Geothermal Energy Investing Update: Growth Spurt Ahead

Commodities / Energy Resources Jan 21, 2011 - 06:11 PM GMTBy: Marin_Katusa

Marin Katusa, Chief Energy Strategist, Casey Research writes: The Canadian Geothermal Energy Association (CanGEA) is a pretty active group. It regularly hosts networking and news events for its members, who range from scientists to industry reps. One meeting that grabbed our eye took us to Toronto in October, ready to sniff around the Geothermal Investment Forum.

Marin Katusa, Chief Energy Strategist, Casey Research writes: The Canadian Geothermal Energy Association (CanGEA) is a pretty active group. It regularly hosts networking and news events for its members, who range from scientists to industry reps. One meeting that grabbed our eye took us to Toronto in October, ready to sniff around the Geothermal Investment Forum.

CanGEA members worldwide operate approximately 20% of global geothermal capacity and have a reported 3,377 MW in reserves and resources. So when these fellows convene, the formal presentations and hallway exchanges offer some significant insight and even a competitive edge for investing in this sector.

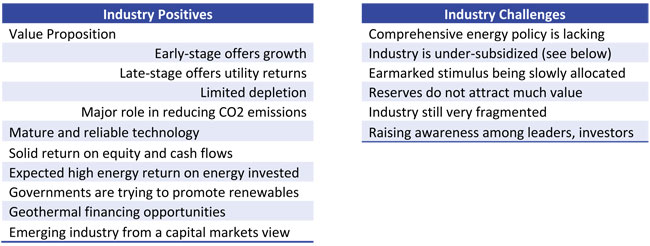

To begin, geothermal is still the forgotten renewable and, compared with fossil fuels, has a long road to becoming a household word in the markets. The industry faces a series of challenges to be taken as a serious and viable alternative to the energy king, fossil fuels. Here's a summary of strengths and weaknesses that came up at the forum:

Where Does the Money Go?

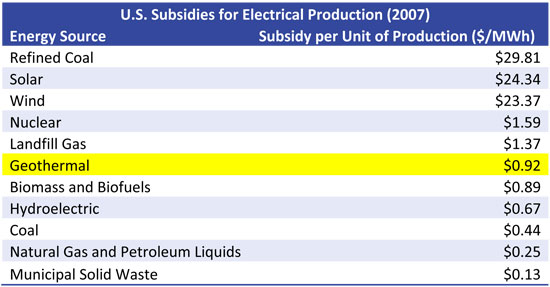

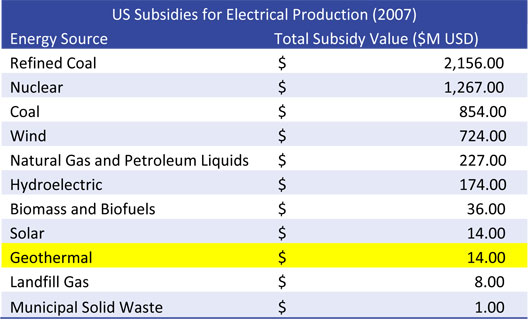

One of geothermal's biggest hurdles is obtaining further subsidies in an environment where all the generating technologies are competing for the same dollars. Many don't know that the fossil fuels as well as renewables are subsidized by governments in the form of grants and loans, fiscal incentives such as tax credits, and other support in addition to infrastructure.

As you'll see below, the per-unit basis for fossil-fuel subsidies is low:

However, when taking into account the fact that there was so much more fossil-fuel generation, the picture is dramatically changed. In total governments worldwide conveyed an estimated US$700 billion in subsidies toward fossil-fuel consumption in 2008, according to the U.S. Energy Information Administration (EIA). Meanwhile, the same governments allocated only about US$100 billion toward the energy sources they get the most press for supporting, the renewables.

The White House has proposed reducing tax breaks for the oil, gas, and coal industries by approximately US$40 billion in the 2011 budget, which would be a nearly 50% decrease from levels in 2002-2008. If that figure passes - not a given, especially with Republicans in control of the House - US$40 billion is still twice that for renewables.

Government policy and subsidies is essential for private investment in the geothermal sector. Greater recognition would be a huge catalyst for this industry.

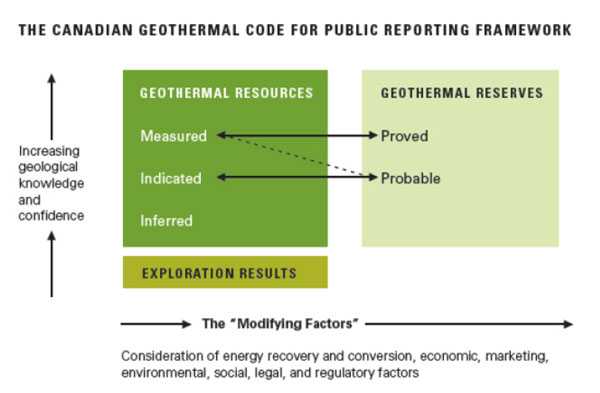

Another Must for Investment: Reporting Standards

One of CanGEA's main achievements is creating a Canadian geothermal code for reporting public information. Similar to the mining and oil/gas sectors, this self-regulation standardizes mechanisms and presentation of data. The idea is not only to make it easier for investors to evaluate projects and companies but to foster confidence to invest in the sector at all.

The standards provide a minimum set of requirements for the public reporting of exploration results, geothermal resources, and geothermal reserves. The result of a committee set up two years ago, compliance with the code is voluntary until 2011. At that point it'll become a requirement for CanGEA membership.

The code pertains to both public and private geothermal assets. Key principles are:

- Transparency: to provide sufficient information that is clear and unambiguous.

- Materiality: to present all relevant information that investors would reasonably require and expect to be made available to make a reasonable investment decision.

- Competence: to ensure the reporting is done by a qualified person based on experience and knowledge. "Qualified" means at least five years' relevant experience, professional registration with an association with a governing code of ethics, and CanGEA membership.

It will also establish value for companies whose assets are underdeveloped - what one's got "in the ground" - similar to the NI 43-101 (mining) and NI 51-101 (oil and gas) classification rules.

So far, it works something like this:

graphic courtesy of CanGEA

Inferred resources is when a temperature gradient well program has been completed, the earliest hands-on stage to determine a site's thermal characteristics. Next come slim-hole wells, which help determine the economic viability of a project and define indicated resources. A company's measured resources require actual production wells to have been started or completed as well as a demonstration that the company can deliver on them.

Then there's the reserves side, which considers factors such as accessibility and economic feasibility of the resources. Accordingly, probable reserves is when deliverability has been demonstrated, and proved reserves is when production wells have started or been completed and deliverability has been demonstrated.

Companies would follow this structure for a variety of documents: quarterly and annual reports, reports required by the Canadian securities exchanges and or by the law, company website information, information releases, and environmental statements, technical papers, and so on.

CanGEA is proud of the code, and rightfully so. Geothermal exploration is a high-risk activity, and raising confidence and reducing unknowns will improve the industry's prospects for attracting capital. The only other country to have a geothermal code is Australia, which has a considerably smaller total market capitalization of geothermal companies than Canada.

The code has been submitted to the International Energy Agency (IEA) and the International Geothermal Association for review and endorsement.

The Take-Home Message

What we came away with confirmed our own analysis: that the geothermal sector faces a fair amount of challenges, as well as a variety of them. In the balance, however, the positives far outweigh the negatives.

We even heard some argue that the geothermal sector is where the oil sector was in the 1950s and is poised for a large bull run. We wouldn't wax that enthusiastic ourselves, but two drivers are indeed true. First, the potential for energy production in the ground is significant, and second, increasing innovation is leading to better exploration techniques and drilling capabilities.

Subsequently, although there are high capital costs right now, we expect solid returns on equity in the long term. Exploration and drilling accounts for approximately 36% of the total capital costs, and as technology improves, this risk will decline.

In short, don't look to the geothermal sector for get-rich-quick schemes. Consider yourself instead as getting in on the ground floor of some promising growth.

[With oil rising again, the energy sector is set to boom in 2011 – whether it’s oil & gas exploration companies or the industries, like nuclear and renewables, that benefit from high oil prices. And now you can get complete coverage of the resource exploration sector for one low price: Subscribe to Casey’s Energy Report at a $300 discount… and get one FREE year of Casey’s International Speculator! But hurry, this offer ends January 31. Details here.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.