Physical Gold Bullion Market Tight - Paper Sell Off Due to "Momentum Monkies"

Commodities / Gold and Silver 2011 Jan 24, 2011 - 04:17 AM GMTBy: GoldCore

After gains in Asia, the precious metals have come under pressure in Europe. The recent sharp sell off has seen gold fall 5.7% in January. Nothing whatsoever has changed regarding the fundamentals of the precious metal markets and long term buyers are again buying on the dip. As long as interest rates remain near historic lows and real interest rates continue to punish savers, gold's bull market remains sound.

After gains in Asia, the precious metals have come under pressure in Europe. The recent sharp sell off has seen gold fall 5.7% in January. Nothing whatsoever has changed regarding the fundamentals of the precious metal markets and long term buyers are again buying on the dip. As long as interest rates remain near historic lows and real interest rates continue to punish savers, gold's bull market remains sound.

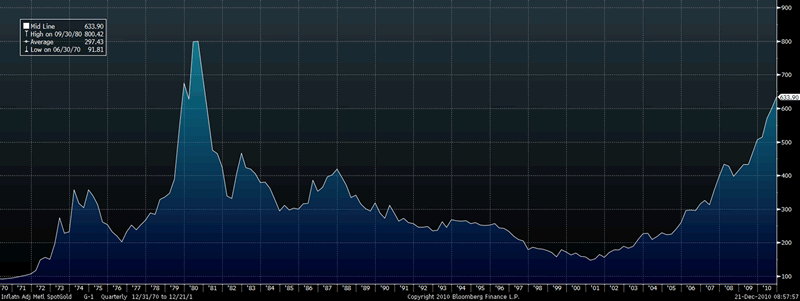

Gold Inflation Adjusted Index - 40 Year (Quarterly). The 'Bloomberg Composite Gold Inflation Adjusted Spot Price' is derived from the monthly US Urban consumers price index

The sell off is once again nothing whatsoever to do with the important supply and demand for bullion, rather it is again due to what one commentator called the "momentum monkies" (hedge funds using leverage to speculate in the short term) and the concentrated short positions of Wall Street banks being investigated by the CFTC.

The collapse of the ruling coalition in Ireland may lead to a renegotiation of Ireland's ruinous "bailout" which could contribute to volatility in European bond markets again. Irish taxpayers, like taxpayers in other countries, will not be able to pay back the massive debts incurred by protecting the massive liabilities of the banking sector. Markets continue to be complacent about the sovereign debt crisis and the real risk that it may spread from Europe to the US where municipalities and states such as Illinois and California are close to bankruptcy.

A debt crisis caused by too much debt will not be solved by printing more money and saddling the tax payers of the western world with even more debt.

The Ivory Coast has imposed an export ban on cocoa. Ivory coast is the world's leading cocoa exporter, with 40% of the global supply, and this will lead to jitters about resource nationalism contributing higher commodity prices leading to further food and energy inflation.

GOLD

Gold is trading at $1,349.15/oz, €994.99/oz and £994.99/oz.

SILVER

Silver is trading at $27.71/oz, €20.43/oz and £17.38/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,817.70/os, palladium at $816.50/oz and rhodium at $2,400/oz.

News

(Bloomberg) --Bullish Gold Bets by Funds Slump on Worst Price Slide Since 1997

Hedge funds are unloading bullish bets on gold as a slide in prices sends the metal to its worst start to a year since 1997. Holdings in silver dropped to the lowest since February.

Managed-money funds held net-long positions, or wagers on rising prices, totaling 134,473 contracts on the Comex in New York as of Jan. 18, U.S. Commodity Futures Trading Commission data showed on Jan. 21. The gold holdings have plunged for three straight weeks, dropping 21 percent since the end of December, while net-long positions in silver are down 24 percent.

Gold has fallen 5.7 percent this month, which would be the worst start to a year since a 6.3 percent drop in January 1997. The metal rose every year for the past decade, reaching a record of $1,432.50 an ounce on Dec. 7 as central banks kept interest rates low and Europe’s debt crisis spurred demand for the metal as a haven. Silver climbed 84 percent last year and reached a 30-year high of $31.275 an ounce in New York on Jan. 3.

“From a technical standpoint, we’ve a strong rally in silver and gold, and when you have that type of performance, it prompts profit-taking,” said Brian Hicks, who helps manage $1 billion in the Global Resources Fund at U.S. Global Investors Inc. in San Antonio. “Money is going elsewhere to the more traditional areas of the equity market.”

Gold for February delivery settled on Jan. 21 at $1,341, the lowest closing price since Nov. 17. The Standard & Poor’s 500 Index of U.S. equities has gained 8.7 percent since the end of November and touched a 28-month high on Jan. 18.

Bets on a rally in silver totaled 20,318 contracts, down 11 percent from the previous week. Silver settled at $27.427 an ounce on the Comex on Jan. 21, capping three straight weeks of losses that was the longest slump since March.

Appeal of Metals

The slide in gold and silver may not last, Hicks said. Prices may rebound on concern that Europe’s debt crisis will spread, and that record-low U.S. interest rates and the biggest budget deficit ever will fuel inflation, Hicks said.

“Prices are close to a short-term oversold area,” Hicks said of the decline in gold and silver. “We’re starting to become interested at these levels. The perfect storm is continuing to build for precious metals.”

Managed-money positions include hedge funds, commodity- trading advisers and commodity pools. Analysts and investors follow changes in speculator positions because such transactions may reflect an expectation of a shift in prices.

(Reuters via CNBC) Spot gold prices firmed on Monday, regaining some lost ground after falling for two consecutive days, while holdings in the SPDR Gold Trust rose for the first time in two weeks, as investors entered the market to bargain-hunt.

The euro rose to its highest in more than two months on Monday, after upbeat data from Germany showed business sentiment rose to its highest in 20 years on the back of a manufacturing sector now fully recovered from the 2008 financial crisis.

The improved economic outlook over the past weeks has dimmed gold's appeal as safe-haven investment, but concerns about inflation may continue to support, analysts said.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.