Gold Stocks: Stick with Juniors and Avoid Large Caps

Commodities / Gold and Silver 2011 Jan 18, 2011 - 04:50 AM GMTBy: Jordan_Roy_Byrne

In covering the gold sector for my premium subscribers, I have noticed something lately. The large-caps really suck! Ok, that is harsh but it is the truth.

In covering the gold sector for my premium subscribers, I have noticed something lately. The large-caps really suck! Ok, that is harsh but it is the truth.

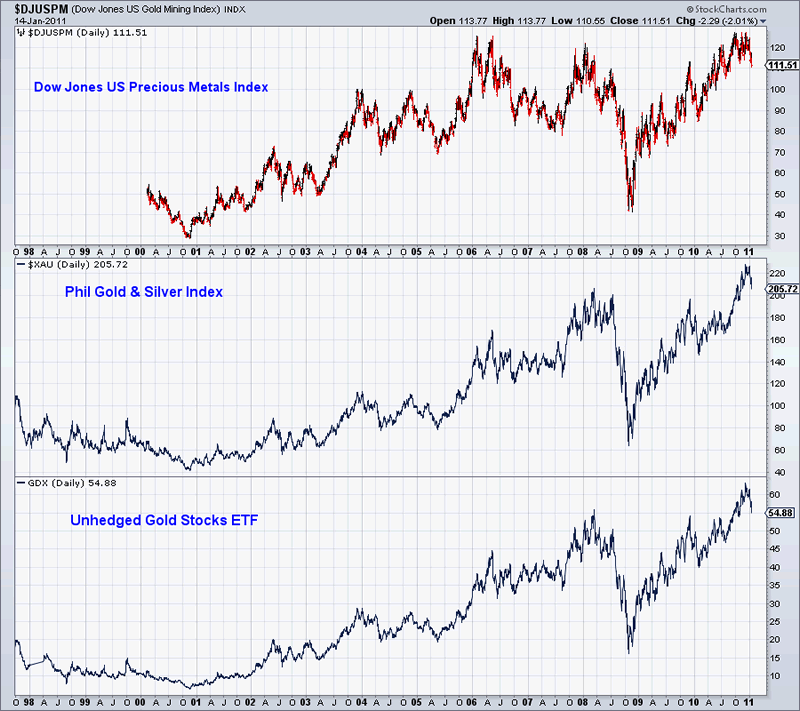

In the chart below I show large-cap indices. What do you see?

The Dow Jones Precious Metals Index hasn’t gone anywhere for five years, while Gold has more than doubled. The next two (the XAU and GDX) are trading right at their 2008 peaks. Since then, I quickly calculate that Gold and Silver are higher by about 33%.

We all know that GDXJ outperformed GDX in 2010. It wasn’t close and even during this correction GDXJ is holding up better.

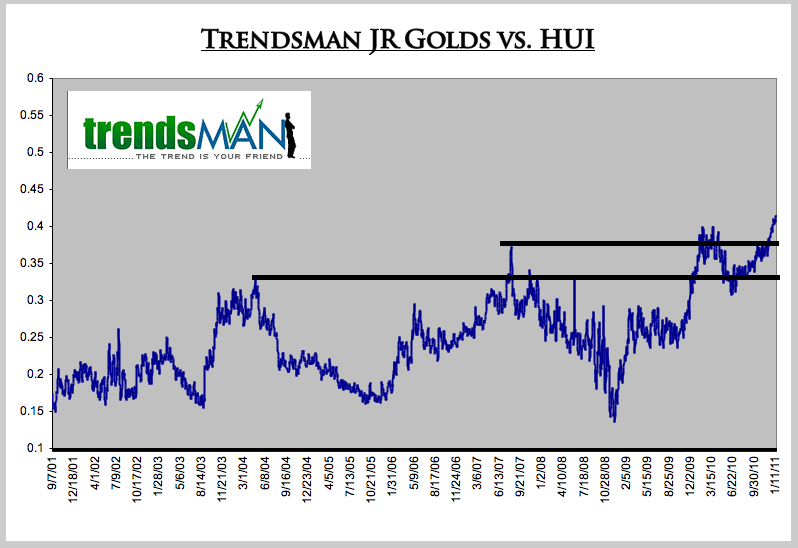

Yet, GDXJ is weighted heavily in some companies that are above $1 Billion in market cap. Where is the “junior” in that? I created my own index of 25 gold stocks, which are equally weighted and range mostly from $200-$700 million in market cap.

My junior index against the HUI (GDX follows the HUI) is moving higher after an 8-year breakout. This chart tells us that the juniors should outperform strongly in 2011 and likely 2012.

We’ve written about this before but it bears hearing again.

Too often we hear about how gold stocks are cheap and how they are priced for $1000 Gold or $800 Gold. Just because the HUI/Gold or XAU/Gold ratio is low doesn’t mean the sector is at a bottom. The reality is that large gold stocks have consistently underperformed Gold over time. TakealookatthispiecefromSteveSavilleandhischartwhichgoesbackto 1960.

Steve attributes the poor performance to rising costs, management errors, environmental and political factors but most importantly, depletion. Just to stay in business gold companies have to consistently find new deposits, mine those deposits and add to reserves. The larger a company is, the more difficult it is to do these things. A junior company can grow by building a few small mines. A large-cap needs to find huge deposits that can become huge mines. It is simply a more difficult business for the larger sized companies.

It is critical that investors and speculators take note of all these factors before partaking in the sector. I fear that the new entrants in the sector will think they are safe by buying Newmont or Barrick. They may be less volatile, but history argues you are better off holding Gold or Silver.

Sure the juniors have already had a fantastic run, but our chart argues that it may be even better in the next few years. As the bull market rages on, the herd will naturally become more speculative. The large players have begun to resort to takeovers and acquisitions. This will continue and further catalyze the junior sector.

Ifyouwanttobeinvolvedinthebullmarketthenyouhavetohaveapresenceinthejuniormarket. Our service offers professional guidance and focus on uncovering the best opportunities in the juniors. We are soon starting a separate portfolio just for trading the GDXJ ETF. Weinviteyoutoconsiderafree 14-daytrial.

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.