Silver Up as US Mint Reports January Eagle Sales Reach Record High

Commodities / Gold and Silver 2011 Jan 19, 2011 - 10:25 AM GMTBy: GoldCore

Gold is slightly higher in the US dollar and other major currencies. Spot silver has given up early gains but the futures market has seen longer term contracts fall more in price so that while spot is up $0.09 to $28.96/oz, the July 11 contract is only trading up $0.01 to $29.00 and and the December 11 contract has fallen by $0.084 to $29.01.

Gold is slightly higher in the US dollar and other major currencies. Spot silver has given up early gains but the futures market has seen longer term contracts fall more in price so that while spot is up $0.09 to $28.96/oz, the July 11 contract is only trading up $0.01 to $29.00 and and the December 11 contract has fallen by $0.084 to $29.01.

The dollar has fallen to 78.42 on the US Dollar Index and is looking technically vulnerable of falling to long term support at 76.0.

Gold is currently trading at $1,370.85/oz, €1,015.90/oz and £857.64/oz.

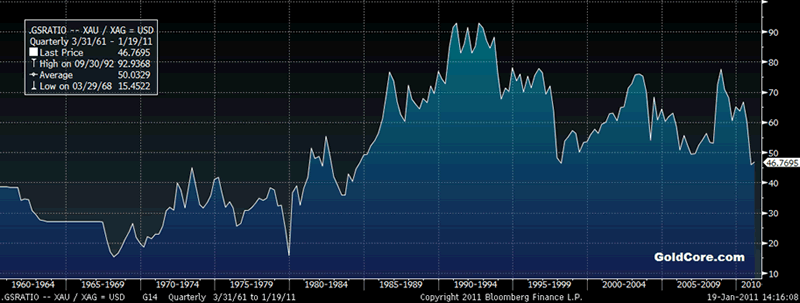

Gold to Silver Ratio – 50 Year (Quarterly)

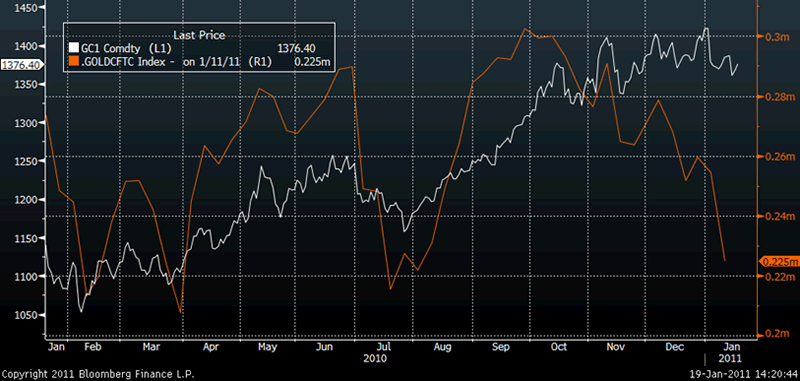

It would be wrong to assume that gold’s recent sell off is over. Hedge funds and leveraged speculators on the COMEX tend to be more technically driven – making “the trend their friend”. As the short term trend remains down they may continue to short the market and force out any remaining weak longs.

As ever, the primary focus of investors and savers should be the long term, and diversification is crucial (see conclusion).

European sovereign debt issues may also be leading to a bid in gold as Portuguese bond yields have risen to the risky 7% level and Greek bond yields rose sharply to nearly 11.5% this morning prior to a reversal.

The likelihood that sovereign debt risk will remain with us for the foreseeable future will likely see investors, pension funds and institutions remain risk averse. It will lead to increased allocations to gold and lead to further diversification into gold. Silver will also benefit from diversification as Jim Rogers recently pointed out.

With inflation pressures threatening emerging markets and taking hold in developed economies, as seen in the UK yesterday, inflation hedging buying continues.

SILVER

Silver is currently trading $28.91/oz, €21.42/oz and £18.09/oz.

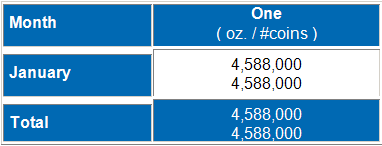

US Mint Reports January Eagle Sales Reach 26 Year High

The US Mint has reported that sales of American Eagle silver bullion coins (1 oz) have reached 4,588,000 (“in ounces / number of coins”) which is a record since the US Mint commenced selling the coins in 1986.

2011 American Eagle Bullion Sales Totals:

(in ounces / number of coins)

http://www.usmint.gov/mint_programs/american_eagles/index.cfm?action=sales&year=2011

This shows that retail bullion demand remains very robust despite the recent feeble economic recovery. It also shows that silver buyers have not been deterred by the surging price of silver. On the contrary, higher silver prices and increased concerns about the US dollar, the euro and other fiat currencies are leading a minority of ‘hard money’ advocates to increase allocations to gold and silver.

Silver bulls are über bullish but they are a tiny minority of the American and international retail investment and savings marketplace. The average investor and saver in the US has no allocation to gold, let alone to silver.

Therefore it would be wrong to assume that these record sales are a negative contrarian signal and that silver has become a bubble with the so called “dumb money” “piling” in.

Rather, a tiny segment of the US public, many of whom are contrarian investors who are worried about the dollar and other macroeconomic and geopolitical risks, are going overweight silver.

However, the majority remain blissfully unaware of silver at this time and the majority of the retail public could not tell you the spot price of silver today or the gold to silver ratio let alone how to invest in it.

Clarification: “Silver Bar Shortages to Lead to Price “Tipping Point”?”

Yesterday, we wrote how there were a myriad of different indicators and much circumstantial evidence of increasing tightness in the gold coin and silver marketplace (as seen in Reuters reports of shortages of gold kilo bars; Sprott Asset Management having difficulty securing 1000 oz bars in volume etc. etc. ).

Some comments in our market update have been picked widely on the internet including on FT Alphaville.

Gold in USD and CFTC Open Interest – Shows that Speculators on COMEX are reducing positions

We reiterate that while shortages of bullion coins and bars are not widespread at this time, it would be wise to keep an eye on this.

Another indication of massive demand in the physical market was seen in research done by German refinery group Heraeus' head of sales Wolfgang Wrzesniok-Rossbach. In his Precious Metals Weekly he contrasted this month's selling of the gold ETF trust-fund by institutional investors, with the continuing demand of private investors. Indeed "in the last two weeks [retail investors] have bought large quantities of gold bars and coins; so much so that despite higher production, some denominations again already have delivery-time delays."

Similarly in silver bullion products, Heraeus reports "massive demand for bars and coins."

Today, the physical gold and silver markets remain tiny in terms of value when compared to equity, bond, deposit and currency markets and even a small shift in capital into physical will likely lead to production and capacity issues and shortages.

As our friend Bron Suchecki of the Perth Mint noted overnight on FT Alphaville “Observations about retail coins and bars being short usually reflects the minting/refining industry's limited production capacity (result of no capex after years of no interest in precious metals) relative to short term surges in retail demand.”

An important question is whether the surge in retail demand is short term in nature or are we in the early stages of gold and silver bullion again becoming mainstream assets which are owned by the majority of retail investors and savers and not just the fringe of libertarians and hard money advocates in the US.

We believe the latter is quite possible given the likelihood of a US and global sovereign debt crisis and of global currency debasement in the coming years. Not to mention, the real risk of a global Depression.

Future Silver Prices

Yesterday we wrote how there is a possibility that silver could reach its nominal high of $50 per ounce and in the longer term the inflation adjusted high of $130 per ounce was quite possible.

We pointed out that these figures were conservative compared to some silver bulls who are über bullish and say silver prices could rise to over 30 times to over $1,000 per ounce. While we are bullish and believe that silver remains a good investment and important financial insurance we do not share their über bullishness. Silver prices would very likely only rise to these levels in the event of hyperinflation.

Hyperinflation remains unlikely although the pathological fiscal and monetary policies of the US and other central banks does not inspire confidence in this regard.

Such wildly bullish predictions for silver remain verboten on Wall Street and in the City of London. In marked contrast to how predictions of ‘Dow 40,000’ were lapped up and propagated to the masses.

As ever, when assessing a marketplace it is important to look at all sides – the über bullish and the über bearish. The über bears are not just bearish on the silver market some of their statements show that they are simply anti gold and anti silver no matter what the outlook for the market.

Many are positively delusional and despite massively strong fundamentals continue to trot out the usual nonsense about bullion. The usual simplistic clichés are - gold and silver have no yield; gold is a bubble (no mention of silver in this regard and they conveniently ignore it remains some 33% below its nominal high in 1980); gold and silver are barbaric relics.

Berkshire Hathaway’s Charlie Munger took it one level further recently by getting personal and pejorative basically saying that you are a jerk if you own gold.

As ever getting a plurality of opinion is good and one should seek out the opinions of all market participants - the uber bullish and the uber bearish; the pro gold and silver and the anti gold and silver.

Ultimately, what happens to the dollar, euro, pound price of gold and silver is irrelevant. Precious metals are not get rich quick schemes and not about making money rather owning physical ounces of gold and silver is about preserving and protecting wealth over the long term. This is why we are always reluctant to get into the price prediction game (even though much of the financial media demand it).

Charlie Munger and the gold bashers in the Financial Time’s Lex Coumn need to again realize the importance of real diversification.

PLATINUM GROUP METALS

Platinum is currently trading at $1,831.00, palladium at $817/oz and rhodium at $2,375/oz.

CONCLUSION

Given the variety of macroeconomic and monetary risks in the world today, owning a genuinely diversified portfolio passively which includes international equities, international bonds (short dated; high credit) gold, silver and some cash has never been more important.

Undiversified savings and investment portfolios, leverage, attempting to time markets, unsafe counterparties and speculation should as ever be avoided.

BullionVault Clarification

Yesterday we wrote how “Zero Hedge reported that Bullion Vault, the digital gold provider, had run out physical silver inventories in Germany (and possibly elsewhere) and was advising clients to buy silver from other sources.”

We were contacted by our friends in Bullion Vault and are happy to clarify that:

BullionVault stores and trades physical silver in London, not Germany. Owing to tight supply in the Good Delivery market, it was unable last weekend to offer silver off its own book, but customers continued trading with each other online. BullionVault did not at any time advise its users to seek alternatives sources (BullionVault).

NEWS

(Financial Times) Brace for a ‘perfect storm’ in gold

Asset managers and central banks are just beginning to readmit gold back into the select group of prudent asset classes. That this is occurring at a time when what might be seen as the world’s safest financial asset classes may also be its scarcest suggests interesting times ahead for those who own gold.

(Bloomberg) -- The Thomson Reuters/Jefferies CRB Index of 19 commodities rose 0.6 percent to 335.72 as of 8:15a.m. in New York, after touching 335.99, the highest since Oct. 2, 2008. Cotton, cocoa, wheat and silver led the gains

(Reuters) - * 2011 likely to be another record year for commodities

* Another $60 billion could be allocated this year - Barcap

* Funds opt for active rather than passive strategies

Commodity investments could near half a trillion dollars by the end of 2011 as the return of $100 oil and a broad-based rally heighten interest in the asset class to levels not seen since 2008.

But the wave of money now hitting commodities is more sophisticated and discerning than its predecessor three years ago. Investors are increasingly looking for active management rather than 'buy-and-hold' plays, which left many counting their losses after the financial crisis hit.

Barclays Capital data and estimates suggest that, if prices remain as they are, total fund investments in commodities at the end of 2011 are likely to be around $420 billion. With any price appreciation, the total would be higher.

(Bloomberg) -- Gold gained for a third day as concern over the pace of the U.S. recovery cut the value of the dollar, boosting the metal’s appeal as an alternative investment. Platinum jumped to the highest price since 2008 Bullion for immediate-delivery advanced 0.5 percent to $1,375.18 an ounce at 4:33 p.m. in Seoul, while February - delivery gold gained 0.5 percent to $1,374.80 in New York.

Immediate-delivery platinum climbed as much as 1.1 percent to $1,847.20 an ounce, the highest level since July 2008. “

There’s growth, but it doesn’t really seem to be exceptional at the moment,” Ben Westmore, an analyst at National Australia Bank Ltd. in Melbourne, said today by phone, referring to the U.S. economy. “It’s basically a currency effect.”

The dollar fell to a five-week low against the euro on speculation that slow recoveries in housing and labor marketswill deter the Federal Reserve from raising interest rates. The Dollar Index, which measures the currency’s strength against six major counterparts, fell for a second day.

U.S. housing starts fell 0.9 percent to a 550,000 annual rate last month, according to a Bloomberg survey before a Commerce Department report today. The number of people continuing to receive jobless benefits increased to 3.99 million in the week ended Jan. 8, from 3.88 million the previous week, another survey showed before tomorrow’s data.

Spot gold jumped 30 percent last year, reaching a record $1,431.25 in December. Prices have declined 3.2 percent this month, stoking demand from individual investors for bars and U.S. Mint coins.

Australia’s Perth Mint reported stronger demand as prices fell below $1,400 an ounce, Barclays Capital analyst Suki Cooper said in an e-mail yesterday. Bar premiums reached two-year highs before the Chinese New Year, Cooper said, citing the mint, which produces about 6 percent of the world’s bullion.

(AP) -- Wheat and corn prices rose Tuesday as bad weather renewed concerns about global supplies

Devastating floods in Australia have raised questions about how much damage occurred to the wheat crop, which was being harvested when the waters hit. The Australian crop had been expected to fill global needs but now inventories are starting to look tighter, Telvent DTN analyst Darin Newsom said.

There also are concerns that the U.S. winter wheat crop could be affected by dry weather in the Great Plains states.

Argentina, a big exporter of corn, has endured a dry spell in the region that grows that crop. There was rain last weekend but some analysts believe it wasn't enough to avert crop damage. Analysts say that could exacerbate a global shortage of the grain.

(Bloomberg) -- Iran successfully test-fired a surface-to-air missile near its Khandab nuclear site, the official Islamic Republic News Agency reported today. The test was intended to ensure that Iran can protect the nation’s “sensitive” sites, IRNA said.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.