What Phase is the Stock Market in Now?

Stock-Markets / Stock Markets 2011 Jan 24, 2011 - 04:04 AM GMTBy: readtheticker

If you are a fan of Wyckoffian logic then you will understand that the stock market has four major phases: Accumulation, Markup, Distribution and Markdown. The $64,000 question is what phase are we in now ?

Quickly, I will define each phase.

Accumulation: In short, an area where Informed forces buy stocks or futures with the intention to mark-up prices. At the same time less informed forces tend to sell in that area.

MarkeUp: Normally appears after a accumulation period. The stock float supply has been soaked up during accumulation, and for market players to acquire stock float then they can do so by only paying higher prices.

Distribution: In short, an area where informed forces sell stocks or futures with the intention to mark-down prices. At the same time less informed forces tend to buy in that area.

MarkeDown: Normally appears after a distribution period. The stock float supply has overcome demand, and for market players to distribute stock float then they can do so by only paying lower prices.

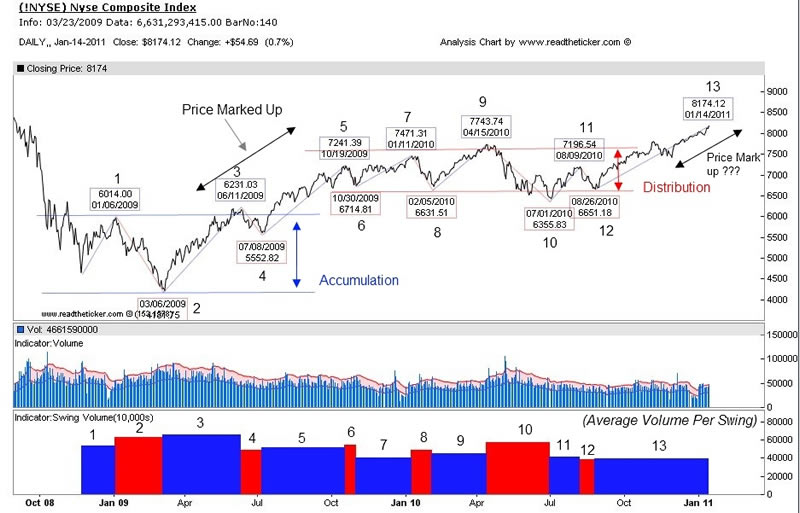

Let's review NYSE stock market index.

I believe between the swings 1 to 3 the market under went accumulation. This is clearly evident by the massive volume increase on swing 3 and the swing up volume of 3 is greater than the swing down volume of 2. Market players acquired stock float under the belief that prices will be marked up in the future. The minor sell off tagged at swing 4, established that stock float supply was tight when demand is great, and the only way for market players to acquire more stock float was to pay higher prices.

Swing 5 clearly can be labeled as a markup period. Volume was consistent and prices rose moderately.

Between swing 6 and 10 the stock market suffered distribution at marked up prices. This is easy to conclude as swings 6, 8 and more so 10 the down swing volume is greater than the upswings (7,9,11).

So what is going on since Oct 2010. We know that Fed Chairman speech at Jackson Hole set up the current trend and now prices have broken resistance at 7743 and have gained nearly 6% beyond 7743. Are we undergoing a new price mark up phase? We could be. However I suggest that this could also be a fake price markup. Why fake, well at the moment until further evidence to the contrary the upswing at 13 has been completed on very low volume, and so far volume has not accelerated. This (possible) false break maybe their to attract the less informed into the market for the better informed to sell into. We will change our mind if after a minor sell off price holds above 7743 and the following push back up is on rising volume greater than swing 13.

What to do! Wait for a sell off to 7743 (at least). Then wait for the expected recovery after this sell off. Measure the recovery for strength, and then if all is well enter the market as this may be a true break out. If it lacks strength and is unsupported by good volume or sound fundamentals, stand aside. For now stay on the couch and do nothing! Believe it or not doing NOTHING is an option in a successful investment plan.

Readtheticker

My website: www.readtheticker.com

My blog: http://www.readtheticker.com/Pages/Blog1.aspx

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2011 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.