Surge in Euro, Weakness in Gold and patterned drop in Aussie Dollar

Currencies / Forex Trading Jan 18, 2011 - 04:08 AM GMTBy: Bari_Baig

The Surge in Euro: Last week was not green backs and regardless of it weakening “materially” it was against Euro where it performed the worst! Many would perhaps think that our reiterated call of Euro bear might have been wrong as on Jan 5th in our article [Euro took a beating yesterday and a bad one! Whereas Greenback doesn’t seem as strong as how the street is portraying it to be] we seemed to be leaning towards the fact that Euro would push higher and Green back would weaken.

The Surge in Euro: Last week was not green backs and regardless of it weakening “materially” it was against Euro where it performed the worst! Many would perhaps think that our reiterated call of Euro bear might have been wrong as on Jan 5th in our article [Euro took a beating yesterday and a bad one! Whereas Greenback doesn’t seem as strong as how the street is portraying it to be] we seemed to be leaning towards the fact that Euro would push higher and Green back would weaken.

As we wrote “Had we had a crystal ball we would have known precisely when the break would take place but unfortunately we don’t and only time shall tell however, as we’re trading near lows and the wider public wants to or is short already therefore the probability of price turning around seems high to us and we’d not be surprised if it takes off from here.” Well, the fact of the matter is we didn’t pay heed to what we had said ourselves and thus it is not only our “ego” which is hurt but also our trading account. We brought this up not because it is the first time we’ve made a mistake but for a fact that from mistakes greater lessons are understood and ones who don’t keep those lessons in view are much more prone to making the same mistakes again. We were foolish to go against what we felt, we were foolish to let “street’s” sentiment rule us and for that we have paid the price but that said we exited as we had stops in place and thus we are here to fight another day.

Now, looking at Europe and evaluating what changed “materially” that Euro behaved the way it did or was it just material weakness in Green back as we have argued not once, not twice but numerous times in the past that it is more than often material strength or weakness in Green back which dictates the side Euro tilts and not vice versa. So, to start with our anatomy of last week we have the President of ECB Mr. Trichet who seemed even more hawkish than he has been regarding inflation in the past. The question of uniting European Monetary Authorities to support the single currency and last but not least the Stabilization Fund which the political hard wigs want to have in place [ASAP] but like always for now seem to be buying time as Germany wants a comprehensive “program”. This would lead one to think that perhaps efforts thus far have not been “comprehensive” and if they have not been this only supports our view that the politicians are happily not doing anything and are passing the ball from one court to another in their efforts to buy time. The street might take it “bullishly” in the immediate short term but what about not immediate short term [days or weeks] what about months? Why should one not be indifferent about Feb 4th when European Heads of state meet that something concrete would be chalked by then? Did we write Feb 4th well, that is when the street had hoped a “final” decision would be reached by however, it has already been put ahead by a month to early March now.

As we all know U.S is closed today, all banks, exchanges everything is closed for Martin Luther King Holiday therefore volatility could remain at bay but we’d be naïve to dwindle around the idea that after a long weekend things might take to a slow start. The Euro bulls would be bored due to sideways trading and thus at first sight of Dollar strength the bears might take control. We then remain bearish of Euro not materially but enough that we’d trade the short side more than we’d like to trade the long side of the trade for now.

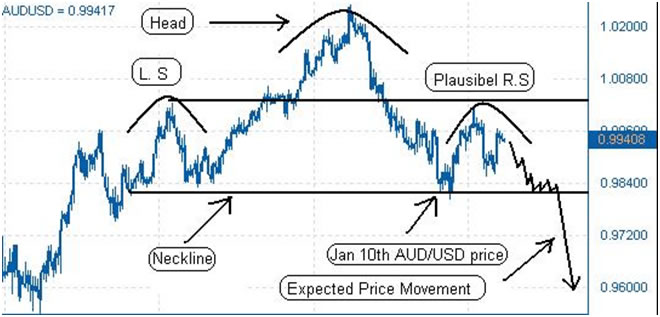

A self-fulfilling prophecy: In our article [The Aussie Dollar and Floods] we wrote on Jan 10th that “At best we see the pair trading as high as 0.997s after which it may not have a free fall as some of the “bears” amongst are of the view but perhaps a more pattern like fall with inclination towards a plausible Head and Shoulder after which the price may travel down to 0.960s territory but this is where it gets even more interesting.”

We’d say something in a while but first we need to have a look at the chart below where AUD/USD seems to be making a complex HnS as we had stated on Jan 10th.

What is evident from the chart above is neither the hyper bears of Aussie Dollar which were of the view that Aussie Dollar would collapse and nor the Bulls who had anticipated a move back up are sitting comfortably. We stated above that the pair seems to be making a complex HnS that is because it has two plausible Left shoulders which it seems to be replicating at the moment on the right side and the most interesting fact is “bulls” are hopeful that somehow the 2nd of the right shoulders instead of falling gives a leg up and forming a Double bottom. Surely, that would be interesting and surely anything and everything can be expected in the complex world of currencies but would we side the Bulls this time around? Our answer is a resounding No! We have been bullish for too long of Aussie Dollar and only on Jan 4th cut our long position and gave a sell call for much lower levels 0.96 as the first of supportive region therefore until Aussie Dollar cannot muster enough strength to break above par and maintain it, we shall remain on the bear side of this trade.

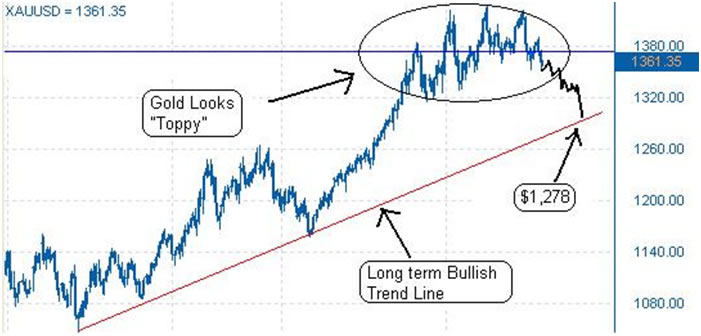

Has Gold Lost its luster: We’d not say we went bears of Gold on Jan 7th because primarily what everyone wants to know is which way Gold is headed and if it is down than it is “not a correction” but a bear spell! Perhaps that is how people nowadays like to classify bear and bull spells. We are however old school and as stated on Jan 7th that Gold to us now seems to be in a corrective pattern with lower highs and lower lows and this could easily take Gold to $1,278s and still the overall trend remains bullish. At the same time below $1,330s lies not one, not two but many supportive regions so much so, some of the supportive region seems to be overlapping each other or at few cents difference thus to expect Gold to hold $1,320s and above for a while before trying to break $1,300s is only logical.

We remain corrective of Gold since Jan 7th which is why we have even liquidated our Gold position in non-U.S Dollar terms and are instead 3 units of Gold short in U.S Dollar terms which we intend to hold until our target is achieved as our shorts are nicely in the money [thanks to Friday’s drop] and we’ve moved our Stops at breakeven to give us a better opportunity to ride this move fully. Once Gold drops below $1,350 we’d perhaps remove the stop from Breakeven and put a trailing stop with $17 spread.

It seems Gold is succumbing to the pressures of its own success as it has not moved but rather jumped far ahead of other base metals and commodities overall. From the Chart below, without incorporating any chart study or line studies one gets a very basic idea that Gold is finding it ever more difficult to post higher highs and the last high was a bad attempt at a new [high] as it only managed to improve the previous high by just over $5 per ounce.

Situation in Europe seems to be settling down so that is one avenue out of the picture which puts a bid on Gold. To us the price action would be gradual but with a distinct lower gradient. The late longs might starts to offload their position but this is where it gets complicated as they would offload their instinct to [hunt bottom of the trend] would kick in which would not result in strength but rather more weakness as they come to sell again. We believe we are clear about our take on Gold that it is not “bearish” but corrective.

By Bari Baig

http://www.marketprojection.net

© 2011 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.