Gold and Silver Open Interest Show Speculators Have Reduced Positions

Commodities / Gold and Silver 2011 Jan 20, 2011 - 11:38 AM GMTBy: GoldCore

Gold has fallen by 1.7% and silver by 4% as the US dollar has bounced from 2 month lows. Some are attributing the sell off to interest rate hikes in Brazil and the bounce in the dollar. However, it is more likely due to further selling by momentum-driven traders who see that the short term trend is down and they are sticking it to under pressure longs.

Gold has fallen by 1.7% and silver by 4% as the US dollar has bounced from 2 month lows. Some are attributing the sell off to interest rate hikes in Brazil and the bounce in the dollar. However, it is more likely due to further selling by momentum-driven traders who see that the short term trend is down and they are sticking it to under pressure longs.

Gold is currently trading at $1,347.73/oz, €1,004.19/oz and £850.12/oz.

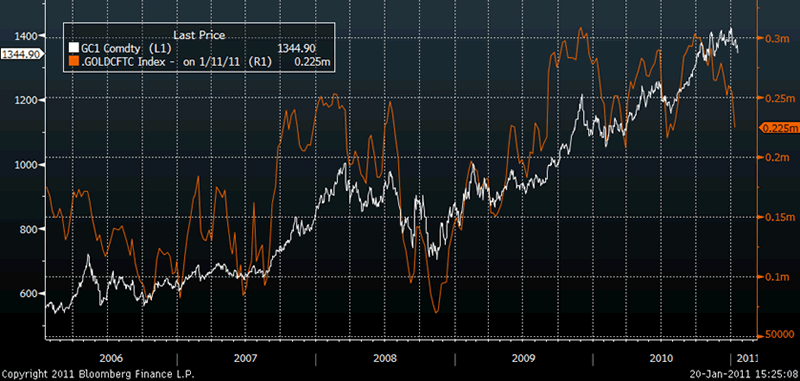

Gold in USD and CFTC CEI Open Interest - 5 Years (Daily)

Most major equity and government bonds have also been sold despite the US job data which was ostensibly positive. An indication that the recovery of the US economy and long term outlook remains less than rosy was seen in more Fitch talk regarding the precarious nature of the US’ AAA credit rating and this has been reflected in a further rise in the cost of insuring the US against default.

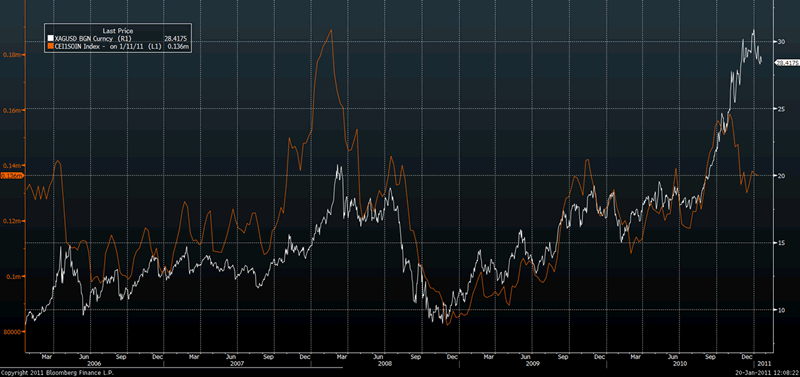

Contrary to the widely held market opinion that gold resembles a bubble with speculators and investors manically buying gold, the CFTC Open Interest figures show that open interest in the gold and silver markets have fallen and are a long way from record highs.

We pointed out yesterday that record buying of American silver bullion coins is most certainly not a contrarian signal of a mass mania speculative bubble. Bullion coin buyers acquiring silver bullion coins at 15% premiums are not speculators piling into a market place. Rather they are long term buy and hold hard asset investors who are buying a store of value, unlike the leveraged paper speculators on the COMEX. Many have no intention of selling in their lifetimes or at least until the US and the world returns to the path of fiscal and monetary prudence.

Widely followed and publicised newsletter writer and fund manager Dennis Gartman has issued a bearish warning regarding silver and commodities in general but he remains positive on gold. Gartman’s short term calls on gold and silver have been wrong more often than not in recent years and the bulls will use his call as a contrarian signal that we may be getting close to a low in this most recent sell off.

SILVER

Silver is currently trading $27.55/oz, €20.53/oz and £17.37/oz.

Silver in USD and CFTC CEI Open Interest/ Futures - 5 Years (Daily)

PLATINUM GROUP METALS

Platinum is currently trading at $1,805.25, palladium at $806/oz and rhodium at $2,375/oz.

NEWS

Capital Controls Roil Latin America Bond Markets by Evoking `80s

Latin American nations from Brazil to Peru are returning to currency and foreign investment controls that marked the 1980s era of hyperinflation.

Since the start of the year, policy makers across the region have increased dollar purchases to record levels, raised reserve requirements and curbed banks’ ability to bet against the dollar in a bid to stem a 29 percent rally in Latin American currencies since March 2009. Controls may stiffen, and other nations could join the “market-unfriendly” drive, said Alberto Ramos, an economist at Goldman Sachs Group Inc.

“In all these countries, if it continues, there will be the temptation to escalate the level of restrictions,” said Ramos, a former economist at the International Monetary Fund, in a phone interview from New York. “We cannot throw into the dustbin four decades of good economic research. Capital controls have serious economic costs.”

Local-currency bonds in Latin America lost 0.5 percent in dollar terms in the past three months, the first decline for the period since October 2008 in the aftermath of the collapse of Lehman Brothers Holdings Inc., according to JPMorgan Chase & Co.’s GBI-EM Global Diversified Index. Yields on Brazilian government notes due in 2017 jumped 111 basis points since the middle of October to 12.55 percent. The higher rates push up the country’s cost to roll over debt that equals 58 percent of gross domestic product, compared with 34 percent in South Korea.

Hyperinflation Era

Latin America’s economic turnaround that caused net private inflows to quadruple since 2003 and tamed price increases to record lows comes two decades after defaults spread from Mexico to Venezuela and inflation in Brazil climbed to as high as 6,821 percent in 1990. While governments are taking steps to limit spending, price rises and borrowing costs are picking up and could accelerate should currencies weaken, jeopardizing the nations’ progress, according to Bank of America Corp (Bloomberg).

Gold May Decline as Investors Sell Asian Stocks, Buoying Dollar

Gold, trading little changed in Asia, may drop for the first day in four as declines in equities boosted demand for the dollar, hurting the metal’s appeal as an alternative investment. Bullion for immediate delivery was at $1,370.72 an ounce at 12:21 p.m. in Singapore after fluctuating between a drop of 0.2 percent and a gain of 0.1 percent. The February-delivery contract fell as much as 0.3 percent $1,366.70 an ounce on the Comex in New York, before trading at $1,368.50. Asian stocks dropped, following U.S. losses yesterday, after housing starts in the world’s largest economy fell and Goldman Sachs Group Inc. failed to exceed profit estimates. The dollar gained against 15 of 16 major counterparts today. The precious metal often moves counter to the U.S. currency. “Gold has been following the fortunes of the U.S. dollar in the last few days,” Darren Heathcote, head of trading at Investec Bank (Australia) Ltd., said from Sydney. The figures released yesterday showed U.S. housing starts fell 4.3 percent last month, while a Bloomberg survey shows the number of people continuing to receive jobless benefits probably increased in the week ended Jan. 8. The MSCI Asia Pacific Index fell as much as 1.3 percent, the biggest drop since Nov. 26. “Stock losses are making it easy for the dollar to rebound,” said Takashi Kudo, general manager of market information services at NTT SmartTrade Inc., a unit of Nippon Telegraph & Telephone Corp. in Tokyo (Bloomberg).

British Group Plans Greek Gold Store Chain, Naftemporiki Says

A group of British investors plans to open a chain of stores to buy gold in Greece, as the economic crisis presents an opportunity, Naftemporiki newspaper reported. The group is in Greece scouting locations to open as many as eight stores in central Athens as well as surrounding suburbs in the immediate future, the Athens-based newspaper reported, without saying where it got the information. The purchase price will be based on assay results, tests to determine the weight and purity of the metal, Naftemporiki said (Bloomberg).

China 2010 Gold Output Advances 6% to 615 Tons; Silver Gains 8%

China’s gold output in 2010 gained 6 percent from a year earlier to 615 metric tons, the Beijing- based National Bureau of Statistics said today in a statement. The country’s December gold output was 67 tons, it said. Silver production rose 8.3 percent to 11,617 tons last year, it said. December silver output was 1,051 tons, it said (Bloomberg).

Sales of 1-Ounce American Silver Coins Soar, U.S. Mint Says

Sales of 1-ounce American Eagle silver coins are headed for a record this month, according to data from the U.S. Mint . About 4,588,000 coins have been sold in January, according to data on the Mint website. That would be the highest monthly total since sales began in 1986. Silver futures for March delivery dropped 11.1 cents, or 0.4 percent, to $28.801 an ounce on the Comex in New York today. The price touched a 30-year high of $31.275 on Jan. 3 and gained 84 percent last year as investor demand surged (Bloomberg).

BHP says floods knock coal output, iron ore hits record

Australia's devastating floods will affect BHP Billiton's coal mining operations for at least six more months, the company warned on Thursday, with its last quarter production already down a third in hardest-hit Queensland state. BHP Billiton, the world's biggest mining company, also posted a 4 percent rise in quarterly output of iron ore to record levels to meet swelling demand from its main customers in China and other parts of Asia. Flood damage estimates are bound to worsen, as Thursday's figures do not reflect the impact of January storms brought by a La Nina weather pattern that may still bring more rain to Queensland. "Until now there wasn't a peep from BHP about water and flooding and rain or anything in Queensland," said Andrew Harrington, a mining analyst for Patersons Securities in Sydney. "It's obvious now that this flooding has had an enormous effect on its coal business," Harrington added. "I would expect coking coal prices to go up on this, if only temporarily, until the lost production can be made up down the line." The wet weather has driven long-term pricing for coking coal as high as $225 per tonne for the first quarter of 2011, and some analysts say the floods could result in coal prices between $400 to $500 per tonne. "When combined with disruption to external infrastructure, we expect an ongoing impact on production, sales and unit costs for the remainder of the 2011 financial year," BHP Billiton said in releasing its fiscal second-quarter production data, which covers the October-December period. In a joint venture with Japan's Mitsubishi Development Pty Ltd, BHP Billiton is the world's largest supplier of sea-borne traded hard coking coal, needed to make crude steel. The statement was the most detailed publicly on the impact of the floods on the company's collieries since the rains started in November, leading BHP Billiton and other miners to postpone shipments and make force majeure declarations to break sales contracts. "Queensland Coal (Australia) production was significantly affected by the persistent rain and flooding that impacted the Bowen Basin during the period," BHP Billiton said, adding that output of coal dropped 30 percent versus the previous quarter. That is significantly more damage than the 6 percent loss in coking coal production close peer Rio Tinto this week said it suffered from the floods. The shortage of coking coal from Australia, which usually accounts for two-thirds of global coking coal trade, 90 percent of that contributed by Queensland, is prompting Asia's steelmakers to look to other countries for supplies. Japan's JFE Steel Corp, the world's fifth-biggest steelmaker, this week said it will boost purchases from the United States, China, Russia and Indonesia. JSW Steel Ltd, India's third biggest steelmaker, has said it was also turning to U.S. suppliers for more coal. BHP confirmed that force majeure was declared for the majority of Bowen Basin coal, including at its Goonyella Riverside, Peak Downs, Norwich Park, Gregory Crinum, South Walker and Blackwater operations. Meteorologists say the rains that devastated huge areas of Australia's eastern seaboard, flooded coalfields and cut off shipment corridors for miners clustered in the inland Bowen Basin were triggered by a La Nina Pacific weather pattern that only recently peaked and threatens more wild weather. "The drop in output BHP is reporting today really only covers the period before the real flooding began in January, which did the most damage," Patersons' Harrington said. "That won't show up until the end of this quarter." Energy firm Santos, which recently approved its $16-billion Gladstone liquefied natural gas (LNG) investment in Queensland, also said extensive rains across Australia sharply cut its 2010 output and hit some coal seam gas exploration. The heavy flooding in Queensland did not impact coal seam gas production but field construction and drilling activity were suspended, it said. Santos gave a final go ahead for Gladstone LNG earlier this month, in a project that would bring Australia one step closer to becoming the second-largest LNG producer by 2020 as producers try to meet growing demand from Asia. Iron ore is expected to account for more than $5 billion in first-half earnings for Melbourne-based BHP Billiton, nearly three times forecast EBIT earnings from coal mining. Most analysts expect BHP to show underlying earnings above $10 billion for the half-year ended Dec. 31. Deutsche Bank analyst Paul Young said he had already factored in the lost coal production and was maintaining a full-year net profit forecast of $22.198 billion. Rio Tinto also reported this week record iron ore production after running its mines at peak rates in 2010. "For the likes of BHP and Rio Tinto, iron ore is where the money is right now," said Keith Goode, an analyst for Eagle Mining Research. Spot iron ore prices are at nine-month peaks and nearing the record $200 a tonne level from February 2008. [IRONORE/] "I don't expect to see a massive hike in global steel demand but there is this constant underlying need for steel," said Michael Gaylard, strategy director at Freight Investor Services in Shanghai. "And if you have iron ore supply that is restricted, it is going to prompt people to take on board maybe slightly higher reserves now than they possibly would do at another time due to potentially where prices would be in two months down the road." The sharper-than-expected fall in coal output and lower copper prices overnight helped drive BHP's shares lower. BHP Billiton shares fell nearly 2 percent to A$45.15, after the data was released, while Rio Tinto was down as much as 2.3 percent to $85.57, outpacing losses in the wider market. Aluminium production was in line with previous comparable quarters, BHP Billiton data showed. Aluminum prices, which slumped dramatically during the global recession, rose 11 percent last year -- 5 percent in the December quarter alone -- and are now near a two-year peak. BHP Billiton also warned that delays in the Gulf of Mexico were continuing to impact its petroleum division by causing the deferral of drilling of high-volume production wells. "Our current expectation is that production volumes for the 2011 financial year will be in line with the 2010 financial year," it said. The company's Australia iron ore shipments rose to an annualised rate of 148 million tonnes a year in the quarter, underscoring a growing global appetite for the steelmaking material. "Robust growth in developing economies remains the primary driver of commodity demand and further positive signs are emerging in the United States following the Federal Reserves ongoing efforts to stimulate the economy," BHP Billiton said. Existing supply side constraints on industrial commodities has been further exacerbated by weather-related disruptions in Australia, Colombia, South Africa and elsewhere, according to the company (Reuters).

Global Copper Shortage to Widen on Economic Recovery

Copper demand will outstrip supply for the next two years as the economy recovers, China sustains consumption and mine output drops, Japan’s top producer said. Demand will likely exceed supply by 635,000 metric tons in 2011, the biggest deficit since 2004, compared with 234,000 tons last year, Hidenori Kamoo, general manager of the marketing department at Pan Pacific Copper Co., said in an interview Jan. 18. The shortage may be 91,000 tons in 2012, he said. Copper, used in wires and pipes, climbed to a record $9,781 a ton yesterday after gaining 30 percent in 2010 as the world economy recovered from its worst recession since World War II. Goldman Sachs Group Inc. says the price may climb 12 percent in the next year to $11,000 a ton. Michael Jansen, metals strategist at JPMorgan Securities Ltd., predicts a deficit of 500,000 tons to 600,000 tons this year. “The market will see a wider deficit because of steady demand growth in emerging markets, including China and Brazil, a gradual economic recovery in the U.S. and Europe and tight mine supplies,” Kamoo said. This year’s deficit would be the most since 2004, according to company data. While there is likely to be a shortage, growth of copper consumption in China, the biggest user, may almost halve this year as the government curbs monetary expansion, cooling demand, Jansen said Jan. 15. Macquarie expects a shortfall of 550,000 tons, while the International Copper Study Group expects a shortage of 435,000 tons (Bloomberg).

Copper, Nickel, Lead Rally as China’s Economic Growth Quickens

Copper in London rebounded from its biggest drop in two months, and nickel, zinc and lead rallied, as growth in China, the world’s biggest metals consumer, accelerated in the fourth quarter. Three-month delivery copper advanced as much as 0.6 percent to $9,628 a metric ton before trading at $9,615 a ton on the London Metal Exchange at 10:44 a.m. Singapore time. The metal dropped 1.3 percent yesterday, the most since Nov. 23, after reaching a record $9,781, as U.S. housing starts declined. China’s expansion quickened to a more-than-forecast 9.8 percent in the fourth quarter, despite policy makers’ efforts to rein in credit and counter inflation. The government ordered banks to set aside more reserves six times in 2010 and boosted interest rates twice to prevent the economy from overheating. “We’ve always been of the view that China’s growth may slow this year but it will continue growing,” Lin Ling, an analyst at Industrial Futures Co., said from Shanghai. “Government measures are not going to halt the growth.” April-delivery metal on the Shanghai Futures Exchange fell as much as 2 percent to 71,470 yuan ($10,848) a ton, before trading at 71,860 yuan. Futures on the Comex in New York climbed as much as 0.4 percent to $4.388 a pound, after dropping 1.3 percent yesterday, the most since Jan. 6. Housing starts in the U.S. fell 4.3 percent in December to the lowest annual rate since October 2009, Commerce Department figures showed. Builders are the biggest users of copper in the U.S., the largest consumer after China (Bloomberg).

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.