to log a gain for the five-day span. No one or two catalysts could claim responsibility for this large/small fractioning of returns, so it was really just a matter of momentum stocks taking a breather after a strong run into earnings and quieter stocks just ambling quietly higher.

The action did not appear to be indicative of any major change of sentiment, as all the concerns that emerged over the past week would be familiar to any bright tenth-grader who reads a newspaper: Margins may be peaking, estimates were a touch too high and earnings were good but not spectacular. News on the economic front appeared to improve, with fewer people filing initial jobless claims and troubled European countries having no trouble selling bonds.

The only negative piece of the puzzle was China, where both economic growth and inflation were reported running too high, leading to the usual concerns that Beijing will raise rates to the point that growth and inflation will be stymied.

Bottom line: The reason most mid-cap and small-cap stocks did not make more progress was that businesses are not making as much progress as investors had hoped. That's not to say earnings growth is poor. It's up double digits across the board. But expectations are higher still -- perhaps a bit out of whack -- and many companies are not meeting lofty goals.

This is why we are seeing a lot of companies like F5 Networks Inc. (Nasdaq: FFIV) post a sterling quarter of earnings but get shellacked because they are a few bucks shy on the revenue line. Recognize the problem for what it is: "expectational roulette." You never really know what the baked-in expectation is until a report is out.

Yet it's more than results. It's also outlooks. I don't know what has gotten into executives lately but they are not acting like the cheerleaders that we have always scorned but at the same time come to rely upon.

Check this out: Bloomberg News reported this week that the number of American companies offering positive outlook -- i.e. higher than consensus -- has hit the lowest level in more than 10 years. Through mid-January, 54 companies had offered guidance that was better than consensus estimates, the wire service reported. That's the fewest number of upside surprises for outlook at this point in January since 2000. The prior low was 58 outlook-raisers in 2008.

This is the same state of glumness that is preventing companies from hiring, borrowing and lending. Companies continue to hoard cash and wait for some sort of all-clear siren.

Well guess what, execs: There won't be one.

You've got to be bold and get after new business or nimbler new competitors are going to come in and eat your lunch. Eras when corporate leaders are gun shy are a great time to create a new business because, like Kris Kristofferson said: "Freedom's just another word for nothing left to lose."

Just ask AltaVista and Inktomi, which owned search before Google Inc. (Nasdaq: GOOG) came around. This is a transitional phase but recognizing that doesn't make it any less problematic.

Surging Staples

The economic news last week was actually quite positive. To be more specific, initial jobless claims fell to 404,000 in the week ending January 15, which was lower than the 441,00 the prior week. And existing home sales jumped 12.3% month-over-month in December to a 5.28 million annualized rate, which was the highest pace since May and over the 4.85 million consensus. Supply also fell in December to 8.1 months from 9.5 months in November. And on the manufacturing front, the details in the Philadelphia Fed survey were upbeat.

Commodities were mostly weaker, with gold, copper, fertilizer and all the miners lower, and crude oil down 2.4%; it seems that inventory has expanded a bit, but that's very volatile.

I always want to know what the shockers of the week were, and for me that was Wal-Mart Stores Inc. (NYSE: WMT) hitting a one-year high, and The Home Depot Inc. (NYSE: HD) also lifting by 2.4%. On the surface that looked like optimism over retail but it turns out that it was more about Dilllards Inc. (NYSE: DDS) declaring that it was looking to unlock the value of its real estate. This is what gave department stores a lift.

As for surprises elsewhere, how about those defensive stocks? Utilities were on a roll, with ITC Holdings Corp. (NYSE: ITC), AES Corp. (NYSE: AES), Allegheny Energy Inc. (NYSE: AYE) and Exelon Corp. (NYSE: EXC) all up more than 3% in the week.

I was talking last week about the potential for food makers like H.J. Heinz Co. (NYSE: HNZ), which did rise 1% on Thursday. But the tastiest serving came from General Mills (NYSE: GIS), which lifted a whopping 3.3% on Thursday alone. Also knifing higher were ConAgra Foods Inc. (NYSE: CAG) and Kellogg Co. (NYSE: K).

GIS has been one of the most reliable "widows-and-orphans" stocks for decades, and pays a 3% dividend. Cheerios and Wheaties are forever. Stocks like this, when they have been down for a while, are like pure comfort food for institutional investors looking for a safe haven. It won't go up much, but it won't go down much either.

Retirees who are delighted with a position that pays 10% in total return per year -- 7% in capital appreciation and 3% in yield -- should buy the General Millses of the world when they are down a few points over a scare like higher corn prices. And that is what is happening with these food makers at the moment.

We talked a lot last week about the disconnect between the fundamental business success recorded by Intel Corp. (Nasdaq: INTC) and its stagnant stock price. But there has been no such disconnect with so many other companies, such as International Business Machines Corp. (NYSE: IBM) and Apple Inc. (Nasdaq: AAPL), which reported earnings on Tuesday night.

IBM reported that revenues in the fourth quarter rose to $29 billion, a record, due in large part to sales of mainframes and analytics software. Analysts expected $28 billion. Big Blue signed 18% more services contracts. as that part of its business hit $22.1 billion. Revenue from what the company calls "growth markets" -- that's India, China and Brazil -- rose 15%. The company said it expects sales to these regions to account for a quarter of revenue by 2015, up from 21% at present.

Shares rose 3.5% the following day, and as you can see in the chart above they are well into a new secular bull market. "Investors are encouraged by strengths in the signings this quarter,'' Deutsche Bank AG (NYSE: DB) analyst Chris Whitmore told Bloomberg. ''They exited the year well.''

The company said it plans to invest increasingly in cloud computing, one of our themes this year, like last year. The initiative embodied in television commercials you may have seen, called Smarter Planet, is oriented toward helping companies and governments monitor and digitally analyze everything from freeways and sports arena to hospitals and airports to make them run more smoothly at lower costs.

IBM Chief Executive Officer Sam Palmisano has told reporters that he plans to spend $20 billion in acquisitions over the next four years to speed the process. And you can bet that his competitors plan the same. This puts a bid under the market, and gives a buyout premium to such niche leaders like F5 Networks and Cavium Networks Inc. (Nasdaq: CAVM).

Housing Splat

Among the fact parade that smacked investors upside the head this week: Single family home starts fell 9% month-over-month in December, seasonally adjusted.

Just another housing snafu? I'm not so sure.

You know my belief is that that nothing really awesome is going to get rolling in the U.S. economy until home building gets rolling again. It's not because of some gauzy view about the American dream. It's because it's the one industry that is not outsourced and cannot be automated. Plus it is the industry that hires the greatest number of lightly skilled workers, which is the category of the labor market that is most persistently unemployed.

Home and commercial construction means jobs, and jobs are the foundation of a strong economy. From the cynical perspective of an investor, fewer jobs for a while -- sometimes a long while --means improved earnings growth as companies squeeze labor costs out of their capital structure. But at some point, and every economist has a different opinion on what that point is, there must be enough people with decent jobs to buy the stuff that companies are selling.

Earlier this month, you may recall, the federal report on payrolls was much worse than the consensus expected but the market rallied anyway. I had a much worse-than-consensus view on employment at that time, and recommended lightening up on total exposure to the market, and my view has not changed. All the data that I see on employment is anything but impressive and my expectation is that payrolls could actually get worse -- possibly much worse -- before hiring starts to improve down the road.

When you combine stagnant employment with an overbought market and then add a huge earnings miss by a company like Goldman Sachs Group Inc. (NYSE: GS) and a revenue miss by a company like F5 Networks, you can begin to see the possibility that stocks can be what we might delicately term "accident prone."

Don't expect anything real dramatic, and it may not come right away. But weak employment and stumbles by leaders like Goldman and F5 are not something we should ignore. Stay alert. Tighten stops and make a plan. This should still be a very good year, and even a good quarter, but they're not going to make it as easy for as the first three weeks of January were.

Looking Forward

Gazing at the road ahead through the fog, the picture now is not as muddled as you might think.

Refer back to the chart at the top of this report. The S&P 500 came into support at its 13-day average and a 50% retracement of its December-to-January advance, and bounced at the 1,278 level. Look at Thursday and Friday this way: If the market opens soft it should find support in the 1,278 area again.

If it fails in a material way, then bears have a shot at pounding the benchmark index all the way to its 50-day average as it did in November, which is around 1,236. That's 3.5% lower, which is in the range of the November correction as well.

But the bears won't have a clear shot at a win, either. Remember that they have failed to take the market down in the past two years except for May-June last year when they hit a trifecta: Within a two week span came the Securities and Exchange Commission (SEC) suit against Goldman, the Gulf oil well explosion and the "Flash Crash." And even those did not leave any lasting tire marks on bulls.

Bears are also going to have to push against a statistical tide. The database guys tell me that the S&P 500 has logged a negative weekly close following six or more consecutive up weeks 30 times since 1960. In only one of those cases was there a decline of more than 1% the following week, while there were 12 cases of a +1% return the next week. You can see that in a generally bullish period a single weekly loss does not normally lead to a big tumble.

If there is a weaker market, however, the higher beta stocks will be slapped the most while defensives like The Coca-Cola Cola (NYSE: KO), which have already corrected, may be a lot firmer. And most firm of all could be the most defensive positions, such as utilities.

Now finally here are the three big risk factors to watch:

-- Emerging markets inflation and interest-rate tightening may be worse than the consensus expects. I'm not expecting a hard landing in China and India, but the recent squiggles may be a precursor to something worse than what was seen last year. The big problem is global food inflation, which was one of the causes of the Tunisian government's overthrow and is the biggest fear for Beijing. Emerging markets are a major driving force in global growth, and if they are stymied the whole machine slows down.

-- Eurozone companies may be harder hit than expected. Portugal, Greece and Ireland are peripheral conversations. Spain, Belgium and Italy are not.

-- U.S. "risk-on" stock groups are near the peak of their historic relationship with defensive groups. This is the same strain that led to the 15% correction in May-June last year. However, the strain is not as intense, so if things start to slip away I doubt the correction will be greater than 5% to 10% before both stock and corporate merger buyers are motivated to swoop in.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2011/01/24/last-weeks-winners-and-the-three-biggest-risk-factors-to-watch/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.